By Matthew Mendelsohn | Part of our Special Series: Always Canada. Never 51 | This post originally appeared in the Toronto Star

The Carney government’s early economic growth priorities have been clear for months. The details can be found in the Building Canada Act, which makes way for big, national infrastructure projects, biased heavily toward natural resources and energy.

This is perfectly reasonable for an early growth agenda, so long as Indigenous rights are respected. But it misses something important: how to increase Canadian ownership of Canadian assets and ensure that more Canadians stand to benefit.

Concentrated ownership of our economy, and the inequality and plutocracy that result from it, are causing deep distress among working and young people who feel — quite accurately — that the economy is rigged against them. Broad-based Canadian ownership of our businesses, resources and assets needs to be part of the growth agenda.

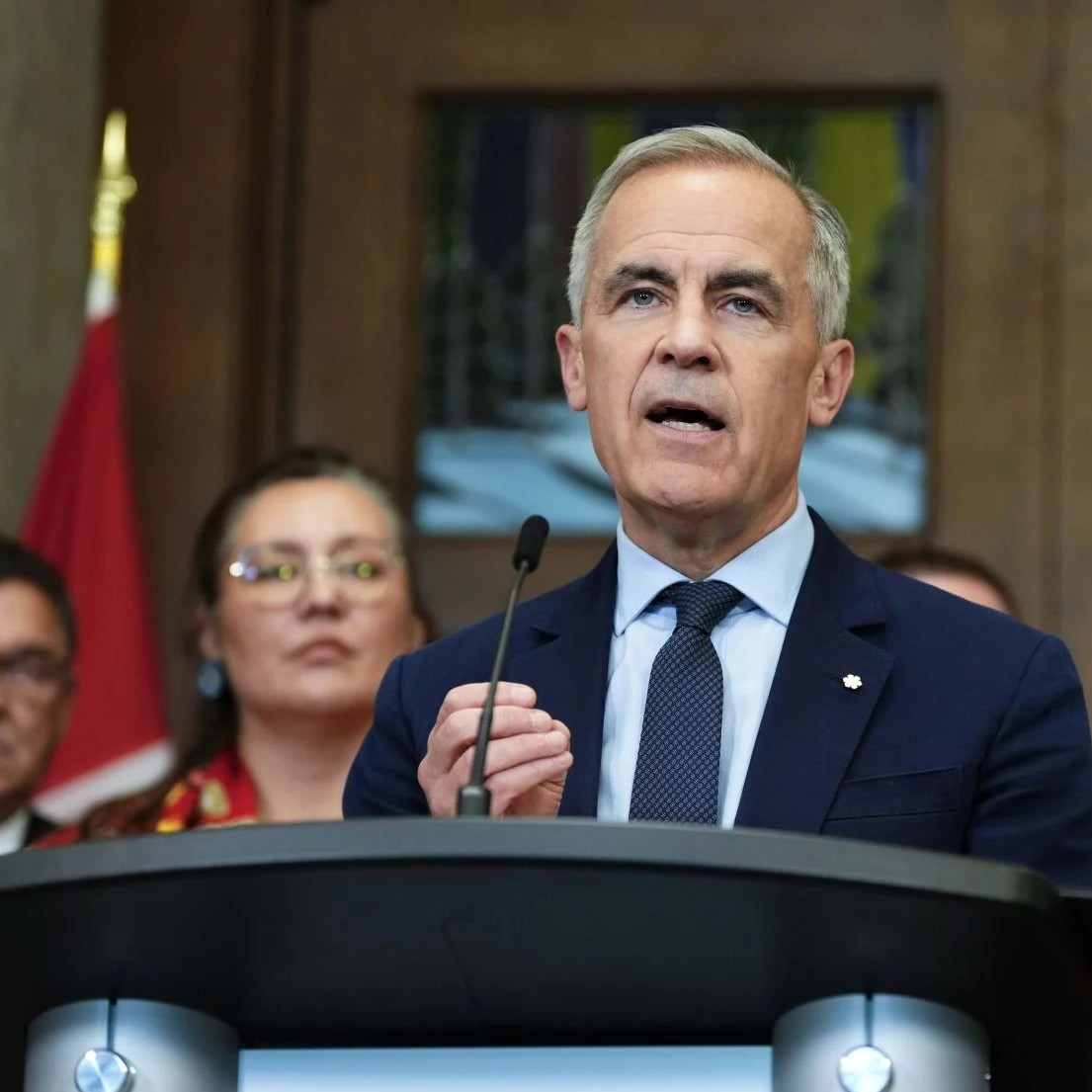

It appears that Prime Minister Mark Carney knows this. He has said that “we are masters in our own home,” that “Canada is not for sale” and that U.S. President Donald Trump is using tariffs to “break us so he can own us.” At the White House in early May, Carney sat in the Oval Office and referred to the Canadian people as “the owners of Canada.”

But so far, the plan for Canadians to own more of our economy is pretty thin. We need to strengthen our economic sovereignty with bigger goals than simply creating more jobs in the trades and securing more resource royalties to provincial governments.

In fairness, the federal government has taken some steps to align with this vision in recent years, including $10 billion in loan guarantees to enable Indigenous communities to maintain equity in resource extraction and other major projects.

The Black Entrepreneurship Loan Fund gets more low-cost capital to entrepreneurs who have faced barriers to accessing capital. And First Nations Bank of Canada and the Business Development Bank of Canada recently announced a program to facilitate the acquisition of existing businesses by Indigenous communities.

These creative uses of financing and capital, deployed by a strategic state, leverage the federal government’s AAA credit rating and should be a core component of, not peripheral to, our growth agenda. We need more investments aimed at achieving more widespread Canadian ownership of Canadian assets that produce economic activity and wealth.

We also need to make it easier for independent Canadian entrepreneurs to buy businesses from retiring owners. We need a better funded network of community investment institutions to provide low-cost capital to small businesses, social enterprises and non-profits in rural and other communities that often have trouble accessing financing. We need more ambitious use of federal loan guarantees and co-investment to facilitate the acquisition of small- and medium-sized businesses by employees, co-ops and communities.

A sovereign fund could invest in and acquire vulnerable Canadian businesses, keeping them in Canadian hands. New industrial strategies could help preserve Canadian sovereignty in food production. We must strengthen local, independently owned media and digital infrastructure to escape extortion from American digital platforms. We must be stricter about preventing foreign takeovers of Canadian firms, as well as the consolidation of ownership that’s underway in many communities. And we must get serious again about Crown corporations and other forms of public ownership.

Finally, our public financial institutions, pension funds and philanthropic foundations need to consider how they can support this ambitious ownership agenda so that all Canadians benefit, not just investors.

The ownership agenda is just as important to our economic future as pipelines — if not more so — because an economy owned by a broader swath of society is more sustainable and resilient than one in which wealth and ownership are concentrated among few.

Sovereignty isn’t just about control of our border. It’s also about control of our resources and assets.

We can’t truly be masters of our own home if that home is owned by an American hedge fund. If we don’t protect and broaden Canadian ownership as part of the growth agenda, two years from now we will be even more economically vulnerable than we are today. The owners of Canada need a plan to deliver on the promise of “maîtres chez nous.”

Share with a friend

Related reading

Mark Carney’s Davos speech is a manifesto for the world’s middle powers

Mark Carney's recent speech at Davos matters because it treats this moment as a rupture, not a passing disruption. It’s in this rethink, write Matthew Mendelsohn and Jon Shell, that there is also relief: “From the fracture, we can build something better, stronger and more just,” Carney said. “This is the task of the middle powers.” The world's middle powers are not powerless, but we have been acting as if we are, living within the lie of mutual benefit with our outsized and increasingly erratic neighbour. Without the U.S., the world's middle-power democracies are rich, powerful and principled enough that we can unite to advance human well-being, prosperity and progress.

Four reasons our economy needs employee ownership now

Employee ownership offers a timely solution to some of Canada’s most pressing economic challenges, writes Deborah Aarts in Smith Business Insight. Evidence shows that when employees share ownership, businesses become more productive, innovative and resilient. Plus, beyond firm-level gains, employee ownership can help address the coming mass retirement of business owners, protect local economic sovereignty, boost national productivity and reduce wealth inequality. There is enough data about the brass-tacks benefits of employee ownership to sway even the most hardened skeptic.

Advice to the public service: Five ways to confront monsters and chaos

Canada's political and bureaucratic leaders are quickly trying to re-wire the federal government to confront a belligerent Unites States, but systems can’t deliver what they were not designed for. This is a time like no other in our history, writes Matthew Mendelsohn, and those making decisions have not been trained for this—because we haven’t experienced anything like this before. Drawing on his own time in Ottawa, he walks us through five priority “machinery of government” changes our public service needs to make to meet the threat of an increasingly authoritarian, imperialist America.