Bill Young

Team

M@st3rSCP

Name Here

Bill founded Social Capital Partners in 2001, and has been one of the leading voices in promoting social finance in Canada. He also sits on a variety of boards and advisory boards for social enterprises and community organizations. Bill previously spent 20 years in the private sector, primarily as CEO of Hamilton Computers and Optel Communications Corp (later Axxent). He holds an Honours BA from the University of Toronto, an MBA from the Harvard Business School, and is a Chartered Accountant. In 2013, Bill was appointed as a member of the Order of Canada for his achievements as a social entrepreneur and philanthropist.

Emiko Savic

Team

M@st3rSCP

Name Here

Emiko manages our finances and operations, making sure everything in the office runs smoothly. With an interest in leveraging capital for social good from sustainable finance to charitable donations, she also conducts research and due diligence on impact investments. Emiko was previously an office manager for a health food company in Toronto, and before moving to Canada she worked for major investment banks in Japan. Emiko holds a BA in Law from Ritsumeikan University in Japan, studied business and management in France, and received an MFin from the Smith School of Business at Queen’s University.

Michelle Arnold

Team

M@st3rSCP

Name Here

Michelle supports our research and policy work. Her professional experience spans the private, public and non-profit sectors, with a focus on social impact, strategy development and change management. She started her career in consulting before moving to the Ontario government, where she spent five years working to cultivate a robust social enterprise ecosystem. Michelle also worked with Boys and Girls Clubs of Canada and Big Brothers Big Sisters Canada facilitating collaboration and mergers within and across both organizations. Most recently, she worked at the City of Toronto, managing technology transformation initiatives. Michelle holds a BA in Arts and Business from the University of Waterloo and a Masters of Global Affairs from the University of Toronto’s Munk School.

Kiran Gill

Team

M@st3rSCP

Name Here

Kiran provides administrative and policy support to the CEO and the rest of the team at Social Capital Partners. He is especially interested in creating opportunities for young people to create wealth and finding solutions that address intergenerational fairness. Kiran has experience in the federal government, working on Indigenous land policy and program delivery. He has also worked at the Media Ecosystem Observatory monitoring the integrity of social and traditional media and its impact on Canadian elections. Most recently, Kiran was a researcher on the Quebec Homelessness Prevention Collaborative, investigating the relationship between constitutional protections and housing outcomes. He holds a BA in Industrial and Labour Relations from McGill University and a Master’s degree in Public Policy from the Max Bell School at McGill.

Katherine Janson

Team

M@st3rSCP

Name Here

A seasoned media and communications strategist, Katherine spent over two decades advancing high-profile brands and issues within the scientific, health and social impact sectors before joining SCP in 2024. A former investigative journalist at CTV News, Katherine’s work has been recognized with several journalism and cause marketing awards. A self-professed word nerd, she writes, edits and develops award-winning PR, communications and marketing campaigns that are rooted in evidence and tell meaningful stories. She consistently delivers messages that cut through the noise, resonate with diverse audiences and inspire community action. Katherine holds a degree in English from Queen’s University and a Master of Arts in Journalism from Western University.

Dan Skilleter

Team

M@st3rSCP

Name Here

Dan leads our research and policy work on employee ownership in addition to managing SCP’s longer-term policy agenda with an overall objective of broadening opportunity by reducing the power of financial and corporate interests. He has previously led a diverse range of policy files in government as both a political staffer and civil servant, and served as a senior economic advisor to a former Premier of Ontario and Minister of Finance. Dan holds a BA in Political Science from Huron University College and an MPA from Queen’s University.

Judy Doidge

Team

M@st3rSCP

Name Here

Judy works with our private, public and non-profit partners within workforce development. With experience in all three sectors, she is able to bridge gaps in communication, incentives and objectives of all stakeholders. Having managed national recruitment and retention programs for employers across Canada, Judy has extensive knowledge in employer engagement skills training, and diversity and inclusion. She led SCP’s partnerships with the Ontario, Manitoba and Nova Scotia governments on demand-led employment and training systems, and worked with the Ontario Centre for Workforce Innovation and Metcalf Foundation’s Toronto Sector Skills Academy. Currently she is supporting the work of partners on workforce development projects across various sectors and population groups. Judy holds a BA in Sociology from the University of Western Ontario.

Jon Shell

Team

M@st3rSCP

Name Here

Jon was Managing Director of SCP from 2017-2023, leading the transition to our Ownership Agenda. He spent most of his career in the private sector before joining SCP, founding and growing successful companies in both Canada and Australia. Jon co-founded both Save Small Business and the Canadian Employee Ownership Coalition. Jon was first introduced to SCP when Bill supported a volunteer entrepreneurship project he was leading in Kenya in 2008. He received a BA from Queen’s University and an MBA from the Richard Ivey School of Business at Western University.

CAMP x SCP virtual talk - understanding private equity

In industries from dentistry to aircraft manufacturing, private equity (PE) is everywhere—some of it intent on rejuvenating flailing businesses, and some of it poised to extract maximum profit at any cost. To demystify this financial tool, CAMP and SCP hosted an expert panel of informed insiders and prominent American critics who have been on the frontlines of fighting PE’s worst excesses. Together, moderator Ana Pereira from the Toronto Star, Private Equity Stakeholder Project’s Jim Baker, Plunder author Brendan Ballou, SCP’s Jon Shell and CAMP Fellow Rachel Wasserman break down how PE is commonly used, what’s next and how we can change course.

Panelists

Jim Baker

Executive Director, Private Equity Stakeholder Project

Brendan Ballou

Author, Plunder: Private Equity’s Plan to Pillage America

Jon Shell

Chair, Social Capital Partners

Rachel Wasserman

Fellow, CAMP

Moderator

Ana Pereira

Business Reporter, Toronto Star

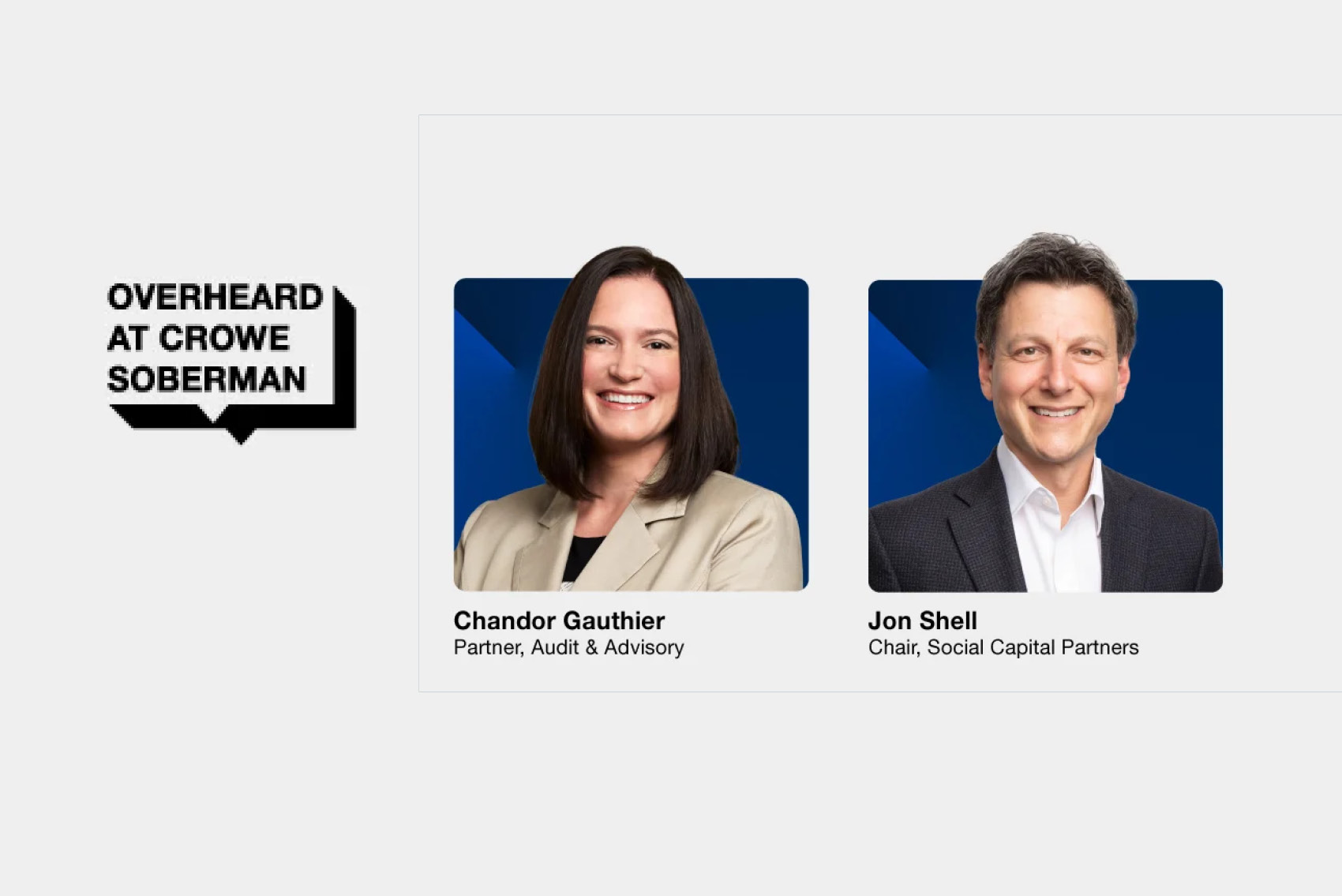

Overheard at Crowe Soberman: The EOT advantage

Crowe Soberman Audit and Advisory Partner Chandor Gauthier sits down with Jon Shell, Chair of Social Capital Partners and Board Member at Employee Ownership Canada. They dive into the benefits of Employee Ownership Trusts and get into the nitty gritty of how EOTs can support smooth business succession, boost equity and retention and safeguard business legacies.

Speakers

Chandor Gauthier

Audit and Advisory Partner, Crowe Soberman LLP

Jon Shell

Chair, Social Capital Partners

Board Member, Employee Ownership Canada