Sellers’ inflation is back on the horizon. We can stop it before working people pay the price.

By Kaylie Tiessen | Part of our Special Series: Always Canada. Never 51.

Canada’s inflation rate sat at 1.7% in April, but that headline figure hides some worrying trends. The federal carbon tax cut lowered the rate quite a bit—without it, inflation would have been 2.3%. That’s still within the Bank of Canada’s 1–3% target, but significantly more concerning than the number making headlines. The carbon tax cut will act as a built-in offset on the inflation rate for the next year, muting the headline inflation rate, but camouflaging other underlying price pressures.

In fact, Bank of Canada Governor Tiff Macklem recently acknowledged that inflation in April was higher than forecast, with many goods and services rising faster than expected, signalling that inflation could be gathering momentum again.

It has me thinking about the different drivers of inflation—and which sources of inflation we should be watching for today. We should expect some tariff-related inflation as the counter tariffs push prices up on affected imports and inputs. And we could also see some supply-chain related inflation as the world adjusts to a new global trade regime.

But the one that worries me most is sellers’ inflation, or profit-led inflation. This is when companies with market control choose to hike prices to gouge consumers and grow their profits when they have the chance. It often hides behind other drivers and can blindside us if we’re not watching closely.

Profit-led inflation was a real issue during the pandemic, and there are three reasons why I’m worried about it re-emerging today:

Inflation expectations: In the Bank of Canada’s latest survey of consumer expectations, 75% of Canadian consumers believe prices are going to rise, making it likely they will accept outsized price increases—tariff-related or not.

Tariff confusion: Canada’s counter-tariff regime is clear as mud to consumers and business owners. The rules keep changing, making it difficult to keep current.

The end of the consumer carbon tax: the negative inflation rate on oil and gas as a result of the end of the tax will pull down headline inflation for the next year and camouflage inflation on other goods driven by other sources of inflation, including profiteering.

Each of these factors on their own would provide cover for opportunistic price makers to gouge their customers: they’ll make a few extra bucks and blame Trump. Add to this the lack of competition in many sectors of Canada’s economy—and the fact that firms had a practice run just a few years ago—and we’re looking at fertile ground for profit-led inflation.

As we saw during COVID, corporate markups skyrocketed in 2021 to nearly 16% from an average of 11.5% the years before the pandemic and have hovered around 15% ever since– down from the pandemic peak but much higher than pre-pandemic levels.

Statistics Canada found that food store profit margins grew to more than 3% by the end of 2022 from around 1.6% before the pandemic—doubling the industry’s profit margin. Food-store margins have come down slightly since then, but are still hovering a full percentage point above pre-pandemic levels, coming in at 2.7% in the first quarter of 2025.

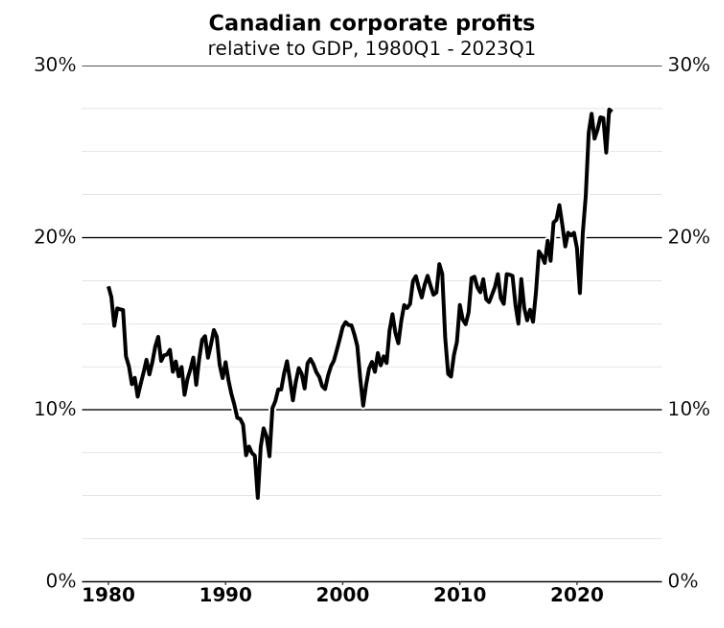

Profits as a share of GDP skyrocketed during the pandemic as well, reaching upwards of 24% in mid-2022. The measure has declined to 18% in the years since, but last quarter it ticked up again to 19.6%—nearly two percentage points above the pre-pandemic average.

In lay terms, all of this means that a larger share of Canada’s economy is being diverted into the profits of corporations, while many of us are struggling to pay our bills.

So, what should we do?

First, get clear on tariffs. Governments must be radically transparent about Canada’s counter-tariff strategy and provide clear information to consumers and business owners about all the items that are tariffed. Some grocery stores are attempting to do this, but many consumers, myself included, are skeptical about their trustworthiness, given their profit motives.

But transparency and clear communication can’t solve everything—international trade is complex, and Trump’s shifting tariff policies add to the confusion.

Second, the Bank of Canada must take a much more aggressive stance against abnormal pricing behaviour. The Bank of Canada usually deals with price gouging/profiteering after it happens, through interest rate hikes to deal with the inflation. But the Bank can take action proactively. While it may not have fiscal or policy tools at its disposal, strong language and public information sessions describing signs of profiteering it is seeing in the data can have an impact on firms’ behaviour.

The Bank used a similar (though unwarranted for the time) tactic on wages in late 2022, when they warned publicly that wages could lead to a wage-price spiral, when there was no evidence that wages were causing inflation at all. This warning was so effective that it will take many years for some workers to see their purchasing power catch up. The Bank should use this tactic now pre-emptively against the cause of inflation, instead of punishing the rest of us after the fact.

The third solution is to put public policies in place to help deter profiteering.

Governments should consider implementing an excess-profits tax on firms that are making extraordinary profits due to opportunistic pricing behaviour.

Governments can also consider price caps, or margin caps, on certain goods like baby formula, food stuffs and energy in order to reduce the inflationary pressures on essentials. The evidence for the usefulness of price controls in some circumstances has been mounting in recent years.

Some U.S. states have laws that prohibit price gouging during emergencies. Why not extend that to all periods, instead of just during emergencies?

The Competition Act can be further strengthened and the Competition Bureau can go after price gouging and wage fixing made possible by corporate concentration. And governments should continue efforts to crack down on hidden junk fees and “dynamic pricing,” which adjusts prices based on an algorithm’s assessment of a customers’ ability or willingness to pay.

These policies are important tools in any government’s toolbox to prevent profit-led inflation before it starts, instead of having to deal with the consequences.

There are good reasons to accept some tariff-related inflation—elbows up, right? But we shouldn’t allow opportunistic sellers to use the crisis to mask their profiteering.

We know what happens when powerful companies exploit confusion and weak oversight: working people pay the price while profits soar. Preventing inflation driven by opportunism requires coordinated action now—before working Canadians are left to bear the burden yet again.

New Canadian Tax Observatory seeks visionary founding CEO

May 21, 2025, Toronto (ON) – Canada’s tax system is contributing to economic inequality and an increased concentration of wealth, but there is a widespread misunderstanding of how our tax system works and who it serves. Many well-funded interests falsely suggest that tax fairness would undermine economic growth.

Recognizing the need for more balance in publicly available information, Social Capital Partners and other funders are incubating a new, non-partisan, nonprofit Canadian institution to lead an informed national conversation on the links between taxation, economic fairness and a thriving democracy.

“There is a global groundswell of interest in economic systems that deliver equitable benefits across society. Our vision for a more democratic capitalism in Canada requires well-regulated markets and policy changes that provide real opportunities for people to build economic security. And it also requires fair taxation,” says the Canadian Tax Observatory’s founding board chair, Matthew Mendelsohn. “We are seeking a visionary leader who can shape and grow the Observatory into a permanent, influential Canadian institution connected to global networks identifying better, more effective ways to achieve tax fairness.”

The organization’s mission is to support a more equitable tax system that advances shared prosperity and economic growth through rigorous research, collaboration, advocacy and public education. The board has secured seed funding of approximately $550,000 per year over three years and is in the foundational stages of building the incorporated nonprofit organization into a registered charity. The board is open to adapting the Observatory’s operating structure to suit the preferred leadership model of the chosen leader.

To learn more about the Founding CEO position and how to submit a Statement of Ambition expressing interest in this transformative role, please visit: www.socialcapitalpartners.ca/ObservatoryFoundingCEO

About the Canadian Tax Observatory

The Canadian Tax Observatory is an essential voice in Canadian tax policy. A non-partisan nonprofit established in 2025, the new organization supports a more equitable tax system that advances shared prosperity and economic growth through rigorous research, collaboration, advocacy and public education. The Canadian Tax Observatory’s founding board of directors is comprised of Chief Executive Officer of Social Capital Partners Matthew Mendelsohn (Board Chair), Professor of Political Management at Carleton University Jennifer Robson and Executive Director of Euphrosine Foundation Niamh Leonard.

About Social Capital Partners

Who owns the economy matters. Social Capital Partners believes working people deserve a fighting chance to build economic security and wealth. A Canadian nonprofit organization founded in 2001, we undertake public policy research, invest in initiatives and advocate for ideas that broaden access to wealth, ownership and opportunity, and that push back against extreme economic inequality. To learn more, please connect with us on LinkedIn or Bluesky or visit socialcapitalpartners.ca.

For more information, please contact:

Katherine Janson

Director of Communications

Social Capital Partners

647-717-8674

katherine@socialcapitalpartners.ca

A new middle-power alliance would give Canada leverage and Canadians hope

By Jon Shell | Part of our Special Series: Always Canada. Never 51 | Reprinted with permission from The Hill Times

Following Donald Trump’s first threats to annex Canada, there was a country-wide energy to forge a new and more independent path, with political rhetoric to match. But with Trump’s “51st state” bluster diminishing, Mark Carney’s drama-free visit to the White House and a stay-the-course cabinet, Canadian business leaders seem eager to settle for the best “new-new-NAFTA” we can get.

This tendency toward the status quo is exactly what fuels Canada’s self-loathing: we’re not entrepreneurial enough, don’t take enough risks, don’t invest in our potential. Instead of charting ambitious, but uncertain, territory, we defer to the corporate lobbyist on our shoulder whispering “be practical.”

Playing it safe is both the wrong short-term tactic and the wrong long-term strategy. Sure, Canada could probably get a new deal if we don’t anger the president but it would undoubtedly be a downgrade – just as CUSMA is worse than NAFTA – because, as JD Vance likes to say, we don’t have the cards. We’d remain an underperforming “branch-plant economy,” selling our innovations and resources south for pennies on the dollar. And it would leave us exposed to the same risks of military and economic dependency currently on stark display.

Instead, Canada should lead the world’s middle powers in a collective and overdue weaning from American primacy by establishing a grand new security and economic alliance.

Ten countries – Canada, Australia, France, Germany, Italy, the U.K., Spain, Japan, South Korea and the Netherlands, or the “Core 10” – would amount to about the same GDP as the U.S., with significant natural resources and about six hundred million wealthy residents with massive buying power. From Robert Reich to The Economist, versions of this idea have been proposed, all with the objective of creating leverage against American economic aggression.

While each potential grouping of countries would have its complexities, even one formal meeting to discuss a new alliance would be enough to demonstrate that a break from U.S. dominance is possible. Announcing new multilateral partnerships in areas of American interest such as military procurement, pharmaceutical development, cloud infrastructure or resource refinement would solidify the group’s potential.

It is clear that President Trump fears this possibility.

Prime Minister Carney’s visit to France and the UK in March prompted Trump to threaten “large scale tariffs, far greater than currently planned” if the European Union were to work with Canada to “do economic harm to the USA.” His reaction proves the idea’s merit – America’s global trade war can only succeed against a divided opposition.

A new alliance is also the right long-term strategy. While the U.S.-led western countries had a long and successful run after World War II, we are all now facing similar crises, including decreasing housing affordability, increasing inequality and repeated failures to address climate change. As a result, belief in democracy, capitalism and global institutions are in steady, long-term decline, along with global comfort with American leadership.

Part of the issue is that, in many ways, America has become an outlier among its allies. On issues like health care, taxation, social security and climate, and on critical social metrics like inequality, life expectancy and gun violence, the middle powers of the Core 10 are both highly aligned and diverging further and further from the U.S. Common ground to solve our collective challenges will remain elusive with America at the table.

A middle power alliance, however, built on security and economic commitments patterned after NATO, would constitute an ambitious, creative and credible third power centre alongside the U.S. and China. Unshackled from American dominance, these countries so aligned in values and approaches could develop innovative new solutions to our common crises. Rather than trying to salvage a collapsing world order in which so many have lost faith, Canada and its Core 10 allies could build the next great era of democratic progress.

The U.S. will always be Canada’s largest trading partner and so a new deal is necessary. But we should resist the temptation to choose short-term comfort and certainty. By finally stepping into a more entrepreneurial and ambitious leadership role, not only can we improve our own hand in trade negotiations with America, but spark energy and enthusiasm for a new and better global superpower.

The tariff war means a new normal for Hamilton businesses | Hamilton City Magazine

By Eugene Ellman, Hamilton City Magazine

Editor’s note: This story was finalized in late April. We acknowledge that this is a highly fluid and volatile situation and that tariffs being imposed may have changed since HAMILTON CITY Magazine went to press.

Keanin Loomis, a leader in Hamilton’s business community who has lived and worked in both Canada and the United States, can’t come to grips with the delusional and reckless tariff policies of Donald Trump.

For Loomis, the long-standing rules governing trade between the two countries have seemed so permanent, so well-established that it seems impossible that the U.S. can wave them away with a simple presidential order.

“This is hard as an American citizen, as a dual national,” says Loomis, the former CEO of the Hamilton Chamber of Commerce, a past mayoral candidate and now CEO of the Canadian Institute of Steel Construction. “This is particularly personal for somebody who’s straddled both sides of the border for my entire life. I can’t even believe we’re here, to be honest.”

While Canadians and Hamiltonians grapple with the enormity of these tariffs, a new normal of Canada-U.S. trade relations is beginning to settle in with the city’s business community.

“People realize that the status quo is no longer good,” says Norm Schleehahn, director of economic development with the City of Hamilton. “It’s a wake-up call. We’re going to see the east-west discussion being more of the norm now versus just relying on north-south relationships.”

This new normal – the realization that the traditional Canada-U.S. relationship has come to an end – was front and centre in Canada’s recent election campaign. “It is clear that the United States is no longer a reliable partner,” Prime Minister Mark Carney told reporters at the end of March. “We will need to dramatically reduce our reliance on the United States. The road ahead will be long. There is no silver bullet. There is no quick fix.”

Hamilton is vulnerable

Hamilton’s economic base evolved in the years after World War II, a time of growing integration in cross-border markets. While there have been occasional trade disputes, especially in the steel industry, the city’s manufacturing and transportation businesses established firm links with suppliers and customers across the border based on a faith in enduring free trade.

That friendly arrangement ended on April 2.

That was the day Trump unveiled his so-called “reciprocal tariffs.” In his words, the new policies were meant to fight unfair tariff and non-tariff barriers by America’s trading partners. In fact, the tariffs were created with flimsy math based on national trade patterns that in most cases had nothing to do with tariff rates imposed on the U.S.

In Canada’s case, no “reciprocal tariffs” were imposed. Rather, Trump levied a 25 per cent tariff on non-U.S. content of vehicles imported into the U.S. These new tariffs came in addition to a 25 per cent tariff on steel and aluminum products imposed earlier. The Canadian government levied counter-tariffs on the same goods and billions of dollars of other U.S. products.

By sparing (at least for now) Canada from “reciprocal tariffs,” Hamilton was saved from the worst possible impacts of the U.S. trade policies. Nevertheless, the blow to Hamilton was significant.

This is because of the large share of employment in the city related to the steel industry. About 10,000 people work for the primary steel producers and fabrication companies, and thousands more work in related supply and service providers. In addition, about 1,800 Hamiltonians work in auto parts companies. Together, that’s more than a third of the city’s total manufacturing employment of 29,000.

To make matters worse, a large share of the primary steel produced in Hamilton is used in auto production. Several car companies issued layoff notices after the Trump announcement in April because tariffs immediately disrupted cross-border auto industry supply chains, also causing potential ripple effects in the steel industry.

“When you layer in the steel and auto tariffs, I’d be shocked if we are not now into the top three communities impacted in the country,” says Greg Dunnett, CEO of the Hamilton Chamber of Commerce.

There are signs that business growth plans are being halted or slowed down. Thirty-eight per cent of more than 200 local businesses responding to a City of Hamilton survey said they expect to put off investments due to tariff-related uncertainty. Thirty-two per cent expect to reduce their workforce.

“Businesses have stopped their expansion plans or have delayed them because they don’t know what tomorrow looks like, much less what a three-, five- or 10-year window looks like,” Dunnett said in an early April interview. “It’s going to have a long-term slowdown because those expansion and growth opportunities are being delayed or shuttered.”

At the time of writing in early April, neither ArcelorMittal Dofasco nor Stelco had publicly commented on the tariffs. But Laurenco Goncalves, CEO of Cleveland-Cliffs Inc., Stelco’s U.S. owner, said he supports the tariffs and believes Stelco can weather them by pursuing Canadian markets, a strategy the company used with some success in a previous tariff fight in 2018.

Canadians get a friendly reception in Europe

The week that Trump announced his tariff plan, business people from around the world gathered at Hannover Messe (messe means “trade fair” in German), site of the largest annual manufacturing trade event in the world. Held annually in a sprawling convention centre in Hannover, Germany, the event this year attracted 130,000 participants from 4,000 companies and more than 150 countries. As the official partner country, Canada had one of the largest contingents at more than 250 delegates and more than 230 exhibitors.

Planning for Canada’s participation was a year in the making, long before Trump was re-elected president or his tariffs were rolled out. But a large number of Hamilton companies sent delegates or exhibited, at least partly motivated by potential opportunities presented by the Trump trade attacks. The reception was very positive.

“It has been absolutely overwhelming to see the response and the reception we are getting from European markets,” Brad Sparkman, president of Orangeville-based Innovating Finishing Solutions, told CBC News.

Representing the City of Hamilton, Schleehahn said Canadian companies told European customers and suppliers they would be a reliable partner. The message was greeted warmly. “They absolutely love Canada,” he said.

Attending companies based in Hamilton or with local interests included Kubes Steel, a construction steel manufacturer, industrial supply companies Bar Hydraulics and VTR Feeder Solutions, pre-fabricated home builder BECC Modular, and real estate developer Slate Asset Management. Mohawk College, McMaster University, McMaster Innovation Park and the Hamilton Oshawa Port Authority also attended.

Hamilton-based EVM Group, which provides industrial automation products and services, went to the event to meet with existing customers and to explore new markets.

Adam McCormick, chief growth officer, said the company was recently cast out of the running for a major U.S. industrial control panel contract when EVM couldn’t confirm how much of the total cost would be subject to the new steel tariffs.

But Canadian trade in automation services is a growing market as companies demand more artificial intelligence controls over manufacturing processes. And with strong two-way trade between Canada and Europe, there is growing demand for these services in Europe and for European companies operating in Canada, he said.

Canadian expertise in industrial automation is ranked fourth- or fifth-best in the world, said McCormick, which was a strong selling point at the show. “The interest in working with Canada is very, very big. We’ve had a lot of positive conversations with a lot of people about how they want to increase their operations or sales in Canada.”

Fixing Canadian markets

As many companies pursue international markets, others, including some in the steel industry, face a fundamental problem: Steel is being dumped on world markets by China and other countries at prices far too low for them to match.

China produced about 990 million tons of steel in 2024, more than half the world total of 1.9 billion tons. To contrast, the U.S. produced 81 million tons and Canada produced a mere 12 million.

Much of this steel is being dumped by China and other countries such as South Korea, Vietnam and Turkey at cut-rate prices into Canada, a problem that is expected to get worse as producers search for alternatives to the U.S. market.

“We are expecting more unfairly traded (steel) goods to land in Canada because they can’t go to the United States,” says Catherine Cobden, CEO of the Canadian Steel Producers Association. A 25 per cent steel tariff Canada imposed on China last fall will help, she says, but there needs to be greater enforcement and higher tariffs. “It is time for the government to do much more to get that unfair trade out of the market.”

“There is still a threat of Chinese steel flooding the zone here in North America,” said Loomis at the Canadian Institute of Steel Construction. “We want to make sure that we’re acting in concert with the Americans against this common threat.”

While the steel industry is hopeful the Canadian government can get relief from U.S. tariffs by focusing on the common problem of offshore dumping, industry representatives are looking for Canadian markets for at least some of the steel now sold in the U.S.

Loomis is calling for federal and provincial rules requiring that Canadian steel must be used for infrastructure projects like bridges, public buildings, pipelines and the giant new auto battery plants that will be built partly with government funding. “We’re looking at projects that are close to being awarded where there is a threat of them using Chinese steel or foreign fabricators.”

Modular houses made with corrosion-resistant steel could be another major market as governments call for a crash program in home-building, says Peter Warrian, a steel industry researcher at University of Toronto’s Munk School for International Studies. An east-west energy pipeline and expansion of the national electric grid could also provide additional demand for Canadian steel.

But Warrian also believes there will be substantial pressure on Trump to relent on the tariffs, particularly on autos. “We’ve just spent 20 or 30 years and billions of dollars building an integrated North American industry. Are you (Trump) really saying we’re supposed to unwind all that?”

At the time this article was written, there were growing signs that the Trump tariff plan may not last long. Trump supporters like Texas Senator Ted Cruz warned that tariff-caused inflation and unemployment could devastate Republican support. The Senate was flexing its muscles, preparing measures to re-take control of national trade policy. Stock markets were plunging and auto plants on both sides of the border had announced layoffs.

But even if Trump’s tariff plan unravels, the fundamental relationship between Canada and the U.S. has changed. Hamilton businesses and their industry leaders are adapting to new realities, looking less at the U.S. and more toward fresh markets at home and abroad.

Dunnett says this new paradigm is about more than business relationships; it’s about Canada’s existence.

“It’s imperative for us as a nation as we go through this that we don’t back down,” he says. “We all have to be cognizant of the fact that this is about more than just trade. We need to protect our sovereignty.”

Local food chain casts out U.S.-made products

MRKTBOX, a trio of three Hamilton food stores with a mission to promote local purchasing, has struck a blow for Canadian food producers by wiping their shelves clean of products from the United States.

The decision to go non-U.S. came this spring after Donald Trump suggested he would impose tariffs on Canada.

“We decided to remove the American products from our offerings out of solidarity” with workers and industries affected by the tariffs, says MRKTBOX CEO Rachael Henderson. MRKTBOX also felt strongly that the action was warranted by current U.S. policies on human rights issues, especially those affecting 2SLGBTQIA+ communities.

The company operates Strathcona Market, Ottawa Market and Dundurn Market as well as a home food delivery service.

Growing numbers of Canadian retailers are abandoning U.S. brands in the face of a grassroots consumer boycott that has been catalyzed in the “elbows up” movement popularized by comedian Mike Myers. Henderson said the action has been popular with MRKTBOX customers and is prompting many customers to find out more about how their food is sourced.

“A lot of people are asking more questions now about where things are made, and they are more interested to know where their food comes from, which I think has been one of the silver linings of the whole situation.”

Hamilton native leads effort to protect Canada’s wealth, sovereignty

Shortly after his election in November, Donald Trump started pontificating about how Canada should become the 51st state, while claiming the United States was subsidizing its northern neighbour.

For Bill Young, this was too much. The Hamilton-born founder of Toronto-based Social Capital Partners – a social enterprise devoted to solving the problem of wealth inequality – talked to his SCP colleagues and decided to launch Always Canada – Never51.

The project, part economic populism mixed with methodical policy-making, is devoted to the issues of wealth inequality and Canadian sovereignty.

“It was a timely way of channeling our collective frustration, not just at Social Capital Partners but Canadians as a whole,” he says. Young says Trump’s talk of taking over Canada supercharged the company’s mission.

SCP wants to build policy responses inspired by one of its chief success stories: a worker ownership package that saved Taylor Guitars by enabling employees of the vintage American guitar maker to buy out its aging founders.

The team is advocating ideas like how Canadian entrepreneurs can buy existing businesses, how pension funds can invest in Canadian manufacturers, how company owners can sell to their employees, and how governments can limit Americans from buying Canadian firms.

Young established a successful computer business in the 1990s, and then invested in Red Hat, a hugely profitable software company founded by his cousin and fellow Hamiltonian, Bob Young. Bill Young established SCP in 2001.

Bill Young is also an advisor to the Young Fund at the Hamilton Community Foundation. The fund was established by his mother Joyce with a $40 million donation in 2000. At the time, it was one of the largest donations in Canada’s history.

Bill Young says his combination of business and charitable experience has led him to this moment when both these ways of thinking are crucial. “Capitalism is here to stay. We’ve got to make it work way better for way more people.”

As the federal government sets out to “build, baby, build,” do we want to own or be owned?

By Matthew Mendelsohn | Part of our Special Series: Always Canada. Never 51.

The new Liberal government has a mandate to pursue an economic growth and sovereignty agenda. Prime Minister Carney has placed the idea of building at its centre.

And the government is getting lots of advice on how to pursue that growth agenda. Some of this advice is simply wrong and will make our economic problems worse, like the suggestion to cut corporate or capital taxes.

But a lot of the advice will deliver real benefits and growth. There is momentum to deliver nation-building trade and transportation infrastructure, build one integrated Canadian economy and a broad consensus that we can deliver natural resource projects more quickly, particularly when Indigenous people have equity stakes.

But that agenda represents only a sliver of what needs to be done and doesn’t get to the core of our structural economic challenges. Canada has systemic problems that require systemic solutions.

These problems are well-documented, and many of them speak directly to the issue of ownership. We simply do not own enough of our economy. This leaves us vulnerable as a nation, with many Canadians feeling economically at risk.

Our businesses and natural resources have been bought by foreign investors. We have accepted being a branch-plant economy. We have sold our IP to others and celebrated it as a windfall. We have hollowed out our Main Streets and consolidated local economies. Our “industrial policy” has been geared towards writing big cheques to foreign giants or subsidizing business-as-usual amongst Canadian oligopolies. We have built businesses with a mindset towards exit—usually to a large financialized global interest—rather than building for long-term value, as owner-operators do.

These structural problems must be addressed as the government pursues its growth agenda, and they won’t be fixed by listening to the same voices who want governments to cut tax and regulations. The record shows that corporate Canada prefers to boost profits, extract wealth, hoard cash and sell to foreign buyers rather than invest in their own innovation and productivity.

These structural problems have also meant that too few Canadians have seen the benefits from growth. As we continue to watch the unfolding spectacle south of the border in horror, it is important to keep one key lesson in mind: economic growth that concentrates wealth and privilege leads to economic, social, environmental and democratic collapse.

So, as we pursue growth and prosecute the “building Canada” agenda, we should remember the lesson from our history: too often, we build and invest, only to sell off our assets and resources to the highest foreign bidder, leaving us economically vulnerable.

In this moment of extreme peril, how should we “build, baby, build” in a way that doesn’t merely accelerate the trends towards consolidation of wealth and deeper economic dependence?

Four overarching principles should guide the economic growth agenda to deliver broadly shared benefits and avoid exacerbating current unsustainable economic inequality.

First, we must put our economic sovereignty and ownership of our own assets front and centre. We need more community ownership, employee ownership, local independent business ownership, and Indigenous ownership. It means we need more Canadian-owned businesses looking to grow globally.

In practice, this means using loan guarantees or co-investing with pension funds to keep Canadian businesses in Canadian hands, enforcing the Investment Canada Act to prevent our assets from being bought up and setting up independently managed sovereign funds to invest in and purchase vulnerable Canadian businesses.

Second, we must mobilize capital from across society so that it actually gets to the people and communities where it can build wealth and ownership for Canadians. The government has talked about catalyzing private-sector capital for big infrastructure projects, but we must catalyze capital from all sectors to reinvest in communities, local businesses, social enterprises and not-for-profits.

In practice, this means unlocking philanthropic capital by requiring impact investment, amending legislation to make community financing of local businesses and social enterprises easier, using loan guarantees to facilitate the transition to employee and co-op ownership and using the Business Development Bank of Canada (BDC) and its community banking arm to provide lower-cost capital to vulnerable entrepreneurs and to those Indigenous, Black, rural and other entrepreneurs who have been shut out from capital markets in the past.

Third, we must remake our economic model so that independent entrepreneurs, smaller businesses and new ventures have a real chance to compete against our entrenched, consolidated and financialized corporate sector. The dominant Canadian business model driven by our oligopolies—crush competition, consolidate markets, secure favourable treatment from regulators, rent-seek, extract wealth and grind consumers on price—is bad for Canadians and weakens us economically. It pools up wealth in the hands of a small number of legacy oligopolies and the billionaires who own them.

In practice, this means making it easier for independent Canadian entrepreneurs to buy existing businesses, strengthening the Competition Act to address serial acquisitions that extract wealth rather than investing it and making tax changes to disincentivize private equity (PE) buyouts and roll-ups—along with share buybacks—that make it more attractive for corporate leaders to enrich themselves rather than invest in their businesses.

And fourth, we must use all the tools of strategic industrial policy to catalyze investment in the Canadian economy, which will require new government skills and capacity.

In practice, this means choosing a few big goals and building the state capacity needed to leverage the full power of government—procurement, regulation, tax policy, R&D investment, concessionary capital deployment, infrastructure builds, governance and a nation-building role for our public financial institutions—to shape a dynamic and growth-oriented economy that reinforces our economic sovereignty and goals. If we place popular “missions” at the heart of our industrial strategy—like food security and affordable housing—we can succeed in finding a path through this moment of historic disruption and emerge, truly, as “masters in our own home.”

The strategic direction proposed here for our growth agenda is not radical and most initiatives would be broadly supported across parties. They are good public policy.

But the approaches are not top-of-mind when decision- and policy-makers think about the economic growth agenda. They are not the ones that pop up in editorials or on panel discussions in Ottawa about productivity. But they should be.

Canada has everything we need to emerge stronger from this period of geopolitical disruption if we put economic sovereignty and broad access to wealth-building at the heart of our agenda. If our economy is broadly owned by Canadians, we will be more resilient to whatever threats may come our way from MAGA or elsewhere.

If, on the other hand, we merely use this moment to check off the wish list from corporate Canada, we will reproduce our current structural weakness and exacerbate the wealth inequality that is leading to the societal unravelling we see down south. I hope those making decisions in the federal government have learned the right lessons from the past twenty years of capitalism and choose to build the right way.

Innovate? In this economy? With these profit margins?

By Tom Goldsmith | Part of our Special Series: Always Canada. Never 51. | This post first appeared in Orbit Policy's Deep Dives

Happy Wednesday, everyone. Today, I want to expand on one thing I mentioned in Monday’s post—Canadian corporate profits and their implications for innovation.

Long story short, the financialization of Canada’s economy and the high levels of rent extraction that accompany it are barriers to innovation. We are impoverishing ourselves over the long term to support short-term financial gains. If we care about innovation and productivity, then we need to focus far more critical attention on corporate Canada.

Let’s dig in.

High Profitability

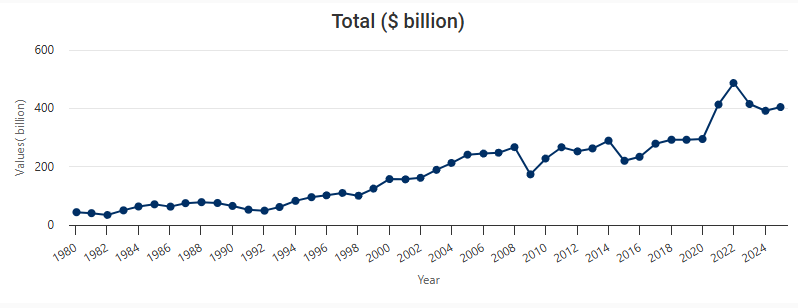

Canadian businesses are immensely profitable. In raw terms, their profits were at near record highs, over $400 billion last year.

Those profits are also at record levels relative to GDP:

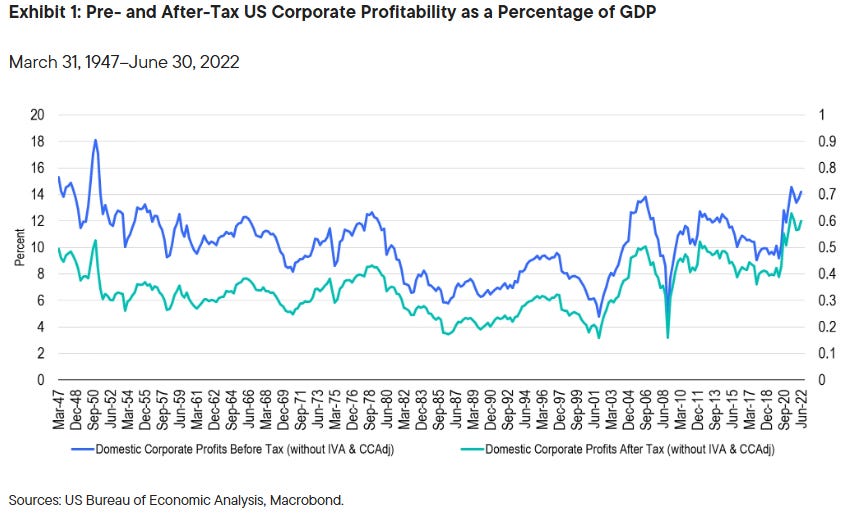

These profit levels surpass those found in the US and have for a long time. If we look at US corporate profitability relative to GDP, we can see that at almost no point over the past 45 years have US corporate profits exceeded the share of GDP of Canadian firms.

Various factors influence these high levels of Canadian corporate profitability, with Peter Josty highlighting a lack of competition, growing company size, and cross-border trade as contributing factors. But what matters most is what is done with those profits, and here the picture isn’t pretty.

Low Investment

Despite profits reaching astronomical figures, businesses simply haven’t been reinvesting them. Business investment on multiple fronts is paltry and a driving cause of our productivity challenges.

Capital investment per worker has been falling. Research from C.D. Howe highlights that in 2024, Canadian workers will likely receive only 66 cents of new capital for every dollar received by their counterparts in the OECD as a whole and 55 cents for every dollar received by their US counterparts. Canadian corporations spend more on structures than the US, but we massively lag in machinery, equipment, and IP products.

Investment in workers lags our peers. Research from Shift Insights for the Future Skills Centre estimated, using the limited data available, that Canadian firms invest only an estimated $240 per employee annually and lag their international peers in rates and hours of instruction.

Investment in R&D is falling. If you are a reader of this newsletter, you probably don’t need this pointed out, but nevertheless, Canada’s business expenditure on R&D has fallen over the past 25 years, and even after a relative improvement since 2017, it remained at 1.07% of GDP in 2023. The OECD average, meanwhile, has been consistently increasing over that time, to a record high of 1.99% of GDP.

Record corporate subsidies. All of this is happening at a time when there are record subsidies to businesses. As Laurent Carbonneau highlighted in his recent book At the Trough, since 2019-20, Canadians have been giving away more than 50 cents of every dollar collected in corporate income taxes right back to businesses. Corporate subsidies are expected to reach $50 billion annually by 2027-28 – the equivalent of $1246 for each person in Canada – and that is before the Liberal platform included a range of new corporate tax breaks.

So, where are the profits going?

In short, to shareholders. Calculations by DT Cochrane found that from 1985 to 2014 around equal shares of profits were distributed to shareholders as was invested in physical assets less depreciation (38% vs 36%). Since then, though, shareholder distribution has shot up, and investments have crashed. From 2020 to 2022, almost 50% of profits were distributed to owners while less than 10% was invested. And as we’ve seen above, there hasn’t been a corresponding jump in investment in non-physical assets such as IP.

But wait, it gets worse

High profitability at a time of paltry investment is bad enough. But there is a further trend that exacerbates the picture—growing rates of dividend recapitalization. As Rachel Wasserman has highlighted, instead of dividends returning profits to shareholders, dividend recapitalization is sourced by taking on new debt. The private equity industry drives this trend, using cash flow, not just profits, to enrich itself.

Companies that take this path have “less cash available for productive activities such as business operations and capital investments. With less cash available, a company may be forced to slash expenses, lay off employees or declare bankruptcy when faced with unexpected hardship.”

Combined, these two trends point to the massive financialization of the economy, which prioritizes short-term rent extraction at the expense of long-term productivity and growth. It is another example of what Alex Usher has described in a different context as us “eating the future”.

Innovators vs Corporate Canada

Where does this leave innovators in Canada? Well, if you care about innovation, pushing forward our knowledge frontier, solving real-world challenges, and boosting our productivity and growth, then I think you need to be clear that you stand in opposition to much of corporate Canada.

There are deep ties between corporate Canada and the innovation economy, not least the links between private equity and venture capital. However, we should see how corporate Canada is a barrier to innovation and not an enabler.

Government procurement is often cited as a way to accelerate innovation in Canada, and it is certainly an important and underutilized lever. But let’s put it into context: The public sector’s contribution to GDP last year was $475 billion. That’s only around 21% of our total GDP of $2.265 trillion. Increasing business investment to the levels of our peer countries would unlock huge innovation and procurement opportunities.

And that is all without analyzing the role of capital accumulation and corporate elites in closing off political routes to innovation. If innovation is a process of creative destruction, we can’t ignore that part of what is being destroyed is the existing elites’ economic and political power. It is no surprise that elites typically oppose genuine innovation.

If innovators support and perpetrate our existing system of rent extraction and financialization, then we will condemn Canada to continuing low innovation and ongoing corporate capture.

We need to rein in corporate Canada. As Lenore Palladino said in the essay I cited on Friday: “The corporation’s privileges come from the public, and we have the right to promote innovation and productivity rather than extraction.”

It is time we realized how far extraction and innovation stand in opposition to each other. Opposing extraction must be an essential part of unleashing innovation.

–

Orbit Policy’s Deep Dives explore how innovation and technology can help build a more inclusive and prosperous society and economy in Canada.

Letting private equity buy law firms may stifle service, mobility | Bloomberg Law

By SCP Fellow Rachel Wasserman | Part of our Special Series: Always Canada. Never 51. | This post first appeared in Bloomberg Law

Rachel Wasserman of Wasserman Business Law says law firms should decentralize, not consolidate, to provide good service and keep lower overhead.

Private equity firms are quietly buying up and consolidating dental, accounting, medical, and veterinary practices, turning smaller independent firms into corporate chains. These firms offer professionals handsome payouts in exchange for ownership of their practice. Law firms are the final frontier for these consolidators. Recent developments in Arizona may finally give private equity the door into the legal industry that it’s been waiting for.

If we allow for private equity ownership of law firms, it isn’t unreasonable to expect a similar result as we are seeing in other professions—lower quality of service and work for clients and lower job satisfaction for lawyers. As these firms consolidate, it will be even harder for independent lawyers to compete against the economies of scale of these corporate behemoths.

In the longer term, this could mean less upward mobility for future generations of lawyers. It isn’t impossible for equity participation to disappear entirely if these corporate chains take over the market, which could also lead to the commodification of our profession. On the bright side, at least a handful of already rich partners and investors will have gotten even richer.

The scale advantage that once insulated big law is disappearing. Thanks to AI and legal technology, large-scale projects such as due diligence and discovery no longer require armies of associates. Boutique firms, with lower overhead and without the burden of luxury offices and top-heavy compensation structures, are now able to compete, offering sophisticated legal services at a fraction of the price. We don’t need investment capital or consolidation to make law firms more efficient—the future lies in decentralization.

Firm Ownership Matters

Legal regulatory bodies have largely prohibited nonlawyers from owning law firms, but these protections are starting to erode. Regulatory rollbacks often operate under the guise of altruism, purporting to promote access to justice. But maybe large multinationals and investors who have been shut out from this high-margin industry are just looking for access to more profits?

One example of this is the alternative business structure now permitted in Arizona. The regime still prohibits non-licensed attorneys from practicing law, but nonlawyers are now entitled to the economic interests and decision-making authority of law firms.

Nonlawyers having equity in a legal practice is a fantastic way to motivate non-legal professionals to deliver the best result for firm clients. But there is a significant difference between ownership in and control of a firm. Those in control dictate the firm’s values, performance expectations, and culture.

Once law firms are controlled by private equity, such firms will be required to juggle fiduciary duties to both their investors and their clients. Private equity’s interest in owning law firms is merely a means to an end. Whether it’s practicing law or manufacturing widgets, these firms seek out the most lucrative investment opportunities for their investors and themselves.

They don’t really care how the sausage gets made—as long as the sausages keep selling. Private equity firms are eager to capitalize on economies of scale through the consolidation of smaller practices, while also benefiting from the streamlined operations and reduced headcount enabled by adopting artificial intelligence.

Cautionary Tales

To understand the impact private equity ownership could have on the legal profession, we don’t have to look far. There are countless examples of PE firms’ impact on other professions that have already undergone significant PE consolidation.

A study published in the Journal of the American Veterinary Medical Association found that veterinarians working for large corporations reported more pressure to generate revenue than independent practices. An employee at two different corporate vets recounted that one of them had five price increases in one year, each between 3% and 6%, with no justification provided.

The cost for veterinary care outpaced general inflation by 2.7 times in the US last year. As the cost of care rapidly increases, many vets are now being forced to euthanize pets because the price for care has become out of reach for some clients.

Medical care also has suffered under private equity ownership. When private equity buys a hospital or physician practice, costs usually rise, as do the number of costly procedures and serious medical errors.

Sen. Sheldon Whitehouse (D-R.I.) went so far as to say “private equity has infected our health care system, putting patients, communities, and providers at risk” after a scathing bipartisan report on the subject was released earlier this year. In nursing homes, private equity ownership is associated with an 11% higher mortality rate and a 50% greater chance of being sedated, which reduces demands on staff and helps to lower labor costs.

Thinking law firms wouldn’t be faced with similar issues would be naive.

Lawyers are no more virtuous than the countless veterinarians, doctors, and other professionals who have sold their practices to investors. Many senior partners have already built immense personal wealth, and if private equity begins consolidating law firms, they’ll undoubtedly be enticed by the same kinds of lucrative offers that younger lawyers will be unable to match.

Protecting Our Professions

Clients come to us for independent, expert advice—not guidance shaped by firm profitability. We can’t allow the legal profession to be stripped of its integrity and independence in the name of efficiency and returns.

Lawyers must not only resist private equity control within our own profession—we must also stand alongside other professionals facing the same threat. Our skills, our judgment, and our commitment to the public trust are needed now more than ever.

This article does not necessarily reflect the opinion of Bloomberg Industry Group, Inc., the publisher of Bloomberg Law and Bloomberg Tax, or its owners.

Mark Carney passed a tough test in Washington. He now faces an even tougher one at home | Toronto Star

By Matthew Mendelsohn and Jon Shell | Part of our Special Series: Always Canada. Never 51. | This post first appeared in the Toronto Star

Prime Minister Mark Carney went to the White House last week to meet U.S. President Donald Trump. It was his first real test, and just about everyone agreed that he had passed. Carney was smart, funny and very Canadian, and he even seemed to disarm the president.

Now he faces a very different kind of test.

Sunoco, the energy giant based in Dallas and chaired by Trump ally Ray Washburne, is pushing to take over Alberta-based Parkland Corporation. The deal would bring together U.S. infrastructure and Canadian retail and refining assets to create the largest independent fuel distributor in the Americas — and it would be owned by an American company.

At this inflection point in Canadian history, where years of globalization and continental integration have come to an end, our “elbows up” approach is now coming face-to-face with real-world policy choices.

A transaction like the Sunoco deal would once have been a no-brainer: there’s a buyer offering a good price for a Canadian company, and if the board and shareholders approve, there should be no reason for the government to obstruct the deal. The market will produce value and the right outcomes.

But Canadians now have to decide how to navigate a new world, and we must ask ourselves whether we’ve learned the lessons of recent history.

Decades ago, Canada lost its mining leaders when Inco, Falconbridge and Alcan were bought by foreign giants. Now, instead of owning the world’s foremost mining companies and generating wealth in Canada, Canadians are working for foreign entities. This story has been well told.

Despite short-term benefits for shareholders, we know now that these deals robbed Canadians of their ability to build global firms. We also know that the era of taking free trade for granted is over — and that state power in the U.S. and elsewhere is being used more aggressively to protect national sovereignty.

It would be bad for Canadians to have an economy owned by others. It would be bad for Canadians to have merely a “branch plant” economy, one that doesn’t own or control its natural-resource companies.

We predicted earlier this year that American investors would soon look to buy up Canadian businesses and other assets, and we argued that it would threaten our national security and economic sovereignty. And here we are. Do we want to be owned by American billionaires, to work for them and have our wealth stripped away to pad bank accounts in New York and Dallas?It’s hard to say no to predators, and doing so comes with risk. But we need to start saying no anyway. As the prime minister has said, Trump wants to weaken us in order to own us. Invasion is the least likely way for him to achieve that aim — it’s much easier to buy up Canadian assets.

In March, the government introduced changes to the Investment Canada Act to strengthen its ability to review foreign takeovers. Everything about our history tells us that the Sunoco deal is exactly the kind of foreign investment that would threaten Canada’s long-term economic competitiveness.

As the transaction awaits Canadian regulatory review, we must follow through on Minister of Innovation, Science and Industry François-Philippe Champagne’s commitment to “take action on transactions that could harm Canada’s national and economic security … and bring the foreign investment review regime in line with today’s reality.”

The government should kill the Sunoco deal through its review under the ICA. True, some shareholders would be deprived of a bump to their portfolios. But we are in the midst of an economic war, and we cannot further cede control of our infrastructure or accept more high-value talent leaving Canada for the United States.

In the Oval Office last week, the prime minister described Canadians to the president as the “owners of Canada” and said the country would never (never, never, never) be for sale. If we really want it to remain ours, then we need to think and act like it.

We have the tools. Now let’s deploy them to protect our sovereignty.

These Canadian millionaires are asking for tax increases—but just for themselves | CBC News

By Anis Heydari | CBC News

A group of wealthy Canadians calling themselves “Patriotic Millionaires” is banding together to lobby governments to increase the amount of taxes they must pay, with a campaign patterned after similar movements in the United States and United Kingdom.

But there is already pushback on the concept — even before the group officially launches in Canada — with the opposing view being that higher taxes would drive entrepreneurship away from this country.

Speaking exclusively to CBC News in advance of the group’s Canadian launch, members of the Patriotic Millionaires say their organization is looking for broad changes to wealth taxes and capital gains in this country.

The group says it believes lower-income citizens often pay tax on much of their income, while wealthier investors can leverage dividends, investments and capital gains to change what they pay and how.

“Patriotic Millionaires, which started in the U.S., rapidly realized that this is an international issue,” said Claire Trottier, chair of the Canadian branch, in addition to her work as a businesswoman, investor and philanthropist in Montreal.

“Every country should be taking a look at the way that they design their tax system to try to ensure greater fairness across the system.”

The organization said it’s initially focusing on changing how Canadians think about taxing the wealthy, but is working to release research in early June on how it believes different wealth taxes across G7 nations could change government revenues.

An event planned for that month in Ottawa will push the idea that as the 2025 host nation for the G7 summit, Canada can encourage other nations to re-assess how wealthier citizens are taxed.

Changing taxation policy by lobbying new members of Parliament and a soon-to-be-announced finance minister is also an explicit goal of the organization, said Patriotic Millionaires Canada executive director Dylan Dusseault.

The organization wants to enable wealthier Canadians to be part of an “organizing, and lobbying campaign to change the public narrative and the law around tax fairness,” said Dusseault.

Even Trump might support higher wealth taxes

Further south, U.S. President Donald Trump has recently said he was “OK” with raising taxes on the wealthiest Americans in order to benefit people in middle- and lower-income brackets.

“I would love to do it, frankly,” he said in the Oval Office on Friday. He says he would be willing to pay more in taxes himself.

However, the U.S. House of Representatives Speaker Mike Johnson and other top Republicans have resisted the idea of raising taxes on the wealthy.

The president told Johnson this past week that he wanted to see a higher tax rate on incomes of $2.5 million for single filers, or $5 million for couples, only to sort of back off the idea on Friday. “Republicans should probably not do it, but I’m OK if they do,” Trump wrote on social media.

But Trump’s verbal — if loose — support of increasing tax on the rich didn’t actually surprise Patriotic Millionaires Canada.

“[Trump] and his rich friends don’t pay income tax because they don’t declare income. It’s just one more sign of the problems with the tax system in the U.S. that are mirrored in Canada,” said Dusseault.

Meanwhile, group member Avi Bryant, who now lives on B.C.’s Galiano Island, founded a Canadian tech company that was sold to Twitter in 2010 and says the bulk of his family’s wealth comes from that work in the Silicon Valley tech sector. He says he believes higher taxes for the wealthy can maintain Canada as a desirable location to both live and work.

“If we want thriving businesses with knowledge work, like tech startups, [we need] to be a nice place to live. Taxation and redistribution and good social services help a great deal with that,” said Bryant.

New government to lobby

The recently victorious federal Liberal Party’s platform includes tax changes focused on increasing tax penalties and fines through the Canada Revenue Agency (CRA), promising revenues of $3.8 billion over four years.

It also promised a tax cut to the lowest marginal tax rate, which could be interpreted as a tax cut for many — if not all — Canadians earning income.

Only the NDP, who were not able to retain official party status in the election, promised a tax increase on what that part labelled the “super rich.”

“Why is it that we’re paying less taxes than the people who are actually working for a paycheck… your teachers, your nurses,” said Patriotic Millionaires group member Sabina Vohra-Miller, who splits time between California and Toronto with her spouse Craig Miller, former chief product officer at Shopify.

Specifically, one goal of the organization as it launches will be to encourage the federal government to re-attempt a functional increase in how much wealthier Canadians would pay in capital gains tax.

That policy announcement triggered opposition when first announced earlier in 2024. The finance minister at the time, Chrystia Freeland, said it was intended to address what she called issues of tax fairness.

Groups such as the Calgary Chamber of Commerce had said the changes to capital gains, which would primarily have hit wealthier Canadians, were a “negative signal for investment.”

In the end, the capital gains changes were implemented, then delayed by the Liberals under Justin Trudeau. They were then fully cancelled by Prime Minister Mark Carney. Conservatives were also against the tax increase.

Anti-tax anxiety in current climate

The principle of increasing taxes that primarily target the wealthy elicited a fiery reaction from a venture capitalist in Canada.

“If you want to use tax policy, you tax the things that you don’t want,” said John Ruffolo, the founder of Maverix Private Equity and vice-chair of the Council of Canadian Innovators, a group that referred to the now-cancelled capital gains tax changes as “bad policy.”

“You don’t want wealthy people, you don’t want capital, you don’t want entrepreneurship. Is that what we’re saying? Is that what you really want?” said Ruffolo.

A Canadian expert in taxation points out that weaker economic indicators in Canada, along with anxiety around relations with the U.S., could mean that politicians will be very cautious to respond to lobbying efforts to increase taxes.

“I think there’s anxiety about doing anything that might signal anything that would cause people with money to think, Oh, well, Canada is not a good place,” said David Duff, director of the Tax LLM (Master of Laws) program at the Peter A. Allard School of Law at the University of British Columbia.

“We’re also in an environment where a sort of an anti-tax agenda has become politically more dominant,” he said, an observation in keeping with both major Canadian federal parties explicitly indicating they would not support the previous increase in capital gains inclusion rates.

Duff pointed out that increasing taxes on the wealthy may not generate earth-shattering revenue for Canadian governments, but can be a symbolic statement.

“In many cases, these are people who have benefited from a Canadian society and economy that’s allowed them to earn or inherit significant fortunes.

“The downside, in my experience over 30 years of doing tax, is generally highly overblown … dire economic consequences from any kind of additional taxes,” he said.

Duff also pointed out that while higher taxes may lead Canadians to try and hide their taxes through loopholes, if that was easily done, those subject to higher levies “wouldn’t get so upset about raising taxes.”

Donations aren’t good enough: millionaire

The idea that donations and philanthropy are an alternative to mandatory wealth taxes is mentioned by both proponents and opponents of the lobby group.

“It’s just not enough to wait for people to make the proactive decision to give away their money and also trust that they’re going to give away their money to these different priorities,” said Trottier, who is involved with multiple philanthropic organizations including a family foundation that pledges hundreds of millions of dollars.

On the flip side, opponents say they should not be forced — through taxation — to fund those priorities, especially if they must give up control over how the money is used to governments.

“If you feel so passionately about it, nothing stops you from giving it all the way, nothing,” said Ruffolo, who said he fundamentally believes in giving his money away.

“But I will decide I will decide who gets it and why,” he added, pointing out that Warren Buffett is planning to do the same with his fortune.The philanthropist and billionaire Buffett, 94, has announced he will retire at the end of this year and had previously said on his death he’ll donate 99.5 per cent of his remaining wealth to a charitable trust.

Tech billionaire Bill Gates has made a similar pledge, saying he will donate 99 per cent of his remaining tech fortune to the Gates Foundation, worth an estimated $107 billion US.

However, Patriotic Millionaires chair Trottier feels there is a stronger issue at play: that taxation must be used to address the growing gap between the rich and poor in Canada, rather than through select causes supported by choice.

The gap between the disposable income of the wealthiest and poorest groups of Canadians hit the widest gap in 2024 since Statistics Canada first starting collecting data in 1999.

The widening gap was pinned, at the time, on investment gains — something Patriotic Millionaires Canada wants to see taxed differently in this country

“Are we going to recognize that massive growing runaway wealth inequality is a danger to democracy?” Trottier said.

Canada's Liberal party will face down Trump. But will it address inequality? | Truthout

By Nora Loreto | Part of our Special Series: Always Canada. Never 51. | This post first appeared in Truthout

Canada entered the 2025 federal election with a Liberal minority government and it emerged from the 2025 federal election with a Liberal minority government. The outcome is shocking, given that Conservative leader Pierre Poilievre had been riding the top of the polls since the end of 2023.

Liberal leader Mark Carney now has a monumental task to lead Canadians through the turmoil of a second Donald Trump term, while also addressing various crises: affordability, housing, toxic drugs and health care, to name a few.

While these crises loomed over the election, one fundamental cause was never clearly identified: concentrated corporate power.

Polls showed that Canadians were concerned about finances, the economy and the cost of living just as, or more than, than Canada-U.S. relations.

And yet, each of the parties talked more about the need to help corporations rather than limit their reach. Now, Canada’s prime minister is a man who has been the top banker at not one, but two central banks, and the chairman of one of Canada’s largest asset management companies, Brookfield Asset Management.

“During crises, corporations have the power to just raise profits at everyone else’s expense,” explains Silas Xuereb, research and policy analyst with the nonprofit group Canadians for Tax Fairness. Xuereb points to the fact that during the first years of the pandemic, corporations raised their prices with very little pushback from the Liberal government. The result was profiteering the likes of which Canada has never seen before.

Trudeau’s Liberals didn’t try to reign in corporate profiteering, instead actually backtracking on the one measure that they had promised to implement — lowering the amount of profits that are sheltered from tax when a person or a business makes a large sale, called the capital gains inclusion rate.

As a result, corporate profits in 2022 were higher than in any other year in the history of Canada, at $685 billion — Canadians had never before witnessed profits as high. While profits dipped slightly in the following years — by 3 percent in 2023 — they still remained record-high.

In 2023, real estate and education, health and social assistance services had the largest profit margins, surpassing 25 percent, and oil and gas made the largest jump to reach nearly 20 percent from -11 percent. Real estate represents 40 percent of Canada’s GDP, higher than any other G7 nation. Real estate is big business for investors, which drives Canada’s housing affordability crisis.

Xuereb points to the fact that Canada’s tax laws allow corporations to reinvest their profits without being subject to tax. That means that what is left over is all that is taxed, and therefore, wealth is increasingly concentrated in the hands of stockholders and doesn’t go toward creating jobs. “When we cut corporate taxes, corporations end up with more profits left over to give back to their wealthy shareholders,” he says.

The flip side of these profits is record-high and growing income inequality. One analysis from 2024 calculated that where the richest 20 percent of Canadians owned 67.7 percent of total wealth in 2023, the poorest 40 percent of Canadians owned just 2.7 percent of Canada’s total wealth. In monetary terms, where the wealthiest households hold $3.3 million, on average, lower income households hold just $67,038 on average.

Skyrocketing corporate wealth barely registered as an issue to debate during the election campaign. Instead, the parties all promised various tax measures that targeted personal income taxes rather than corporate profits.

The Conservatives’ campaign focused on eliminating several tax measures, which gave the Liberals a lot of space to promise a more balanced approach to taxation. Instead, they vowed to cut taxes as well. It was Carney’s first promise, something that the Liberals said would “keep more of what they earn and build a stronger Canada in the face of President Trump’s tariffs.” The proposed income tax cut would save the average middle and upper income household $300, and cost the state $22 billion over four years.

The Liberals also promised corporations the ability to shelter even more of their profits from taxes, both by maintaining the capital gains inclusion rate and by lowering corporate income tax rates if corporations reinvest profits either in Canada or abroad.

Despite the fact that Canadians said they were worried about the affordability crisis, ultimately, they did not vote for the two parties that did make very modest promises to tax wealthy Canadians more: both left-leaning parties, the Greens and the New Democratic Party, were decimated, and the latter didn’t elect enough people to hold party status. The Liberals increased their percentage of the popular vote by 10.9 percent, and the Conservatives increased theirs by 7.6 percent.

Under Carney, Xuereb warns that Canadians should expect more of the same.

“I don’t think there will be any huge changes to corporate taxation or really the taxation system in general,” Xuereb told Truthout. “I’m sure he will implement some tax breaks around the edges for corporations, which will just allow corporations to send more money to their wealthy shareholders. A status quo policy in this area is continuing a status quo that is already benefiting the wealthy and allowing billionaires to accumulate billions of wealth on the backs of working people.”

—

This article originally appeared in Truthout. It is republished here under a Creative Commons license.