Canada's Liberal party will face down Trump. But will it address inequality? | Truthout

By Nora Loreto | Part of our Special Series: Always Canada. Never 51. | This post first appeared in Truthout

Canada entered the 2025 federal election with a Liberal minority government and it emerged from the 2025 federal election with a Liberal minority government. The outcome is shocking, given that Conservative leader Pierre Poilievre had been riding the top of the polls since the end of 2023.

Liberal leader Mark Carney now has a monumental task to lead Canadians through the turmoil of a second Donald Trump term, while also addressing various crises: affordability, housing, toxic drugs and health care, to name a few.

While these crises loomed over the election, one fundamental cause was never clearly identified: concentrated corporate power.

Polls showed that Canadians were concerned about finances, the economy and the cost of living just as, or more than, than Canada-U.S. relations.

And yet, each of the parties talked more about the need to help corporations rather than limit their reach. Now, Canada’s prime minister is a man who has been the top banker at not one, but two central banks, and the chairman of one of Canada’s largest asset management companies, Brookfield Asset Management.

“During crises, corporations have the power to just raise profits at everyone else’s expense,” explains Silas Xuereb, research and policy analyst with the nonprofit group Canadians for Tax Fairness. Xuereb points to the fact that during the first years of the pandemic, corporations raised their prices with very little pushback from the Liberal government. The result was profiteering the likes of which Canada has never seen before.

Trudeau’s Liberals didn’t try to reign in corporate profiteering, instead actually backtracking on the one measure that they had promised to implement — lowering the amount of profits that are sheltered from tax when a person or a business makes a large sale, called the capital gains inclusion rate.

As a result, corporate profits in 2022 were higher than in any other year in the history of Canada, at $685 billion — Canadians had never before witnessed profits as high. While profits dipped slightly in the following years — by 3 percent in 2023 — they still remained record-high.

In 2023, real estate and education, health and social assistance services had the largest profit margins, surpassing 25 percent, and oil and gas made the largest jump to reach nearly 20 percent from -11 percent. Real estate represents 40 percent of Canada’s GDP, higher than any other G7 nation. Real estate is big business for investors, which drives Canada’s housing affordability crisis.

Xuereb points to the fact that Canada’s tax laws allow corporations to reinvest their profits without being subject to tax. That means that what is left over is all that is taxed, and therefore, wealth is increasingly concentrated in the hands of stockholders and doesn’t go toward creating jobs. “When we cut corporate taxes, corporations end up with more profits left over to give back to their wealthy shareholders,” he says.

The flip side of these profits is record-high and growing income inequality. One analysis from 2024 calculated that where the richest 20 percent of Canadians owned 67.7 percent of total wealth in 2023, the poorest 40 percent of Canadians owned just 2.7 percent of Canada’s total wealth. In monetary terms, where the wealthiest households hold $3.3 million, on average, lower income households hold just $67,038 on average.

Skyrocketing corporate wealth barely registered as an issue to debate during the election campaign. Instead, the parties all promised various tax measures that targeted personal income taxes rather than corporate profits.

The Conservatives’ campaign focused on eliminating several tax measures, which gave the Liberals a lot of space to promise a more balanced approach to taxation. Instead, they vowed to cut taxes as well. It was Carney’s first promise, something that the Liberals said would “keep more of what they earn and build a stronger Canada in the face of President Trump’s tariffs.” The proposed income tax cut would save the average middle and upper income household $300, and cost the state $22 billion over four years.

The Liberals also promised corporations the ability to shelter even more of their profits from taxes, both by maintaining the capital gains inclusion rate and by lowering corporate income tax rates if corporations reinvest profits either in Canada or abroad.

Despite the fact that Canadians said they were worried about the affordability crisis, ultimately, they did not vote for the two parties that did make very modest promises to tax wealthy Canadians more: both left-leaning parties, the Greens and the New Democratic Party, were decimated, and the latter didn’t elect enough people to hold party status. The Liberals increased their percentage of the popular vote by 10.9 percent, and the Conservatives increased theirs by 7.6 percent.

Under Carney, Xuereb warns that Canadians should expect more of the same.

“I don’t think there will be any huge changes to corporate taxation or really the taxation system in general,” Xuereb told Truthout. “I’m sure he will implement some tax breaks around the edges for corporations, which will just allow corporations to send more money to their wealthy shareholders. A status quo policy in this area is continuing a status quo that is already benefiting the wealthy and allowing billionaires to accumulate billions of wealth on the backs of working people.”

—

This article originally appeared in Truthout. It is republished here under a Creative Commons license.

School meals aren’t just good for kids: they can also be good for industry

By SCP Fellow Sarah Doyle and SCP Advisor Alex Himelfarb | Part of our Special Series: Always Canada. Never 51.

Canada’s National School Food Policy has the potential to significantly improve learning and life outcomes for hundreds of thousands of children. It could also benefit Canada’s agrifood industries and serve as a model of how to integrate economic, social and environmental objectives.

Every province and territory and parties across the spectrum have signed on, with good reason. Until this year, Canada was the only G7 country and one of the few in the OECD without a national school meals program. The benefits are well documented: children’s health, school attendance and scholastic achievement improve; dropout rates, socioeconomic inequality, food insecurity and pressure on household budgets go down.

What we have not yet fully exploited, however, is its potential to contribute to a more robust and sustainable agrifood sector.

In the face of U.S. threats, Canadian governments have rightly adopted procurement policies that give preference to Canadian businesses. Prime Minister Carney, in his party’s election platform, emphasized the imperative of directing government purchasing power to buy Canadian—specifically proposing to do so through the National School Food Policy. These policies open the door to a more strategic approach to food procurement—one that shifts the focus from minimizing price to maximizing public value.

Getting food procurement right is particularly consequential now, as Canadian governments work to build a more resilient, less dependent economy. Canada’s agrifood businesses—responsible for about 1 in 9 jobs and 7% of GDP—are grappling with escalating trade tensions with China and the U.S., which respectively account for 14% and over 60% of Canada’s agrifood exports.

Specifically, governments could require a minimum percentage of school meals procurement budgets to be spent on healthy food that is grown and made in Canada, with incentives for suppliers to adopt sustainable practices and decent work standards. Support could be made available to businesses that are willing to transform to improve nutrition, sustainability and labour standards, with smaller suppliers receiving additional support to help them compete for contracts against larger incumbents.

This is not uncharted territory. Brazil’s National School Feeding Program requires at least 30% of federal funding for school meals to be used to procure from family farms, with priority given to local and Indigenous farmers, and to those who adopt sustainable land use practices. This program contributes to creating more sustainable value chains for food and nutrition security—one of six “missions” in Brazil’s industrial policy.

The patchwork nature of Canada’s School Food Policy is unlikely to offer much of a boost to industry. But it is not too late to negotiate a coordinated, national approach that reconciles flexibility with solidarity. Governments should identify procurement criteria that transcend provincial and territorial barriers, complemented by mechanisms for pooled procurement and advanced purchasing agreements for certain products, enhancing market certainty for businesses.

A national agreement could apply to all public food procurement, including in schools, hospitals and programs for northern and remote communities, building on sophisticated local procurement approaches that already exist. Such an agreement would reflect the collaborative approach to federalism that all parties are calling for to weather the impacts of U.S. aggression. Failing a national approach, willing governments could move forward together with agreed targets and principles.

Canada’s School Food Policy commits the federal government to spend $1B over five years on top of existing provincial, territorial and municipal funding and to work towards universal access. The benefits to children make this a worthy investment, but the return on investment could be greater. Clearly school meals are good social policy, but if school meal procurement is leveraged as an instrument of inclusive and green industrial strategy, they could be good economic policy as well.

Orienting procurement around the challenge of providing sustainable, healthy meals that are grown and made in Canada could stimulate innovation across the value chain, driving investment in potential growth areas like plant protein and greenhouse production, and providing a path to scale for made-in-Canada innovations like Growcer’s modular vertical farms. A strategic approach to food procurement could work in concert with, and augment, other tools of industrial strategy, such as government support for agrifood research and development, infrastructure, concessionary financing and supply-chain adaptation.

Scaling up access to school meals is a big win for children and families. It could also be a win for agrifood businesses, the climate and workers, contributing to a more resilient, just, sustainable and less dependent Canadian economy—but only if Canada’s newly elected government takes an ambitious, collaborative approach to how food is procured.

–

Sarah Doyle is Policy Fellow at the UCL Institute for Innovation and Public Purpose and a Fellow at Social Capital Partners and Alex Himelfarb is former Clerk of the Privy Council and Fellow at the Broadbent and Parkland Institutes.

Watch the video: Unleashing Canada’s potential in turbulent times | Canada Growth Summit 2025

A Quick Start Plan to Double Down on Investment

Panel discussion: Here’s how global experts suggest we can accelerate investment to drive economic growth and create a sustainable, prosperous environment.

Thursday, April 24, 2025

10:15 a.m.

Fairmont Royal York

100 Front Street West, Toronto, ON M5J 1E3

Panelists

Matthew Mendelsohn

CEO, Social Capital Partners

Michelle Harradence

Executive Vice-President and President, Gas Distribution & Storage, Enbridge

Peter Tertzakian

Founder, ARC Energy Research Institute

Moderator

Luiza Ch. Savage

Executive Editor, POLITICO

#HIRING Visionary Founding CEO to lead the Canadian Tax Observatory

What is the Canadian Tax Observatory:

The Canadian Tax Observatory (the “Observatory”) is a newly established non-partisan, non-profit organization committed to confronting wealth inequality through transformative tax policy. Our mission is to support a more equitable tax system that advances shared prosperity and economic growth through rigorous research, collaboration, advocacy and public education.

Why are we launching the Canadian Tax Observatory?

Highly unequal societies are not compatible with democratic governance. They are too unstable and vulnerable to the erosion of democratic norms. Democratic capitalism requires well-regulated markets, real opportunities for people to build economic security, and fair taxation. Today’s tax debate is shaped by wealthy interests and the organizations and lobbyists they support. Tax policy is increasingly structured to benefit the wealthy. Misleading stories about the tax system abound and are pushing Canada to accept rising inequality and wealth concentration as the price of economic growth. We want to correct this.

What we aim to achieve:

The Canadian Tax Observatory will be a catalyst to confront wealth inequality in Canada. We aim to reshape Canada’s tax landscape by delivering evidence-based analysis and workable options that will promote a more equitable and growth-oriented tax system. Confronting growing wealth concentration requires a full range of policy and legislative solutions, including tax reform.

Our journey thus far:

We are in the foundational stages of building this organization: we have incorporated as a nonprofit and are in the process of registering as a charity. The Observatory is currently incubated by Social Capital Partners, a nonprofit organization that provides robust governance, administrative and operational backing during this transitional period. We have thus far secured initial seed funding of roughly $550,000 per year for the first three years and are actively developing funding partnerships with other organizations. We are ready for a leader who can shape and grow the Observatory into a permanent, nationally recognized Canadian institution.

The leader we’re seeking:

We are searching for a visionary—a Founding CEO who sees beyond conventional boundaries. This person is innovative, strategic, deeply committed to social justice and capable of engaging diverse stakeholders, ranging from civil society to academic experts, industry stakeholders and government leaders. The ideal candidate will possess:

- Exceptional strategic vision with the ability to translate ideas into actionable policy solutions.

- A proven track record in organizational leadership, fundraising, and building influential partnerships.

- Credibility and expertise in economic and tax policy, preferably with a focus on Canadian public policy.

- Powerful communication skills to inspire, educate, and advocate across varied audiences, along with comfort engaging with the public, decision-makers and expert policy networks.

- An ambitious, entrepreneurial spirit eager to build and sustain an impactful, lasting institution that will have a transformative impact in Canada on the sustainability of democratic capitalism.

Position Details

- Type: Full-time permanent.

- Location: Remote within Canada – option to work out of SCP’s Toronto office if desirable.

- Compensation: $175-275,000/annum. The salary range is wide to accommodate various potential operating models and scopes of the role. We are open to honest discussions around compensation.

- Benefits: Competitive benefits package.

- Vacation: To be discussed and determined by the founding board and CEO.

Your application – an invitation to dream big:

We invite you to craft and submit a letter of no more than three (3) pages outlining how you would build and lead the Canadian Tax Observatory. Your letter should clearly state your vision for the Observatory and how you plan to bring this vision to life.

We are committed to adapting the Observatory’s operating structure to support the leadership model best suited to the chosen Founding CEO. All candidates should feel comfortable reaching out to us for a preliminary conversation to help determine their suitability for the role or to ask any clarifying questions.

Please submit your letter of no more than three (3) pages, along with your CV (including a list of your relevant publications), to careers@socialcapitalpartners.ca by June 4, 2025. As applications will be reviewed as they are submitted, we encourage all interested individuals to submit their application package as soon as possible.

Next steps:

Selected candidates will be invited to present their vision to our founding board and key stakeholders and will be compensated for their time. Our goal is to appoint our Founding CEO as soon as possible to promptly begin laying the groundwork for the Observatory’s next steps.

We are excited to learn about your bold vision for building this new Canadian institution—a beacon for economic fairness, sustainable economic growth and a thriving democracy.

Together, let’s redefine what’s possible for Canada.

Watch the video: Is Canada really poorer than Alabama?

Corporate leaders are obsessing over GDP per capita. But if you look at just about any number that would meaningfully tell you how well our economy is doing, Canada does better than the U.S. So, when corporate leaders speak glowingly of the American economic model, and how great it would be if Canada could be more like the U.S., it is worth asking: which aspect of that mess do they really want to replicate here? And how would that be good for Canadians?

Ten ways to unleash Canada’s potential | Public Policy Forum

By Deborah Aarts | Public Policy Forum

Public Policy Forum’s Canada Growth Summit 2025 gathered some of Canada’s top leaders and policy minds. Here are some of their biggest and brightest ideas.

No Canadian has any doubt of the magnitude of this economic moment. As U.S. President Donald Trump’s mercurial tariff mandate unleashes market mayhem and geopolitical unease, Canadians have galvanized — buying local, putting the maple leaf on everything, ratcheting our elbows way up.

Which may explain the pronounced air of intent at the Public Policy Forum’s 2025 Canada Growth Summit, which took place this week at Toronto’s Royal York Hotel. Over the course of a dozen sessions, more than 40 speakers put forward a series of smart, actionable ideas for how governments, businesses, policymakers and communities can work together to advance our collective fortune.

There was plenty of debate — when isn’t there when you put more than 400 heavily caffeinated wonks, politicians and businesspeople in the same room? — but as the day unfolded, a few themes emerged. This is a moment for pragmatic clarity, not wishful thinking; for focus, not blue-sky experimentation. It’s a time to, finally, activate our long-lamented untapped economic potential.

Here are 10 of the day’s best ideas to make that happen, including reflections from SCP’s CEO Matthew Mendelsohn on the role of policy in attracting business investment in Canada.

The misleading use of per capita GDP: Numerators, denominators and living standards | Policy Options

By Jim Stanford | Part of our Special Series: Always Canada. Never 51. | This post first appeared in Policy Options.

Some political and business commentators argue Canada experienced a lost decade of subpar economic performance even before U.S. President Donald Trump’s erratic trade actions cast their shadow. The most common evidence presented for this pessimistic judgment is a comparison of Canada’s per capita GDP to the U.S. and other industrial countries.

To be sure, Canada’s economy has traversed many challenges in recent years, including a global pandemic and subsequent inflation. Many features of the economy need to be strengthened. But for several reasons, it is misleading to use per capita GDP to grade Canada’s overall economic performance or, as it often is used, as a proxy for measuring living standards.

Per capita GDP is a simple ratio of the total value of goods and services produced for money in an economy divided by that jurisdiction’s population. The math sounds easy. But the methodology is complicated. Equating average output per person with the standard of living in a country is not credible.

Per capita GDP has a numerator (GDP) and a denominator (population). Canada’s numerator has not performed badly by international standards. Real GDP growth over the past decade averaged close to two per cent per year, despite a shallow recession in 2015 and a bigger downturn during the COVID-19 pandemic. That’s the second fastest among G7 economies, behind only the U.S.

It’s the denominator, therefore, that explains Canada’s seemingly poor performance by this measure. GDP has grown but not as fast as the population. Indeed, in recent years, Canada has had its fastest population growth since the 1950s. The population grew three per cent in each of 2023 and 2024, almost entirely due to immigrants – two thirds of whom were non-permanent arrivals (on temporary work or student visas).

Economic averages diluted by immigration

There is much to debate about the appropriate pace of this and the federal government has recently curtailed non-permanent immigration. But the impact of rapid population growth on an arbitrary statistical ratio hardly proves a broader economic failure.

The link between immigration and GDP is indirect and felt with a time lag. We do not expect the arrival of new Canadians to immediately boost GDP in the same proportion as the existing population for many reasons. It takes time to find work, gain skills and develop productivity.

Any surge in immigration will normally result in lower average per capita GDP, but that doesn’t mean Canada’s previous residents suddenly became poorer.

It simply means that Canada is absorbing new people to lay the groundwork for future expansion. The resulting decline in per capita GDP cannot be interpreted as evidence of a more general malaise.

It is also worth noting that many of the business voices now bemoaning Canada’s per capita GDP performance were the same voices demanding more access to temporary foreign labour after COVID-19 (to solve purported labour shortages and reduce wage pressures). It’s contradictory for them to now complain about poor GDP per capita resulting precisely from the temporary immigration they demanded.

GDP itself – the numerator of the ratio – encounters numerous conceptual and methodological questions, casting further doubt on its validity as a measure of living standards. GDP includes many components that have no direct bearing on the quality of life, such as depreciation, real estate commissions and imputed rents on housing.

It is tricky to measure real GDP over time and even trickier to compare it across countries, different currencies and different prices.

Moreover, simple per capita averages ignore how GDP is distributed. Only about half of GDP is paid to workers. Much is captured in profits and investment income, disproportionately concentrated at the top of the income ladder. Very high incomes for a rich elite can pull up average GDP per capita figures, even when most members of a society face hardship.

International comparisons confirm the perils of evaluating economic performance by GDP per capita. The top four countries on the International Monetary Fund’s per capita GDP ranking are all tax havens: Luxembourg, Switzerland, Ireland and Singapore. A fifth, Liechtenstein, is not included due to incomplete data, but its GDP per capita (US$186,000) is the highest of all – helped by the fact its population is just 40,000.

These countries receive inflows of profits from global companies lured by low corporate taxes and lax banking rules. Those inflows boost GDP per capita (with profits credited to local subsidiaries of those global firms), but have little impact on work, production or living standards.

The Irish example

The Irish case is instructive. Ireland has recorded the fastest growth of real GDP per capita of any OECD country over the last decade and its GDP per capita is purportedly twice Canada’s. Ireland is a wonderful, fascinating place. But any visitor can immediately confirm it is not rich. Average living standards (evidenced by wages, housing, health and poverty) are no higher and, by some measures lower, than Canada’s.

Because Ireland’s corporate tax rate is lower than other European Union countries, global multinationals have established Irish subsidiaries to receive intracorporate transfers. In 2023, more than half of all net value added in Ireland consisted of business profits – two thirds of which belonged to foreign firms.

GDP per capita has soared but living standards have not. Because the whole model is driven by corporate tax avoidance, the Irish government’s ability to capture some of that largesse for domestic use is constrained.

The vagaries of per capita thinking are equally visible in Canada. Consider Newfoundland and Labrador. After the development of offshore oil resources in the 1990s, that province’s GDP grew rapidly. Some of the new wealth trickled down to residents, but not as much as might be assumed.

By 2006, per capita GDP in Newfoundland and Labrador exceeded the Canadian average. Its new status as a “have” province was significant beyond provincial pride. It meant that Newfoundland and Labrador soon stopped receiving federal equalization payments.

However, personal incomes in the province remained below national averages. Over the latest five years, Newfoundland and Labrador’s GDP per capita was 6.1 per cent higher than the Canadian average, yet personal income per capita (including government transfer programs) was 3.4 per cent lower.

Exacerbating this anomaly, Newfoundland and Labrador’s population shrank through the 2000s. Population decline is negative for any economy, but it has the perverse effect of artificially boosting GDP per capita (by shrinking the denominator). This further eroded the province’s chances of receiving equalization.

Much of the GDP associated with offshore oil literally never touches ground in the province. It is shipped overseas by tanker, with most of the profits appropriated by petroleum firms headquartered on the mainland or in other countries. Because of this, the province’s GDP is skewed heavily toward corporate profit. That’s good for business but doesn’t enrich its residents.

Little wonder then that the province is challenging the federal equalization formula in court. Last year, shrinking oil revenues pushed the province’s GDP per capita back slightly below the Canadian average, so Newfoundland and Labrador will now receive (small) equalization payments once again. But this experience confirms per capita GDP is no way to measure the true well-being of a province or a country.

The goal of economic policy is not to maximize an abstract statistic. It should be to enhance the well-being of people. Per capita GDP is not an accurate or reliable measure of progress toward that goal.

—

This is part 1 of a 2-part analysis. In part 2, Jim Stanford evaluates per capita GDP comparisons between Canada and the U.S. This article originally appeared in Policy Options. It is republished here under a Creative Commons license.

🎥 Plus, view Social Capital Partners’ video: Is Canada really poorer than Alabama?

The perils of per capita GDP: No, Canada is not poorer than Alabama | Policy Options

By Jim Stanford | Part of our Special Series: Always Canada. Never 51. | This post first appeared in Policy Options.

Some business and political commentators cite a growing gap between the per capita GDP of Canada and the U.S. as evidence of Canada’s purported economic dysfunction. Some even conclude that because of stagnating per capita GDP, Canada is now poorer than Alabama – a state with widespread poverty, low incomes and short life expectancy.

This far-fetched conclusion reflects deep flaws in the use of per capita GDP as a measure of prosperity and living standards. As explained in the first part of this commentary, GDP per capita measures total output produced (for money) in a country relative to its population.

However, this simple ratio ignores important issues such as what is included in GDP, who owns it and how it is distributed. International comparisons are further complicated by necessary adjustments for exchange rates, price levels and population estimates.

Comparing GDP per capita between Canada and the U.S. is especially fraught because of other methodological problems. For example, the much larger proportion of unauthorized immigrants living in the U.S. artificially boosts its apparent per capita GDP. There are an estimated 11 million people there who contribute to the numerator (GDP) but are not counted in the denominator (population).

Similarly, per capita GDP ignores the value of time. In 2023, the average employed American worked 114 hours longer than the average employed Canadian – about three weeks more of full-time work.

American working hours are among the longest of any OECD country because low wages compel many of them to work extra hours or even second jobs and because there are no legal requirements for paid vacation. Those longer working hours account for much of the Canada-U.S. gap in GDP per capita.

Another issue is the failure to consider the environmental effects of economic production. Conventional GDP statistics take no account of the costs of pollution. America produces more output per person, but takes fewer measures to protect the environment, which obviously affects the quality of life of current and future generations. Like time, nature is not free.

These methodological issues cast considerable doubt on the validity of simplistic Canada-U.S. comparisons.

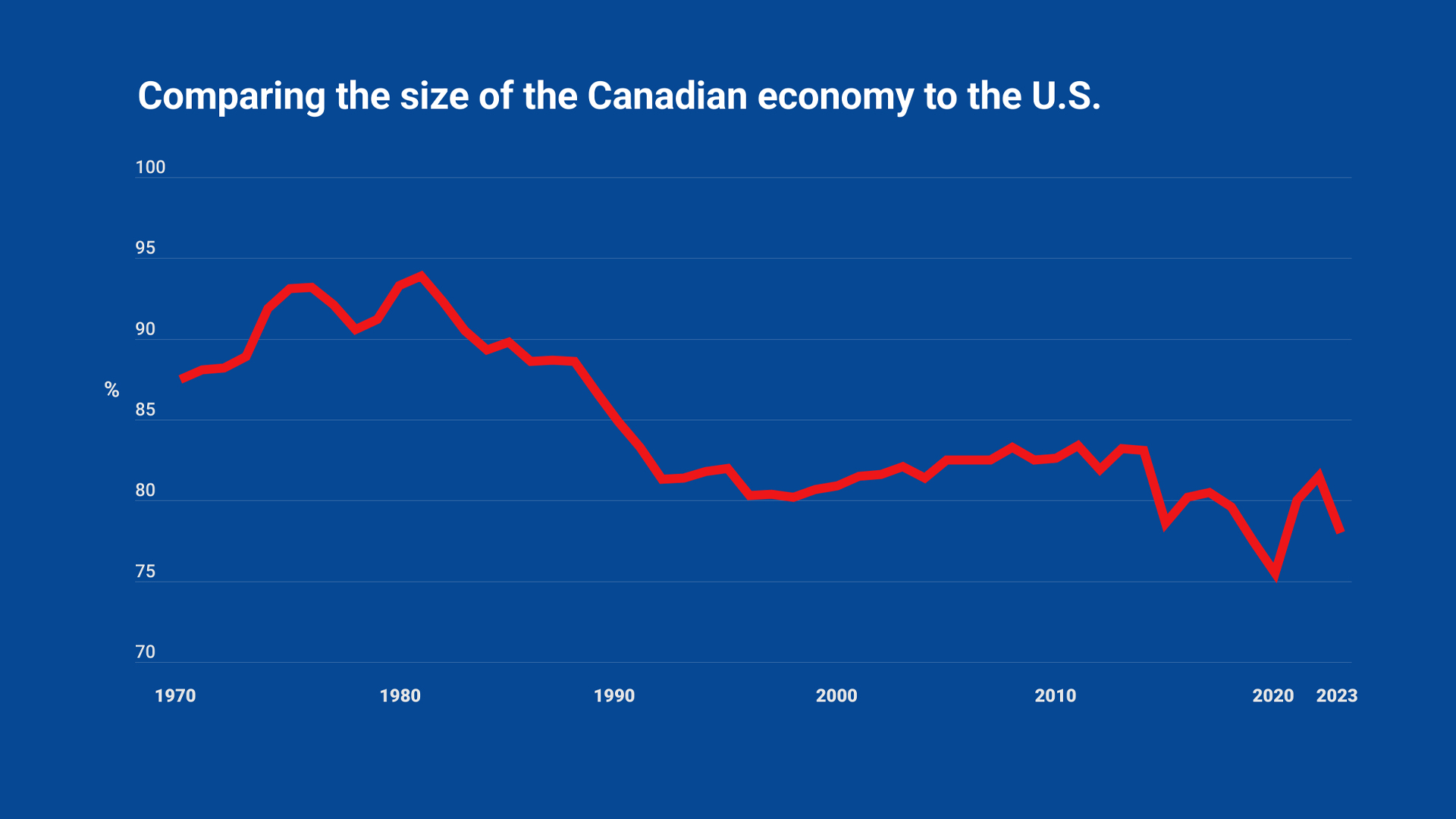

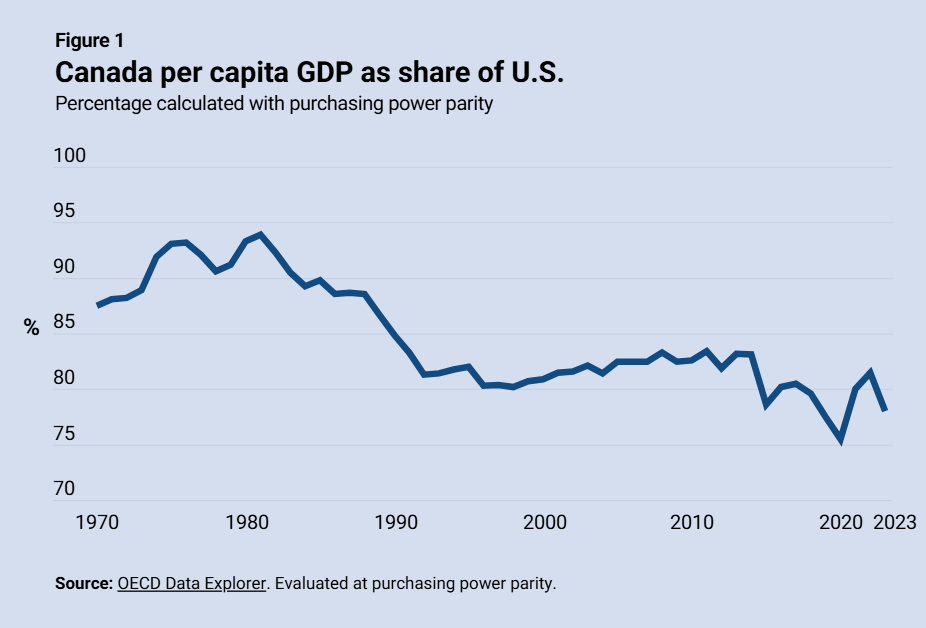

Attention to Canada’s per capita GDP has grown during the current federal election campaign. However, it is important to view the issue through a long-term lens. Canada’s per capita GDP has been sliding relative to the U.S. since the early 1980s. The following figure portrays the ratio, based on OECD estimates.

Thanks to rapid industrialization, Canada largely closed the long-standing disadvantage versus the U.S. from 1950 through 1980. Relative per capita GDP peaked in 1981 at 94 per cent of the U.S. level. It then fell rapidly during the 1980s and early 1990s, to just 81 per cent by 1992. It partially recovered in the late 1990s and 2000s but then fell again in the 2010s.

After fluctuating during the COVID-19 pandemic, Canada’s per capita GDP had fallen by 2023 to 78 per cent of U.S. levels.

Data and politics

There is a natural tendency to put a political spin on economic measurements. However, there is no correlation between which party is in power in Ottawa and the evolution of this ratio.

Canada’s per capita GDP relative to the U.S. rose during Pierre Elliott Trudeau’s first years in office but began to fall during his final term. It declined most steeply under Brian Mulroney, was stable during the terms of Jean Chrétien and Paul Martin, fell during the last years of Stephen Harper’s rule and then declined further under Justin Trudeau.

Canada-U.S. per capita GDP comparisons reflect a complex mix of many determinants, including economic growth, sectoral changes, population growth, immigration, inflation and exchange rates. It is far-fetched to conclude that any government deserves either credit or blame for its trajectory.

Prosperity depends not just on how much is produced, but how it is distributed. Bank of Canada research shows most of the U.S. advantage in per capita GDP is concentrated among high income earners.

Three-quarters of the gap in per capita output is captured by higher incomes for the top 10 per cent of Americans. There is little difference in incomes between the bottom 90 per cent in the two countries. The richest 10 per cent of Americans receive almost half of all pre-tax income, so their wealth significantly inflates the overall per capita average.

In fact, most Canadian workers earn higher wages than those in the U.S. It is most accurate to measure typical incomes by the median wage (the halfway point in a distribution), not the average (which can be distorted by very high incomes at the top).

The median hourly wage in Canada in 2023 was C$28.79 or US$24.61 at the OECD’s purchasing power parity exchange rate. The median hourly wage in the U.S. in 2023 was US$23.11. The typical Canadian worker thus earned 6.5 per cent more than their U.S. counterpart, despite lower per capita GDP.

Perhaps surprisingly, the Canadian worker also paid a lower marginal federal tax rate (20.5 per cent for full-time workers) than their U.S. counterpart (22 per cent).

Of course, public services, not just private incomes, are also important to living standards. Canada’s more extensive health care, public education and other services enhance the quality of life in ways not captured by per capita GDP.

For example, eight per cent of Americans have no health insurance and one-quarter are underinsured (facing out-of-pocket costs that force many to skip needed care). That takes much of the shine off a higher GDP.

For all these reasons, it is clear the typical Canadian has a higher standard of living than the typical American. We are healthier, live three years longer, face much less inequality and are happier. These outcomes are not accidents. They reflect deliberate policy choices (including regulation, taxes and public programs) that shape both production and distribution to improve well-being.

The decade is not lost

In that light, Canada has continued to make progress in recent years – contrary to claims we have suffered a lost decade.

For example, the poverty rate (as defined by Statistics Canada’s market basket measure) fell by one-third between 2015 and 2022. Average real hourly wages (after inflation) are nine per cent higher than a decade ago, despite post-COVID inflation. The average unemployment rate was lower over the last decade than the previous decade.

The United Nations human development index (HDI) confirms Canada’s success in converting economic activity into well-being. It attempts to directly measure living standards, rather than relying on per capita GDP to evaluate well-being. The HDI considers three components: per capita gross national income (GNI), life expectancy (a proxy for health) and education.

Canada ranked 18th on the latest HDI scorecard, three places ahead of the U.S. Our human development has improved more than twice as fast since 2010 as the U.S. We rank eight places higher on HDI than we do on GNI per capita – confirming we efficiently improve human welfare with our economic resources. In contrast, the U.S. ranks 11 places lower on HDI than GNI, a bigger negative gap than any other developed country.

In sum, per capita GDP is a deeply flawed measure that says little about real-world living standards. To be sure, Canada has much to improve in its economy: not only to produce more but also to produce it more sustainably and use it more effectively to improve human and social conditions.

Nevertheless, the typical Canadian lives better than the typical American across a wide range of tangible indicators. Living standards for most Canadians have improved over the last decade, not cratered. We should not be misled by one flawed, abstract measure into believing that Canada is somehow an economic basket case.

—

This is part 2 of a 2-part analysis of Canada’s GDP per capita. Part 1 can be found here. This article originally appeared in Policy Options. It is republished here under a Creative Commons license.

🎥 Plus, view Social Capital Partners’ video: Is Canada really poorer than Alabama?

Workforce shocks are coming. Are we going to retreat—or reinvent?

By Lisa Taylor, CEO of Challenge Factory | Part of our Special Series: Always Canada. Never 51.

Many Canadian industries and businesses hardest hit by trade uncertainty are considering furloughs and layoffs. Workers and business owners are understandably anxious.

All levels of government, to their credit, have signaled a readiness to step in and help, elbows up. While approaches may differ on how support is distributed and to whom, the shared message is clear: no one should face this alone.

We can learn a lot from earlier crises so we don’t repeat some of our past mistakes.

During the early days of the pandemic in 2020, Challenge Factory noticed a pattern – there was an almost obsessive focus on when things would “go back to normal.” Back then, we spent a lot of time discussing when lockdowns would lift and businesses could reopen. Perhaps it was easier to focus on what we were waiting to return to, rather than accepting what we were living through.

This time, there may be no “normal” to go back to. This time, we are probably not just waiting it out. We probably need to prepare for a different world. That means leaning into this opportunity to undertake real change.

Government support programs, like Employment Insurance (EI), need to do more than allow everyone to hunker down. They need to do more than provide income while people wait to get called back to work.

If we see our current workforce disruption as a window of opportunity, the most urgent questions should be: How can Canada use this time to the advantage of workers and businesses? Which actions taken today will best position us for recovery tomorrow, in a different economy?

Many businesses are grappling with their strategy in a world of American tariffs and unpredictability. Government programs should incentivize businesses to train and upskill workers to meet new market demands and execute on new strategies, rather than lay those employees off.

Recovery will come from reinvention and transformation. It will come from workers and employers using our time wisely, supported by government policy.

This should be a moment to invest in our workers, in our businesses and industries, in the future we want for our families and communities.

Time away from regular work should be used to reskill and upskill, to experiment and explore, to test new partnerships and uncover hidden potential. Furloughed time should become a time for growth and career exploration. It is better for employees, employers and the economy if we can find useful ways to keep employees attached to their current firm, rather than experiencing permanent separation.

“How can Canada use this time to the advantage of workers and businesses? Which actions taken today will best position us for recovery tomorrow, in a different economy?”

Here are some creative ways we could ensure our workforce has the skills to contribute to new directions for their employers:

- Early-career professionals could be paired with late-career professionals either within the same company, or within supply chain partnerships, to share knowledge with each other, facilitate knowledge translation and accelerate lifelong learning and intergenerational collaboration across the workforce.

- Mid-career professionals could take on temporary internship-style roles in adjacent teams where there could be more opportunities for growth. The new benefit proposed in the Liberal platform could facilitate this type of work-integrated learning, not just participation in training programs.

- Teams of workers without sufficient work could be temporarily embedded in other parts of an organization or in other organizations to build cross-sectoral knowledge and collaboration.

- Workers who do get laid off could spend the time upgrading their skills, including exploring career and labour market dynamics to improve career literacy, instead of looking for work in a field where there may be no work for a while or pursuing skills that are not going to lead to satisfying work.

In each case, employees would be gaining new skills and market insights that their current or next employer would need to execute new business strategies and seize new opportunities.

These suggestions aren’t fantasy. These ideas and others are being explored in creative ways by many firms right now. In the last three weeks alone, Challenge Factory has been in many discussions with industries actively seeking to pilot this type of short-term workforce redeployment.

To make this work, existing rules around EI – including income support, support for training and job-sharing regimes – should be updated to incentivize these kinds of forward-thinking approaches. The building blocks are there in the current system, and in the Canada Training Credit, but they need to be improved to encourage these kinds of innovative approaches to training and learning.

In past periods of economic shock, workers have relied on EI to weather the storm, and some employers have severed employment relationships with the hope that they’ll find new, qualified workers to hire once their business environment is in recovery. Both groups were essentially crossing their fingers that they’d come out all right on the other side.

Our approach needs to be better this time – for companies, workers and the economy as a whole. EI eligibility rules can evolve to allow for this kind of support and small employers can be supported to get creative in how to retain and retrain staff.

In Canada, we’ve done hard things before, and we can do them again. When the future is uncertain, it is important to invest and prepare. Governments know how to design and deploy support programs for workers and businesses. But this time, it’s critical to deliver them in ways that give people the time they need to prepare, adapt and plan for what comes next. Sitting at home on furlough – rather than working and learning new parts of the business – will not help us prepare for change.

Now is not the time to retreat or just endure challenging times. It’s time to get curious, get creative and get moving, supported by our social safety net system. Let’s turn workforce disruption into workforce evolution – because we have the talent, tools and tenacity to lead our own way forward.

–

Lisa Taylor is an author, entrepreneur, consultant, futurist and community leader focused on shaping the world of work. She is CEO of Challenge Factory, a Canadian research and advisory services firm that helps clients achieve productivity gains and positive social impact.

Hands Off: Investing in employee ownership can ensure Canadian businesses stay Canadian | ImpactAlpha

By Matthew Mendelsohn | Part of our Always Canada. Never 51 series. | This post first appeared in ImpactAlpha

Canada’s investors and businesses are focused on the economic attacks by the Trump administration on the Canadian economy. Trump’s tariffs are creating higher prices, job losses and uncertainty in both countries. But for many Canadian businesses, there is a bigger existential risk.

A weak Canadian dollar, low interest rates and expected liquidity challenges for some Canadian businesses that rely on exports to the US all create the conditions for an acceleration of private equity-led buyouts of Canadian firms. While Canada’s policymakers try to figure out how to make the Canadian economy less vulnerable to Trump’s whims, many Canadian businesses are going to look like a good deal for American investors – even in the context of America’s own economic turmoil.

Predatory foreign ownership, focused on stripping assets and extracting wealth for American investors, will be bad for the long-term resilience of the Canadian economy. These kinds of acquisitions will hurt Canadian economic sovereignty and the local community economies in which many of these businesses have thrived for decades.

Just a few weeks ago, iconic Canadian department store chain Hudson’s Bay—founded in 1670—was forced into liquidation. The company’s slow death began in 2008 after it was acquired by National Realty and Development Corp. Equity Partners out of the US. Now, at a time when Canadians are racing to protect and shore up their economic security and control of their assets, Canadian communities may lose 80 local stores, along with 9,400 employees at one of Canada’s most iconic brands.

Employee ownership

Many Canadian entrepreneurs have been thinking about retiring and are looking to sell to secure a comfortable retirement. Some 76% of business owners are planning to retire in the next decade – with business assets worth over $2 trillion, according to the Canadian Federation of Independent Business.

It is of course perfectly reasonable for a business owner to sell to the highest bidder, including private-equity buyout funds. But many of these retiring baby boomers are deeply torn, knowing that if they sell their business to American investors, they might be doing long-term damage to their community, the workers who they have relied on and Canada’s economic independence. Policymakers are currently designing solutions to these challenges.

One approach: making it easier for new Canadian entrepreneurs to buy existing businesses, via a program modeled after the US Small Business Administration’s 7A Loan program, which helps finance working capital, equipment purchase and business acquisitions.

Another is to significantly increase the number of employee-ownership transitions, which Canada calls Employee Ownership Trusts, or EOTs. Canada passed a new EOT legislation last year and should be ramping up to achieve a goal of 10% of all sales of Canadian businesses to their employees by 2030. We know this target is achievable because it’s happening in the UK. More than 400 businesses were sold to employees in the UK last year.

Not only did that improve economic security for 40,000 new employee-owners in the UK, those businesses remain domestically owned and rooted in their local communities. Achieving similar employee-ownership conversion rates in Canada would take 300 businesses a year off the market from American buyouts, with head offices staying in Canada and improving the resilience of the Canadian economy in the face of an autarkist American administration.

Mobilizing capital

To achieve these targets, Canada needs to mobilize capital to support these transitions.

Canada already has a number of funds and intermediaries working on employee-ownership conversions, but they generally target risk-adjusted market returns. At a time of extreme vulnerability and risk, there are legitimate obstacles to making EOT conversions work. Business owners are far more likely to accept a buy-out offer in cash, rather than deferred payments from an EOT.

Capital could be mobilized more urgently in different ways. Through the government’s public financial institutions, including the Business Development Bank of Canada, concessionary capital should seed a fund to crowd in investments from banks, philanthropic foundations and other investors. This could be stylized as a sovereign fund, making low-interest loans focused on employee-ownership conversions of viable businesses that need time to overcome liquidity crises and re-tool away from dependence on the American market.

The federal government could guarantee a benchmark rate of return to ensure that foundations’ capital is not at risk, which would make the fund more appealing to both Canadian and American impact investors.

Some advisors within the field suggest there is enough capital already in private financial institutions to finance many EOTs, but that financing often comes with onerous conditions that make these employee-ownership transitions too risky for many workers. In particular, employees are often required to sign personal guarantees for the amount of the loan, which transfers all the risk onto workers and makes the deals far less likely to happen.

We need to expand pathways to wealth and ownership for workers, which is why we suggest the federal government also offer a loan guarantee program. This would reduce risk for employees and business owners undertaking employee-ownership transitions and protect all types and sizes of lenders, including banks, pension funds and foundations. Other blended finance models could be considered, but transferring more of the risk onto the government in the form of a loan guarantee probably makes the most sense.

As Canada faces Trump’s mercurial and predatory approach to trade and economic policy, employee-owned companies, which are shown to be more innovative and resilient during economic downturns, can bring much-needed stability and less economic vulnerability. Canada should mobilize capital to scale employee-ownership transitions through loan guarantees, blended finance and concessionary capital to build and secure more economic resilience and wealth for working people.