The stories we’ve been sold for decades about how our economy works have been collapsing in front of our eyes. Yet the most prominent, well-funded ideas for how to create economic opportunity and security for working people in Canada are stuck in the 1990s.

Free trade, privatization and low taxes on capital and wealth have led to economic insecurity and anxiety for working people. Their benefits have not trickled down.

Right now, our market economy is neither free nor fair. Gobsmacking inequality and high barriers to asset ownership and wealth building for working people are policy choices – and we can make different choices.

It is increasingly clear that governments must shape markets so they work for working people. Governments must aggressively push back against the economic practices that are consolidating wealth, concentrating ownership of assets and robbing working people of their political power and economic agency.

The stories we continue to be told about how the economy works are not true. It’s time for new, more accurate stories.

Solutions to the concentration of wealth, power and opportunity exist. At SCP, we are committed to highlighting these solutions and the increasingly clear evidence that there are alternatives that will build economic resilience, sustainable economic growth, community well-being, human happiness and democratic stability.

On this topic

A youth employment supplement could rebalance Canada’s generational divide | Policy Options

Canada is overdue for a broader debate on intergenerational fairness and how our taxes and benefits support—and exclude—different age groups. As Kiran Gill and Matthew Mendelsohn explain in Policy Options, we continue to live with programs designed by baby boomers to provide security to seniors, even if those seniors are well off. Meanwhile, young adults in our country face challenges entering the labour market, securing stable employment and saving to build some measure of economic security in the face of rising costs. They propose a policy designed to make the economy work for younger Canadians—a youth supplement to the existing Canada Workers Benefit. This youth employment supplement—aptly coined a YES!—could help rebuild financial security and allow younger adults to buy homes, finance education for themselves or their children and save for the future.

Watch the video: Are foreign takeovers good for Canada’s economy?

We all want more investment in Canada's economy. But as SCP Chair Jon Shell explains in this video, when it comes to foreign investment in the Canadian economy, or FDI, we have to ask: is it investment that builds? Or investment that buys? Because these are two very different things.

Mark Carney’s Davos speech is a manifesto for the world’s middle powers

Mark Carney's recent speech at Davos matters because it treats this moment as a rupture, not a passing disruption. It’s in this rethink, write Matthew Mendelsohn and Jon Shell, that there is also relief: “From the fracture, we can build something better, stronger and more just,” Carney said. “This is the task of the middle powers.” The world's middle powers are not powerless, but we have been acting as if we are, living within the lie of mutual benefit with our outsized and increasingly erratic neighbour. Without the U.S., the world's middle-power democracies are rich, powerful and principled enough that we can unite to advance human well-being, prosperity and progress.

Advice to the public service: Five ways to confront monsters and chaos

Canada's political and bureaucratic leaders are quickly trying to re-wire the federal government to confront a belligerent Unites States, but systems can’t deliver what they were not designed for. This is a time like no other in our history, writes Matthew Mendelsohn, and those making decisions have not been trained for this—because we haven’t experienced anything like this before. Drawing on his own time in Ottawa, he walks us through five priority “machinery of government” changes our public service needs to make to meet the threat of an increasingly authoritarian, imperialist America.

How to get single family homes out of the hands of investors | Toronto Star

About 1.3 million homes in Canada that could be family-owned are held by investors—mostly individuals. In The Star, Matthew Mendelsohn, the Missing Middle Initiative's Mike Moffat and Jon Shell explain how a simple tax change could finance new rental construction while also freeing up homes for families to buy. The policy would temporarily allow investors to defer capital gains taxes if they reinvest proceeds into new purpose-built rentals. Many policy changes are needed to fully address the complex Canadian housing crises, and this could be one that puts Canadian capital to more productive uses.

Budget was missing a Canadian ownership strategy

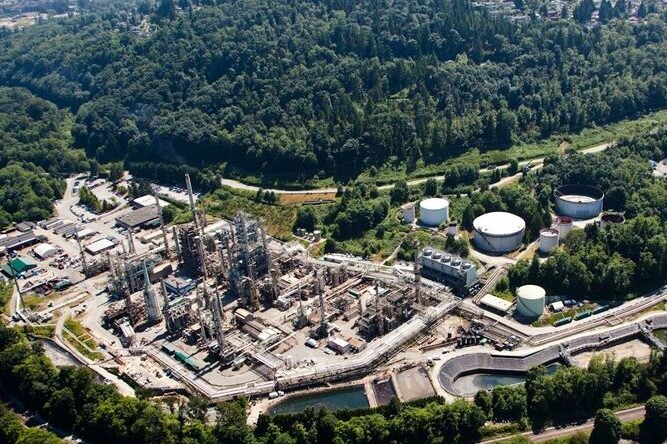

Gas station giant Parkland is already shedding Canadian employees in the wake of TX-based Sunoco’s recent takeover of the Canadian fuel chain, which owns 15% of our gas stations and a key refinery in Burnaby, B.C. These layoffs were a predictable outcome of Ottawa's decision not to flex its new regulatory muscle through the Canada Investment Act to quash foreign investment deals that pose an economic security threat. As SCP chair Jon Shell writes, the government has not defined a clear strategy to build and maintain Canadian ownership of our assets. Combined with the federal budget’s focus on attracting private capital, there’s a real danger that Ottawa will enable a sell-off of Canadian firms to foreign investors.

What the new World Inequality Report tells us, and why it matters for Canada

The 2026 World Inequality Report is out and the results paint a picture of a world in which a tiny minority commands unprecedented financial power, while billions remain excluded from even basic economic stability. As SCP Director of Policy Dan Skilleter writes, Canada is far from immune to these global trends: although our own GDP keeps rising, wealth gains have been concentrated at the very top, while many households struggle to afford food and housing. The top 1% in Canada hold about 29.3% of total wealth, making our country's wealth inequality even more pronounced than our own Canadian Parliamentary Budget Officer reports. The good news is, momentum is building in Canada for better wealth data, shedding light on our "Billionaire Blindspot."

Mapping the economic centre-left

The large and well-funded American blogosphere has a pretty wide array of economic voices and ideological camps within the centre-left tent. So big, in fact, that there’s a sub-genre of inter-blog conflict dedicated to people named Matt. Over the years, SCP Director of Policy Dan Skilleter has found it useful to categorize these various different centre-left ideological camps in his head. The categories are not mutually exclusive, and most people probably identify with a few at once. This explainer breaks down each camp's story about what’s wrong with the economy and how they’d prioritize dealing with it.

How intergenerational inequality threatens trust in democracy | Policy Options

Our political leaders must be willing to make difficult tradeoffs to rebalance policies toward the young and away from older Canadians, write Jean-François Daoust, Liam O'Toole and Jacob Robbins-Kanter in Policy Options. The broader economic picture for younger Canadians offers little hope, and economic frustration is shown to run hand-in-hand with political alienation. As intergenerational inequality persists and deepens, Canada risks experiencing an even sharper decline in trust in its democratic institutions than what already exists. Building affordable housing and supporting young families are essential first steps in a much-needed generational reset that puts fairness at the centre of Canadian political life.

Elbows up: Keeping Canadian companies in Canadian hands | Policy Options

Blue Jays pride notwithstanding, many of Canada's most iconic companies and brands have been quietly but steadily purchased by foreign entities in recent years. As Danny Parys writes in Policy Options, policymakers should do more to keep Canadian companies in Canadian hands by providing more support to expand financing opportunities, expanding awareness of untraditional ownership models and beefing up Canada’s net-benefit review requirements. These quiet foreign sales not only lead to major frustrations for consumers, but workers also feel the impacts because, as corporate leadership moves further away from the community, so do quality and accountability.