What is the Canadian Tax Observatory:

The Canadian Tax Observatory (the “Observatory”) is a newly established non-partisan, non-profit organization committed to confronting wealth inequality through transformative tax policy. Our mission is to support a more equitable tax system that advances shared prosperity and economic growth through rigorous research, collaboration, advocacy and public education.

Why are we launching the Canadian Tax Observatory?

Highly unequal societies are not compatible with democratic governance. They are too unstable and vulnerable to the erosion of democratic norms. Democratic capitalism requires well-regulated markets, real opportunities for people to build economic security, and fair taxation. Today’s tax debate is shaped by wealthy interests and the organizations and lobbyists they support. Tax policy is increasingly structured to benefit the wealthy. Misleading stories about the tax system abound and are pushing Canada to accept rising inequality and wealth concentration as the price of economic growth. We want to correct this.

What we aim to achieve:

The Canadian Tax Observatory will be a catalyst to confront wealth inequality in Canada. We aim to reshape Canada’s tax landscape by delivering evidence-based analysis and workable options that will promote a more equitable and growth-oriented tax system. Confronting growing wealth concentration requires a full range of policy and legislative solutions, including tax reform.

Our journey thus far:

We are in the foundational stages of building this organization: we have incorporated as a nonprofit and are in the process of registering as a charity. The Observatory is currently incubated by Social Capital Partners, a nonprofit organization that provides robust governance, administrative and operational backing during this transitional period. We have thus far secured initial seed funding of roughly $550,000 per year for the first three years and are actively developing funding partnerships with other organizations. We are ready for a leader who can shape and grow the Observatory into a permanent, nationally recognized Canadian institution.

The leader we’re seeking:

We are searching for a visionary—a Founding CEO who sees beyond conventional boundaries. This person is innovative, strategic, deeply committed to social justice and capable of engaging diverse stakeholders, ranging from civil society to academic experts, industry stakeholders and government leaders. The ideal candidate will possess:

- Exceptional strategic vision with the ability to translate ideas into actionable policy solutions.

- A proven track record in organizational leadership, fundraising, and building influential partnerships.

- Credibility and expertise in economic and tax policy, preferably with a focus on Canadian public policy.

- Powerful communication skills to inspire, educate, and advocate across varied audiences, along with comfort engaging with the public, decision-makers and expert policy networks.

- An ambitious, entrepreneurial spirit eager to build and sustain an impactful, lasting institution that will have a transformative impact in Canada on the sustainability of democratic capitalism.

Position Details

- Type: Full-time permanent.

- Location: Remote within Canada – option to work out of SCP’s Toronto office if desirable.

- Compensation: $175-275,000/annum. The salary range is wide to accommodate various potential operating models and scopes of the role. We are open to honest discussions around compensation.

- Benefits: Competitive benefits package.

- Vacation: To be discussed and determined by the founding board and CEO.

Your application – an invitation to dream big:

We invite you to craft and submit a letter of no more than three (3) pages outlining how you would build and lead the Canadian Tax Observatory. Your letter should clearly state your vision for the Observatory and how you plan to bring this vision to life.

We are committed to adapting the Observatory’s operating structure to support the leadership model best suited to the chosen Founding CEO. All candidates should feel comfortable reaching out to us for a preliminary conversation to help determine their suitability for the role or to ask any clarifying questions.

Please submit your letter of no more than three (3) pages, along with your CV (including a list of your relevant publications), to careers@socialcapitalpartners.ca by June 4, 2025. As applications will be reviewed as they are submitted, we encourage all interested individuals to submit their application package as soon as possible.

Next steps:

Selected candidates will be invited to present their vision to our founding board and key stakeholders and will be compensated for their time. Our goal is to appoint our Founding CEO as soon as possible to promptly begin laying the groundwork for the Observatory’s next steps.

We are excited to learn about your bold vision for building this new Canadian institution—a beacon for economic fairness, sustainable economic growth and a thriving democracy.

Together, let’s redefine what’s possible for Canada.

Share with a friend

Related reading

Blame the denominator, not the economy

Over the last couple of years, there have been countless articles warning of Canada’s poor economic performance. The mic drop has increasingly been Canada’s poor performance relative to peer countries on “GDP per capita,” with growth rankings used to draw a variety of sweeping, negative conclusions about Canada’s economy. SCP CEO Matthew Mendelsohn and Policy Director Dan Skilleter draw on economist and SCP Fellow Dr. Gillian Petit's new research to explain why GDP per capita is a deeply flawed measurement for evaluating rich countries - and is easily influenced by a variety of factors having little to do with economic performance or economic well-being.

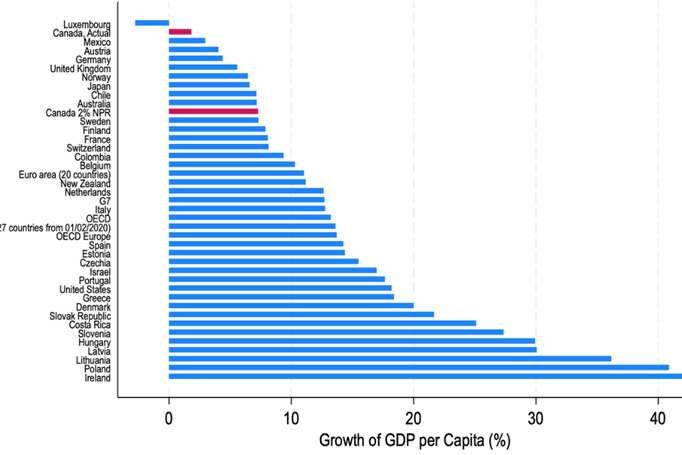

Non-Permanent Residents and their impact on GDP per capita | Summary

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.

Non-Permanent Residents and their impact on GDP per capita | Report

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.