January 21, 2025, Toronto (ON): Social Capital Partners CEO Matthew Mendelsohn today announced the appointment of a new Advisory Board that will support the organization in its next phase of work confronting growing wealth inequality in Canada. The nonprofit’s mission is to create more pathways to wealth and asset ownership for working people.

“The economic assumptions that have informed our understandings of how capitalist, democratic economies work are collapsing in front of our eyes,” says Mendelsohn. “That vacuum needs to be filled with realistic and viable options to make the economy work better for more people.”

The data are clear that working people and young people are facing higher barriers to economic security than in previous decades. Those challenges are creating well-founded anxieties that are causing the destabilization of democratic societies around the world.

“At Social Capital Partners, we are comfortable trying new things, even when we’re unsure of the outcomes,” says Mendelsohn. “We have assembled a creative, intellectually diverse group of brilliant, kind Canadians who all want our economy to work better. They will challenge our assumptions and help us make the right strategic choices about where we put our resources in the coming years.”

Advisory Board members will advise on SCP’s strategy and agenda, drawing on decades of experience across finance, business, government, public policy, communications, civil society and community economic development. They include:

“We have assembled a creative, intellectually diverse group of brilliant, kind Canadians who all want our economy to work better.”

Upkar Arora, CEO of Rally Assets.

Victor Beausoleil, Executive Director of SETSI – The Social Economy Through Social Inclusion.

Vass Bednar, Executive Director of McMaster University’s Master of Public Policy in Digital Society program.

Tiffany Callender, Co-Founder and CEO, Federation of African Canadian Economics (FACE).

Jeff Cyr, Founder & Managing Partner of Raven Indigenous Raven Indigenous Capital Partners.

Brian Dijkema, President, Canada at Cardus.

Tariq Fancy, Founder of The Rumie Initiative.

Rob Germain, CEO at CHEK Media.

Alex Himelfarb, Former Clerk of the Privy Council.

Charmian Love, Chief International Advocacy Officer at Natura &Co.

Marguerite Mendell, Distinguished Professor Emerita at the School of Community and Public Affairs and Director of the Karl Polyani Institute of Political Economy and Concordia University.

Erin Millar, CEO and Co-founder of Indiegraf.

Jennifer Robson, Associate Professor of Political Management at Carleton University.

Edward Waitzer, past Chair of Stikeman Elliott LLP.

To learn more about the Advisory Board and see complete biographies, please visit www.socialcapitalpartners.ca/our-people/.

About Social Capital Partners

Who owns the economy matters. Social Capital Partners believes working people deserve a fighting chance to build economic security and wealth. A Canadian nonprofit organization founded in 2001, we undertake public policy research, invest in initiatives and advocate for ideas that broaden access to wealth, ownership and opportunity, and that push back against extreme economic inequality. To learn more, please connect with us on LinkedIn or Bluesky or visit socialcapitalpartners.ca.

For more information, or to arrange an interview, please contact:

Katherine Janson

Director of Communications

Social Capital Partners

647-717-8674

katherine@socialcapitalpartners.ca

Share with a friend

Related reading

Blame the denominator, not the economy

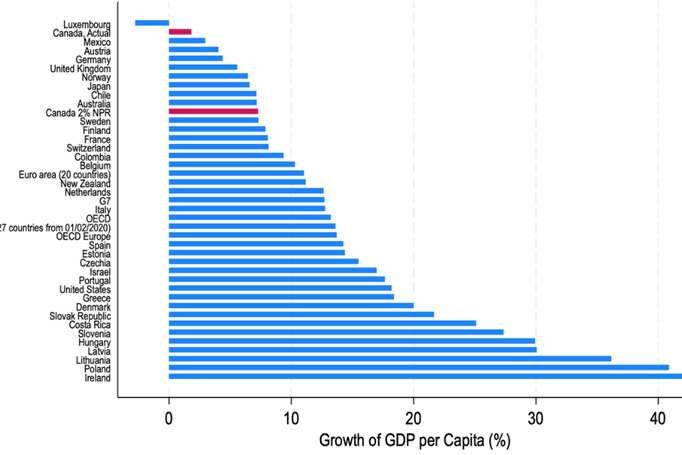

Over the last couple of years, there have been countless articles warning of Canada’s poor economic performance. The mic drop has increasingly been Canada’s poor performance relative to peer countries on “GDP per capita,” with growth rankings used to draw a variety of sweeping, negative conclusions about Canada’s economy. SCP CEO Matthew Mendelsohn and Policy Director Dan Skilleter draw on economist and SCP Fellow Dr. Gillian Petit's new research to explain why GDP per capita is a deeply flawed measurement for evaluating rich countries - and is easily influenced by a variety of factors having little to do with economic performance or economic well-being.

Non-Permanent Residents and their impact on GDP per capita | Summary

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.

Non-Permanent Residents and their impact on GDP per capita | Report

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.