TORONTO, Apr. 4, 2024 –Social Capital Partners (SCP) today released a new report documenting how wealth inequality in Canada is far closer to the inequality that exists in the United States than official statistics claim.

The report, entitled “Billionaire Blindspot: How official data understates the severity of Canadian wealth inequality”, critically analyzes Canada’s flagship wealth survey, the Survey of Financial Security (SFS), and outlines how its methodological shortcomings lead to significant underreporting of wealth inequality.

“Wealth concentration is getting worse in Canada, just like in the U.S. The difference is that Americans have the data they need to accurately understand, discuss, and propose solutions,” explains the report’s author and SCP’s policy director, Dan Skilleter. “StatsCan has already acknowledged the need for better data, and we hope that this report will encourage them to act on our recommendations, ensuring a more accurate understanding of wealth inequality in Canada.”

The report concludes that the top 1% in Canada own 26% of all wealth, and the top 0.1% own 12.4% of all Canadian wealth. These numbers are significantly higher than official estimates and are much closer to U.S. levels of wealth inequality than previously understood. The report concludes that the American survey, the Survey of Consumer Finance (SCF), does a much better job of measuring reality and presents a series of recommendations to improve the Canadian survey.

“Deep wealth inequality corrodes democratic societies and threatens economic resilience,” said Matthew Mendelsohn, CEO of Social Capital Partners. “The misleading portrait of wealth inequality in Canada undermines our ability to have an evidenceinformed debate about how to address growing wealth concentration. Canadians are telling ourselves a story about wealth inequality that is fundamentally wrong.”

“Wealth concentration is getting worse in Canada, just like in the U.S. The difference is that Americans have the data they need to accurately understand, discuss and propose solutions.”

Share with a friend

Related reading

Blame the denominator, not the economy

Over the last couple of years, there have been countless articles warning of Canada’s poor economic performance. The mic drop has increasingly been Canada’s poor performance relative to peer countries on “GDP per capita,” with growth rankings used to draw a variety of sweeping, negative conclusions about Canada’s economy. SCP CEO Matthew Mendelsohn and Policy Director Dan Skilleter draw on economist and SCP Fellow Dr. Gillian Petit's new research to explain why GDP per capita is a deeply flawed measurement for evaluating rich countries - and is easily influenced by a variety of factors having little to do with economic performance or economic well-being.

Non-Permanent Residents and their impact on GDP per capita | Summary

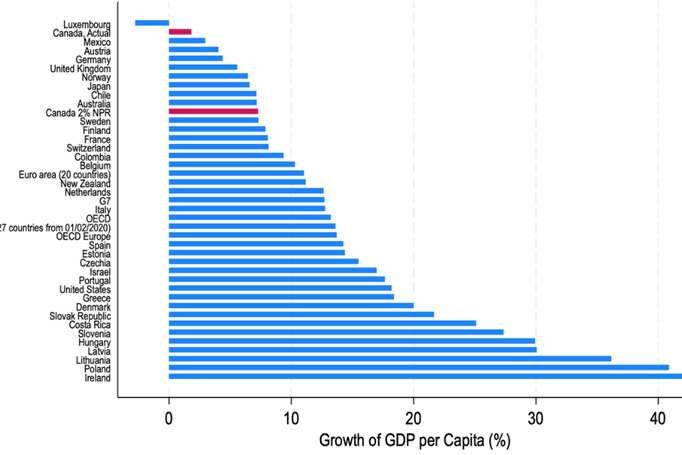

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.

Non-Permanent Residents and their impact on GDP per capita | Report

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.