FAQs on Budget 2025 and the future of Employee Ownership Trusts (EOTs) in Canada

There is some confusion out there about Budget 2025 and employee ownership trusts (EOTs). To confirm, the federal government did not extend the $10M capital-gains exemption for sales through EOTs, in the budget released on Tuesday, November 4, 2025. Because the sale of a business to an EOT is a process that often takes more than a year, certainty on the rules is essential for owners, advisors and employees planning succession. In this FAQ, Employee Ownership Canada answers key questions about what’s enacted now, why the incentive matters for uptake and how the sector, businesses and the organization are moving forward from the Budget news.

November 6, 2025Alternative ownership,Changing narratives,Blog,Employee Ownership Canada (EOC)Economic policy,Explainer,The Ownership Solution

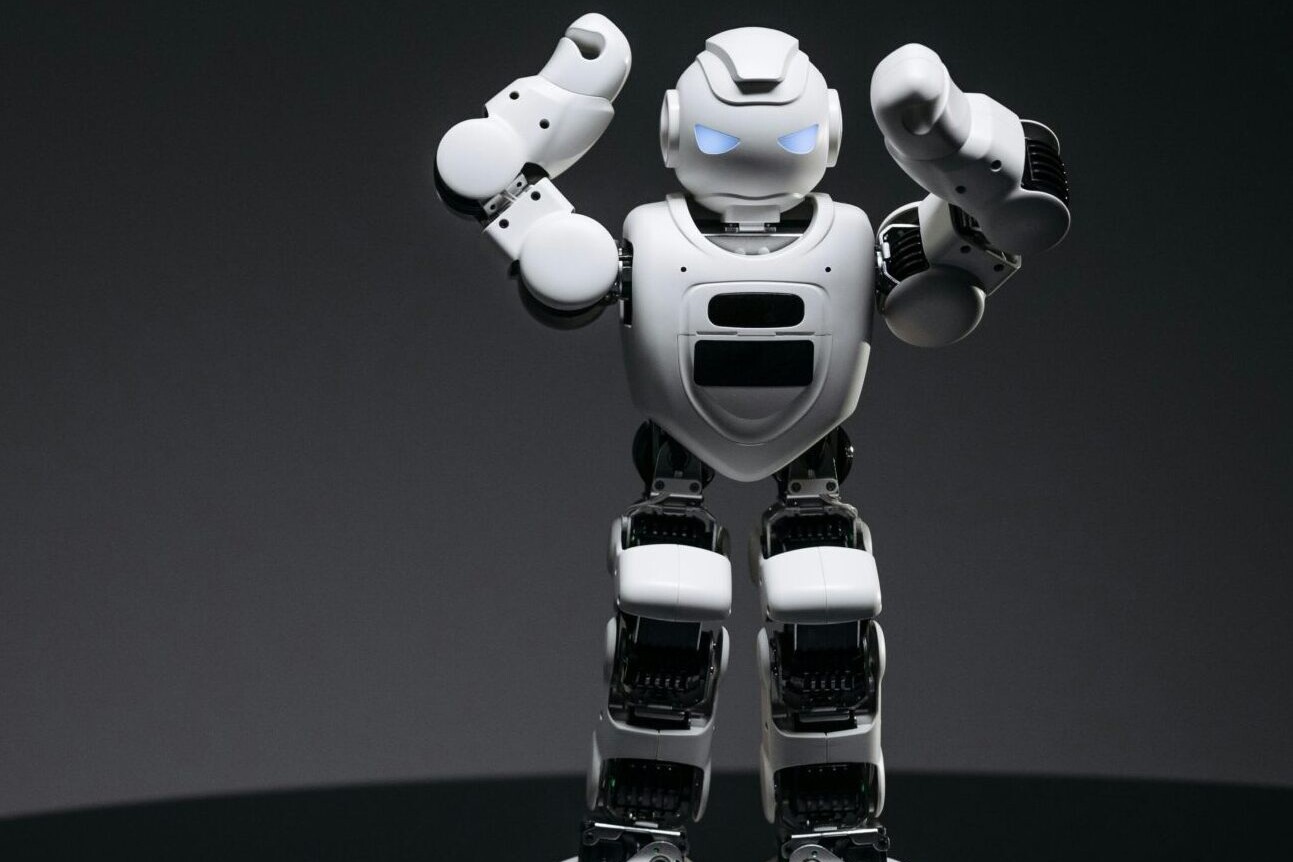

Codetermination and upskilling in the age of AI

So much uncertainty surrounding AI and its impact on jobs has many Canadian workers asking themselves, “who’s next?” With 60% of Canadian workers in roles at risk of AI-driven job transformations, business and political leaders are champing at the bit to automate workforces. As Danny Parys writes, with so many livelihoods at stake, it’s clear that the Canadian economy needs to make bold changes, such as taking a page from many European countries' books and building employee consultation into their governance models. Codetermination could not only help ensure that the productivity gains of AI and automation are realized, but that workers are consulted first.