Budget 2025 should bolster employee ownership to strengthen Canada’s economy | Canadian Dimension

Budget 2025 offers Canada a chance to make employee ownership permanent by extending tax incentives for employee ownership trusts (EOTs) and worker co-ops. In Canadian Dimension, Simon Pek, Lorin Busaan and Alex Hemingway write that doing so would boost productivity, reduce inequality and secure business succession, while keeping jobs and decision-making local. A modest investment promises significant economic and social dividends.

October 8, 2025Alternative ownership,Blog,Employee Ownership Canada (EOC)Economic policy,In the media,The Ownership Solution

What being an employee-owned company means to me

For what it’s like to be on the inside of an employee-owned company, we spoke to a few of the 750 employees who recently became 100-per cent owners of Taproot Community Support Services, a social services provider across B.C., Alberta and Ontario. Rewards the employees highlighted include company morale and spirit, for sure. They also include financial rewards paid out annually to each employee as dividends. Last year, each employee would have received about $1000 to $1500 on top of their salaries—and as the company succeeds over time, the employees will share financially in Taproot’s success.

October 2, 2025Alternative ownership,BlogEmployee Ownership Canada (EOC),The Ownership Solution

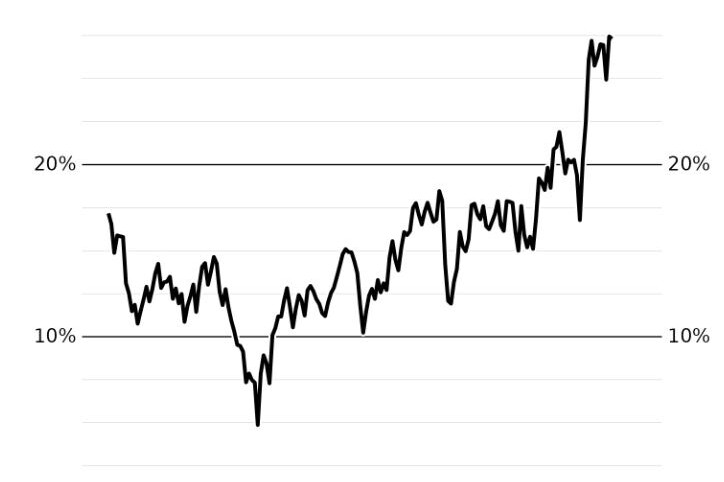

Wealth inequality in Canada is far worse than StatsCan reports

Our government’s best available data on Canada’s wealth gap excludes, by design, the wealthiest families in the country. As SCP Director of Policy Dan Skilleter writes, if we didn’t have the Parliamentary Budget Officer fact-checking Statistics Canada’s work, their numbers would tell us the top one per cent own only 2.5 per cent of all wealth – not nearly 25 per cent of all wealth in Canada, as the PBO reports. We like to think of Canada as a beacon of egalitarianism compared to our southern neighbours, but when you add in data from "rich lists" published by Forbes and Maclean's, our wealth concentration looks quite similar to the U.S.

October 2, 2025Changing narratives,BlogWealth inequality,Never 51

The federal government is leaving investment dollars on the table—but it can fix that in the budget

At the recent Victoria Forum, community and philanthropic leaders outlined creative community finance and impact investment ideas that could mobilize big pools of private capital to invest in local businesses, social purpose organizations and community infrastructure. However, as SCP CEO Matthew Mendelsohn writes, despite the growing maturity of the social finance community, Canada still lacks the social and community financing infrastructure and policies to make this happen. With some important fixes to fragmented financing and outdated regulatory frameworks, the coming Budget could make it easier for social finance investments to properly scale and deliver the kind of outsized impact Canada needs at this time.

September 23, 2025Alternative ownership,Local economies,Leveraging capital,Changing narratives,Blog,Employee Ownership Canada (EOC),Economic policy,Community FinanceNever 51,Never 51

How Canada’s tax system puts the wealthy above workers

Rather than using the tax system to prevent wealth concentration, our current tax system promotes it. Those who earn income from their investments have more income left over after taxes, allowing them to accumulate wealth more quickly than others. SCP Fellow Silas Xuereb explains how, south of the border, we are witnessing the consequences of runaway wealth inequality – billionaires use their media conglomerates to get political favours, exploit the instruments of the state to enrich themselves and, increasingly, secure political office. All of these trends are leading to the erosion of democracy and public policy that advances the interests of the wealthy at the expense of everyone else. If Canada does not rebalance our tax system to prioritize work over wealth, we may soon find ourselves on the same path.

August 27, 2025Changing narratives,Blog,Wealth inequality,Tax policyNever 51,Never 51

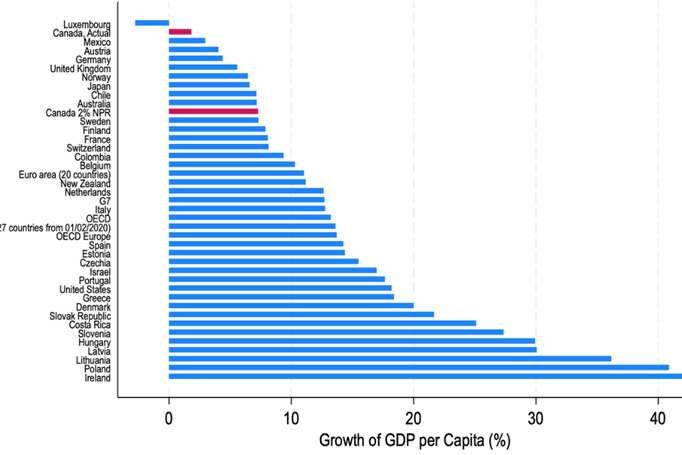

Blame the denominator, not the economy

Over the last couple of years, there have been countless articles warning of Canada’s poor economic performance. The mic drop has increasingly been Canada’s poor performance relative to peer countries on “GDP per capita,” with growth rankings used to draw a variety of sweeping, negative conclusions about Canada’s economy. SCP CEO Matthew Mendelsohn and Policy Director Dan Skilleter draw on economist and SCP Fellow Dr. Gillian Petit's new research to explain why GDP per capita is a deeply flawed measurement for evaluating rich countries - and is easily influenced by a variety of factors having little to do with economic performance or economic well-being.

Sellers’ inflation is back on the horizon. We can stop it before working people pay the price.

Trade-war chaos and confusion are creating a perfect storm for sellers' inflation—when companies with market control choose to hike prices to gouge consumers and grow their profits when they have the chance. As SCP Fellow Kaylie Tiessen writes, this profit-led inflation often hides behind other drivers and can blindside us if we’re not watching closely. There are good reasons to accept some tariff-related price increases—elbows up, right? But she outlines three ways we can stop opportunistic sellers from using this trade chaos to mask their profiteering. We can stop powerful companies from exploiting confusion and weak oversight so working people don't pay the price while profits soar.

June 13, 2025Changing narratives,Blog,Economic policy,CompetitionNever 51,Never 51

As the federal government sets out to “build, baby, build,” do we want to own or be owned?

As our new government pursues growth and a nation-building agenda, we should remember this lesson from history: too often, we build and invest, only to sell off our assets and resources to the highest foreign bidder, leaving us economically vulnerable. In this moment of extreme peril, SCP CEO Matthew Mendelsohn asks how we should “build, baby, build” in a way that doesn’t merely accelerate the trends towards consolidation of wealth and deeper economic dependence. Canada has everything we need to emerge stronger from this period of geopolitical disruption if we put economic sovereignty and broad access to wealth-building at the heart of our agenda.

May 15, 2025Alternative ownership,Local economies,Leveraging capital,Changing narratives,Blog,Productivity,Economic policy,Small business,Competition,Community FinanceNever 51,Never 51

Innovate? In this economy? With these profit margins?

Canadian businesses are immensely profitable, but businesses simply haven't been reinvesting in them. As Tom Goldsmith writes in Orbit Policy's Deep Dives, the financialization of Canada’s economy and the high levels of rent extraction that accompany it are barriers to innovation. We are impoverishing ourselves over the long term to support short-term financial gains. If we care about innovation and productivity, then we need to focus far more critical attention on corporate Canada.

May 14, 2025Blog,ProductivityWealth inequality,Economic policy,Never 51,Never 51

Canada’s Liberal party will face down Trump. But will it address inequality? | Truthout

Prime Minister Mark Carney has a monumental task to lead Canadians through the turmoil of a second Donald Trump term, while also addressing various crises: affordability, housing, toxic drugs and health care, to name a few. For Truthout, Nora Loreto interviewed SCP Fellow Silas Xuereb about the crises that loomed over Canada's recent federal election and one fundamental cause that was never clearly identified: concentrated corporate power.

May 8, 2025Changing narratives,Blog,Wealth inequality,Tax policyNever 51,Never 51