Who owns the economy matters, and there are workable, scalable ownership models that can keep more wealth in the hands of working people.

Canada is facing its largest-ever wave of business transitions, as baby boomers look to sell their businesses and retire. Over $2 trillion in assets will change hands in the next decade. Many businesses will be purchased by competitors or private equity buy-out funds, extracting wealth, enriching investors outside Canada and consolidating local economies.

There are alternatives.

Through years of coalition building and political advocacy, SCP helped bring Employee Ownership Trusts to Canada. Now led by Employee Ownership Canada, which we incubate and support, EOTs are poised to explode in popularity in Canada – securing entrepreneurs’ legacies, preserving local jobs and keeping companies Canadian-owned.

We are champions of the employee-ownership movement, and we are exploring other ownership ideas, like how to expand co-ops and not-for-profit conversions.

There are alternatives to the trends towards market consolidation and value extraction impacting smaller businesses. At SCP, we want to build an economy where more people are owners.

On this topic

Sign the open letter | Make the Employee Ownership Trust incentive permanent

Employee Ownership Trusts (EOTs) offer a practical succession pathway that keeps businesses Canadian-owned, empowers employees to share in the value they help create and supports long-term investment in our communities. With the right policy support, employee ownership can be a strong, proven path forward for Canada’s economy. If this is something you support too, you are invited to read and sign Employee Ownership Canada’s national open letter.

Four reasons our economy needs employee ownership now

Employee ownership offers a timely solution to some of Canada’s most pressing economic challenges, writes Deborah Aarts in Smith Business Insight. Evidence shows that when employees share ownership, businesses become more productive, innovative and resilient. Plus, beyond firm-level gains, employee ownership can help address the coming mass retirement of business owners, protect local economic sovereignty, boost national productivity and reduce wealth inequality. There is enough data about the brass-tacks benefits of employee ownership to sway even the most hardened skeptic.

Budget was missing a Canadian ownership strategy

Gas station giant Parkland is already shedding Canadian employees in the wake of TX-based Sunoco’s recent takeover of the Canadian fuel chain, which owns 15% of our gas stations and a key refinery in Burnaby, B.C. These layoffs were a predictable outcome of Ottawa's decision not to flex its new regulatory muscle through the Canada Investment Act to quash foreign investment deals that pose an economic security threat. As SCP chair Jon Shell writes, the government has not defined a clear strategy to build and maintain Canadian ownership of our assets. Combined with the federal budget’s focus on attracting private capital, there’s a real danger that Ottawa will enable a sell-off of Canadian firms to foreign investors.

Ontario wakes up to the succession tsunami

In November, 2025, the Ontario provincial government finally stepped into the looming “succession tsunami,” launching a modest $1.9M Business Succession Planning Hub to help micro-business owners plan exits through local Small Business Enterprise Centres. Notably, the hub spotlights employee ownership and the new Employee Ownership Trust, signaling a shift toward mainstream adoption. But, as Dan Skilleter writes, Ontario’s approach focuses narrowly on retiring owners, ignoring how different buyers shape risks and benefits to workers, communities and Canada's broader economic sovereignty. This is a promising start that could and should grow into a broader succession-planning policy that protects Ontario’s long-term resilience.

Smith School of Business launches new Employee Ownership Research Initiative

Smith School of Business at Queen's University is launching Canada's first-ever research initiative focused on deepening Canada’s knowledge and understanding of a powerful succession model that can enhance outcomes for owners, employees and communities: employee ownership. With funding support from Jon Shell, the EORI will be housed in Smith’s Centre for Entrepreneurship Innovation & Social Impact (CEISI). The initiative will shape a made-in-Canada approach to employee ownership and create a multi-disciplinary network of academics, researchers, practitioners and businesses to fill gaps in relevant data, expertise and business-oriented resources to support employee-ownership activities across the country.

Elbows up: Keeping Canadian companies in Canadian hands | Policy Options

Blue Jays pride notwithstanding, many of Canada's most iconic companies and brands have been quietly but steadily purchased by foreign entities in recent years. As Danny Parys writes in Policy Options, policymakers should do more to keep Canadian companies in Canadian hands by providing more support to expand financing opportunities, expanding awareness of untraditional ownership models and beefing up Canada’s net-benefit review requirements. These quiet foreign sales not only lead to major frustrations for consumers, but workers also feel the impacts because, as corporate leadership moves further away from the community, so do quality and accountability.

Budget 2025 did not extend the $10M capital-gains exemption for sales through EOTs

We share the disappointment felt across Canada’s business and advisory community that Budget 2025 did not make the $10 million capital gains exemption for sales through Employee Ownership Trusts (EOTs) a permanent feature of Canada’s tax system. The current incentive, passed only in 2024 with an expiry set for December 2026, means that the business community has not had adequate time to act on this opportunity or build adequate momentum for this promising succession model. In this statement, Employee Ownership Canada responds to the Budget and reaffirms its strong commitment to working with government and partners to make the capital gains exemption permanent, ensuring employee ownership trusts remain a viable, long-term option for Canadian businesses.

FAQs on Budget 2025 and the future of Employee Ownership Trusts (EOTs) in Canada

There is some confusion out there about Budget 2025 and employee ownership trusts (EOTs). To confirm, the federal government did not extend the $10M capital-gains exemption for sales through EOTs, in the budget released on Tuesday, November 4, 2025. Because the sale of a business to an EOT is a process that often takes more than a year, certainty on the rules is essential for owners, advisors and employees planning succession. In this FAQ, Employee Ownership Canada answers key questions about what’s enacted now, why the incentive matters for uptake and how the sector, businesses and the organization are moving forward from the Budget news.

Could increased employee ownership restore confidence in Canada’s economy? | The Hub

As companies consolidate under ever larger pools of private capital, there’s growing unease around who’s actually benefiting from corporate growth. Falice Chin writes in The Hub that it’s no coincidence, then, that voices across the political spectrum are now revisiting models of employee ownership as a potential antidote to widening wealth inequality, fading community ties and a growing distrust in capitalism itself. This deep-dive looks at how employee ownership trusts, or EOTs, could be an elegant policy remedy to a crisis of confidence in the modern economy.

Budget 2025 should bolster employee ownership to strengthen Canada’s economy | Canadian Dimension

Budget 2025 offers Canada a chance to make employee ownership permanent by extending tax incentives for employee ownership trusts (EOTs) and worker co-ops. In Canadian Dimension, Simon Pek, Lorin Busaan and Alex Hemingway write that doing so would boost productivity, reduce inequality and secure business succession, while keeping jobs and decision-making local. A modest investment promises significant economic and social dividends.

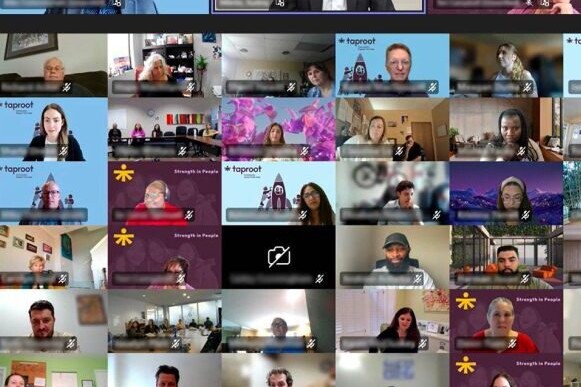

What being an employee-owned company means to me

For what it’s like to be on the inside of an employee-owned company, we spoke to a few of the 750 employees who recently became 100-per cent owners of Taproot Community Support Services, a social services provider across B.C., Alberta and Ontario. Rewards the employees highlighted include company morale and spirit, for sure. They also include financial rewards paid out annually to each employee as dividends. Last year, each employee would have received about $1000 to $1500 on top of their salaries—and as the company succeeds over time, the employees will share financially in Taproot’s success.

The federal government is leaving investment dollars on the table—but it can fix that in the budget

At the recent Victoria Forum, community and philanthropic leaders outlined creative community finance and impact investment ideas that could mobilize big pools of private capital to invest in local businesses, social purpose organizations and community infrastructure. However, as SCP CEO Matthew Mendelsohn writes, despite the growing maturity of the social finance community, Canada still lacks the social and community financing infrastructure and policies to make this happen. With some important fixes to fragmented financing and outdated regulatory frameworks, the coming Budget could make it easier for social finance investments to properly scale and deliver the kind of outsized impact Canada needs at this time.

Maple Ridge-based company now owned by its 750 employees | Maple Ridge-Pitt Meadows News

Neil Corbett of the Maple Ridge-Pitt Meadows News reports on locally based Taproot Community Support Services making some business history in Canada. Taproot's 750 employees in B.C., Alberta Ontario will now own 100 per cent of the business, becoming the largest Employee Ownership Trust (EOT) in Canada and the first in the social services sector. Finance minister Francois-Philippe Champagne explains why this is a perfect example of what EOTs can do, calling the trusts "a powerful, timely tool that helps Canadian employees become owners of the businesses they work for, while helping entrepreneurs find the right people to carry their legacy forward."

Taproot becomes Canada’s largest employee-owned trust with 750 workers | The Globe and Mail

On Sept. 2, 2025, B.C.-based Taproot community support services surprised its 750 employees with the news they will become equal owners of the company they helped build. Minister of Finance & National Revenue Francois-Philippe Champagne joined CEO Mike Fotheringham and Social Capital Partners Chair Jon Shell to celebrate the new worker-owners and Canada’s largest Employee Ownership Trust (EOT) to date. In the Globe and Mail, Meera Raman reports on Taproot's milestone and how this succession model keeps companies Canadian, keeps jobs in local communities and builds wealth for workers.

Mark Carney’s economic agenda misses something vital | Toronto Star

Prime Minister Mark Carney's campaign focused on economic growth and sovereignty. He talked a lot about how Trump wants to "break us so he can own us," and yet, so far, details of an ownership agenda are pretty thin. The reality is that Canadians cannot be "masters in our own home" if the home is owned by a U.S. hedge fund. Broadly distributed, local Canadian ownership of our economy and our assets must be a central part of our economic growth strategy. In the Toronto Star, SCP CEO Matthew Mendelsohn writes that he sees some early, positive signs of such a plan coming from the federal government and spells out what a real ownership agenda that serves "the owners of Canada" would look like.

HBS Case | Taylor Guitars: Making Employee Ownership Work the Taylor Way

After a successful transition to 100% employee ownership, Taylor Guitars' experience is now the subject of a Harvard Business School case. Read more about how their experience brings the evidence to life: "Employee-owned firms grow faster, default less often, are far more resilient in economic downturns and pay their people more, even before you factor in the wealth-generating effects of ownership. It’s also a great business succession option as it lets owners exit for fair prices while protecting the people and communities they care deeply about.”

As the federal government sets out to “build, baby, build,” do we want to own or be owned?

As our new government pursues growth and a nation-building agenda, we should remember this lesson from history: too often, we build and invest, only to sell off our assets and resources to the highest foreign bidder, leaving us economically vulnerable. In this moment of extreme peril, SCP CEO Matthew Mendelsohn asks how we should “build, baby, build” in a way that doesn’t merely accelerate the trends towards consolidation of wealth and deeper economic dependence. Canada has everything we need to emerge stronger from this period of geopolitical disruption if we put economic sovereignty and broad access to wealth-building at the heart of our agenda.

Mark Carney passed a tough test in Washington. He now faces an even tougher one at home | Toronto Star

We predicted that American investors would be looking to buy up Canadian businesses and assets, and that this would threaten our national security and economic sovereignty. Now Canada has to make a call on whether to kill Texas-based energy giant Sunoco's takeover of Parkland Corporation. In the Toronto Star, SCP CEO Matthew Mendelsohn and Chair Jon Shell ask: do we want to be owned by American billionaires, to work for them and have our wealth stripped away to pad bank accounts in New York and Dallas? If we really want Canada to remain ours, they argue, then we need to think and act like it.

Hands Off: Investing in employee ownership can ensure Canadian businesses stay Canadian | ImpactAlpha

While Canada’s policymakers try to figure out how to make the Canadian economy less vulnerable to Trump’s whims, many Canadian businesses are going to look like a good deal for American investors. A weak Canadian dollar, low interest rates and expected liquidity challenges create the conditions for an acceleration of private equity-led buyouts of Canadian firms. In ImpactAlpha, SCP's CEO Matthew Mendelsohn explains how, as Canada faces Trump’s mercurial and predatory approach to trade and economic policy, employee ownership can offer much-needed stability and resilience.

How employee ownership can help secure Canadian sovereignty | The Calgary Herald

With Canada’s sovereignty at stake, we must invest in every approach to keeping Canadian businesses in Canadian hands. If we match the U.K.'s success in incentivizing employee-ownership conversion, we would see 300 Canadian companies sold to their workers each year. SCP Chair Jon Shell and Employee Ownership Canada CEO Michael Ras explain how very few policies promise as powerful an outcome.

The Alternative Exit podcast: Championing Employee Ownership Trusts to revolutionize wealth distribution

SCP Chair Jon Shell sits down with Andy Farquharson on The Alternative Exit Podcast to explore the transformative potential of employee ownership. Jon recounts how he advocated for Employee Ownership Trusts (EOTs) in Canada to address wealth inequality and business succession. He talks advantages of EOTs, from preserving a company’s legacy to fostering economic resilience in the workforce and reshaping both business culture and wealth distribution.

Overheard at Crowe Soberman: The EOT advantage

Crowe Soberman Audit and Advisory Partner Chandor Gauthier sits down with Jon Shell, Chair of Social Capital Partners and Board Member at Employee Ownership Canada. They dive into the benefits of Employee Ownership Trusts and get into the nitty gritty of how EOTs can support smooth business succession, boost equity and retention and safeguard business legacies.

At the corner of Main Street and Purpose: Rethinking small businesses by rethinking who owns them

Is alternative ownership the future of business in Canada? Shane Gibson from Future of Good reports on how converting to a non-profit, establishing an Employee Ownership Trust, or becoming a co-operative can help a small business become more sustainable, ensure job security and retain wealth within the community.

Employee ownership trusts explainer | Toronto Sun

SCP Chair Jon Shell in the Toronto Sun on what Employee Ownership Trusts mean for business owners, the community and the broader economy

Employee Ownership Trusts make it easier for Canadian businesses to share wealth with employees

When outside interests take over a small or medium business, it's often purchased then closed, leaving holes in the community. Future of Good reports on how new laws could encourage more retiring business owners to sell to their employees through Employee Ownership Trusts. EOTs help businesses stay local and contribute to employee retention and financial wealth.

Employee ownership trusts: What they mean for Canadian business owners

A helpful summary of Employee Ownership Trusts that gives Canadian business owners and their advisors a simple (albeit not short) explanation about what they are, and why they should care.

Employee ownership trusts FAQs

Bringing EOTs to Canada has been a labour of love for a lot of people over the last few years. We’re deeply grateful to the government for establishing the policies we need for employee ownership to flourish here. Now that it’s real we can’t wait to see the community pick the idea up and run with it.

Budget 2024 unleashes unprecedented opportunities for employee ownership in Canada

After four years of research, engagement and advocacy, the federal government has finalized the legislative and tax structure for Employee Ownership Trusts (EOTs). Social Capital Partners and the Canadian Employee Ownership Coalition are grateful for the government's careful work to make EOTs an attractive option for business owners.

Unlocking the potential of employee ownership in Canada

In the US and the UK, employee-owned companies grow faster, pay better, are less prone to lay-offs or bankruptcies in economic downturns, and are more likely to keep jobs in local economies. Due to supportive public policy, EOTs are a popular structure for business succession in those countries and have generated significant wealth for front-line employees. Canada does not have a business structure comparable to the employee ownership trust (EOT).

Inclusive search fund concept paper

Search funds allow entrepreneurs without capital to buy small businesses. However, only an exclusive club can access the financing to do so and are often forced to re-sell their businesses. We’ve put a twist on the search-fund model to make it more inclusive and long-term.

Building an employee ownership economy

New research continues to demonstrate that employee ownership fosters economic resilience. As in previous economic crises, employee-owned companies were better at retaining employees and at maintaining hours and salaries throughout the pandemic. In a post-pandemic economic environment, the demonstrated benefits of increased employee retention and alignment by employee-owned companies will be even more important to support economic growth.

Taylor Guitars’ transitions to 100% employee ownership with support from the Healthcare of Ontario Pension Plan (HOOPP) and Social Capital Partners (SCP)

In a transaction that would be impossible for a Canadian company, the owners of North America's largest builder of acoustic guitars secure a sustainable future for their company and its employees.