How Canada can curb the serial acquisitions quietly reshaping our economy

In many cases, threats to the affordability of everyday goods and services are the byproduct of what competition experts call serial acquisitions—a pattern of larger firms buying up a series of smaller players to try and corner the market. As Michelle Arnold and Kiran Gill explain, a fair and competitive economy does not emerge by accident. The Competition Bureau's proposed Merger Enforcement Guidelines will play an important role in preventing bigger firms from creating unfair playing fields that hurt Canadian small businesses, workers and consumers. The next step for the bureau should be aggressive enforcement of the new guidelines.

February 17, 2026Blog,CompetitionThe Ownership Solution,The Ownership Solution

A youth employment supplement could rebalance Canada’s generational divide | Policy Options

Canada is overdue for a broader debate on intergenerational fairness and how our taxes and benefits support—and exclude—different age groups. As Kiran Gill and Matthew Mendelsohn explain in Policy Options, we continue to live with programs designed by baby boomers to provide security to seniors, even if those seniors are well off. Meanwhile, young adults in our country face challenges entering the labour market, securing stable employment and saving to build some measure of economic security in the face of rising costs. They propose a policy designed to make the economy work for younger Canadians—a youth supplement to the existing Canada Workers Benefit. This youth employment supplement—aptly coined a YES!—could help rebuild financial security and allow younger adults to buy homes, finance education for themselves or their children and save for the future.

February 12, 2026Changing narratives,BlogWealth inequality,In the media

Mark Carney’s Davos speech is a manifesto for the world’s middle powers

Mark Carney's recent speech at Davos matters because it treats this moment as a rupture, not a passing disruption. It’s in this rethink, write Matthew Mendelsohn and Jon Shell, that there is also relief: “From the fracture, we can build something better, stronger and more just,” Carney said. “This is the task of the middle powers.” The world's middle powers are not powerless, but we have been acting as if we are, living within the lie of mutual benefit with our outsized and increasingly erratic neighbour. Without the U.S., the world's middle-power democracies are rich, powerful and principled enough that we can unite to advance human well-being, prosperity and progress.

January 30, 2026Changing narratives,What we’re exploring,Blog,Economic policyNever 51,Never 51

Four reasons our economy needs employee ownership now

Employee ownership offers a timely solution to some of Canada’s most pressing economic challenges, writes Deborah Aarts in Smith Business Insight. Evidence shows that when employees share ownership, businesses become more productive, innovative and resilient. Plus, beyond firm-level gains, employee ownership can help address the coming mass retirement of business owners, protect local economic sovereignty, boost national productivity and reduce wealth inequality. There is enough data about the brass-tacks benefits of employee ownership to sway even the most hardened skeptic.

January 20, 2026Alternative ownership,BlogEconomic policy,The Ownership Solution

Advice to the public service: Five ways to confront monsters and chaos

Canada's political and bureaucratic leaders are quickly trying to re-wire the federal government to confront a belligerent Unites States, but systems can’t deliver what they were not designed for. This is a time like no other in our history, writes Matthew Mendelsohn, and those making decisions have not been trained for this—because we haven’t experienced anything like this before. Drawing on his own time in Ottawa, he walks us through five priority “machinery of government” changes our public service needs to make to meet the threat of an increasingly authoritarian, imperialist America.

Budget was missing a Canadian ownership strategy

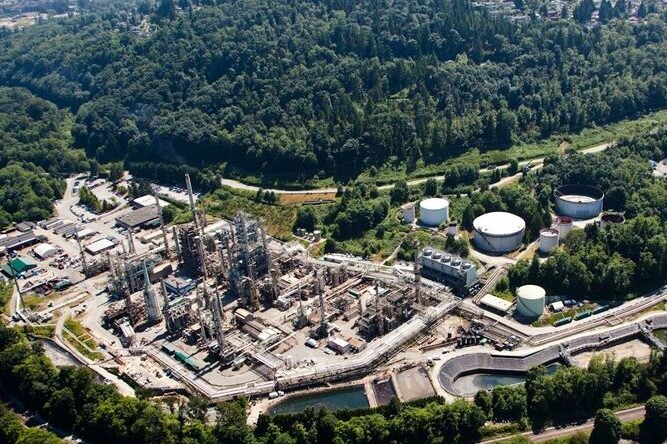

Gas station giant Parkland is already shedding Canadian employees in the wake of TX-based Sunoco’s recent takeover of the Canadian fuel chain, which owns 15% of our gas stations and a key refinery in Burnaby, B.C. These layoffs were a predictable outcome of Ottawa's decision not to flex its new regulatory muscle through the Canada Investment Act to quash foreign investment deals that pose an economic security threat. As SCP chair Jon Shell writes, the government has not defined a clear strategy to build and maintain Canadian ownership of our assets. Combined with the federal budget’s focus on attracting private capital, there’s a real danger that Ottawa will enable a sell-off of Canadian firms to foreign investors.

January 5, 2026Alternative ownership,Changing narratives,BlogEconomic policy,The Ownership Solution

What the new World Inequality Report tells us, and why it matters for Canada

The 2026 World Inequality Report is out and the results paint a picture of a world in which a tiny minority commands unprecedented financial power, while billions remain excluded from even basic economic stability. As SCP Director of Policy Dan Skilleter writes, Canada is far from immune to these global trends: although our own GDP keeps rising, wealth gains have been concentrated at the very top, while many households struggle to afford food and housing. The top 1% in Canada hold about 29.3% of total wealth, making our country's wealth inequality even more pronounced than our own Canadian Parliamentary Budget Officer reports. The good news is, momentum is building in Canada for better wealth data, shedding light on our "Billionaire Blindspot."

Ontario wakes up to the succession tsunami

In November, 2025, the Ontario provincial government finally stepped into the looming “succession tsunami,” launching a modest $1.9M Business Succession Planning Hub to help micro-business owners plan exits through local Small Business Enterprise Centres. Notably, the hub spotlights employee ownership and the new Employee Ownership Trust, signaling a shift toward mainstream adoption. But, as Dan Skilleter writes, Ontario’s approach focuses narrowly on retiring owners, ignoring how different buyers shape risks and benefits to workers, communities and Canada's broader economic sovereignty. This is a promising start that could and should grow into a broader succession-planning policy that protects Ontario’s long-term resilience.

December 10, 2025Alternative ownership,Blog,Economic policySmall business,The Ownership Solution

Mapping the economic centre-left

The large and well-funded American blogosphere has a pretty wide array of economic voices and ideological camps within the centre-left tent. So big, in fact, that there’s a sub-genre of inter-blog conflict dedicated to people named Matt. Over the years, SCP Director of Policy Dan Skilleter has found it useful to categorize these various different centre-left ideological camps in his head. The categories are not mutually exclusive, and most people probably identify with a few at once. This explainer breaks down each camp's story about what’s wrong with the economy and how they’d prioritize dealing with it.

November 26, 2025Changing narratives,BlogEconomic policy,Explainer

How intergenerational inequality threatens trust in democracy | Policy Options

Our political leaders must be willing to make difficult tradeoffs to rebalance policies toward the young and away from older Canadians, write Jean-François Daoust, Liam O'Toole and Jacob Robbins-Kanter in Policy Options. The broader economic picture for younger Canadians offers little hope, and economic frustration is shown to run hand-in-hand with political alienation. As intergenerational inequality persists and deepens, Canada risks experiencing an even sharper decline in trust in its democratic institutions than what already exists. Building affordable housing and supporting young families are essential first steps in a much-needed generational reset that puts fairness at the centre of Canadian political life.

November 25, 2025Changing narratives,BlogWealth inequality,In the media