TORONTO, Apr. 11, 2016 – A new financial product being offered through a handful of banks and credit unions in Hamilton, London and Ottawa will give qualified business owners the opportunity to lower the interest rate on their business loans or lines of credit, and provide free assistance with hiring. This partnership is expected to significantly impact the three communities by offering disadvantaged population groups improved access to local employment opportunities.

“Rate Drop Rebate is a financial product that rewards Ontario’s business owners for the steps they take to grow their operations, helping them save time and money and improve cash flow with a cash back interest rebate,” explains Bill Young, business entrepreneur, philanthropist and founder of Social Capital Partners, the social finance organization that developed Rate Drop Rebate.

“Rate Drop Rebate helps businesses that hire people facing barriers to employment. This is expected to help generate up to 1,100 new employment opportunities in Ontario, contributing to a stronger local economy for all.”

“Rate Drop Rebate is an excellent way to connect small businesses with attractive financing terms and to help increase employment options for people with disabilities and others who face barriers when looking for work”

For every new employee hired through Rate Drop Rebate and retained for a minimum of six months, business owners will receive a cash back rebate equivalent to a 1% reduction in the interest rate on their term loan up to a maximum interest rate reduction of 4%, or the actual interest paid over six months on the business’s line of credit up to a maximum of two years interest-free.

The Government of Ontario’s Ministry of Economic Development, Employment and Infrastructure is partnering with Alterna Savings, CIBC, First Ontario Credit Union, Libro Credit Union and Meridian to deliver Rate Drop Rebate.

“Rate Drop Rebate is an excellent way to connect small businesses with attractive financing terms and to help increase employment options for people with disabilities and others who face barriers when looking for work,” says Brad Duguid, Minister of Economic Development, Employment and Infrastructure.

“We are proud to partner with these forward-thinking financial institutions on Rate Drop Rebate. Together, we are promoting a culture of inclusion and strengthening our economy.” Those facing barriers to employment include students with limited work experience, long-term unemployed, older unemployed, people with disabilities, newcomers to Canada and unemployed Indigenous persons.

Based on a program by Social Capital Partners that placed 480 people in jobs, this unique product links a social purpose to a financial product by bringing together business borrowers, financial institutions, and the Ontario government to help individuals facing barriers to employment.

To qualify, business owners must:

- Run a for-profit business with a physical address that lies within the boundaries of the City of Hamilton (including Ancaster, Stoney Creek, and Binbrook), City of London (including Middlesex County), or City of Ottawa.

- Have or need a term loan or line of credit, which must be obtained through a partnering financial institution.

- Be currently hiring or have an anticipated need for an entry-level position(s) with a minimum of 20 working hours per week.

- Fill the position through the Rate Drop Rebate hiring channel between now and October 31, 2017 and retain the new hire for a minimum of six months.

- Register for Rate Drop Rebate by April 30, 2017. “Small businesses are significant contributors to the economic development of the communities in which they are established. In addition, they help stimulate growth by offering local employment opportunities,” explains Young.

Rate Drop Rebate Recruitment Liaisons will be screening all job candidates to ensure they meet the job requirements and are the right fit for the company. “This is especially helpful for a business that might not have an existing HR department,” Young says.

Share with a friend

Related reading

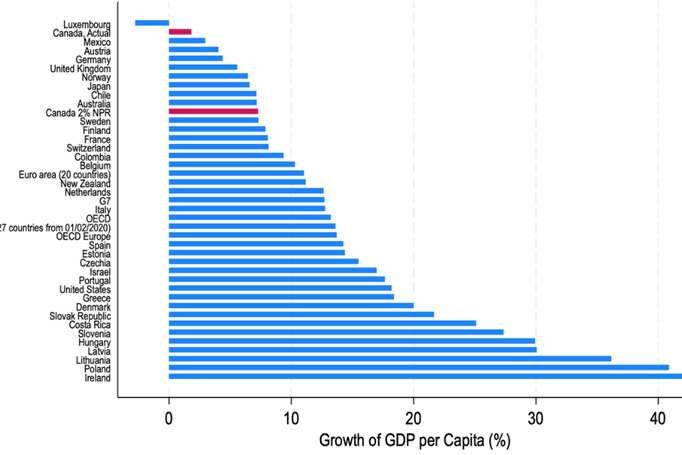

Blame the denominator, not the economy

Over the last couple of years, there have been countless articles warning of Canada’s poor economic performance. The mic drop has increasingly been Canada’s poor performance relative to peer countries on “GDP per capita,” with growth rankings used to draw a variety of sweeping, negative conclusions about Canada’s economy. SCP CEO Matthew Mendelsohn and Policy Director Dan Skilleter draw on economist and SCP Fellow Dr. Gillian Petit's new research to explain why GDP per capita is a deeply flawed measurement for evaluating rich countries - and is easily influenced by a variety of factors having little to do with economic performance or economic well-being.

Non-Permanent Residents and their impact on GDP per capita | Summary

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.

Non-Permanent Residents and their impact on GDP per capita | Report

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.