TORONTO, Nov. 7, 2014 – Social Capital Partners is pleased to announce an innovative collaboration with the Government of Ontario designed to explore a novel social finance approach that provides employment opportunities for people with disabilities and other vulnerable populations.

In the coming weeks, consultations with Canadian financial institutions will explore ways to scale the Community Loans Pilot Project.

This approach is based on the past success of Social Capital Partner’s Community Employment Loan Program which has facilitated loans to business owners of franchises in more than 60 locations who have committed to hiring those at a disadvantage. The interest rates of the loans are directly linked to the desired social outcome: for every employee hired from a community agency partner, the interest rate on the loan decreases. Such financing attracts communityminded business owners who have entry level positions with the potential for career growth and advancement. It’s a win-win scenario: disadvantaged job seekers are offered opportunities for meaningful employment while small businesses gain access to attractive financing terms and motivated employees.

With support provided by the Government of Ontario, Social Capital Partners worked with Deloitte to complete a feasibility study of how a program like this could be scaled. The study concluded that by offering an interest rate incentive to small and medium sized enterprises that implement a community hiring program savings would be realized by the reduction of other government support costs.

The study concluded that this financing scheme is an untapped opportunity to provide job opportunities to disadvantaged groups. The study is available on the SCP website www.socialcapitalpartners.ca.

The government and Social Capital Partners will now begin consultations to refine the design with the goal of implementing a pilot to test the model in the near future.

“Ontario is pleased to work with Social Capital Partners to start consulting with Canada’s leading financial institutions to help scale up the Community Loans Pilot. This program is a great example of an innovative solution that improves employment opportunities for persons with disabilities and others facing employment barriers, and helps them become active participants in the workforce.”

– Brad Duguid, Minister of Economic Development, Employment and Infrastructure

“We are excited to work with the Ministry of Economic Development, Employment and Infrastructure to take our existing Community Loan Program to the next level, working closely with both bank and community partners. We view this as an important step to expand the use of community employment practices by Canadian business owners, helping to facilitate employment access to countless job seekers who face added obstacles in finding work. We believe this is a prime example of how social finance can be leveraged to engage the private sector and generate win-win solutions.”

– Bill Young, Founder and President of Social Capital Partners

“We view this as an important step to expand the use of

community employment practices by Canadian business owners, helping to facilitate employment access to countless job seekers who face added obstacles in finding work. We believe this is a prime example of how social finance can be leveraged to engage the private sector and generate win-win solutions.”

Share with a friend

Related reading

Blame the denominator, not the economy

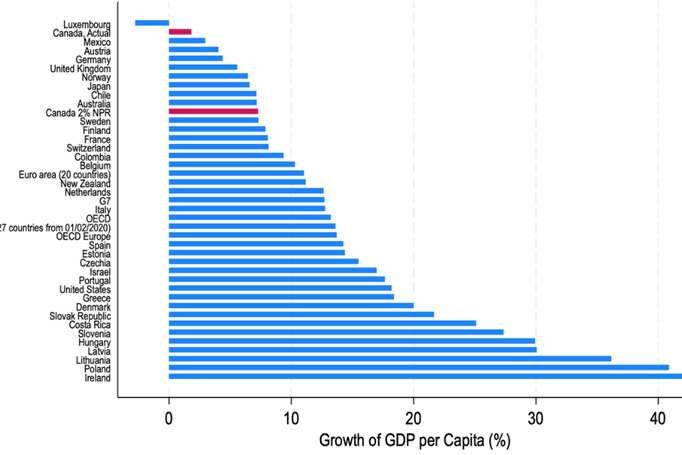

Over the last couple of years, there have been countless articles warning of Canada’s poor economic performance. The mic drop has increasingly been Canada’s poor performance relative to peer countries on “GDP per capita,” with growth rankings used to draw a variety of sweeping, negative conclusions about Canada’s economy. SCP CEO Matthew Mendelsohn and Policy Director Dan Skilleter draw on economist and SCP Fellow Dr. Gillian Petit's new research to explain why GDP per capita is a deeply flawed measurement for evaluating rich countries - and is easily influenced by a variety of factors having little to do with economic performance or economic well-being.

Non-Permanent Residents and their impact on GDP per capita | Summary

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.

Non-Permanent Residents and their impact on GDP per capita | Report

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.