Pipelines and algorithms aren’t going to save us | The Hill Times

Smart investments in natural resources and AI alone will not get us through this moment of geopolitical rupture. As Matthew Mendelsohn writes in an op-ed for The Hill Times, SMEs contribute just over half of Canada’s GDP and employ 64 per cent of our people. We have to make more low-cost capital available to the smaller businesses, locally owned enterprises, not-for-profits and social enterprises who crucially employ and reinvest locally, act as important local economic infrastructure and provide services that are crucial for well-being. They are automatic stabilizers in the face of tariff threats outside our control.

October 28, 2025Local economies,Leveraging capital,Small business,OpinionIn the media,Community Finance

The federal government is leaving investment dollars on the table—but it can fix that in the budget

At the recent Victoria Forum, community and philanthropic leaders outlined creative community finance and impact investment ideas that could mobilize big pools of private capital to invest in local businesses, social purpose organizations and community infrastructure. However, as SCP CEO Matthew Mendelsohn writes, despite the growing maturity of the social finance community, Canada still lacks the social and community financing infrastructure and policies to make this happen. With some important fixes to fragmented financing and outdated regulatory frameworks, the coming Budget could make it easier for social finance investments to properly scale and deliver the kind of outsized impact Canada needs at this time.

September 23, 2025Alternative ownership,Local economies,Leveraging capital,Changing narratives,Blog,Employee Ownership Canada (EOC),Economic policy,Community FinanceNever 51,Never 51

Maple Ridge-based company now owned by its 750 employees | Maple Ridge-Pitt Meadows News

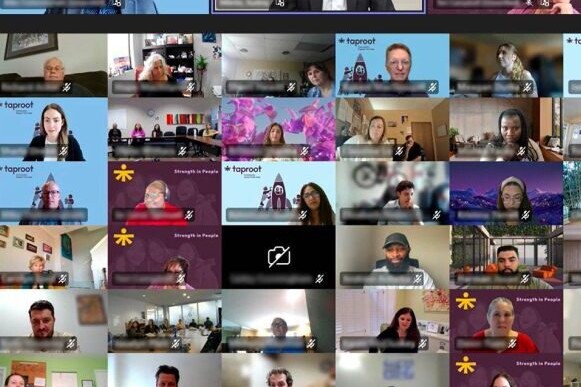

Neil Corbett of the Maple Ridge-Pitt Meadows News reports on locally based Taproot Community Support Services making some business history in Canada. Taproot's 750 employees in B.C., Alberta Ontario will now own 100 per cent of the business, becoming the largest Employee Ownership Trust (EOT) in Canada and the first in the social services sector. Finance minister Francois-Philippe Champagne explains why this is a perfect example of what EOTs can do, calling the trusts "a powerful, timely tool that helps Canadian employees become owners of the businesses they work for, while helping entrepreneurs find the right people to carry their legacy forward."

September 4, 2025Alternative ownership,Local economies,Changing narratives,Employee Ownership Canada (EOC),Economic policyIn the media,The Ownership Solution

Taproot becomes Canada’s largest employee-owned trust with 750 workers | The Globe and Mail

On Sept. 2, 2025, B.C.-based Taproot community support services surprised its 750 employees with the news they will become equal owners of the company they helped build. Minister of Finance & National Revenue Francois-Philippe Champagne joined CEO Mike Fotheringham and Social Capital Partners Chair Jon Shell to celebrate the new worker-owners and Canada’s largest Employee Ownership Trust (EOT) to date. In the Globe and Mail, Meera Raman reports on Taproot's milestone and how this succession model keeps companies Canadian, keeps jobs in local communities and builds wealth for workers.

September 2, 2025Alternative ownership,Local economies,Employee Ownership Canada (EOC),Economic policyIn the media,The Ownership Solution

The tariff war means a new normal for Hamilton businesses | Hamilton City Magazine

The wrecking ball that Donald Trump has taken to international trade has wounded relations between Hamilton businesses and their American suppliers and customers, reports Eugene Ellman in Hamilton City Magazine. Now, they’re looking east and west to replace traditional links to the south and pushing back. When Trump started pontificating about how Canada should become the 51st state and claiming the United States was subsidizing its northern neighbour, SCP Founder Bill Young and the team responded with Always Canada. Never 51 - part economic populism mixed with methodical policy-making, the series is devoted to the issues of wealth inequality and Canadian sovereignty.

May 20, 2025Local economies,Changing narratives,Wealth inequality,Economic policy,Small business,In the mediaNever 51,Never 51

As the federal government sets out to “build, baby, build,” do we want to own or be owned?

As our new government pursues growth and a nation-building agenda, we should remember this lesson from history: too often, we build and invest, only to sell off our assets and resources to the highest foreign bidder, leaving us economically vulnerable. In this moment of extreme peril, SCP CEO Matthew Mendelsohn asks how we should “build, baby, build” in a way that doesn’t merely accelerate the trends towards consolidation of wealth and deeper economic dependence. Canada has everything we need to emerge stronger from this period of geopolitical disruption if we put economic sovereignty and broad access to wealth-building at the heart of our agenda.

May 15, 2025Alternative ownership,Local economies,Leveraging capital,Changing narratives,Blog,Productivity,Economic policy,Small business,Competition,Community FinanceNever 51,Never 51

Workforce shocks are coming. Are we going to retreat—or reinvent?

Many Canadian businesses and workers are facing looming furloughs and layoffs. As CEO of Challenge Factory Lisa Taylor argues, these workforce disruptions should be seen as an opportunity to invest in our workers, in our businesses and industries and in the future we want for our families and communities. We must evolve government programs to incentivize businesses to train and upskill workers to meet new market demands and execute on new strategies, rather than lay those employees off. Recovery from workforce shocks is possible with creative ways to reinvent and transform.

April 17, 2025Local economies,Blog,Economic policy,Labour & skillsNever 51,Never 51

Hands Off: Investing in employee ownership can ensure Canadian businesses stay Canadian | ImpactAlpha

While Canada’s policymakers try to figure out how to make the Canadian economy less vulnerable to Trump’s whims, many Canadian businesses are going to look like a good deal for American investors. A weak Canadian dollar, low interest rates and expected liquidity challenges create the conditions for an acceleration of private equity-led buyouts of Canadian firms. In ImpactAlpha, SCP's CEO Matthew Mendelsohn explains how, as Canada faces Trump’s mercurial and predatory approach to trade and economic policy, employee ownership can offer much-needed stability and resilience.

April 16, 2025Alternative ownership,Local economies,Employee Ownership Canada (EOC),In the mediaNever 51,Never 51

Canada’s pension funds need to get their elbows up

Canada’s pension funds need to step up and help the Canadian economy pivot. They can do so in keeping with their fiduciary duty to their contributors, but in a way that builds long-term economic resilience. SCP's Matthew Mendelsohn and Michelle Arnold argue that defenders of the status quo are mistaken in their analysis, and that the federal government can use its fiscal power in targeted ways to get more capital into the hands of Canadian businesses and communities.

April 9, 2025Local economies,Leveraging capital,BlogNever 51,Never 51

Why commercial rent control is key to Canada’s economic sovereignty

For small businesses across Canada, a lack of commercial tenancy protections means unexpected rent increases, undue financial distress and even threat of closure. As SCP Fellow Liliana Locke argues, there are jurisdictions that have solved for commercial rent hikes that we can learn from in this moment. Smart policy in the commercial rent market would provide Canada’s small businesses the vital stability they need to sustain and grow their businesses through these turbulent economic times.

April 3, 2025Local economies,Blog,Small businessNever 51,Never 51