Browse our ideas, opinions and initiatives designed to unlock pathways to wealth and economic security for working people. Or, filter your search by Topic or Type by clicking the menu options on the left.

Advice to the public service: Five ways to confront monsters and chaos

Canada's political and bureaucratic leaders are quickly trying to re-wire the federal government to confront a belligerent Unites States, but systems can’t deliver what they were not designed for. This is a time like no other in our history, writes Matthew Mendelsohn, and those making decisions have not been trained for this—because we haven’t experienced anything like this before. Drawing on his own time in Ottawa, he walks us through five priority “machinery of government” changes our public service needs to make to meet the threat of an increasingly authoritarian, imperialist America.

January 8, 2026

Four key steps can help secure Canadian sovereignty

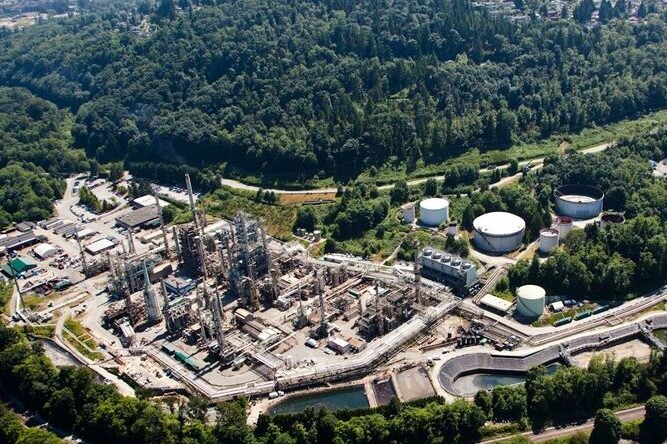

Gas station giant Parkland is already shedding Canadian employees in the wake of TX-based Sunoco’s recent takeover of the Canadian fuel chain, which owns 15% of our gas stations and a key refinery in Burnaby, B.C. These layoffs were a predictable outcome of Ottawa's decision not to flex its new regulatory muscle through the Canada Investment Act to quash foreign investment deals that pose an economic security threat. As SCP chair Jon Shell writes, the government has not defined a clear strategy to build and maintain Canadian ownership of our assets. Combined with the federal budget’s focus on attracting private capital, there’s a real danger that Ottawa will enable a sell-off of Canadian firms to foreign investors.

January 5, 2026

What the new World Inequality Report tells us, and why it matters for Canada

The 2026 World Inequality Report is out and the results paint a picture of a world in which a tiny minority commands unprecedented financial power, while billions remain excluded from even basic economic stability. As SCP Director of Policy Dan Skilleter writes, Canada is far from immune to these global trends: although our own GDP keeps rising, wealth gains have been concentrated at the very top, while many households struggle to afford food and housing. The top 1% in Canada hold about 29.3% of total wealth, making our country's wealth inequality even more pronounced than our own Canadian Parliamentary Budget Officer reports. The good news is, momentum is building in Canada for better wealth data, shedding light on our "Billionaire Blindspot."

December 16, 2025

Ontario wakes up to the succession tsunami

In November, 2025, the Ontario provincial government finally stepped into the looming “succession tsunami,” launching a modest $1.9M Business Succession Planning Hub to help micro-business owners plan exits through local Small Business Enterprise Centres. Notably, the hub spotlights employee ownership and the new Employee Ownership Trust, signaling a shift toward mainstream adoption. But, as Dan Skilleter writes, Ontario’s approach focuses narrowly on retiring owners, ignoring how different buyers shape risks and benefits to workers, communities and Canada's broader economic sovereignty. This is a promising start that could and should grow into a broader succession-planning policy that protects Ontario’s long-term resilience.

December 10, 2025

Mapping the economic centre-left

The large and well-funded American blogosphere has a pretty wide array of economic voices and ideological camps within the centre-left tent. So big, in fact, that there’s a sub-genre of inter-blog conflict dedicated to people named Matt. Over the years, SCP Director of Policy Dan Skilleter has found it useful to categorize these various different centre-left ideological camps in his head. The categories are not mutually exclusive, and most people probably identify with a few at once. This explainer breaks down each camp's story about what’s wrong with the economy and how they’d prioritize dealing with it.

November 26, 2025

How intergenerational inequality threatens trust in democracy | Policy Options

Our political leaders must be willing to make difficult tradeoffs to rebalance policies toward the young and away from older Canadians, write Jean-François Daoust, Liam O'Toole and Jacob Robbins-Kanter in Policy Options. The broader economic picture for younger Canadians offers little hope, and economic frustration is shown to run hand-in-hand with political alienation. As intergenerational inequality persists and deepens, Canada risks experiencing an even sharper decline in trust in its democratic institutions than what already exists. Building affordable housing and supporting young families are essential first steps in a much-needed generational reset that puts fairness at the centre of Canadian political life.

November 25, 2025

Elbows up: Keeping Canadian companies in Canadian hands | Policy Options

Blue Jays pride notwithstanding, many of Canada's most iconic companies and brands have been quietly but steadily purchased by foreign entities in recent years. As Danny Parys writes in Policy Options, policymakers should do more to keep Canadian companies in Canadian hands by providing more support to expand financing opportunities, expanding awareness of untraditional ownership models and beefing up Canada’s net-benefit review requirements. These quiet foreign sales not only lead to major frustrations for consumers, but workers also feel the impacts because, as corporate leadership moves further away from the community, so do quality and accountability.

November 19, 2025

Reflections on Budget 2025: Economic growth alone won’t save us

In this reflection on Budget 2025, SCP CEO Matthew Mendelsohn explains that we really like the Budget’s focus on industrial strategy, some tentative steps on making more capital available to a wider diversity of Canadians and commitments to loosen the grip that our oligopolistic sectors have over our economy. However, we are concerned by the lack of a strategic approach to providing more working people and young people a path to wealth, ownership and economic security. While the Budget responds to the wish list that corporate Canada has articulated for several years, there are no guarantees that they will indeed step up to invest—or that those investments will produce growth that benefits working people and communities.

November 10, 2025

Budget 2025 did not extend the $10M capital-gains exemption for sales through EOTs

We share the disappointment felt across Canada’s business and advisory community that Budget 2025 did not make the $10 million capital gains exemption for sales through Employee Ownership Trusts (EOTs) a permanent feature of Canada’s tax system. The current incentive, passed only in 2024 with an expiry set for December 2026, means that the business community has not had adequate time to act on this opportunity or build adequate momentum for this promising succession model. In this statement, Employee Ownership Canada responds to the Budget and reaffirms its strong commitment to working with government and partners to make the capital gains exemption permanent, ensuring employee ownership trusts remain a viable, long-term option for Canadian businesses.

November 7, 2025

FAQs on Budget 2025 and the future of Employee Ownership Trusts (EOTs) in Canada

There is some confusion out there about Budget 2025 and employee ownership trusts (EOTs). To confirm, the federal government did not extend the $10M capital-gains exemption for sales through EOTs, in the budget released on Tuesday, November 4, 2025. Because the sale of a business to an EOT is a process that often takes more than a year, certainty on the rules is essential for owners, advisors and employees planning succession. In this FAQ, Employee Ownership Canada answers key questions about what’s enacted now, why the incentive matters for uptake and how the sector, businesses and the organization are moving forward from the Budget news.

November 6, 2025

Codetermination and upskilling in the age of AI

So much uncertainty surrounding AI and its impact on jobs has many Canadian workers asking themselves, “who’s next?” With 60% of Canadian workers in roles at risk of AI-driven job transformations, business and political leaders are champing at the bit to automate workforces. As Danny Parys writes, with so many livelihoods at stake, it’s clear that the Canadian economy needs to make bold changes, such as taking a page from many European countries' books and building employee consultation into their governance models. Codetermination could not only help ensure that the productivity gains of AI and automation are realized, but that workers are consulted first.

November 6, 2025

Elbows up: A practical program for Canadian sovereignty | Report

Canada can’t become a sovereign country by doing the same old things, explains a new compendium of essays co-sponsored by the CCPA, the Centre for Future Work and several national civil society organizations. Elbows Up: A Practical Program for Canadian Sovereignty is a response to corporate rallying cries responding to Donald Trump with a familiar playbook: deregulation, austerity, tax cuts and fossil fuel expansion. The collection includes contributions from 20 progressive economists and policy experts, including SCP CEO Matthew Mendelsohn and others who participated in the Elbows Up Economic Summit held in September 2025 in Ottawa.

October 31, 2025

What’s wrong with mainstream economics?

Mainstream, or “neoclassical,” economics still dominates how we teach, study and understand our economy, even though much of it doesn’t match reality. In this piece, economists Louis-Philippe Rochon and Guillaume Vallet explain why outdated economic ideas persist and how they can lead to harmful policies. They challenge five common myths about inflation, growth and inequality, showing that today’s economy is driven more by power and institutions than by perfect markets. As "heterodox" economists, they argue it's time for a new kind of economics that reflects how the real world actually works.

October 27, 2025

Creativity could be collateral damage of U.S. film tariff

When U.S. tariffs threaten to strike creativity and culture, we can't afford to stay quiet. SCP Fellow and POV executive director Biju Pappachan explores the implications of the U.S. imposing a tariff on foreign-made films and explains why this is the moment for Canada to stand up for its filmmakers, crews and cultural sovereignty. Film and television are not luxuries; cultural production is a strategic sector that delivers exports, jobs and soft power. Just as we negotiate for agricultural or industrial tariff exemptions, cultural production deserves equal protection.

October 21, 2025

Hype or help? Can crypto and stablecoins solve economic inequality?

Some cryptocurrency advocates are promoting the use of stablecoins as a common currency, arguing that this new currency could help the cost-of-living crisis and promote economic equality – particularly for young people. Law professor, money expert and SCP Fellow Dan Rohde is not convinced that crypto can help address economic inequality. In this explainer, he breaks down what stablecoins are and aren’t, and how to think critically about their promises.

October 21, 2025

Budget 2025 should bolster employee ownership to strengthen Canada’s economy | Canadian Dimension

Budget 2025 offers Canada a chance to make employee ownership permanent by extending tax incentives for employee ownership trusts (EOTs) and worker co-ops. In Canadian Dimension, Simon Pek, Lorin Busaan and Alex Hemingway write that doing so would boost productivity, reduce inequality and secure business succession, while keeping jobs and decision-making local. A modest investment promises significant economic and social dividends.

October 8, 2025

What being an employee-owned company means to me

For what it’s like to be on the inside of an employee-owned company, we spoke to a few of the 750 employees who recently became 100-per cent owners of Taproot Community Support Services, a social services provider across B.C., Alberta and Ontario. Rewards the employees highlighted include company morale and spirit, for sure. They also include financial rewards paid out annually to each employee as dividends. Last year, each employee would have received about $1000 to $1500 on top of their salaries—and as the company succeeds over time, the employees will share financially in Taproot’s success.

October 2, 2025

Wealth inequality in Canada is far worse than StatsCan reports

Our government’s best available data on Canada’s wealth gap excludes, by design, the wealthiest families in the country. As SCP Director of Policy Dan Skilleter writes, if we didn’t have the Parliamentary Budget Officer fact-checking Statistics Canada’s work, their numbers would tell us the top one per cent own only 2.5 per cent of all wealth – not nearly 25 per cent of all wealth in Canada, as the PBO reports. We like to think of Canada as a beacon of egalitarianism compared to our southern neighbours, but when you add in data from "rich lists" published by Forbes and Maclean's, our wealth concentration looks quite similar to the U.S.

October 2, 2025

The federal government is leaving investment dollars on the table—but it can fix that in the budget

At the recent Victoria Forum, community and philanthropic leaders outlined creative community finance and impact investment ideas that could mobilize big pools of private capital to invest in local businesses, social purpose organizations and community infrastructure. However, as SCP CEO Matthew Mendelsohn writes, despite the growing maturity of the social finance community, Canada still lacks the social and community financing infrastructure and policies to make this happen. With some important fixes to fragmented financing and outdated regulatory frameworks, the coming Budget could make it easier for social finance investments to properly scale and deliver the kind of outsized impact Canada needs at this time.

September 23, 2025

How Canada’s tax system puts the wealthy above workers

Rather than using the tax system to prevent wealth concentration, our current tax system promotes it. Those who earn income from their investments have more income left over after taxes, allowing them to accumulate wealth more quickly than others. SCP Fellow Silas Xuereb explains how, south of the border, we are witnessing the consequences of runaway wealth inequality – billionaires use their media conglomerates to get political favours, exploit the instruments of the state to enrich themselves and, increasingly, secure political office. All of these trends are leading to the erosion of democracy and public policy that advances the interests of the wealthy at the expense of everyone else. If Canada does not rebalance our tax system to prioritize work over wealth, we may soon find ourselves on the same path.

August 27, 2025

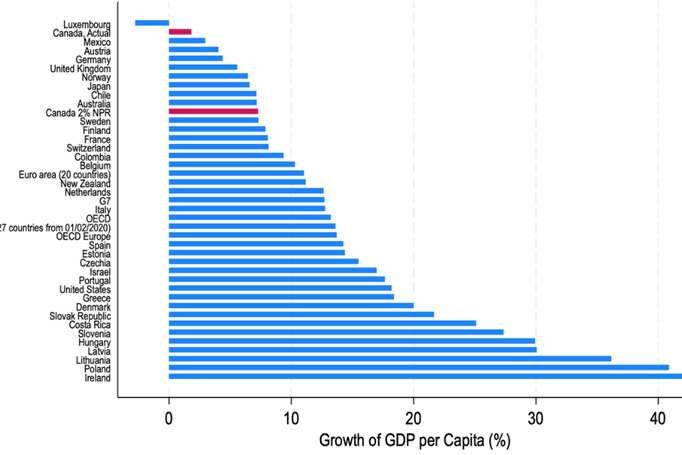

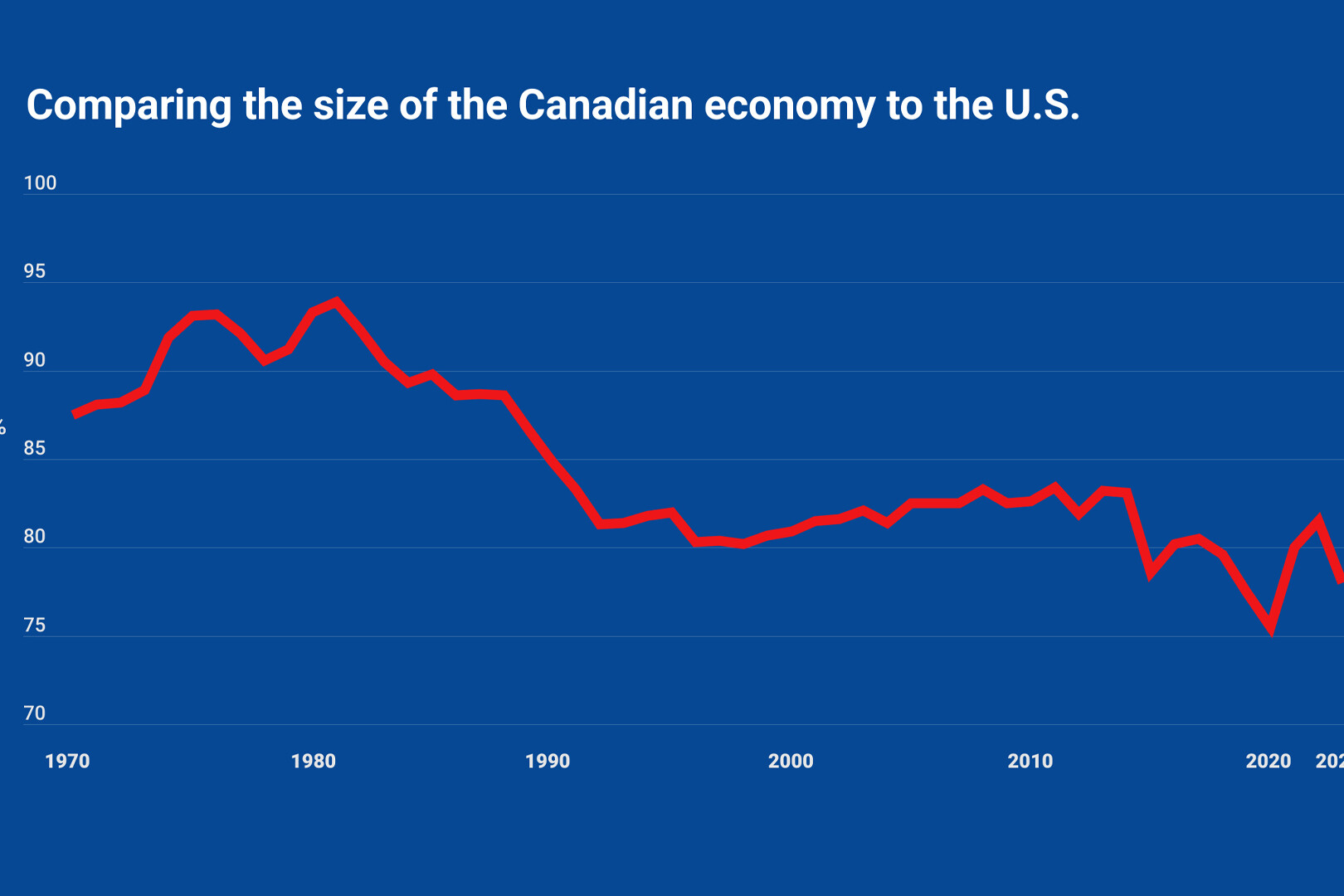

Blame the denominator, not the economy

Over the last couple of years, there have been countless articles warning of Canada’s poor economic performance. The mic drop has increasingly been Canada’s poor performance relative to peer countries on “GDP per capita,” with growth rankings used to draw a variety of sweeping, negative conclusions about Canada’s economy. SCP CEO Matthew Mendelsohn and Policy Director Dan Skilleter draw on economist and SCP Fellow Dr. Gillian Petit's new research to explain why GDP per capita is a deeply flawed measurement for evaluating rich countries - and is easily influenced by a variety of factors having little to do with economic performance or economic well-being.

July 11, 2025

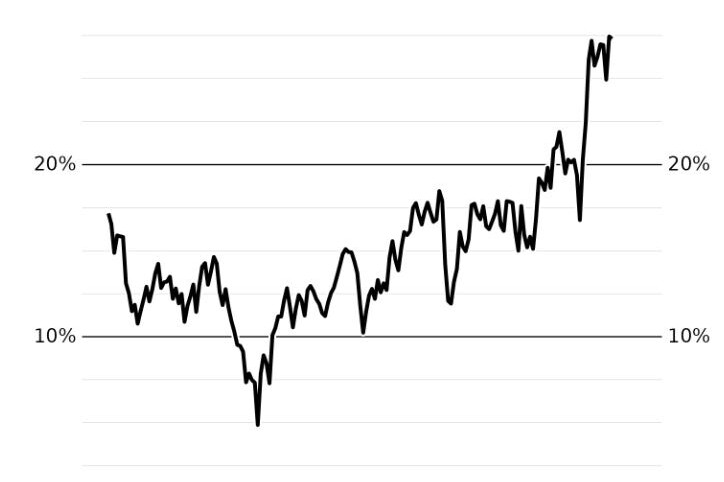

Non-Permanent Residents and their impact on GDP per capita | Report

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.

July 11, 2025

HBS Case | Taylor Guitars: Making Employee Ownership Work the Taylor Way

After a successful transition to 100% employee ownership, Taylor Guitars' experience is now the subject of a Harvard Business School case. Read more about how their experience brings the evidence to life: "Employee-owned firms grow faster, default less often, are far more resilient in economic downturns and pay their people more, even before you factor in the wealth-generating effects of ownership. It’s also a great business succession option as it lets owners exit for fair prices while protecting the people and communities they care deeply about.”

July 3, 2025

Sellers’ inflation is back on the horizon. We can stop it before working people pay the price.

Trade-war chaos and confusion are creating a perfect storm for sellers' inflation—when companies with market control choose to hike prices to gouge consumers and grow their profits when they have the chance. As SCP Fellow Kaylie Tiessen writes, this profit-led inflation often hides behind other drivers and can blindside us if we’re not watching closely. There are good reasons to accept some tariff-related price increases—elbows up, right? But she outlines three ways we can stop opportunistic sellers from using this trade chaos to mask their profiteering. We can stop powerful companies from exploiting confusion and weak oversight so working people don't pay the price while profits soar.

June 13, 2025

As the federal government sets out to “build, baby, build,” do we want to own or be owned?

As our new government pursues growth and a nation-building agenda, we should remember this lesson from history: too often, we build and invest, only to sell off our assets and resources to the highest foreign bidder, leaving us economically vulnerable. In this moment of extreme peril, SCP CEO Matthew Mendelsohn asks how we should “build, baby, build” in a way that doesn’t merely accelerate the trends towards consolidation of wealth and deeper economic dependence. Canada has everything we need to emerge stronger from this period of geopolitical disruption if we put economic sovereignty and broad access to wealth-building at the heart of our agenda.

May 15, 2025

Innovate? In this economy? With these profit margins?

Canadian businesses are immensely profitable, but businesses simply haven't been reinvesting in them. As Tom Goldsmith writes in Orbit Policy's Deep Dives, the financialization of Canada’s economy and the high levels of rent extraction that accompany it are barriers to innovation. We are impoverishing ourselves over the long term to support short-term financial gains. If we care about innovation and productivity, then we need to focus far more critical attention on corporate Canada.

May 14, 2025

Canada’s Liberal party will face down Trump. But will it address inequality? | Truthout

Prime Minister Mark Carney has a monumental task to lead Canadians through the turmoil of a second Donald Trump term, while also addressing various crises: affordability, housing, toxic drugs and health care, to name a few. For Truthout, Nora Loreto interviewed SCP Fellow Silas Xuereb about the crises that loomed over Canada's recent federal election and one fundamental cause that was never clearly identified: concentrated corporate power.

May 8, 2025

School meals aren’t just good for kids: they can also be good for industry

Scaling up access to school meals through Canada's National School Food Policy is a big win for children and families. As SCP Fellow Sarah Doyle and SCP Advisor Alex Himelfarb outline, the program could also be a win for agrifood businesses, the climate and workers, contributing to a more resilient, just, sustainable and less dependent Canadian economy. The key is an ambitious and strategic approach to food procurement—one that shifts the focus from minimizing price to maximizing public value.

May 2, 2025

The misleading use of per capita GDP: Numerators, denominators and living standards | Policy Options

Certain partisans have been citing Canada's performance on per capita GDP as evidence of a supposed 'lost decade' and economic mismanagement. In Policy Options, economist and director of the Centre for Future Work Jim Stanford deconstructs this arbitrary and misleading statistic. In the first of a two-part analysis, he explains multiple factors affecting both the numerator and denominator in this headline-grabbing number and how recent trends in GDP per capita say more about rapid immigration than about Canada’s overall economic health.

April 23, 2025

The perils of per capita GDP: No, Canada is not poorer than Alabama | Policy Options

Some business and political commentators cite a growing gap between the per capita GDP of Canada and the U.S. as evidence of Canada’s purported economic dysfunction. In Policy Options, economist and director of the Centre for Future Work Jim Stanford deconstructs this arbitrary and misleading statistic. In the second of a two-part analysis, he explains how Canada is not poorer than Alabama and how, despite lower economic growth per person, most Canadians earn more, live longer and fare better than Americans.

April 23, 2025

Workforce shocks are coming. Are we going to retreat—or reinvent?

Many Canadian businesses and workers are facing looming furloughs and layoffs. As CEO of Challenge Factory Lisa Taylor argues, these workforce disruptions should be seen as an opportunity to invest in our workers, in our businesses and industries and in the future we want for our families and communities. We must evolve government programs to incentivize businesses to train and upskill workers to meet new market demands and execute on new strategies, rather than lay those employees off. Recovery from workforce shocks is possible with creative ways to reinvent and transform.

April 17, 2025

Canada’s pension funds need to get their elbows up

Canada’s pension funds need to step up and help the Canadian economy pivot. They can do so in keeping with their fiduciary duty to their contributors, but in a way that builds long-term economic resilience. SCP's Matthew Mendelsohn and Michelle Arnold argue that defenders of the status quo are mistaken in their analysis, and that the federal government can use its fiscal power in targeted ways to get more capital into the hands of Canadian businesses and communities.

April 9, 2025

Why commercial rent control is key to Canada’s economic sovereignty

For small businesses across Canada, a lack of commercial tenancy protections means unexpected rent increases, undue financial distress and even threat of closure. As SCP Fellow Liliana Locke argues, there are jurisdictions that have solved for commercial rent hikes that we can learn from in this moment. Smart policy in the commercial rent market would provide Canada’s small businesses the vital stability they need to sustain and grow their businesses through these turbulent economic times.

April 3, 2025

As Canada prepares for disruption and sacrifice, whose side are our leaders on?

In this election, Canadians are looking for a leader who will stand up to economic threats from our mercurial and adversarial neighbour. But how, Matthew Mendelsohn asks, will the ideas on offer help workers, regular people, not-for-profits and smaller and medium-sized businesses transition to the emerging new world order? Yes, Canada needs economic growth, but it needs to be the kind that enriches working Canadians, not just not just large financial and corporate interests.

March 29, 2025

A ‘silver tsunami’ of business exits is coming—here’s how to keep them Canadian

A combination of rising U.S. tariffs, a weakening Canadian dollar and a generation of business owners nearing retirement has created the perfect storm for a wave of foreign takeovers. SCP's Michelle Arnold, Futurpreneur's Karen Greve Young and Venture for Canada's Scott Stirrett on how a few targeted policy changes could enable aspiring entrepreneurs to buy existing businesses, keeping jobs and ownership local while injecting fresh energy into our Canadian economy.

March 26, 2025

Policy ideas that meet this moment can come from anywhere—even LinkedIn

From fighter jets to TikTok, nothing is off the table when Canadians talk about how best to counter Trump's economic assault on Canada. SCP brings you some creative, crowdsourced policy ideas gathered by our Chair Jon Shell on a recent LinkedIn post. More evidence that new voices entering the policy discussion will help us get through the current crisis and emerge in a more hopeful place.

March 24, 2025

The hidden takeover of our economy—and 5 things we can do about it

Today, Canada’s main streets are more likely to feature American chains and less likely to be locally owned. We already face economic assault from the south—SCP's CEO Matthew Mendelsohn and Fellow Rachel Wasserman on why we cannot accept unchecked serial acquisitions as a tactic in this economic war against us and what we can do about it.

March 11, 2025

Four ways to keep Canadian businesses in Canadian hands

Despite the fact that governments, business leaders, workers and Canadians all say they want to be less economically vulnerable, there is a real risk that, two years from now, even more of our businesses and assets will be owned by U.S. investors. SCP's CEO Matthew Mendelsohn and Chair Jon Shell propose four ideas to prevent American finance from gobbling up the Canadian economy.

March 5, 2025

Canada is a way better bet than the United States right now

Canada’s value proposition aligns with the values most Canadians hold, even if we execute on them imperfectly: diversity, inclusion, freedom, equality, democracy, respect and reconciliation. SCP's CEO, Matthew Mendelsohn, on why he would rather invest in a country that strives to uphold those values and build an inclusive, democratic capitalist system than invest in the uncertain, volatile mess that is the United States right now.

March 2, 2025

Canadian foundations must invest more in Canada and invest for local impact

Foundations in Canada, both private and community, hold upwards of $140 billion dollars in their endowments. Our CEO, Matthew Mendelsohn, lays out how endowments held by our universities, colleges, hospitals and other public-purpose institutions, including our philanthropic foundations and those who manage our donor advised funds, need to reorient their investment practices to meet this moment.

February 25, 2025

The answer to economic threats: Always Canada. Never 51.

Under economic threat from the Trump administration, Social Capital Partners launches a Special Series of policy ideas that support Canadian economic sovereignty, advance ownership for Canadians and reduce dependence on the U.S. Our CEO, Matthew Mendelsohn, explains how we need to seize this opportunity to advance the interests of workers, small businesses, the economically vulnerable and young Canadians who have known for a long time that our economy is not working well for them.

February 25, 2025

Three ideas to make home ownership more affordable that aren’t getting the attention they need

Canadians are more vulnerable to Trump’s economic warfare today because our housing system is in crisis and has left many Canadians without affordable places to live. Some of our own bad policy choices have put us in this position of vulnerability. We've got three housing policy ideas we want the team at Missing Middle to look into.

February 3, 2025

Concepts of a plan to confront the new United States

Living next to a superpower run by oligarchs is not where we expected to be 20 years ago, says Matthew Mendelsohn. But it’s where we are. Pretending otherwise doesn’t serve our interests. Canada is big enough, powerful enough, smart enough and rich enough to build a stronger, more independent economy if we start now.

January 24, 2025

Why small businesses need rent control

Rising rents are pushing mom-and-pop shops off Canada's streets. In Canadian Business, Aaron Binder and SCP Fellow Liliana Locke (née Camacho) from the Better Way Alliance argue new commercial tenant protections are the answer.

January 16, 2025

A message from Social Capital Partners: We’re going to tell you the truth

There are lots of real, tangible public-policy solutions to the problems we face, says Matthew Mendelsohn. It begins with talking about the economy in a different way, grounded firmly in the public interest and data that reflect the reality of how people experience their economic lives.

January 16, 2025

Employee ownership trusts: What they mean for Canadian business owners

A helpful summary of Employee Ownership Trusts that gives Canadian business owners and their advisors a simple (albeit not short) explanation about what they are, and why they should care.

May 9, 2024

Employee ownership trusts FAQs

Bringing EOTs to Canada has been a labour of love for a lot of people over the last few years. We’re deeply grateful to the government for establishing the policies we need for employee ownership to flourish here. Now that it’s real we can’t wait to see the community pick the idea up and run with it.

May 9, 2024

Billionaire Blindspot: How official data understates the severity of Canadian wealth inequality

Statistics Canada's official wealth survey significantly underestimates wealth inequality. Canada’s wealth concentration is not as extreme as in the United States, but closer than official data suggest. This misleading portrait undermines Canadians’ ability to have an evidence-informed conversation about how to address growing wealth concentration and the threats it represents for economic resilience and democratic stability.

April 24, 2024

Preparing for SCP’s next strategic phase

Social Capital Partners has a long history of investing in people and projects that create more economic opportunity in Canada. Recently, our focus has been on establishing more avenues for working Canadians to build wealth through ownership. Learn more about what we are moving towards.

April 23, 2024

Getting the facts straight on the changes to capital gains tax in budget 2024

Social Capital Partners' Chair, Jon Shell, sets the record straight on the capital gains changes in the 2024 Federal Budget.

April 22, 2024

Bank of Canada’s unproductive productivity speech

Social Capital Partners' CEO, Matthew Mendelsohn, reflects on the Bank of Canada's productivity speech and calls for need of fresh ideas, voices and questions.

March 28, 2024

Building an employee ownership economy

New research continues to demonstrate that employee ownership fosters economic resilience. As in previous economic crises, employee-owned companies were better at retaining employees and at maintaining hours and salaries throughout the pandemic. In a post-pandemic economic environment, the demonstrated benefits of increased employee retention and alignment by employee-owned companies will be even more important to support economic growth.

March 22, 2022

Rate drop rebate: final evaluation report

The story of the Rate Drop Rebate pilot, including key milestones, successes, dilemmas, insights and lessons learned. The Rate Drop Rebate was a unique partnership that brought SCP together with financial institutions, publicly funded employment service providers and the Government to reduce unfair barriers to employment and help grow the province’s small and mid-sized businesses.

October 24, 2017

Partnership council on employment oportunities for people with disabilities

The Partnership Council champions the hiring of people with disabilities and provides strategic advice to the Ontario Minister of Economic Development, Employment and Infrastructure to enhance employment opportunities for Ontarians with disabilities.

May 11, 2015

Working together: Implementing a demand-led employment and training system

Canada’s approach to training and development needs reform. Billions of dollars are spent annually on job training and skills development, with limited evidence of lasting benefits. Most problematic, employers’ talent needs (i.e., actual skills demand) are not formally embedded in the process of determining how or where money is spent, leaving a fundamental disconnect between demand for skills and the investments being made by governments.

April 14, 2009