As Canadians, we like to think we’re strong and free. But, when it comes to the wealth gap, we’re looking more like America Lite—better manners, but almost all the inequality. The way our economy is set up means that most of the benefits from economic growth go to financial interests and speculators, rather than to workers or other businesses. We can shift economic power to more people and aspiring entrepreneurs by making them owners. When more people have a stake, Canada’s economy works better for everyone—not just investors.

Share with a friend

Related reading

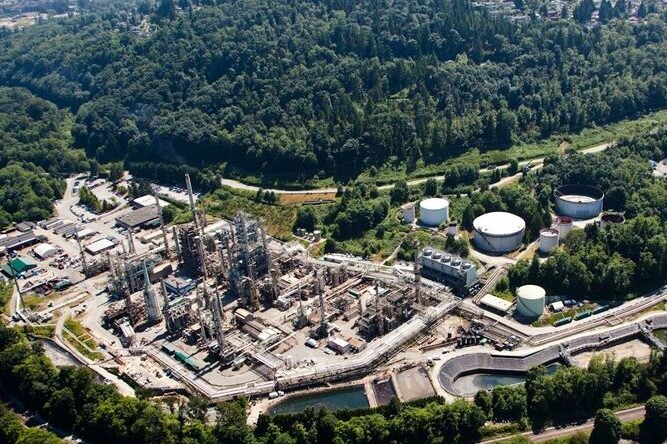

Four key steps can help secure Canadian sovereignty

Gas station giant Parkland is already shedding Canadian employees in the wake of TX-based Sunoco’s recent takeover of the Canadian fuel chain, which owns 15% of our gas stations and a key refinery in Burnaby, B.C. These layoffs were a predictable outcome of Ottawa's decision not to flex its new regulatory muscle through the Canada Investment Act to quash foreign investment deals that pose an economic security threat. As SCP chair Jon Shell writes, the government has not defined a clear strategy to build and maintain Canadian ownership of our assets. Combined with the federal budget’s focus on attracting private capital, there’s a real danger that Ottawa will enable a sell-off of Canadian firms to foreign investors.

What the new World Inequality Report tells us, and why it matters for Canada

The 2026 World Inequality Report is out and the results paint a picture of a world in which a tiny minority commands unprecedented financial power, while billions remain excluded from even basic economic stability. As SCP Director of Policy Dan Skilleter writes, Canada is far from immune to these global trends: although our own GDP keeps rising, wealth gains have been concentrated at the very top, while many households struggle to afford food and housing. The top 1% in Canada hold about 29.3% of total wealth, making our country's wealth inequality even more pronounced than our own Canadian Parliamentary Budget Officer reports. The good news is, momentum is building in Canada for better wealth data, shedding light on our "Billionaire Blindspot."

Ontario wakes up to the succession tsunami

In November, 2025, the Ontario provincial government finally stepped into the looming “succession tsunami,” launching a modest $1.9M Business Succession Planning Hub to help micro-business owners plan exits through local Small Business Enterprise Centres. Notably, the hub spotlights employee ownership and the new Employee Ownership Trust, signaling a shift toward mainstream adoption. But, as Dan Skilleter writes, Ontario’s approach focuses narrowly on retiring owners, ignoring how different buyers shape risks and benefits to workers, communities and Canada's broader economic sovereignty. This is a promising start that could and should grow into a broader succession-planning policy that protects Ontario’s long-term resilience.