Non-Permanent Residents and their impact on GDP per capita | Summary

New research from economist and SCP Fellow Gillian Petit, PhD, JD, explains why GDP per capita is a poor measure of economic performance and economic well-being. Using changes in GDP per capita as evidence of either improving or deteriorating economic well-being is poor economics, poor public policy and poor reasoning. Click here to read the full report.

Main messages

- The statistic “GDP per capita” has been used by some Canadian commentators as a summary measure to make sweeping claims about the state of the Canadian economy. However, this is misleading. Canada’s GDP per capita should not be used as if it were the sole indicator of economic well-being.

- Many conclude that low growth in GDP per capita over the past decade suggests that Canada’s economic growth has been low. But that is untrue. Canada’s economic growth has been on par or ahead of peer countries. Growth in GDP per capita, however, has been decreased by a high growth in temporary residents, like temporary foreign workers and international students. This is an arithmetic quirk of GDP per capita.

- This paper estimates what our GDP per capita growth would have been if Canada’s intake of temporary residents was more in line with recent historical norms. It also estimates the impact on GDP per capita growth in the coming years as a result simply of lowering our intake of temporary residents. Under both scenarios, Canada’s GDP per capita growth would have looked—and will look—very much like our peers.

Non-Permanent Residents and their impact on GDP per capita | Report

New research from economist and SCP Fellow Gillian Petit, PhD, JD, explains why GDP per capita is a poor measure of economic performance and economic well-being. Using changes in GDP per capita as evidence of either improving or deteriorating economic well-being is poor economics, poor public policy and poor reasoning.

Main messages

- The statistic “GDP per capita” has been used by some Canadian commentators as a summary measure to make sweeping claims about the state of the Canadian economy. However, this is misleading. Canada’s GDP per capita should not be used as if it were the sole indicator of economic well-being.

- Many conclude that low growth in GDP per capita over the past decade suggests that Canada’s economic growth has been low. But that is untrue. Canada’s economic growth has been on par or ahead of peer countries. Growth in GDP per capita, however, has been decreased by a high growth in temporary residents, like temporary foreign workers and international students. This is an arithmetic quirk of GDP per capita.

- This paper estimates what our GDP per capita growth would have been if Canada’s intake of temporary residents was more in line with recent historical norms. It also estimates the impact on GDP per capita growth in the coming years as a result simply of lowering our intake of temporary residents. Under both scenarios, Canada’s GDP per capita growth would have looked—and will look—very much like our peers.

Read the related article by Matthew Mendelsohn and Dan Skilleter.

How do we not go broke? | Gloves Off Podcast

Part of our Special Series: Always Canada. Never 51

A Canadian toy company is on the brink because of US tariffs. Millions in unsold stock. But this isn’t just one company’s problem—it’s Canada’s.

Author and Gloves Off podcast host Stephen Marche digs into the economic war we’re already in with the US. How can we fight against an economy ten times our size, where the tariff goal posts keep moving, and where any brokered deal is a tweet away from becoming meaningless? What are new approaches to doing business in today’s climate?

This episode features bold ideas from business owner and Shorefast founder Zita Cobb and chair of Social Capital Partners Jon Shell and looks at how to build the Canadian economy without dependence on a superpower in chaos.

Speakers

Zita Cobb

Founder, Shorefast

Jon Shell

Chair, Social Capital Partners

Stephen Marche

Host, Gloves Off podcast

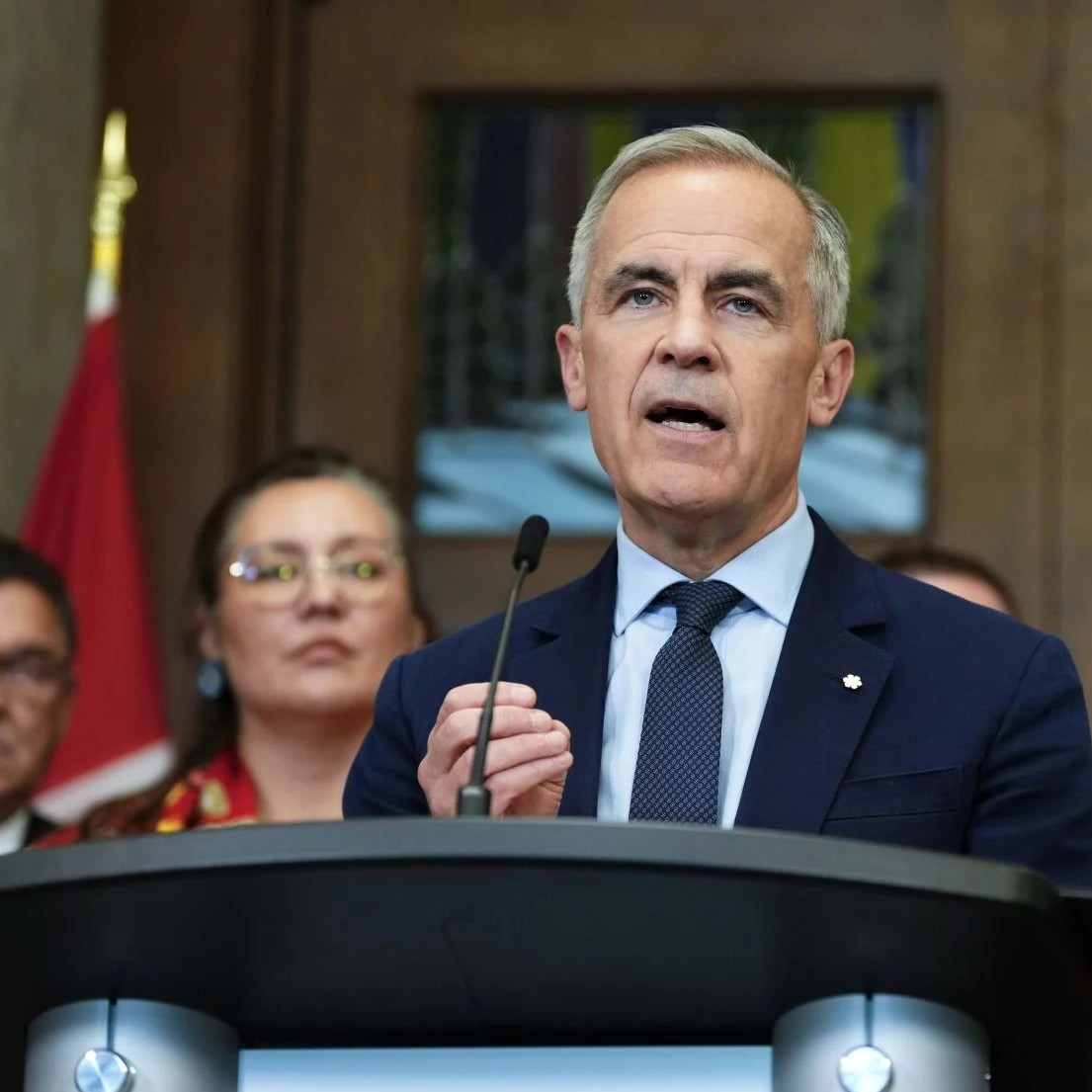

Mark Carney’s economic agenda misses something vital | Toronto Star

By Matthew Mendelsohn | Part of our Special Series: Always Canada. Never 51 | This post originally appeared in the Toronto Star

The Carney government’s early economic growth priorities have been clear for months. The details can be found in the Building Canada Act, which makes way for big, national infrastructure projects, biased heavily toward natural resources and energy.

This is perfectly reasonable for an early growth agenda, so long as Indigenous rights are respected. But it misses something important: how to increase Canadian ownership of Canadian assets and ensure that more Canadians stand to benefit.

Concentrated ownership of our economy, and the inequality and plutocracy that result from it, are causing deep distress among working and young people who feel — quite accurately — that the economy is rigged against them. Broad-based Canadian ownership of our businesses, resources and assets needs to be part of the growth agenda.

It appears that Prime Minister Mark Carney knows this. He has said that “we are masters in our own home,” that “Canada is not for sale” and that U.S. President Donald Trump is using tariffs to “break us so he can own us.” At the White House in early May, Carney sat in the Oval Office and referred to the Canadian people as “the owners of Canada.”

But so far, the plan for Canadians to own more of our economy is pretty thin. We need to strengthen our economic sovereignty with bigger goals than simply creating more jobs in the trades and securing more resource royalties to provincial governments.

In fairness, the federal government has taken some steps to align with this vision in recent years, including $10 billion in loan guarantees to enable Indigenous communities to maintain equity in resource extraction and other major projects.

The Black Entrepreneurship Loan Fund gets more low-cost capital to entrepreneurs who have faced barriers to accessing capital. And First Nations Bank of Canada and the Business Development Bank of Canada recently announced a program to facilitate the acquisition of existing businesses by Indigenous communities.

These creative uses of financing and capital, deployed by a strategic state, leverage the federal government’s AAA credit rating and should be a core component of, not peripheral to, our growth agenda. We need more investments aimed at achieving more widespread Canadian ownership of Canadian assets that produce economic activity and wealth.

We also need to make it easier for independent Canadian entrepreneurs to buy businesses from retiring owners. We need a better funded network of community investment institutions to provide low-cost capital to small businesses, social enterprises and non-profits in rural and other communities that often have trouble accessing financing. We need more ambitious use of federal loan guarantees and co-investment to facilitate the acquisition of small- and medium-sized businesses by employees, co-ops and communities.

A sovereign fund could invest in and acquire vulnerable Canadian businesses, keeping them in Canadian hands. New industrial strategies could help preserve Canadian sovereignty in food production. We must strengthen local, independently owned media and digital infrastructure to escape extortion from American digital platforms. We must be stricter about preventing foreign takeovers of Canadian firms, as well as the consolidation of ownership that’s underway in many communities. And we must get serious again about Crown corporations and other forms of public ownership.

Finally, our public financial institutions, pension funds and philanthropic foundations need to consider how they can support this ambitious ownership agenda so that all Canadians benefit, not just investors.

The ownership agenda is just as important to our economic future as pipelines — if not more so — because an economy owned by a broader swath of society is more sustainable and resilient than one in which wealth and ownership are concentrated among few.

Sovereignty isn’t just about control of our border. It’s also about control of our resources and assets.

We can’t truly be masters of our own home if that home is owned by an American hedge fund. If we don’t protect and broaden Canadian ownership as part of the growth agenda, two years from now we will be even more economically vulnerable than we are today. The owners of Canada need a plan to deliver on the promise of “maîtres chez nous.”

HBS Case | Taylor Guitars: Making Employee Ownership Work the Taylor Way

In 2013, guitar manufacturer Taylor Guitars’ co-founders Bob Taylor and Kurt Listug were considering several exit options including selling to a competitor or to a private equity firm.

The co-founders decided, instead, to embark on a seven-year process to transfer 100% of the ownership of the company from themselves and third owner partner Andy Powers to Taylor Guitars employees.

The co-founders felt an employee stock ownership plan (ESOP) would best preserve the company’s values and distinct culture and in 2021, the transaction was financed by Canadian pension fund Healthcare of Ontario Pension Plan (HOOPP), Canadian non-profit Social Capital Partners (SCP) and the owners.

In 2024, the co-founders, Powers (now president and CEO), CFO Barbara Wight, and Vice President of Human Resources Shaun Paluczak took time to reflect on the ESOP. Many employees were still unclear about what the ESOP meant for them, with some likening it to a retirement plan. The challenge for the leadership team was how to activate employees’ sense of ownership in the company to enhance Taylor Guitars’ performance.

Now, their employee-ownership transition is the subject of a 2025 Harvard Business School case study.

Now #hiring: Executive Assistant to the CEO

Role: Executive Assistant to the CEO

Location: Toronto – Hybrid position with minimum 2 in-office days per week in downtown Toronto office

Position Type: Full-time, Permanent

Salary Range: $55,000-$65,000, plus competitive benefits package (e.g. health benefits; RRSP contribution and supplementary matching; 20 days vacation per annum plus business days between Christmas and New Year’s).

Closing Date: July 14

About Social Capital Partners

Social Capital Partners (SCP) is a Canadian nonprofit founded in 2001 to focus on designing and implementing new financial tools that broaden economic opportunity, security and inclusion. We are independently funded, which enables us to actively engage across a variety of issues without compromising our values.

Over the past few years SCP has focused on identifying initiatives that could create pathways to asset ownership, wealth-building and economic security for working Canadians. We have recently led the work to establish employee ownership trusts (EOTs) in Canada. We believe that growing wealth inequality represents a threat to economic and democratic resilience. We support broader access to capital and more widely distributed ownership of assets.

SCP will continue to build on our recent successes. Our upcoming work will focus on developing projects, building networks, conducting research and advocating for transformative policy ideas that will make it easier for younger and working people to own assets in Canada.

If you have a passion for public policy and are eager to use your skills, knowledge and experience to help us with this work, we want to hear from you!

Position Overview

We’re seeking a highly organized and proactive Executive Assistant (EA) to the CEO who thrives in a fast-paced, mission-oriented environment. While this is a true EA position focused on keeping the CEO and team operating at a high level, it is also a unique opportunity to engage in a wide range of stimulating policy and strategy conversations, including the chance to conduct research, contribute to policy initiatives and engage with influential leaders in the field.

Think of this role as a Junior Chief of Staff: part executive support, part process optimizer, part administrative assistant, part policy research assistant, and part team glue with access to a front-row seat in transformative policy work.

Key Responsibilities

Executive & Administrative Support:

- Manage the CEO’s complex and evolving calendar.

- Draft and manage correspondence, briefings and memos.

- Coordinate and plan internal meetings, team retreats and external convenings.

- Organize and maintain electronic filing systems and documentation.

- Prepare and track Access to Information and Privacy (ATIP) requests.

- Monitor project timelines and team deliverables.

Research & Strategic Input:

- Conduct preliminary research and prepare briefing notes.

- Support preparation for meetings with external stakeholders.

- Assist with policy tracking and landscape analysis.

Internal Operations & Culture:

- Design and refine internal systems and processes.

- Be the go-to person for “making things happen.”

- Champion an organized, high-trust and transparent workplace culture.

Qualifications & Experience

Must-Haves:

- 2+ years in an EA, operations or coordinator role.

- Exceptional organizational skills and attention to detail.

- Outstanding written and verbal communication.

- High emotional intelligence and discretion.

- Ability to prioritize and execute in a fluid, fast-moving environment.

- Good humour and kindness

- Proficiency in Google Workspace, Microsoft Office and willing to learn new systems such as Zotero and Asana.

Nice-to-Haves:

- Experience in policy, government or advocacy environments.

- Research skills and interest in public policy.

- French language skills.

Why Join SCP?

- A Role with Purpose: Help a high-performing organization deliver on its ambitious mission.

- Access & Exposure: Engage with leading thinkers and decision-makers.

- Culture of Learning: SCP supports your personal and professional development.

- Transparency & Collaboration: Work closely with a seasoned team in a transparent, high-trust environment.

How to Apply

Please submit your resume and a short cover letter (PDF preferred) outlining your interest and relevant qualifications to careers@socialcapitalpartners.ca. Use the subject line: Executive Assistant to CEO Application.

Note: Applications submitted via LinkedIn Easy Apply will not be considered.

SCP’s Commitment to Inclusion

We are committed to diversity in our workplace and recruitment. Applications from all equity-deserving groups are encouraged. Accommodations are available upon request. If you’re excited but don’t meet every requirement, we encourage you to apply or reach out to learn more.

Sellers’ inflation is back on the horizon. We can stop it before working people pay the price.

By Kaylie Tiessen | Part of our Special Series: Always Canada. Never 51.

Canada’s inflation rate sat at 1.7% in April, but that headline figure hides some worrying trends. The federal carbon tax cut lowered the rate quite a bit—without it, inflation would have been 2.3%. That’s still within the Bank of Canada’s 1–3% target, but significantly more concerning than the number making headlines. The carbon tax cut will act as a built-in offset on the inflation rate for the next year, muting the headline inflation rate, but camouflaging other underlying price pressures.

In fact, Bank of Canada Governor Tiff Macklem recently acknowledged that inflation in April was higher than forecast, with many goods and services rising faster than expected, signalling that inflation could be gathering momentum again.

It has me thinking about the different drivers of inflation—and which sources of inflation we should be watching for today. We should expect some tariff-related inflation as the counter tariffs push prices up on affected imports and inputs. And we could also see some supply-chain related inflation as the world adjusts to a new global trade regime.

But the one that worries me most is sellers’ inflation, or profit-led inflation. This is when companies with market control choose to hike prices to gouge consumers and grow their profits when they have the chance. It often hides behind other drivers and can blindside us if we’re not watching closely.

Profit-led inflation was a real issue during the pandemic, and there are three reasons why I’m worried about it re-emerging today:

Inflation expectations: In the Bank of Canada’s latest survey of consumer expectations, 75% of Canadian consumers believe prices are going to rise, making it likely they will accept outsized price increases—tariff-related or not.

Tariff confusion: Canada’s counter-tariff regime is clear as mud to consumers and business owners. The rules keep changing, making it difficult to keep current.

The end of the consumer carbon tax: the negative inflation rate on oil and gas as a result of the end of the tax will pull down headline inflation for the next year and camouflage inflation on other goods driven by other sources of inflation, including profiteering.

Each of these factors on their own would provide cover for opportunistic price makers to gouge their customers: they’ll make a few extra bucks and blame Trump. Add to this the lack of competition in many sectors of Canada’s economy—and the fact that firms had a practice run just a few years ago—and we’re looking at fertile ground for profit-led inflation.

As we saw during COVID, corporate markups skyrocketed in 2021 to nearly 16% from an average of 11.5% the years before the pandemic and have hovered around 15% ever since– down from the pandemic peak but much higher than pre-pandemic levels.

Statistics Canada found that food store profit margins grew to more than 3% by the end of 2022 from around 1.6% before the pandemic—doubling the industry’s profit margin. Food-store margins have come down slightly since then, but are still hovering a full percentage point above pre-pandemic levels, coming in at 2.7% in the first quarter of 2025.

Profits as a share of GDP skyrocketed during the pandemic as well, reaching upwards of 24% in mid-2022. The measure has declined to 18% in the years since, but last quarter it ticked up again to 19.6%—nearly two percentage points above the pre-pandemic average.

In lay terms, all of this means that a larger share of Canada’s economy is being diverted into the profits of corporations, while many of us are struggling to pay our bills.

So, what should we do?

First, get clear on tariffs. Governments must be radically transparent about Canada’s counter-tariff strategy and provide clear information to consumers and business owners about all the items that are tariffed. Some grocery stores are attempting to do this, but many consumers, myself included, are skeptical about their trustworthiness, given their profit motives.

But transparency and clear communication can’t solve everything—international trade is complex, and Trump’s shifting tariff policies add to the confusion.

Second, the Bank of Canada must take a much more aggressive stance against abnormal pricing behaviour. The Bank of Canada usually deals with price gouging/profiteering after it happens, through interest rate hikes to deal with the inflation. But the Bank can take action proactively. While it may not have fiscal or policy tools at its disposal, strong language and public information sessions describing signs of profiteering it is seeing in the data can have an impact on firms’ behaviour.

The Bank used a similar (though unwarranted for the time) tactic on wages in late 2022, when they warned publicly that wages could lead to a wage-price spiral, when there was no evidence that wages were causing inflation at all. This warning was so effective that it will take many years for some workers to see their purchasing power catch up. The Bank should use this tactic now pre-emptively against the cause of inflation, instead of punishing the rest of us after the fact.

The third solution is to put public policies in place to help deter profiteering.

Governments should consider implementing an excess-profits tax on firms that are making extraordinary profits due to opportunistic pricing behaviour.

Governments can also consider price caps, or margin caps, on certain goods like baby formula, food stuffs and energy in order to reduce the inflationary pressures on essentials. The evidence for the usefulness of price controls in some circumstances has been mounting in recent years.

Some U.S. states have laws that prohibit price gouging during emergencies. Why not extend that to all periods, instead of just during emergencies?

The Competition Act can be further strengthened and the Competition Bureau can go after price gouging and wage fixing made possible by corporate concentration. And governments should continue efforts to crack down on hidden junk fees and “dynamic pricing,” which adjusts prices based on an algorithm’s assessment of a customers’ ability or willingness to pay.

These policies are important tools in any government’s toolbox to prevent profit-led inflation before it starts, instead of having to deal with the consequences.

There are good reasons to accept some tariff-related inflation—elbows up, right? But we shouldn’t allow opportunistic sellers to use the crisis to mask their profiteering.

We know what happens when powerful companies exploit confusion and weak oversight: working people pay the price while profits soar. Preventing inflation driven by opportunism requires coordinated action now—before working Canadians are left to bear the burden yet again.

New Canadian Tax Observatory seeks visionary founding CEO

May 21, 2025, Toronto (ON) – Canada’s tax system is contributing to economic inequality and an increased concentration of wealth, but there is a widespread misunderstanding of how our tax system works and who it serves. Many well-funded interests falsely suggest that tax fairness would undermine economic growth.

Recognizing the need for more balance in publicly available information, Social Capital Partners and other funders are incubating a new, non-partisan, nonprofit Canadian institution to lead an informed national conversation on the links between taxation, economic fairness and a thriving democracy.

“There is a global groundswell of interest in economic systems that deliver equitable benefits across society. Our vision for a more democratic capitalism in Canada requires well-regulated markets and policy changes that provide real opportunities for people to build economic security. And it also requires fair taxation,” says the Canadian Tax Observatory’s founding board chair, Matthew Mendelsohn. “We are seeking a visionary leader who can shape and grow the Observatory into a permanent, influential Canadian institution connected to global networks identifying better, more effective ways to achieve tax fairness.”

The organization’s mission is to support a more equitable tax system that advances shared prosperity and economic growth through rigorous research, collaboration, advocacy and public education. The board has secured seed funding of approximately $550,000 per year over three years and is in the foundational stages of building the incorporated nonprofit organization into a registered charity. The board is open to adapting the Observatory’s operating structure to suit the preferred leadership model of the chosen leader.

To learn more about the Founding CEO position and how to submit a Statement of Ambition expressing interest in this transformative role, please visit: www.socialcapitalpartners.ca/ObservatoryFoundingCEO

About the Canadian Tax Observatory

The Canadian Tax Observatory is an essential voice in Canadian tax policy. A non-partisan nonprofit established in 2025, the new organization supports a more equitable tax system that advances shared prosperity and economic growth through rigorous research, collaboration, advocacy and public education. The Canadian Tax Observatory’s founding board of directors is comprised of Chief Executive Officer of Social Capital Partners Matthew Mendelsohn (Board Chair), Professor of Political Management at Carleton University Jennifer Robson and Executive Director of Euphrosine Foundation Niamh Leonard.

About Social Capital Partners

Who owns the economy matters. Social Capital Partners believes working people deserve a fighting chance to build economic security and wealth. A Canadian nonprofit organization founded in 2001, we undertake public policy research, invest in initiatives and advocate for ideas that broaden access to wealth, ownership and opportunity, and that push back against extreme economic inequality. To learn more, please connect with us on LinkedIn or Bluesky or visit socialcapitalpartners.ca.

For more information, please contact:

Katherine Janson

Director of Communications

Social Capital Partners

647-717-8674

katherine@socialcapitalpartners.ca

A new middle-power alliance would give Canada leverage and Canadians hope

By Jon Shell | Part of our Special Series: Always Canada. Never 51 | Reprinted with permission from The Hill Times

Following Donald Trump’s first threats to annex Canada, there was a country-wide energy to forge a new and more independent path, with political rhetoric to match. But with Trump’s “51st state” bluster diminishing, Mark Carney’s drama-free visit to the White House and a stay-the-course cabinet, Canadian business leaders seem eager to settle for the best “new-new-NAFTA” we can get.

This tendency toward the status quo is exactly what fuels Canada’s self-loathing: we’re not entrepreneurial enough, don’t take enough risks, don’t invest in our potential. Instead of charting ambitious, but uncertain, territory, we defer to the corporate lobbyist on our shoulder whispering “be practical.”

Playing it safe is both the wrong short-term tactic and the wrong long-term strategy. Sure, Canada could probably get a new deal if we don’t anger the president but it would undoubtedly be a downgrade – just as CUSMA is worse than NAFTA – because, as JD Vance likes to say, we don’t have the cards. We’d remain an underperforming “branch-plant economy,” selling our innovations and resources south for pennies on the dollar. And it would leave us exposed to the same risks of military and economic dependency currently on stark display.

Instead, Canada should lead the world’s middle powers in a collective and overdue weaning from American primacy by establishing a grand new security and economic alliance.

Ten countries – Canada, Australia, France, Germany, Italy, the U.K., Spain, Japan, South Korea and the Netherlands, or the “Core 10” – would amount to about the same GDP as the U.S., with significant natural resources and about six hundred million wealthy residents with massive buying power. From Robert Reich to The Economist, versions of this idea have been proposed, all with the objective of creating leverage against American economic aggression.

While each potential grouping of countries would have its complexities, even one formal meeting to discuss a new alliance would be enough to demonstrate that a break from U.S. dominance is possible. Announcing new multilateral partnerships in areas of American interest such as military procurement, pharmaceutical development, cloud infrastructure or resource refinement would solidify the group’s potential.

It is clear that President Trump fears this possibility.

Prime Minister Carney’s visit to France and the UK in March prompted Trump to threaten “large scale tariffs, far greater than currently planned” if the European Union were to work with Canada to “do economic harm to the USA.” His reaction proves the idea’s merit – America’s global trade war can only succeed against a divided opposition.

A new alliance is also the right long-term strategy. While the U.S.-led western countries had a long and successful run after World War II, we are all now facing similar crises, including decreasing housing affordability, increasing inequality and repeated failures to address climate change. As a result, belief in democracy, capitalism and global institutions are in steady, long-term decline, along with global comfort with American leadership.

Part of the issue is that, in many ways, America has become an outlier among its allies. On issues like health care, taxation, social security and climate, and on critical social metrics like inequality, life expectancy and gun violence, the middle powers of the Core 10 are both highly aligned and diverging further and further from the U.S. Common ground to solve our collective challenges will remain elusive with America at the table.

A middle power alliance, however, built on security and economic commitments patterned after NATO, would constitute an ambitious, creative and credible third power centre alongside the U.S. and China. Unshackled from American dominance, these countries so aligned in values and approaches could develop innovative new solutions to our common crises. Rather than trying to salvage a collapsing world order in which so many have lost faith, Canada and its Core 10 allies could build the next great era of democratic progress.

The U.S. will always be Canada’s largest trading partner and so a new deal is necessary. But we should resist the temptation to choose short-term comfort and certainty. By finally stepping into a more entrepreneurial and ambitious leadership role, not only can we improve our own hand in trade negotiations with America, but spark energy and enthusiasm for a new and better global superpower.

The tariff war means a new normal for Hamilton businesses | Hamilton City Magazine

By Eugene Ellman, Hamilton City Magazine

Editor’s note: This story was finalized in late April. We acknowledge that this is a highly fluid and volatile situation and that tariffs being imposed may have changed since HAMILTON CITY Magazine went to press.

Keanin Loomis, a leader in Hamilton’s business community who has lived and worked in both Canada and the United States, can’t come to grips with the delusional and reckless tariff policies of Donald Trump.

For Loomis, the long-standing rules governing trade between the two countries have seemed so permanent, so well-established that it seems impossible that the U.S. can wave them away with a simple presidential order.

“This is hard as an American citizen, as a dual national,” says Loomis, the former CEO of the Hamilton Chamber of Commerce, a past mayoral candidate and now CEO of the Canadian Institute of Steel Construction. “This is particularly personal for somebody who’s straddled both sides of the border for my entire life. I can’t even believe we’re here, to be honest.”

While Canadians and Hamiltonians grapple with the enormity of these tariffs, a new normal of Canada-U.S. trade relations is beginning to settle in with the city’s business community.

“People realize that the status quo is no longer good,” says Norm Schleehahn, director of economic development with the City of Hamilton. “It’s a wake-up call. We’re going to see the east-west discussion being more of the norm now versus just relying on north-south relationships.”

This new normal – the realization that the traditional Canada-U.S. relationship has come to an end – was front and centre in Canada’s recent election campaign. “It is clear that the United States is no longer a reliable partner,” Prime Minister Mark Carney told reporters at the end of March. “We will need to dramatically reduce our reliance on the United States. The road ahead will be long. There is no silver bullet. There is no quick fix.”

Hamilton is vulnerable

Hamilton’s economic base evolved in the years after World War II, a time of growing integration in cross-border markets. While there have been occasional trade disputes, especially in the steel industry, the city’s manufacturing and transportation businesses established firm links with suppliers and customers across the border based on a faith in enduring free trade.

That friendly arrangement ended on April 2.

That was the day Trump unveiled his so-called “reciprocal tariffs.” In his words, the new policies were meant to fight unfair tariff and non-tariff barriers by America’s trading partners. In fact, the tariffs were created with flimsy math based on national trade patterns that in most cases had nothing to do with tariff rates imposed on the U.S.

In Canada’s case, no “reciprocal tariffs” were imposed. Rather, Trump levied a 25 per cent tariff on non-U.S. content of vehicles imported into the U.S. These new tariffs came in addition to a 25 per cent tariff on steel and aluminum products imposed earlier. The Canadian government levied counter-tariffs on the same goods and billions of dollars of other U.S. products.

By sparing (at least for now) Canada from “reciprocal tariffs,” Hamilton was saved from the worst possible impacts of the U.S. trade policies. Nevertheless, the blow to Hamilton was significant.

This is because of the large share of employment in the city related to the steel industry. About 10,000 people work for the primary steel producers and fabrication companies, and thousands more work in related supply and service providers. In addition, about 1,800 Hamiltonians work in auto parts companies. Together, that’s more than a third of the city’s total manufacturing employment of 29,000.

To make matters worse, a large share of the primary steel produced in Hamilton is used in auto production. Several car companies issued layoff notices after the Trump announcement in April because tariffs immediately disrupted cross-border auto industry supply chains, also causing potential ripple effects in the steel industry.

“When you layer in the steel and auto tariffs, I’d be shocked if we are not now into the top three communities impacted in the country,” says Greg Dunnett, CEO of the Hamilton Chamber of Commerce.

There are signs that business growth plans are being halted or slowed down. Thirty-eight per cent of more than 200 local businesses responding to a City of Hamilton survey said they expect to put off investments due to tariff-related uncertainty. Thirty-two per cent expect to reduce their workforce.

“Businesses have stopped their expansion plans or have delayed them because they don’t know what tomorrow looks like, much less what a three-, five- or 10-year window looks like,” Dunnett said in an early April interview. “It’s going to have a long-term slowdown because those expansion and growth opportunities are being delayed or shuttered.”

At the time of writing in early April, neither ArcelorMittal Dofasco nor Stelco had publicly commented on the tariffs. But Laurenco Goncalves, CEO of Cleveland-Cliffs Inc., Stelco’s U.S. owner, said he supports the tariffs and believes Stelco can weather them by pursuing Canadian markets, a strategy the company used with some success in a previous tariff fight in 2018.

Canadians get a friendly reception in Europe

The week that Trump announced his tariff plan, business people from around the world gathered at Hannover Messe (messe means “trade fair” in German), site of the largest annual manufacturing trade event in the world. Held annually in a sprawling convention centre in Hannover, Germany, the event this year attracted 130,000 participants from 4,000 companies and more than 150 countries. As the official partner country, Canada had one of the largest contingents at more than 250 delegates and more than 230 exhibitors.

Planning for Canada’s participation was a year in the making, long before Trump was re-elected president or his tariffs were rolled out. But a large number of Hamilton companies sent delegates or exhibited, at least partly motivated by potential opportunities presented by the Trump trade attacks. The reception was very positive.

“It has been absolutely overwhelming to see the response and the reception we are getting from European markets,” Brad Sparkman, president of Orangeville-based Innovating Finishing Solutions, told CBC News.

Representing the City of Hamilton, Schleehahn said Canadian companies told European customers and suppliers they would be a reliable partner. The message was greeted warmly. “They absolutely love Canada,” he said.

Attending companies based in Hamilton or with local interests included Kubes Steel, a construction steel manufacturer, industrial supply companies Bar Hydraulics and VTR Feeder Solutions, pre-fabricated home builder BECC Modular, and real estate developer Slate Asset Management. Mohawk College, McMaster University, McMaster Innovation Park and the Hamilton Oshawa Port Authority also attended.

Hamilton-based EVM Group, which provides industrial automation products and services, went to the event to meet with existing customers and to explore new markets.

Adam McCormick, chief growth officer, said the company was recently cast out of the running for a major U.S. industrial control panel contract when EVM couldn’t confirm how much of the total cost would be subject to the new steel tariffs.

But Canadian trade in automation services is a growing market as companies demand more artificial intelligence controls over manufacturing processes. And with strong two-way trade between Canada and Europe, there is growing demand for these services in Europe and for European companies operating in Canada, he said.

Canadian expertise in industrial automation is ranked fourth- or fifth-best in the world, said McCormick, which was a strong selling point at the show. “The interest in working with Canada is very, very big. We’ve had a lot of positive conversations with a lot of people about how they want to increase their operations or sales in Canada.”

Fixing Canadian markets

As many companies pursue international markets, others, including some in the steel industry, face a fundamental problem: Steel is being dumped on world markets by China and other countries at prices far too low for them to match.

China produced about 990 million tons of steel in 2024, more than half the world total of 1.9 billion tons. To contrast, the U.S. produced 81 million tons and Canada produced a mere 12 million.

Much of this steel is being dumped by China and other countries such as South Korea, Vietnam and Turkey at cut-rate prices into Canada, a problem that is expected to get worse as producers search for alternatives to the U.S. market.

“We are expecting more unfairly traded (steel) goods to land in Canada because they can’t go to the United States,” says Catherine Cobden, CEO of the Canadian Steel Producers Association. A 25 per cent steel tariff Canada imposed on China last fall will help, she says, but there needs to be greater enforcement and higher tariffs. “It is time for the government to do much more to get that unfair trade out of the market.”

“There is still a threat of Chinese steel flooding the zone here in North America,” said Loomis at the Canadian Institute of Steel Construction. “We want to make sure that we’re acting in concert with the Americans against this common threat.”

While the steel industry is hopeful the Canadian government can get relief from U.S. tariffs by focusing on the common problem of offshore dumping, industry representatives are looking for Canadian markets for at least some of the steel now sold in the U.S.

Loomis is calling for federal and provincial rules requiring that Canadian steel must be used for infrastructure projects like bridges, public buildings, pipelines and the giant new auto battery plants that will be built partly with government funding. “We’re looking at projects that are close to being awarded where there is a threat of them using Chinese steel or foreign fabricators.”

Modular houses made with corrosion-resistant steel could be another major market as governments call for a crash program in home-building, says Peter Warrian, a steel industry researcher at University of Toronto’s Munk School for International Studies. An east-west energy pipeline and expansion of the national electric grid could also provide additional demand for Canadian steel.

But Warrian also believes there will be substantial pressure on Trump to relent on the tariffs, particularly on autos. “We’ve just spent 20 or 30 years and billions of dollars building an integrated North American industry. Are you (Trump) really saying we’re supposed to unwind all that?”

At the time this article was written, there were growing signs that the Trump tariff plan may not last long. Trump supporters like Texas Senator Ted Cruz warned that tariff-caused inflation and unemployment could devastate Republican support. The Senate was flexing its muscles, preparing measures to re-take control of national trade policy. Stock markets were plunging and auto plants on both sides of the border had announced layoffs.

But even if Trump’s tariff plan unravels, the fundamental relationship between Canada and the U.S. has changed. Hamilton businesses and their industry leaders are adapting to new realities, looking less at the U.S. and more toward fresh markets at home and abroad.

Dunnett says this new paradigm is about more than business relationships; it’s about Canada’s existence.

“It’s imperative for us as a nation as we go through this that we don’t back down,” he says. “We all have to be cognizant of the fact that this is about more than just trade. We need to protect our sovereignty.”

Local food chain casts out U.S.-made products

MRKTBOX, a trio of three Hamilton food stores with a mission to promote local purchasing, has struck a blow for Canadian food producers by wiping their shelves clean of products from the United States.

The decision to go non-U.S. came this spring after Donald Trump suggested he would impose tariffs on Canada.

“We decided to remove the American products from our offerings out of solidarity” with workers and industries affected by the tariffs, says MRKTBOX CEO Rachael Henderson. MRKTBOX also felt strongly that the action was warranted by current U.S. policies on human rights issues, especially those affecting 2SLGBTQIA+ communities.

The company operates Strathcona Market, Ottawa Market and Dundurn Market as well as a home food delivery service.

Growing numbers of Canadian retailers are abandoning U.S. brands in the face of a grassroots consumer boycott that has been catalyzed in the “elbows up” movement popularized by comedian Mike Myers. Henderson said the action has been popular with MRKTBOX customers and is prompting many customers to find out more about how their food is sourced.

“A lot of people are asking more questions now about where things are made, and they are more interested to know where their food comes from, which I think has been one of the silver linings of the whole situation.”

Hamilton native leads effort to protect Canada’s wealth, sovereignty

Shortly after his election in November, Donald Trump started pontificating about how Canada should become the 51st state, while claiming the United States was subsidizing its northern neighbour.

For Bill Young, this was too much. The Hamilton-born founder of Toronto-based Social Capital Partners – a social enterprise devoted to solving the problem of wealth inequality – talked to his SCP colleagues and decided to launch Always Canada – Never51.

The project, part economic populism mixed with methodical policy-making, is devoted to the issues of wealth inequality and Canadian sovereignty.

“It was a timely way of channeling our collective frustration, not just at Social Capital Partners but Canadians as a whole,” he says. Young says Trump’s talk of taking over Canada supercharged the company’s mission.

SCP wants to build policy responses inspired by one of its chief success stories: a worker ownership package that saved Taylor Guitars by enabling employees of the vintage American guitar maker to buy out its aging founders.

The team is advocating ideas like how Canadian entrepreneurs can buy existing businesses, how pension funds can invest in Canadian manufacturers, how company owners can sell to their employees, and how governments can limit Americans from buying Canadian firms.

Young established a successful computer business in the 1990s, and then invested in Red Hat, a hugely profitable software company founded by his cousin and fellow Hamiltonian, Bob Young. Bill Young established SCP in 2001.

Bill Young is also an advisor to the Young Fund at the Hamilton Community Foundation. The fund was established by his mother Joyce with a $40 million donation in 2000. At the time, it was one of the largest donations in Canada’s history.

Bill Young says his combination of business and charitable experience has led him to this moment when both these ways of thinking are crucial. “Capitalism is here to stay. We’ve got to make it work way better for way more people.”