Social Capital Partners' 2025 Federal Pre-Budget Submission

Canada needs an ownership agenda in the face of an unprecedented challenge to Canada’s economy from the American administration and the collapse of the global security and economic order

There has never been a federal budget quite like this one. Canada faces a moment of extreme peril, threatened by an American administration that has abandoned our mutually beneficial trading and security regime.

We cannot know whether the American people and their democratic institutions will be powerful enough to resist the attacks waged upon them by their own government. But this budget is a time to outline how the government will use all available policy and fiscal tools to address our own economic vulnerabilities in the face of this unprecedented assault on the well-being of Canadians.

There is broad consensus that Canada’s new approach to the economy and national security must be governed by a historic pivot away from dependence on the United States to rebuild our own sovereignty and deepen our economic and security partnerships with like-minded democracies around the world.

Canadians have given the federal government the benefit of the doubt to implement a policy agenda that delivers economic growth and builds the strongest economy in the G7. At Social Capital Partners, we strongly believe that the interests of working people and young people must be centred in the economic growth agenda. The global evidence is overwhelming: policy choices that prioritize economic growth alone, without attention to the distributional impacts of that growth, leave countries weaker, societies more unstable and lead to plutocracy.

The Budget should prioritize catalyzing investments that will provide more people and communities with an equity stake in the wealth being created in Canada, which will, in turn, give working Canadians and young people a reason to believe in the future, in Canada and in the promise of democratic capitalism.

What problems must the government address?

At Social Capital Partners, we begin with a simple observation: the benefits from growth over the past few decades have been captured by capital, contributing to extreme wealth inequality, economic insecurity and high barriers to intergenerational mobility. The deepening inequality documented in our Billionaire Blindspot report has created despair for many and, in other countries, has led to the collapse of democracy and the rise of political violence. Addressing the increasingly bumpy road to wealth building, home ownership and economic security facing most young Canadians must be core to Canada’s economic growth agenda.

Too many of our assets are owned by too few and too much of our economy is owned by those with little connection to Canada. Investors are accumulating and inflating the value of our businesses, resources and assets, enriching themselves and leaving more Canadians economically insecure and vulnerable.

The government’s signature initiatives thus far deliver on its campaign commitments to cut taxes and lower regulatory burdens to promote economic growth. We strongly believe that the government should add to its current economic growth agenda by introducing a suite of measures to catalyze investments that will lead to broadly based, widely distributed Canadian ownership of our businesses, resources and assets. Inequality undermines our unity at a time when Canadian unity is our greatest strength in the face of a larger, more powerful neighbour.

The government’s first steps towards fulfilling an inclusive ownership agenda

At Social Capital Partners, we advocate for an overarching strategic orientation that will: increase Canadian ownership of Canadian assets and improve access to wealth and ownership for young people, workers, communities, Indigenous peoples and independent entrepreneurs. Economic sovereignty and ownership of our own assets should be front and centre in the growth agenda at budget time.

We commend the government for already taking some steps to advance more distributed ownership and catalyze new investment in diverse communities:

- $10 billion in loan guarantees to enable Indigenous communities to maintain equity in resource extraction and other major projects.

- The Black Entrepreneurship Loan Fund to get low-cost capital to entrepreneurs who have faced barriers to accessing capital.

- The partnership between First Nations Bank and BDC to facilitate the acquisition of existing businesses by Indigenous communities.

- The capitalization of the community finance ecosystem through the Social Finance Fund.

- The establishment of the Large Enterprise Tariff Loan facility at CDEV to take strategic equity stakes in Canadian companies.

- Investments in food security and innovation through FCC Capital.

- The selection of independent fund managers for the Canada Growth Fund.

- The landmark Employee Ownership Trust legislation, making it easier for workers to become owners of the businesses they help build.

These are the kinds of creative policy and program solutions that are delivering real results – inclusive economic growth, broadly distributed ownership of assets and widespread equity for Canadians, workers and communities.

The ownership solution

As a next step, Social Capital Partners recommends the Budget focus on broadening ownership to ensure the benefits of economic growth are more widely shared. With a huge number of Canadian businesses about to change hands, now is the time to ensure Canadians retain ownership of our own assets and a new generation of Canadians have access to pathways to wealth-building and economic security.

Our policy recommendations come with no or little fiscal cost but will generate economic growth and deliver returns over the medium term. They will catalyze investment in Canadian communities without undertaking new program spending. They require strategic, active state leadership and deploy creative and concessionary financing tools, like loan guarantees.

They speak to the challenges we are facing and the opportunities open to Canadians: create pathways to business ownership for a new generation of Canadian entrepreneurs, employees, communities and not-for-profits; make available more affordable, accessible financing to empower communities to own more of their own assets, strengthen their local economic resilience and build community wealth; and catalyze investment to retain Canadian strategic assets for the benefit of Canadians.

Enhanced and distributed ownership delivers many benefits at this moment: greater sovereignty, strong local community economies, inclusive economic growth and democratic stability.

We recommend the government build on its current economic growth agenda and:

1. Prioritize a coordinated suite of initiatives focused on enabling succession opportunities for Canadian business owners, entrepreneurs, social purpose organizations and communities.

It should be much easier and less risky for younger Canadians and local organizations to buy existing businesses from older owners. 76% of Canadian business owners plan to exit within the next decade, representing $2 trillion in business assets, yet fewer than 10% have a formal succession plan. The government should unleash a wave of business transitions from retiring owners to independent and aspiring Canadian entrepreneurs. Programs to support entrepreneurship tend to prioritize the development of net-new businesses, rather than facilitating transitions of ownership to local, independent and innovative entrepreneurs. The government can address this through changes to the Small Business Financing Program to mirror the successful American 7(a) loan program and by launching a focused “Buy a Business” program through BDC that offers low-cost capital. The government should also use loan guarantees and co-investment to facilitate the acquisition of small- and medium-sized businesses by employees, co-ops, communities and other alternative ownership structures. In a time of decreased housing affordability and rising youth unemployment, buying a business can be one realistic path for young Canadians to build wealth and put their talent to work in securing their future.

2. Enable the growth of robust and accredited Community Investment Institutions.

There are many existing community-responsive financing institutions working across Canada to support local economic investment, development and resilience. By formalizing, accrediting and capitalizing them, the federal government can better support this crucial sector. More formal recognition of this sector would catalyze additional investment opportunities. For example, loan guarantees could be extended to accredited community investment institutions, amendments to the Income Tax Act could be made to designate accredited institutions as qualified donees to unlock more philanthropic investment and tax credits could be offered for local investment. By making small investments in community investment institutions, the federal government can leverage significant new investment in local economies and local and community ownership of businesses.

3. Create a sovereign fund to invest in and acquire vulnerable or strategic Canadian businesses in key sectors.

Many Canadian businesses are facing pressure to relocate or sell to foreign investors. Others require patient capital to remain liquid and re-tool for new markets. The federal government should invest in a new fund that would buy or invest in existing firms that run into trouble or are critical to our economic sovereignty. The federal government should guarantee a benchmark rate of return for pension funds to catalyze additional investment in the fund. Independent and local news media should be one priority, given that sovereign and democratic control of the news media is one buffer against the attacks on Canadian democracy and our capacity for democratic self-government.

4. We strongly endorse the recommendations from Employee Ownership Canada on how to strengthen the existing Employee Ownership Trust (EOT) legislation.

EOTs ensure more Canadian workers can secure an equity stake in the companies they helped build. It can truly be a great time to be a worker in Canada if there are pathways to ownership. EOTs provide a way for owners to sell to their employees and keep companies Canadian, keep jobs in local communities and build wealth for workers. Employee-owned companies have proven to have higher productivity, be more resilient during economic shocks and build and retain more wealth in local communities. As advocated by both Employee Ownership Canada and the CFIB, the EOT tax incentive should be made permanent and reviewed for effectiveness at an appropriate time (e.g. after five years).

Our public financial institutions and crown corporations (including CDEV, EDC, BDC, FCC, FNFA and the CIB) all have nation-building roles to play in this work. Likewise, the federal government should mandate, incentivize and de-risk investments from pension funds, philanthropic foundations and endowments so they increase their investments in a more sovereign Canadian economy where more people can find pathways to build wealth, ownership and economic security.

It is important that the federal government track and report on key ownership metrics. The evidence is overwhelming that communities with more local ownership outperform their peers on economic growth, employment growth and poverty reduction. One study from the Canadian Federation of Independent Business finds that 66 cents of every dollar spent at a locally owned business recirculates in the local economy, while only 11 cents spent at a global chain does – and only eight cents spent through an online American tech platform.

Canadians are ready to rise to the challenge

If our economy is broadly owned by Canadians, we will be more resilient in the face of whatever threats come our way in the future. Economic growth alone will not be enough to save us from the demons looking to push successful democracies like Canada into the abyss. We need to use all the financing and policy levers at our disposal to reclaim ownership of our economy, reassert agency over our future, give young people and working people pathways to economic security and never again find ourselves vulnerable to the whims of imperialist powers.

None of those making and shaping public policy is fully prepared for this moment. However, it is clear that many of the assumptions that have guided our economic and policy thinking for decades no longer apply. We must try things we would have dismissed last year.

Canadians can choose what emerges from this transformational time. The democratic world is resisting the attempt by authoritarian powers to push the world further towards inequality and plutocracy.

Policy choices in this budget need to move us away from an economy fueled by wealth extraction that enriches billionaires and inflates the bottom lines of foreign funds, and instead, move us towards more local reinvestment that builds an inclusive, sustainable and resilient democratic future where all Canadians have realistic chances to build economic security.

How Canada’s tax system puts the wealthy above workers

By SCP Fellow Silas Xuereb | Part of our Special Series: Always Canada. Never 51

A recent headline from Statistics Canada found that the income gap – defined as the difference between the disposable income shares of the richest 40% and the poorest 40% of households – reached a record high in early 2025.

However, little attention has been paid to the main driver of this recent spike – the increasing concentration of income derived from wealth.

In 2024, according to the same Statistics Canada data, two thirds of all the income generated from wealth – that is, income in the form of dividends from stock ownership, interest from bonds, capital gains from business and real estate sales, as opposed to from working – was collected by the richest 20% of households, up from only 56.2% in 1999. In just the last two years, the average income from wealth of the top 20% increased by 37%.

This problem is concentrated among the very highest earners. Other data from Statistics Canada shows that, for the top 1%, the proportion of their income that comes from working has declined to 44.3% in 2022 (the most recent year with available data) from 54.1% in 1999. For the top 0.01%, who collected on average $11.6 million in 2022, the proportion of income from working has declined even further, to 28.7% in 2022 down from 54.1% in 1999.

Income from wealth has become increasingly concentrated among a lucky few. This mirrors Canada’s rising wealth inequality – according to the Parliamentary Budget Officer, the top 1%’s share of wealth increased to 24.3% in 2021 from 19.8% in 1999. This means there were 161,700 families with at least $7.3 million in wealth in 2021.

Thomas Piketty’s book, Capital in the Twenty-First Century, rose to fame for highlighting this problem a decade ago – without careful attention to the issue, wealth inequality can continue to accelerate in capitalist economies. Unfortunately, instead of helping to combat the problem, our tax system contributes to it. Because of tax breaks for capital gains and dividends, tax rates on income derived from wealth are lower than those on income derived from working.

Imagine an Ontario-based CEO who earns $13.2 million a year, which was the average pay of the 100 highest paid CEOs in Canada in 2023 and happens to be 210 times the average income of a worker. Most of their pay comes in the form of stock options and shares in their company, which is retained as wealth. During their tenure working as CEO, most of their income would be subject to the top marginal tax rate on employment income of 53.5%. Although clever tax planning could allow CEOs to avoid some of this tax, compensation through shares and stock options above $200,000 (thanks to a legislative change in 2021) are fully taxable. But after retiring at the end of 10 years as an extremely highly paid CEO, assuming they spent one million dollars annually, they could have accumulated over $75 million in wealth held in shares of their own company plus other passive investments.

A modest estimate of the retiree’s returns would be 2% of their wealth in dividends and 4% of their wealth in capital gains. This is over $4.5 million in annual income that would be generated without any work, and would be taxed at only 31% because of the generous tax breaks for dividends and capital gains. Because Canada has no wealth or inheritance tax, this passive income could continue indefinitely, even being passed on to their children.

And the CEO’s taxes would likely be even lower in practice. They could avoid capital gains taxes for years if they do not sell their assets. They can use tax-free savings accounts, which are only fully exploited by high earners, to shield some of their income from wealth from taxes. They could enlist highly –paid lawyers to help them avoid their taxes through the use of tax havens. Because of all these loopholes, the top 1% of income earners, who earn most of their income from wealth, pay only 23.6% of their income in taxes, while middle-earning Canadians pay over 43% of their income in taxes. Reminiscent of the gilded age, this system has created a new class of plutocrats that earn income from wealth extraction instead of wealth generation.

Rather than using the tax system to prevent wealth concentration, as Piketty recommended, our current tax system promotes wealth concentration – those who earn income from wealth have more income left over after taxes, allowing them to accumulate wealth more quickly than others. Even some of the wealthy themselves are now calling to be taxed more, recognizing the unfairness inherent in the current regime and the related systemic risks to social cohesion, democratic stability and economic growth that emerge in situations of deep inequality.

South of the border we are witnessing the consequences of runaway wealth inequality – billionaires use their media conglomerates to get political favours, exploit the instruments of the state to enrich themselves, and, increasingly, secure political office.

All of these trends are leading to the erosion of democracy and public policy that advances the interests of billionaires at the expense of everyone else. If Canada does not rebalance our tax system to prioritize work over wealth, we may soon find ourselves on the same path. A tax system that promotes efficiency and fairness will reinforce our democracy and protect our sovereignty in the face of the challenges represented by Trump.

Trump pumps private equity with 401k changes | Breaking Points podcast

Breaking Points with Krystal and Saagar is a fearless anti-establishment Youtube show and podcast with over 1.58 million subscribers.

In this episode, BP correspondent James Li sits down with economic analyst and SCP Fellow Rachel Wasserman to discuss Trump’s executive order opening up 401k plans to private equity. Private equity is a type of investment where firms pull money from wealthy individuals and institutions to buy companies usually outside of the public market. Over the past many decades, private equity has promised outsized returns by taking companies private, loading them with debt, improving their operational efficiency and selling them later at a profit. But with rising interest rates and frozen exit markets, that model could be under serious stress.

So, what are the implications of making this type of investment available to retail investors and their retirement plans? Rachel walks James through how private equity works, what’s so dangerous about the buyout-private equity model and who might get left holding the bag.

Speakers

James Li

Correspondent, Breaking Points

Rachel Wasserman

Corporate lawyer and SCP Fellow

The problem with GDP per capita | West of Centre on CBC

Podcast host Rob Brown asks University of Calgary economist and SCP Fellow Dr. Gillian Petit to dissect the metric politicians love to wield. GDP measures total output, while GDP per capita divides that sum by the population. Petit says the simple math offers an easy snapshot but can mislead when used alone. For a true read on prosperity, Petit argues Canada needs a broader economic dashboard that weighs productivity, fairness and long‑term well‑being.

The podcast discusses new research from economist and SCP Fellow Gillian Petit, PhD, that explains why GDP per capita is a poor measure of economic performance and economic well-being. Using changes in GDP per capita as evidence of either improving or deteriorating economic well-being is poor economics, poor public policy and poor reasoning. Click here to read the full report.

Blame the denominator, not the economy

By Matthew Mendelsohn and Dan Skilleter | Read the research report

Over the last couple of years, there have been dozens, if not hundreds, of articles warning of Canada’s poor economic performance. The mic drop has increasingly been Canada’s poor performance on “GDP per capita.” Canada’s low ranking compared to our peers on growth in GDP per capita has been used to draw a variety of sweeping, negative conclusions about Canada’s economy.

One lobby group is now even using GDP per capita as the only summary measure on which they will evaluate Prime Minister Carney’s progress against key commitments.

But GDP per capita is a deeply flawed measurement for evaluating rich countries and is easily influenced by a variety of factors having little to do with economic performance or economic well-being.

GDP per capita looks at the output in the economy and divides it by the number of people in the country. Many of those writing about the economy have interpreted our poor performance to conclude that our economic growth has been particularly bad.

But compared to other rich countries, Canada’s economic growth has actually been relatively average. So, why has Canada been something of an outlier in this one measurement of GDP per capita growth? The culprit has been the denominator in the equation—population growth—driven by significant increases in temporary residents.

Between 2019 and 2024, non-permanent residents (NPRs) as a percentage of the population increased from 3.6% to 7.4%. These temporary foreign workers and international students contribute comparatively less to our economic output than Canadians.

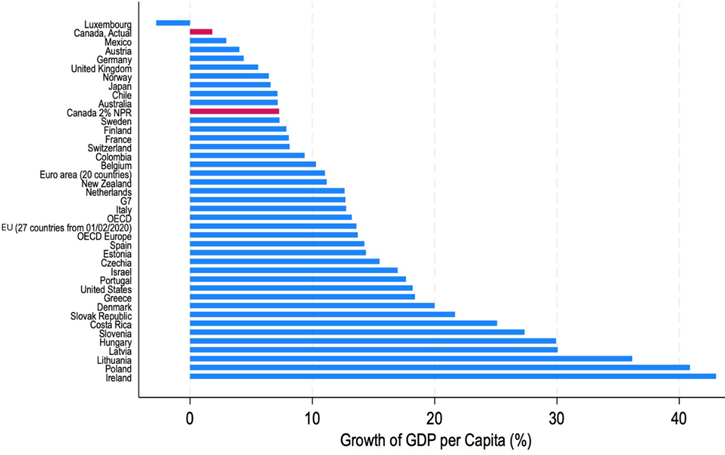

In new research we released today, economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in our intake of temporary residents as outlined in the immigration levels plan.

She concludes that if we had maintained our temporary resident numbers at about 500,000—or two per cent of the population—in recent years, Canada’s GDP per capita would look much more like our comparator countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.

Change in Canada’s GDP per capita ranking if non-permanent residents were held at 2% of population

Data Source: OECD Data Explorer. Quarterly GDP per capita growth, chained prices in USD

adjusted for PPP, Q1 2015 to Q3 2024. Includes OECD countries plus selected aggregates.

She also estimates that our GDP per capita will increase in the coming years simply due to planned reductions in temporary residents.

If this increase in GDP per capita comes to pass, it will of course not mean our economy is doing materially better or that Canadians will experience more economic well-being. This will be an artifact of how the measure is constructed. This research, and the conclusion, offers no commentary on the appropriate number of temporary residents Canada should accept, nor on the immigration levels plan itself. The estimates merely highlight that GDP per capita is not measuring what some seem to think it measures.

We don’t know if those who use GDP per capita as a hammer to complain about Canada’s poor economic performance understand the data and the metric. Do the individuals and organizations fixated on GDP per capita know that it will likely start moving in a positive direction soon, simply because we’re bringing in fewer temporary residents? And will it cease to be such a critical measurement for them when it does? Or will growth in GDP per capita be over-interpreted as a triumph of whatever economic policy they want to credit with the boost? We don’t know.

But we do know that it won’t mean our economy is any better, which is what some seem to imply every time they use the measure as a yardstick for our economic well-being.

To further the point, Ireland has in recent years become a powerhouse of GDP per capita. It’s done so by becoming an international tax haven—an economic strategy that is neither replicable nor desirable for Canada or our peers. Ireland’s GDP per capita numbers are so removed from the reality of its people’s lives that the Bank of Ireland relies on alternative measures like Gross National Income or GNI to conclude that their economy is not in fact number one in Europe, but much lower (ranked somewhere between 8th and 12th in the EU in 2020, they think).

There are real economic challenges for Canada, most of which are shared by our peers. And the economic problems unique to Canada stem from how terribly we’ve messed up our housing policies, the growing concentration of asset ownership and the affordability challenges that working Canadians face.

By all means, we should be tracking Canada’s performance and advocating for policies that contribute to a stronger economy. But there are strong rationales for why economists put so little stock into the GDP per capita of wealthy countries, so let’s be smarter about what we’re measuring. Metrics like economic well-being, standard of living, affordability and median wealth are much better at determining how well Canadians are doing economically.

As we explained in this video, on just about every measure that really matters, Canada is already way ahead.

Non-Permanent Residents and their impact on GDP per capita | Summary

New research from economist and SCP Fellow Gillian Petit, PhD, JD, explains why GDP per capita is a poor measure of economic performance and economic well-being. Using changes in GDP per capita as evidence of either improving or deteriorating economic well-being is poor economics, poor public policy and poor reasoning. Click here to read the full report.

Main messages

- The statistic “GDP per capita” has been used by some Canadian commentators as a summary measure to make sweeping claims about the state of the Canadian economy. However, this is misleading. Canada’s GDP per capita should not be used as if it were the sole indicator of economic well-being.

- Many conclude that low growth in GDP per capita over the past decade suggests that Canada’s economic growth has been low. But that is untrue. Canada’s economic growth has been on par or ahead of peer countries. Growth in GDP per capita, however, has been decreased by a high growth in temporary residents, like temporary foreign workers and international students. This is an arithmetic quirk of GDP per capita.

- This paper estimates what our GDP per capita growth would have been if Canada’s intake of temporary residents was more in line with recent historical norms. It also estimates the impact on GDP per capita growth in the coming years as a result simply of lowering our intake of temporary residents. Under both scenarios, Canada’s GDP per capita growth would have looked—and will look—very much like our peers.

Non-Permanent Residents and their impact on GDP per capita | Report

New research from economist and SCP Fellow Gillian Petit, PhD, JD, explains why GDP per capita is a poor measure of economic performance and economic well-being. Using changes in GDP per capita as evidence of either improving or deteriorating economic well-being is poor economics, poor public policy and poor reasoning.

Main messages

- The statistic “GDP per capita” has been used by some Canadian commentators as a summary measure to make sweeping claims about the state of the Canadian economy. However, this is misleading. Canada’s GDP per capita should not be used as if it were the sole indicator of economic well-being.

- Many conclude that low growth in GDP per capita over the past decade suggests that Canada’s economic growth has been low. But that is untrue. Canada’s economic growth has been on par or ahead of peer countries. Growth in GDP per capita, however, has been decreased by a high growth in temporary residents, like temporary foreign workers and international students. This is an arithmetic quirk of GDP per capita.

- This paper estimates what our GDP per capita growth would have been if Canada’s intake of temporary residents was more in line with recent historical norms. It also estimates the impact on GDP per capita growth in the coming years as a result simply of lowering our intake of temporary residents. Under both scenarios, Canada’s GDP per capita growth would have looked—and will look—very much like our peers.

Read the related article by Matthew Mendelsohn and Dan Skilleter.

How do we not go broke? | Gloves Off Podcast

Part of our Special Series: Always Canada. Never 51

A Canadian toy company is on the brink because of US tariffs. Millions in unsold stock. But this isn’t just one company’s problem—it’s Canada’s.

Author and Gloves Off podcast host Stephen Marche digs into the economic war we’re already in with the US. How can we fight against an economy ten times our size, where the tariff goal posts keep moving, and where any brokered deal is a tweet away from becoming meaningless? What are new approaches to doing business in today’s climate?

This episode features bold ideas from business owner and Shorefast founder Zita Cobb and chair of Social Capital Partners Jon Shell and looks at how to build the Canadian economy without dependence on a superpower in chaos.

Speakers

Zita Cobb

Founder, Shorefast

Jon Shell

Chair, Social Capital Partners

Stephen Marche

Host, Gloves Off podcast

Mark Carney’s economic agenda misses something vital | Toronto Star

By Matthew Mendelsohn | Part of our Special Series: Always Canada. Never 51 | This post originally appeared in the Toronto Star

The Carney government’s early economic growth priorities have been clear for months. The details can be found in the Building Canada Act, which makes way for big, national infrastructure projects, biased heavily toward natural resources and energy.

This is perfectly reasonable for an early growth agenda, so long as Indigenous rights are respected. But it misses something important: how to increase Canadian ownership of Canadian assets and ensure that more Canadians stand to benefit.

Concentrated ownership of our economy, and the inequality and plutocracy that result from it, are causing deep distress among working and young people who feel — quite accurately — that the economy is rigged against them. Broad-based Canadian ownership of our businesses, resources and assets needs to be part of the growth agenda.

It appears that Prime Minister Mark Carney knows this. He has said that “we are masters in our own home,” that “Canada is not for sale” and that U.S. President Donald Trump is using tariffs to “break us so he can own us.” At the White House in early May, Carney sat in the Oval Office and referred to the Canadian people as “the owners of Canada.”

But so far, the plan for Canadians to own more of our economy is pretty thin. We need to strengthen our economic sovereignty with bigger goals than simply creating more jobs in the trades and securing more resource royalties to provincial governments.

In fairness, the federal government has taken some steps to align with this vision in recent years, including $10 billion in loan guarantees to enable Indigenous communities to maintain equity in resource extraction and other major projects.

The Black Entrepreneurship Loan Fund gets more low-cost capital to entrepreneurs who have faced barriers to accessing capital. And First Nations Bank of Canada and the Business Development Bank of Canada recently announced a program to facilitate the acquisition of existing businesses by Indigenous communities.

These creative uses of financing and capital, deployed by a strategic state, leverage the federal government’s AAA credit rating and should be a core component of, not peripheral to, our growth agenda. We need more investments aimed at achieving more widespread Canadian ownership of Canadian assets that produce economic activity and wealth.

We also need to make it easier for independent Canadian entrepreneurs to buy businesses from retiring owners. We need a better funded network of community investment institutions to provide low-cost capital to small businesses, social enterprises and non-profits in rural and other communities that often have trouble accessing financing. We need more ambitious use of federal loan guarantees and co-investment to facilitate the acquisition of small- and medium-sized businesses by employees, co-ops and communities.

A sovereign fund could invest in and acquire vulnerable Canadian businesses, keeping them in Canadian hands. New industrial strategies could help preserve Canadian sovereignty in food production. We must strengthen local, independently owned media and digital infrastructure to escape extortion from American digital platforms. We must be stricter about preventing foreign takeovers of Canadian firms, as well as the consolidation of ownership that’s underway in many communities. And we must get serious again about Crown corporations and other forms of public ownership.

Finally, our public financial institutions, pension funds and philanthropic foundations need to consider how they can support this ambitious ownership agenda so that all Canadians benefit, not just investors.

The ownership agenda is just as important to our economic future as pipelines — if not more so — because an economy owned by a broader swath of society is more sustainable and resilient than one in which wealth and ownership are concentrated among few.

Sovereignty isn’t just about control of our border. It’s also about control of our resources and assets.

We can’t truly be masters of our own home if that home is owned by an American hedge fund. If we don’t protect and broaden Canadian ownership as part of the growth agenda, two years from now we will be even more economically vulnerable than we are today. The owners of Canada need a plan to deliver on the promise of “maîtres chez nous.”

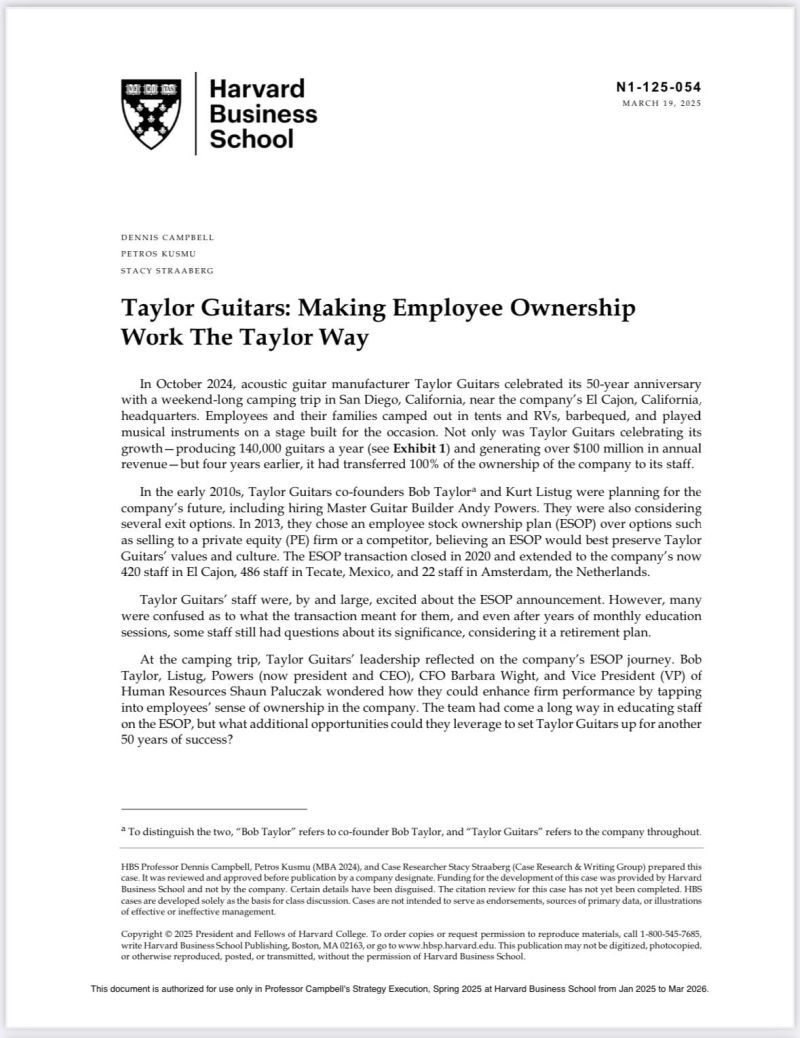

HBS Case | Taylor Guitars: Making Employee Ownership Work the Taylor Way

In 2013, guitar manufacturer Taylor Guitars’ co-founders Bob Taylor and Kurt Listug were considering several exit options including selling to a competitor or to a private equity firm.

The co-founders decided, instead, to embark on a seven-year process to transfer 100% of the ownership of the company from themselves and third owner partner Andy Powers to Taylor Guitars employees.

The co-founders felt an employee stock ownership plan (ESOP) would best preserve the company’s values and distinct culture and in 2021, the transaction was financed by Canadian pension fund Healthcare of Ontario Pension Plan (HOOPP), Canadian non-profit Social Capital Partners (SCP) and the owners.

In 2024, the co-founders, Powers (now president and CEO), CFO Barbara Wight, and Vice President of Human Resources Shaun Paluczak took time to reflect on the ESOP. Many employees were still unclear about what the ESOP meant for them, with some likening it to a retirement plan. The challenge for the leadership team was how to activate employees’ sense of ownership in the company to enhance Taylor Guitars’ performance.

Now, their employee-ownership transition is the subject of a 2025 Harvard Business School case study.