Four reasons our economy needs employee ownership now

Employee ownership offers a timely solution to some of Canada’s most pressing economic challenges, writes Deborah Aarts in Smith Business Insight. Evidence shows that when employees share ownership, businesses become more productive, innovative and resilient. Plus, beyond firm-level gains, employee ownership can help address the coming mass retirement of business owners, protect local economic sovereignty, boost national productivity and reduce wealth inequality. There is enough data about the brass-tacks benefits of employee ownership to sway even the most hardened skeptic.

January 20, 2026Alternative ownership,BlogEconomic policy,The Ownership Solution

Budget was missing a Canadian ownership strategy

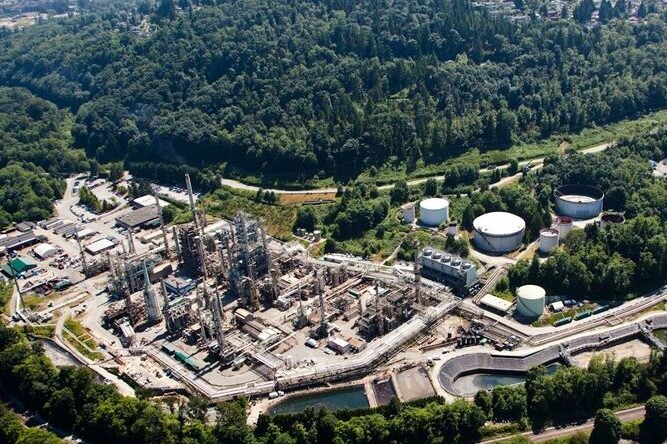

Gas station giant Parkland is already shedding Canadian employees in the wake of TX-based Sunoco’s recent takeover of the Canadian fuel chain, which owns 15% of our gas stations and a key refinery in Burnaby, B.C. These layoffs were a predictable outcome of Ottawa's decision not to flex its new regulatory muscle through the Canada Investment Act to quash foreign investment deals that pose an economic security threat. As SCP chair Jon Shell writes, the government has not defined a clear strategy to build and maintain Canadian ownership of our assets. Combined with the federal budget’s focus on attracting private capital, there’s a real danger that Ottawa will enable a sell-off of Canadian firms to foreign investors.

January 5, 2026Alternative ownership,Changing narratives,BlogEconomic policy,The Ownership Solution

Ontario wakes up to the succession tsunami

In November, 2025, the Ontario provincial government finally stepped into the looming “succession tsunami,” launching a modest $1.9M Business Succession Planning Hub to help micro-business owners plan exits through local Small Business Enterprise Centres. Notably, the hub spotlights employee ownership and the new Employee Ownership Trust, signaling a shift toward mainstream adoption. But, as Dan Skilleter writes, Ontario’s approach focuses narrowly on retiring owners, ignoring how different buyers shape risks and benefits to workers, communities and Canada's broader economic sovereignty. This is a promising start that could and should grow into a broader succession-planning policy that protects Ontario’s long-term resilience.

December 10, 2025Alternative ownership,Blog,Economic policySmall business,The Ownership Solution

Smith School of Business launches new Employee Ownership Research Initiative

Smith School of Business at Queen's University is launching Canada's first-ever research initiative focused on deepening Canada’s knowledge and understanding of a powerful succession model that can enhance outcomes for owners, employees and communities: employee ownership. With funding support from Jon Shell, the EORI will be housed in Smith’s Centre for Entrepreneurship Innovation & Social Impact (CEISI). The initiative will shape a made-in-Canada approach to employee ownership and create a multi-disciplinary network of academics, researchers, practitioners and businesses to fill gaps in relevant data, expertise and business-oriented resources to support employee-ownership activities across the country.

November 25, 2025Alternative ownership,News release,Employee Ownership Canada (EOC)Small business,The Ownership Solution

Elbows up: Keeping Canadian companies in Canadian hands | Policy Options

Blue Jays pride notwithstanding, many of Canada's most iconic companies and brands have been quietly but steadily purchased by foreign entities in recent years. As Danny Parys writes in Policy Options, policymakers should do more to keep Canadian companies in Canadian hands by providing more support to expand financing opportunities, expanding awareness of untraditional ownership models and beefing up Canada’s net-benefit review requirements. These quiet foreign sales not only lead to major frustrations for consumers, but workers also feel the impacts because, as corporate leadership moves further away from the community, so do quality and accountability.

November 19, 2025Alternative ownership,Changing narratives,Blog,Employee Ownership Canada (EOC)Economic policy,The Ownership Solution

Budget 2025 did not extend the $10M capital-gains exemption for sales through EOTs

We share the disappointment felt across Canada’s business and advisory community that Budget 2025 did not make the $10 million capital gains exemption for sales through Employee Ownership Trusts (EOTs) a permanent feature of Canada’s tax system. The current incentive, passed only in 2024 with an expiry set for December 2026, means that the business community has not had adequate time to act on this opportunity or build adequate momentum for this promising succession model. In this statement, Employee Ownership Canada responds to the Budget and reaffirms its strong commitment to working with government and partners to make the capital gains exemption permanent, ensuring employee ownership trusts remain a viable, long-term option for Canadian businesses.

November 7, 2025Alternative ownership,Changing narratives,Blog,Employee Ownership Canada (EOC)Economic policy,The Ownership Solution

FAQs on Budget 2025 and the future of Employee Ownership Trusts (EOTs) in Canada

There is some confusion out there about Budget 2025 and employee ownership trusts (EOTs). To confirm, the federal government did not extend the $10M capital-gains exemption for sales through EOTs, in the budget released on Tuesday, November 4, 2025. Because the sale of a business to an EOT is a process that often takes more than a year, certainty on the rules is essential for owners, advisors and employees planning succession. In this FAQ, Employee Ownership Canada answers key questions about what’s enacted now, why the incentive matters for uptake and how the sector, businesses and the organization are moving forward from the Budget news.

November 6, 2025Alternative ownership,Changing narratives,Blog,Employee Ownership Canada (EOC)Economic policy,Explainer,The Ownership Solution

Could increased employee ownership restore confidence in Canada’s economy? | The Hub

As companies consolidate under ever larger pools of private capital, there’s growing unease around who’s actually benefiting from corporate growth. Falice Chin writes in The Hub that it’s no coincidence, then, that voices across the political spectrum are now revisiting models of employee ownership as a potential antidote to widening wealth inequality, fading community ties and a growing distrust in capitalism itself. This deep-dive looks at how employee ownership trusts, or EOTs, could be an elegant policy remedy to a crisis of confidence in the modern economy.

November 4, 2025Alternative ownership,Changing narratives,Employee Ownership Canada (EOC),Economic policyIn the media,The Ownership Solution

Budget 2025 should bolster employee ownership to strengthen Canada’s economy | Canadian Dimension

Budget 2025 offers Canada a chance to make employee ownership permanent by extending tax incentives for employee ownership trusts (EOTs) and worker co-ops. In Canadian Dimension, Simon Pek, Lorin Busaan and Alex Hemingway write that doing so would boost productivity, reduce inequality and secure business succession, while keeping jobs and decision-making local. A modest investment promises significant economic and social dividends.

October 8, 2025Alternative ownership,Blog,Employee Ownership Canada (EOC)Economic policy,In the media,The Ownership Solution

What being an employee-owned company means to me

For what it’s like to be on the inside of an employee-owned company, we spoke to a few of the 750 employees who recently became 100-per cent owners of Taproot Community Support Services, a social services provider across B.C., Alberta and Ontario. Rewards the employees highlighted include company morale and spirit, for sure. They also include financial rewards paid out annually to each employee as dividends. Last year, each employee would have received about $1000 to $1500 on top of their salaries—and as the company succeeds over time, the employees will share financially in Taproot’s success.

October 2, 2025Alternative ownership,BlogEmployee Ownership Canada (EOC),The Ownership Solution