Watch the video: Why would a company sell to its employees?

Canada is facing a $2-trillion business handoff. What if employees owned more of it? In this video, our Director of Policy Dan Skilleter explains why a company would sell to its own employees, how it happens and who stands to benefits. Spoiler alert: employee-owned companies are shown to be 8-12% more productive, share more wealth with their workers, keep businesses Canadian-owned and shore up the resilience of local communities and the broader economy.

February 20, 2026Video,Economic policyThe Ownership Solution,The Ownership Solution

From Guidelines to Action: Feedback on the Proposed Merger Enforcement Guidelines

The Competition Bureau's proposed Merger Enforcement Guidelines represent meaningful progress against trends towards corporate consolidation in Canada. In our formal feedback submission to the bureau, Social Capital Partners outlines that we strongly support the new guidelines. However, we believe that the operationalization of these guidelines will be the real test of their impact. Guidance documents shape expectations, but enforcement outcomes shape behaviour. Serial acquirers are sophisticated actors who model regulatory risk into their strategies. To succeed, the bureau must demonstrate visible capacity to track, analyze and challenge roll-up patterns that are driving up prices and sacrificing quality and service in key sectors.

Sign the open letter | Make the Employee Ownership Trust incentive permanent

Employee Ownership Trusts (EOTs) offer a practical succession pathway that keeps businesses Canadian-owned, empowers employees to share in the value they help create and supports long-term investment in our communities. With the right policy support, employee ownership can be a strong, proven path forward for Canada’s economy. If this is something you support too, you are invited to read and sign Employee Ownership Canada’s national open letter.

February 10, 2026Employee Ownership Canada (EOC),Economic policy,The Ownership SolutionThe Ownership Solution

Mark Carney’s Davos speech is a manifesto for the world’s middle powers

Mark Carney's recent speech at Davos matters because it treats this moment as a rupture, not a passing disruption. It’s in this rethink, write Matthew Mendelsohn and Jon Shell, that there is also relief: “From the fracture, we can build something better, stronger and more just,” Carney said. “This is the task of the middle powers.” The world's middle powers are not powerless, but we have been acting as if we are, living within the lie of mutual benefit with our outsized and increasingly erratic neighbour. Without the U.S., the world's middle-power democracies are rich, powerful and principled enough that we can unite to advance human well-being, prosperity and progress.

January 30, 2026Changing narratives,What we’re exploring,Blog,Economic policyNever 51,Never 51

Four reasons our economy needs employee ownership now

Employee ownership offers a timely solution to some of Canada’s most pressing economic challenges, writes Deborah Aarts in Smith Business Insight. Evidence shows that when employees share ownership, businesses become more productive, innovative and resilient. Plus, beyond firm-level gains, employee ownership can help address the coming mass retirement of business owners, protect local economic sovereignty, boost national productivity and reduce wealth inequality. There is enough data about the brass-tacks benefits of employee ownership to sway even the most hardened skeptic.

January 20, 2026Alternative ownership,BlogEconomic policy,The Ownership Solution

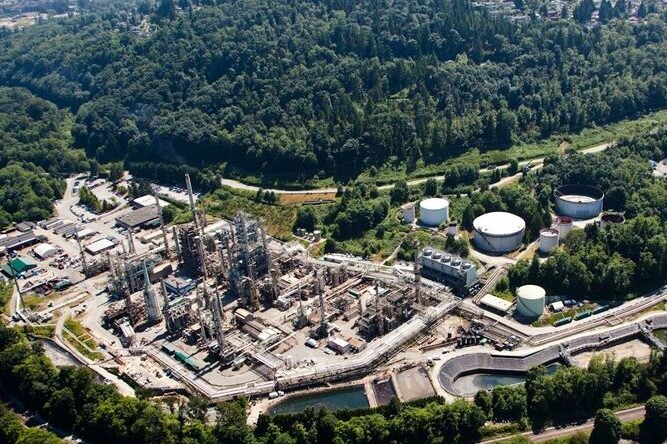

Budget was missing a Canadian ownership strategy

Gas station giant Parkland is already shedding Canadian employees in the wake of TX-based Sunoco’s recent takeover of the Canadian fuel chain, which owns 15% of our gas stations and a key refinery in Burnaby, B.C. These layoffs were a predictable outcome of Ottawa's decision not to flex its new regulatory muscle through the Canada Investment Act to quash foreign investment deals that pose an economic security threat. As SCP chair Jon Shell writes, the government has not defined a clear strategy to build and maintain Canadian ownership of our assets. Combined with the federal budget’s focus on attracting private capital, there’s a real danger that Ottawa will enable a sell-off of Canadian firms to foreign investors.

January 5, 2026Alternative ownership,Changing narratives,BlogEconomic policy,The Ownership Solution

Ontario wakes up to the succession tsunami

In November, 2025, the Ontario provincial government finally stepped into the looming “succession tsunami,” launching a modest $1.9M Business Succession Planning Hub to help micro-business owners plan exits through local Small Business Enterprise Centres. Notably, the hub spotlights employee ownership and the new Employee Ownership Trust, signaling a shift toward mainstream adoption. But, as Dan Skilleter writes, Ontario’s approach focuses narrowly on retiring owners, ignoring how different buyers shape risks and benefits to workers, communities and Canada's broader economic sovereignty. This is a promising start that could and should grow into a broader succession-planning policy that protects Ontario’s long-term resilience.

December 10, 2025Alternative ownership,Blog,Economic policySmall business,The Ownership Solution

Mapping the economic centre-left

The large and well-funded American blogosphere has a pretty wide array of economic voices and ideological camps within the centre-left tent. So big, in fact, that there’s a sub-genre of inter-blog conflict dedicated to people named Matt. Over the years, SCP Director of Policy Dan Skilleter has found it useful to categorize these various different centre-left ideological camps in his head. The categories are not mutually exclusive, and most people probably identify with a few at once. This explainer breaks down each camp's story about what’s wrong with the economy and how they’d prioritize dealing with it.

November 26, 2025Changing narratives,BlogEconomic policy,Explainer

Elbows up: Keeping Canadian companies in Canadian hands | Policy Options

Blue Jays pride notwithstanding, many of Canada's most iconic companies and brands have been quietly but steadily purchased by foreign entities in recent years. As Danny Parys writes in Policy Options, policymakers should do more to keep Canadian companies in Canadian hands by providing more support to expand financing opportunities, expanding awareness of untraditional ownership models and beefing up Canada’s net-benefit review requirements. These quiet foreign sales not only lead to major frustrations for consumers, but workers also feel the impacts because, as corporate leadership moves further away from the community, so do quality and accountability.

November 19, 2025Alternative ownership,Changing narratives,Blog,Employee Ownership Canada (EOC)Economic policy,The Ownership Solution

Reflections on Budget 2025: Economic growth alone won’t save us

In this reflection on Budget 2025, SCP CEO Matthew Mendelsohn explains that we really like the Budget’s focus on industrial strategy, some tentative steps on making more capital available to a wider diversity of Canadians and commitments to loosen the grip that our oligopolistic sectors have over our economy. However, we are concerned by the lack of a strategic approach to providing more working people and young people a path to wealth, ownership and economic security. While the Budget responds to the wish list that corporate Canada has articulated for several years, there are no guarantees that they will indeed step up to invest—or that those investments will produce growth that benefits working people and communities.