Browse our ideas, opinions and initiatives designed to unlock pathways to wealth and economic security for working people. Or, filter your search by Topic or Type by clicking the menu options on the left.

Blame the denominator, not the economy

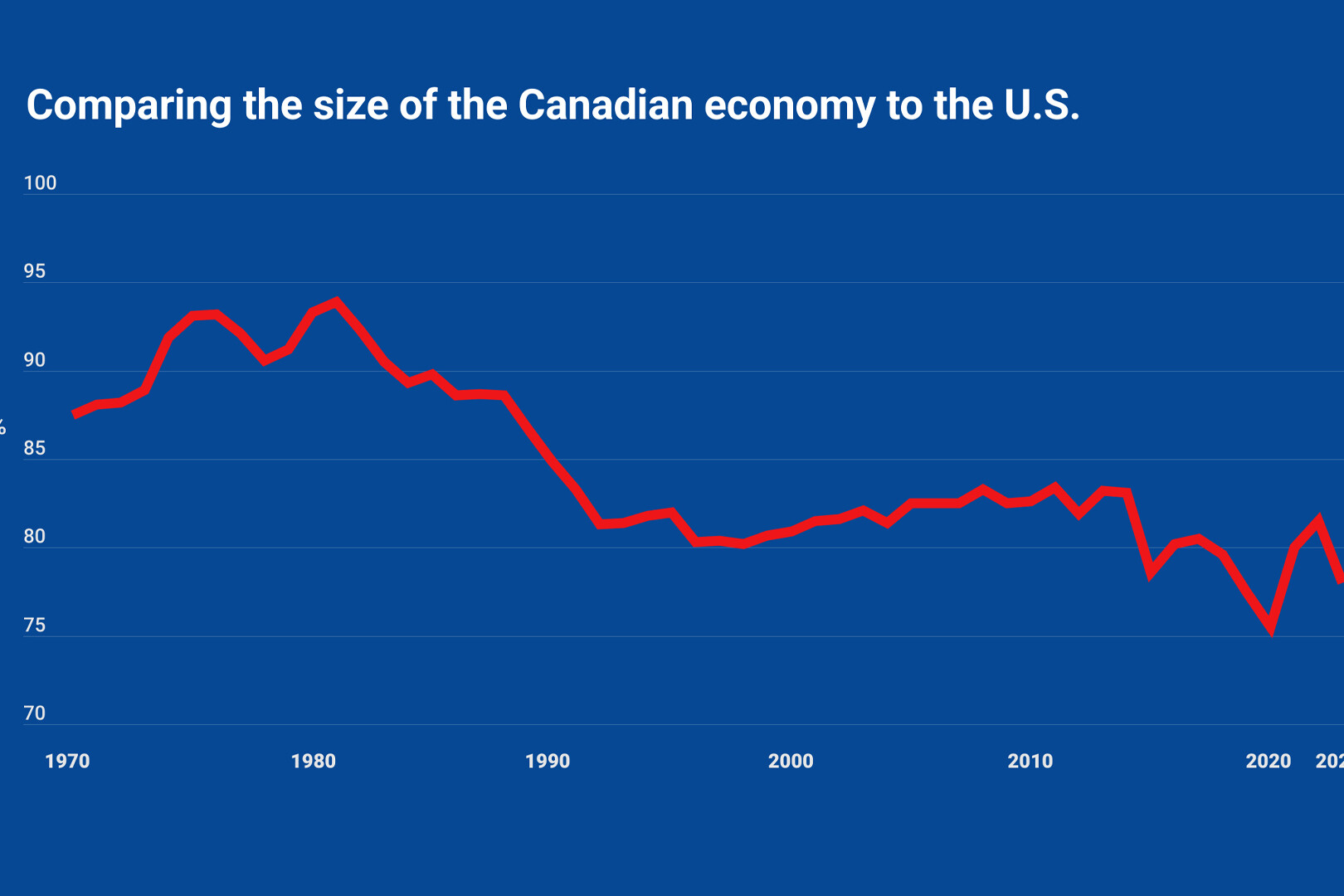

Over the last couple of years, there have been countless articles warning of Canada’s poor economic performance. The mic drop has increasingly been Canada’s poor performance relative to peer countries on “GDP per capita,” with growth rankings used to draw a variety of sweeping, negative conclusions about Canada’s economy. SCP CEO Matthew Mendelsohn and Policy Director Dan Skilleter draw on economist and SCP Fellow Dr. Gillian Petit's new research to explain why GDP per capita is a deeply flawed measurement for evaluating rich countries - and is easily influenced by a variety of factors having little to do with economic performance or economic well-being.

July 11, 2025

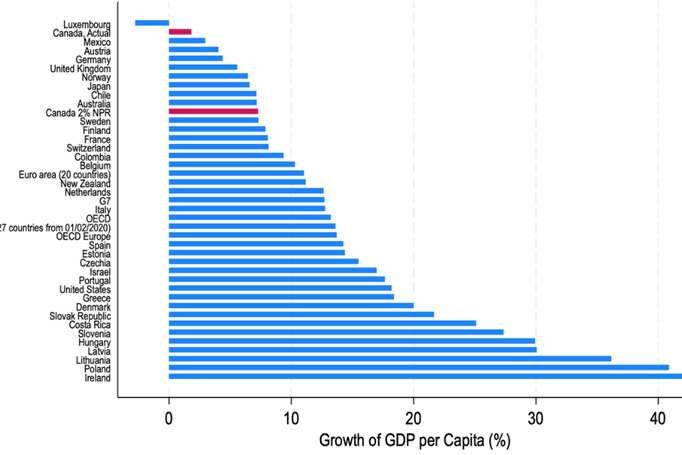

Non-Permanent Residents and their impact on GDP per capita | Summary

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.

July 11, 2025

Non-Permanent Residents and their impact on GDP per capita | Report

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.

July 11, 2025

Mark Carney’s economic agenda misses something vital | Toronto Star

Prime Minister Mark Carney's campaign focused on economic growth and sovereignty. He talked a lot about how Trump wants to "break us so he can own us," and yet, so far, details of an ownership agenda are pretty thin. The reality is that Canadians cannot be "masters in our own home" if the home is owned by a U.S. hedge fund. Broadly distributed, local Canadian ownership of our economy and our assets must be a central part of our economic growth strategy. In the Toronto Star, SCP CEO Matthew Mendelsohn writes that he sees some early, positive signs of such a plan coming from the federal government and spells out what a real ownership agenda that serves "the owners of Canada" would look like.

July 7, 2025

Sellers’ inflation is back on the horizon. We can stop it before working people pay the price.

Trade-war chaos and confusion are creating a perfect storm for sellers' inflation—when companies with market control choose to hike prices to gouge consumers and grow their profits when they have the chance. As SCP Fellow Kaylie Tiessen writes, this profit-led inflation often hides behind other drivers and can blindside us if we’re not watching closely. There are good reasons to accept some tariff-related price increases—elbows up, right? But she outlines three ways we can stop opportunistic sellers from using this trade chaos to mask their profiteering. We can stop powerful companies from exploiting confusion and weak oversight so working people don't pay the price while profits soar.

June 13, 2025

A new middle-power alliance would give Canada leverage and Canadians hope

Canada should lead the world’s middle powers in a collective and overdue weaning from American primacy by establishing a grand new security and economic alliance. As SCP Chair Jon Shell argues in The Hill Times, ten countries including Canada, Australia, France, Germany, Italy, the U.K., Spain, Japan, South Korea and the Netherlands, or the “Core 10," would amount to about the same GDP as the U.S., with significant natural resources, massive buying power - and significant leverage against American economic aggression.

May 21, 2025

The tariff war means a new normal for Hamilton businesses | Hamilton City Magazine

The wrecking ball that Donald Trump has taken to international trade has wounded relations between Hamilton businesses and their American suppliers and customers, reports Eugene Ellman in Hamilton City Magazine. Now, they’re looking east and west to replace traditional links to the south and pushing back. When Trump started pontificating about how Canada should become the 51st state and claiming the United States was subsidizing its northern neighbour, SCP Founder Bill Young and the team responded with Always Canada. Never 51 - part economic populism mixed with methodical policy-making, the series is devoted to the issues of wealth inequality and Canadian sovereignty.

May 20, 2025

As the federal government sets out to “build, baby, build,” do we want to own or be owned?

As our new government pursues growth and a nation-building agenda, we should remember this lesson from history: too often, we build and invest, only to sell off our assets and resources to the highest foreign bidder, leaving us economically vulnerable. In this moment of extreme peril, SCP CEO Matthew Mendelsohn asks how we should “build, baby, build” in a way that doesn’t merely accelerate the trends towards consolidation of wealth and deeper economic dependence. Canada has everything we need to emerge stronger from this period of geopolitical disruption if we put economic sovereignty and broad access to wealth-building at the heart of our agenda.

May 15, 2025

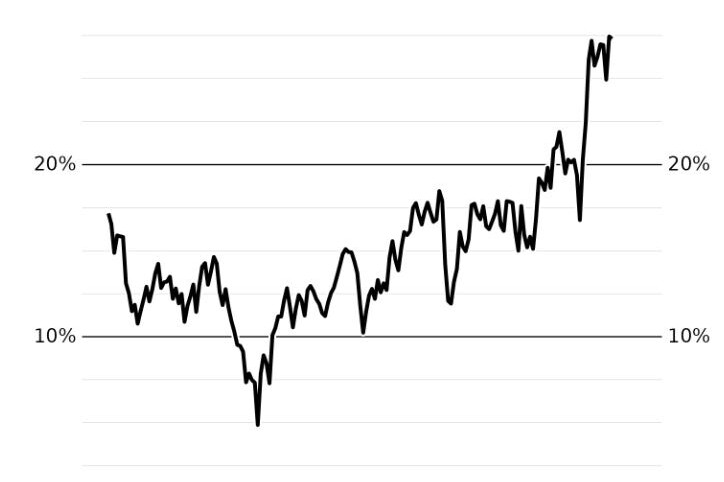

Innovate? In this economy? With these profit margins?

Canadian businesses are immensely profitable, but businesses simply haven't been reinvesting in them. As Tom Goldsmith writes in Orbit Policy's Deep Dives, the financialization of Canada’s economy and the high levels of rent extraction that accompany it are barriers to innovation. We are impoverishing ourselves over the long term to support short-term financial gains. If we care about innovation and productivity, then we need to focus far more critical attention on corporate Canada.

May 14, 2025

Mark Carney passed a tough test in Washington. He now faces an even tougher one at home | Toronto Star

We predicted that American investors would be looking to buy up Canadian businesses and assets, and that this would threaten our national security and economic sovereignty. Now Canada has to make a call on whether to kill Texas-based energy giant Sunoco's takeover of Parkland Corporation. In the Toronto Star, SCP CEO Matthew Mendelsohn and Chair Jon Shell ask: do we want to be owned by American billionaires, to work for them and have our wealth stripped away to pad bank accounts in New York and Dallas? If we really want Canada to remain ours, they argue, then we need to think and act like it.

May 12, 2025

These Canadian millionaires are asking for tax increases—but just for themselves | CBC News

CBC News profiles new advocacy group Patriotic Millionaires Canada who say their organization is looking for broad changes to wealth taxes and capital gains in this country. The group says it believes lower-income citizens often pay tax on much of their income, while wealthier investors can leverage dividends, investments and capital gains to change what they pay and how. Chair Claire Trottier asks: when are we going to recognize that massive growing runaway wealth inequality is a danger to democracy?"

May 11, 2025

Canada’s Liberal party will face down Trump. But will it address inequality? | Truthout

Prime Minister Mark Carney has a monumental task to lead Canadians through the turmoil of a second Donald Trump term, while also addressing various crises: affordability, housing, toxic drugs and health care, to name a few. For Truthout, Nora Loreto interviewed SCP Fellow Silas Xuereb about the crises that loomed over Canada's recent federal election and one fundamental cause that was never clearly identified: concentrated corporate power.

May 8, 2025

Watch the video: Unleashing Canada’s potential in turbulent times | Canada Growth Summit 2025

The United States’ unprecedented economic assault has brought Canada’s many pressing challenges, both internal and geopolitical, into sharp relief. On April 24, SCP CEO Matthew Mendelsohn joined a panel of experts for a discussion on accelerating investment at Growth Summit 2025. This year's PPF event focused on how to urgently unlock Canada’s economic growth potential to safeguard our country’s global competitiveness—and our own standard of living.

May 1, 2025

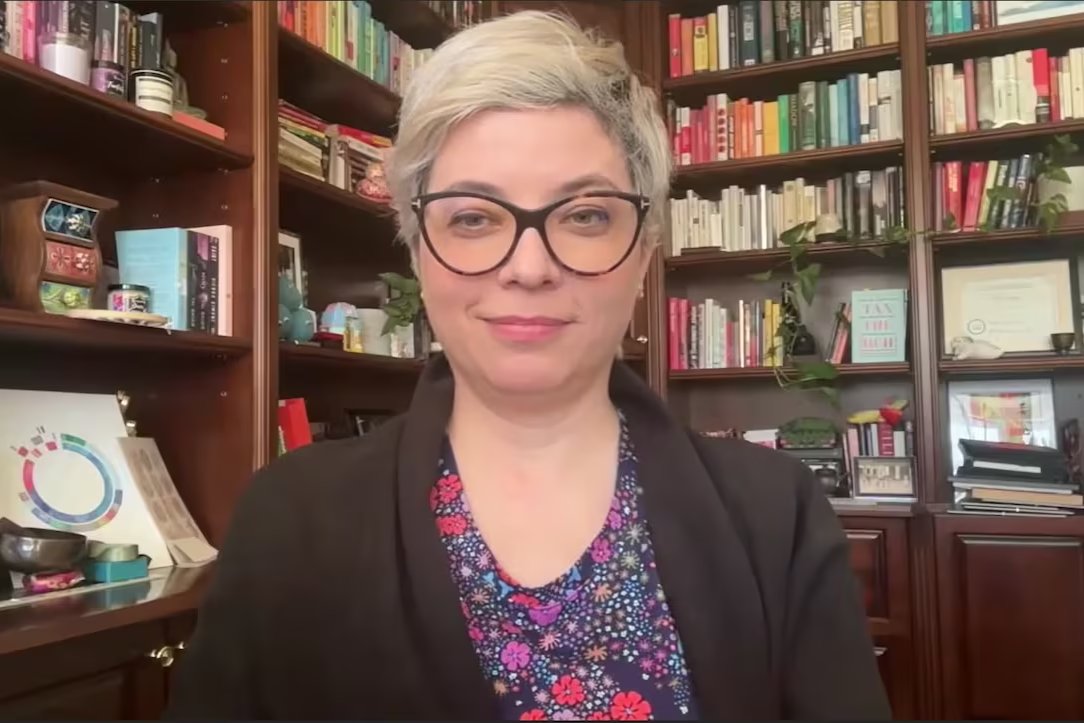

Watch the video: Is Canada really poorer than Alabama?

Corporate leaders are obsessing over GDP per capita. But, as SCP CEO Matthew Mendelsohn explains, if you look at just about any number that would meaningfully tell you how well our economy is doing, Canada does better than the U.S. So, when people speak glowingly of the American economic model, and how great it would be if Canada could be more like the U.S., it is worth asking: which aspect of that mess do they really want to replicate here? And how would that be good for Canadians?

April 28, 2025

Ten ways to unleash Canada’s potential | Public Policy Forum

As Trump’s mercurial tariff mandate unleashes market mayhem and geopolitical unease, Canadians have galvanized—buying local, putting the maple leaf on everything, ratcheting our elbows way up. Over the course of a dozen sessions at Public Policy Forum’s 2025 Canada Growth Summit, more than 40 speakers, including SCP's CEO Matthew Mendelsohn, put forward a series of smart, actionable ideas for how governments, businesses, policymakers and communities can work together to advance our collective fortunes.

April 25, 2025

The misleading use of per capita GDP: Numerators, denominators and living standards | Policy Options

Certain partisans have been citing Canada's performance on per capita GDP as evidence of a supposed 'lost decade' and economic mismanagement. In Policy Options, economist and director of the Centre for Future Work Jim Stanford deconstructs this arbitrary and misleading statistic. In the first of a two-part analysis, he explains multiple factors affecting both the numerator and denominator in this headline-grabbing number and how recent trends in GDP per capita say more about rapid immigration than about Canada’s overall economic health.

April 23, 2025

The perils of per capita GDP: No, Canada is not poorer than Alabama | Policy Options

Some business and political commentators cite a growing gap between the per capita GDP of Canada and the U.S. as evidence of Canada’s purported economic dysfunction. In Policy Options, economist and director of the Centre for Future Work Jim Stanford deconstructs this arbitrary and misleading statistic. In the second of a two-part analysis, he explains how Canada is not poorer than Alabama and how, despite lower economic growth per person, most Canadians earn more, live longer and fare better than Americans.

April 23, 2025

Canada Growth Summit 2025: Unleashing Canada’s potential in turbulent times

The United States’ unprecedented economic assault has brought Canada’s many pressing challenges, both internal and geopolitical, into sharp relief. On April 24, SCP CEO Matthew Mendelsohn joins a panel of experts for a discussion on accelerating investment at Growth Summit 2025. This year's PPF event will focus on how to urgently unlock Canada’s economic growth potential to safeguard our country’s global competitiveness—and our own standard of living.

April 14, 2025

Watch the video: New ideas for a democratic economy | DemocracyXChange 2025

What kind of economy do we want for Canada—one that prioritizes growth and productivity, at any cost? Or one that focuses on greater shared prosperity? Watch the April 5th recording of SCP CEO Matthew Mendelsohn and an expert panel discussing "New Ideas for a Democratic Economy" at DemocracyXchange 2025.

April 7, 2025

Are young people giving up on Canada? | Missing Middle Podcast

Sabrina Maddeaux and Michael Moffatt explore how the inability to afford housing not only affects individuals but also poses systemic risks to the Canadian economy and society. They delve into the implications of economic vulnerability, the talent exodus to the U.S. and the growing disconnection among younger generations, emphasizing the urgent need for a cohesive housing policy that addresses these interconnected issues to ensure a stable and resilient future for Canada.

April 2, 2025

As Canada prepares for disruption and sacrifice, whose side are our leaders on?

In this election, Canadians are looking for a leader who will stand up to economic threats from our mercurial and adversarial neighbour. But how, Matthew Mendelsohn asks, will the ideas on offer help workers, regular people, not-for-profits and smaller and medium-sized businesses transition to the emerging new world order? Yes, Canada needs economic growth, but it needs to be the kind that enriches working Canadians, not just not just large financial and corporate interests.

March 29, 2025

Policy ideas that meet this moment can come from anywhere—even LinkedIn

From fighter jets to TikTok, nothing is off the table when Canadians talk about how best to counter Trump's economic assault on Canada. SCP brings you some creative, crowdsourced policy ideas gathered by our Chair Jon Shell on a recent LinkedIn post. More evidence that new voices entering the policy discussion will help us get through the current crisis and emerge in a more hopeful place.

March 24, 2025

Concepts of a plan to confront the new United States

Living next to a superpower run by oligarchs is not where we expected to be 20 years ago, says Matthew Mendelsohn. But it’s where we are. Pretending otherwise doesn’t serve our interests. Canada is big enough, powerful enough, smart enough and rich enough to build a stronger, more independent economy if we start now.

January 24, 2025

The Alternative Exit podcast: Championing Employee Ownership Trusts to revolutionize wealth distribution

SCP Chair Jon Shell sits down with Andy Farquharson on The Alternative Exit Podcast to explore the transformative potential of employee ownership. Jon recounts how he advocated for Employee Ownership Trusts (EOTs) in Canada to address wealth inequality and business succession. He talks advantages of EOTs, from preserving a company’s legacy to fostering economic resilience in the workforce and reshaping both business culture and wealth distribution.

January 23, 2025

Social Capital Partners appoints slate of new advisors

Advisory Board members will advise on SCP’s strategy and agenda, drawing on decades of experience across finance, business, government, public policy, communications, civil society and community economic development.

January 21, 2025

A message from Social Capital Partners: We’re going to tell you the truth

There are lots of real, tangible public-policy solutions to the problems we face, says Matthew Mendelsohn. It begins with talking about the economy in a different way, grounded firmly in the public interest and data that reflect the reality of how people experience their economic lives.

January 16, 2025

Uncommons Podcast: Wealth inequality and inclusive growth with Matthew Mendelsohn

Social Capital Partners’ CEO, Matthew Mendelsohn, joins Member of Parliament for Beaches-East York, Nate Erksin-Smith, on his podcase “Uncommons”. Matthew and Nate talk about wealth concentration and its threat to democratic stability. They also discuss practical solutions to address wealth inequality, lack of trust in democratic institutions, the role of the federal public service and the need for a competent and responsive government.

July 26, 2024

Mark Carney and the Canadian business elite need to think more about growing wealth inequality that is destabilizing democracies around the world

Mark Carney made a speech last week and many people had plenty to say about it. But one of his replies during the Q & A deserves more attention than it received. MP Nate Erskine-Smith asked Carney what he would do about Canada’s growing wealth inequality. Carney’s answer was a bit unfocused, but he made two points clearly: 1) Let’s hope wealthy people give more to charity, and 2) We shouldn’t only focus on redistribution.

May 14, 2024

Billionaire Blindspot: How official data understates the severity of Canadian wealth inequality

Statistics Canada's official wealth survey significantly underestimates wealth inequality. Canada’s wealth concentration is not as extreme as in the United States, but closer than official data suggest. This misleading portrait undermines Canadians’ ability to have an evidence-informed conversation about how to address growing wealth concentration and the threats it represents for economic resilience and democratic stability.

April 24, 2024

Preparing for SCP’s next strategic phase

Social Capital Partners has a long history of investing in people and projects that create more economic opportunity in Canada. Recently, our focus has been on establishing more avenues for working Canadians to build wealth through ownership. Learn more about what we are moving towards.

April 23, 2024

Getting the facts straight on the changes to capital gains tax in budget 2024

Social Capital Partners' Chair, Jon Shell, sets the record straight on the capital gains changes in the 2024 Federal Budget.

April 22, 2024

Canada is bad at studying wealth inequality and we explain why that matters

Social Capital Partner's Director of Policy Dan Skilleter summarizes the key findings of his recent report "Billionaire Blindspot" in a Toronto Star Opinion piece.

April 4, 2024

Social Capital Partners releases new report on wealth inequality in Canada – concludes that official statistics significantly underestimate the problem

This new report critically analyzes Canada’s flagship wealth survey, the Survey of Financial Security (SFS), and outlines how its methodological shortcomings lead to significant underreporting of wealth inequality.

April 4, 2024

Social Capital Partner’s Director of Policy, Dan Skilleter, on The Agenda with Steve Paikin

Social Capital Partner’s Director of Policy, Dan Skilleter, sits down with Steve Paikin on The Agenda to discuss his recent report “Billionaire Blindspot”. This segment digs into how Canada’s official statistics severely underestimate how rich the richest Canadians are and includes steps that can be taken to correct this misrepresentation.

April 2, 2024

Bank of Canada’s unproductive productivity speech

Social Capital Partners' CEO, Matthew Mendelsohn, reflects on the Bank of Canada's productivity speech and calls for need of fresh ideas, voices and questions.

March 28, 2024

Building an employee ownership economy

New research continues to demonstrate that employee ownership fosters economic resilience. As in previous economic crises, employee-owned companies were better at retaining employees and at maintaining hours and salaries throughout the pandemic. In a post-pandemic economic environment, the demonstrated benefits of increased employee retention and alignment by employee-owned companies will be even more important to support economic growth.

March 22, 2022