Browse our ideas, opinions and initiatives designed to unlock pathways to wealth and economic security for working people. Or, filter your search by Topic or Type by clicking the menu options on the left.

The tariff war means a new normal for Hamilton businesses | Hamilton City Magazine

The wrecking ball that Donald Trump has taken to international trade has wounded relations between Hamilton businesses and their American suppliers and customers, reports Eugene Ellman in Hamilton City Magazine. Now, they’re looking east and west to replace traditional links to the south and pushing back. When Trump started pontificating about how Canada should become the 51st state and claiming the United States was subsidizing its northern neighbour, SCP Founder Bill Young and the team responded with Always Canada. Never 51 - part economic populism mixed with methodical policy-making, the series is devoted to the issues of wealth inequality and Canadian sovereignty.

May 20, 2025

Innovate? In this economy? With these profit margins?

Canadian businesses are immensely profitable, but businesses simply haven't been reinvesting in them. As Tom Goldsmith writes in Orbit Policy's Deep Dives, the financialization of Canada’s economy and the high levels of rent extraction that accompany it are barriers to innovation. We are impoverishing ourselves over the long term to support short-term financial gains. If we care about innovation and productivity, then we need to focus far more critical attention on corporate Canada.

May 14, 2025

Letting private equity buy law firms may stifle service, mobility | Bloomberg Law

If we allow for private equity ownership of law firms, it isn’t unreasonable to expect a similar result as we are seeing in other professions—lower quality of service and work for clients and lower job satisfaction for lawyers. In an op-ed for Bloomberg Law, SCP Fellow Rachel Wasserman of Wasserman Business Law outlines why law firms should decentralize, not consolidate, to provide good service and keep lower overhead.

May 14, 2025

Canada’s Liberal party will face down Trump. But will it address inequality? | Truthout

Prime Minister Mark Carney has a monumental task to lead Canadians through the turmoil of a second Donald Trump term, while also addressing various crises: affordability, housing, toxic drugs and health care, to name a few. For Truthout, Nora Loreto interviewed SCP Fellow Silas Xuereb about the crises that loomed over Canada's recent federal election and one fundamental cause that was never clearly identified: concentrated corporate power.

May 8, 2025

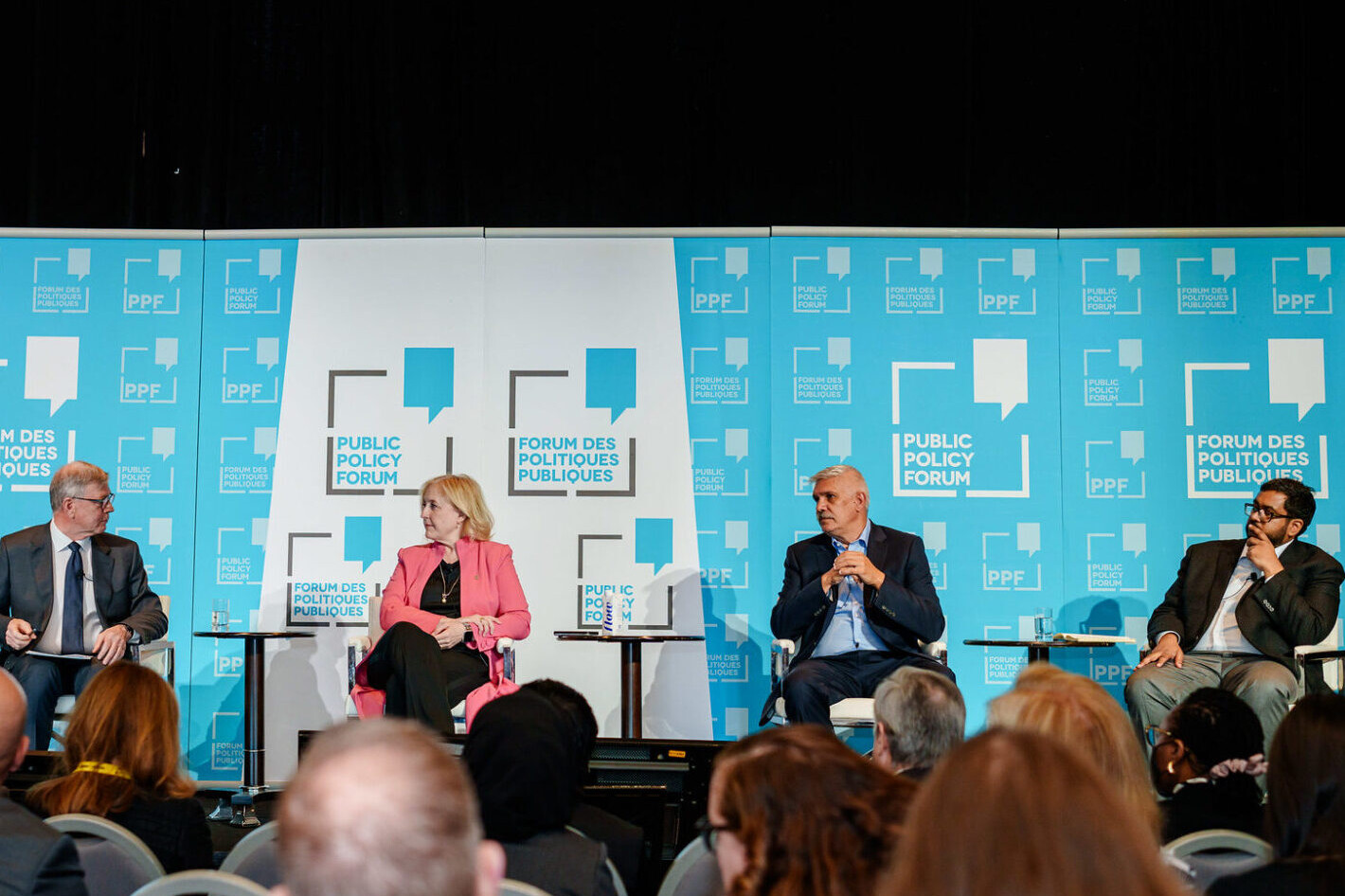

Ten ways to unleash Canada’s potential | Public Policy Forum

As Trump’s mercurial tariff mandate unleashes market mayhem and geopolitical unease, Canadians have galvanized—buying local, putting the maple leaf on everything, ratcheting our elbows way up. Over the course of a dozen sessions at Public Policy Forum’s 2025 Canada Growth Summit, more than 40 speakers, including SCP's CEO Matthew Mendelsohn, put forward a series of smart, actionable ideas for how governments, businesses, policymakers and communities can work together to advance our collective fortunes.

April 25, 2025

Are young people giving up on Canada? | Missing Middle Podcast

Sabrina Maddeaux and Michael Moffatt explore how the inability to afford housing not only affects individuals but also poses systemic risks to the Canadian economy and society. They delve into the implications of economic vulnerability, the talent exodus to the U.S. and the growing disconnection among younger generations, emphasizing the urgent need for a cohesive housing policy that addresses these interconnected issues to ensure a stable and resilient future for Canada.

April 2, 2025

As Canada prepares for disruption and sacrifice, whose side are our leaders on?

In this election, Canadians are looking for a leader who will stand up to economic threats from our mercurial and adversarial neighbour. But how, Matthew Mendelsohn asks, will the ideas on offer help workers, regular people, not-for-profits and smaller and medium-sized businesses transition to the emerging new world order? Yes, Canada needs economic growth, but it needs to be the kind that enriches working Canadians, not just not just large financial and corporate interests.

March 29, 2025

Joint submission to the Ontario Securities Commission regarding a proposal to expand retail investor access to private equity

CAMP and SCP made a joint submission to the Ontario Securities Commission detailing deep concerns about proposals related to expanding retail investor access to private equity funds. The submission details the risks associated with buyout private-equity funds and the harms they can cause to communities and our broader economy.

February 7, 2025

Inside the corporate battle over your pet’s health | The Fifth Estate

SCP Fellow Rachel Wasserman speaks with CBC's Steven D'Souza as part of an investigation into the skyrocketing cost of owning a pet. The documentary reveals how independent vet clinics are being gobbled up by multinational corporations and private equity for profit.

January 24, 2025

The Alternative Exit podcast: Championing Employee Ownership Trusts to revolutionize wealth distribution

SCP Chair Jon Shell sits down with Andy Farquharson on The Alternative Exit Podcast to explore the transformative potential of employee ownership. Jon recounts how he advocated for Employee Ownership Trusts (EOTs) in Canada to address wealth inequality and business succession. He talks advantages of EOTs, from preserving a company’s legacy to fostering economic resilience in the workforce and reshaping both business culture and wealth distribution.

January 23, 2025

Social Capital Partners appoints slate of new advisors

Advisory Board members will advise on SCP’s strategy and agenda, drawing on decades of experience across finance, business, government, public policy, communications, civil society and community economic development.

January 21, 2025

A message from Social Capital Partners: We’re going to tell you the truth

There are lots of real, tangible public-policy solutions to the problems we face, says Matthew Mendelsohn. It begins with talking about the economy in a different way, grounded firmly in the public interest and data that reflect the reality of how people experience their economic lives.

January 16, 2025

CAMP x SCP virtual talk – understanding private equity

In industries from dentistry to aircraft manufacturing, private equity (PE) is everywhere—some of it intent on rejuvenating flailing businesses, and some of it poised to extract maximum profit at any cost. To demystify this financial tool, CAMP and SCP hosted an expert panel of informed insiders and prominent American critics who have been on the frontlines of fighting PE’s worst excesses.

November 18, 2024

Uncommons Podcast: Wealth inequality and inclusive growth with Matthew Mendelsohn

Social Capital Partners’ CEO, Matthew Mendelsohn, joins Member of Parliament for Beaches-East York, Nate Erksin-Smith, on his podcase “Uncommons”. Matthew and Nate talk about wealth concentration and its threat to democratic stability. They also discuss practical solutions to address wealth inequality, lack of trust in democratic institutions, the role of the federal public service and the need for a competent and responsive government.

July 26, 2024

Mark Carney and the Canadian business elite need to think more about growing wealth inequality that is destabilizing democracies around the world

Mark Carney made a speech last week and many people had plenty to say about it. But one of his replies during the Q & A deserves more attention than it received. MP Nate Erskine-Smith asked Carney what he would do about Canada’s growing wealth inequality. Carney’s answer was a bit unfocused, but he made two points clearly: 1) Let’s hope wealthy people give more to charity, and 2) We shouldn’t only focus on redistribution.

May 14, 2024

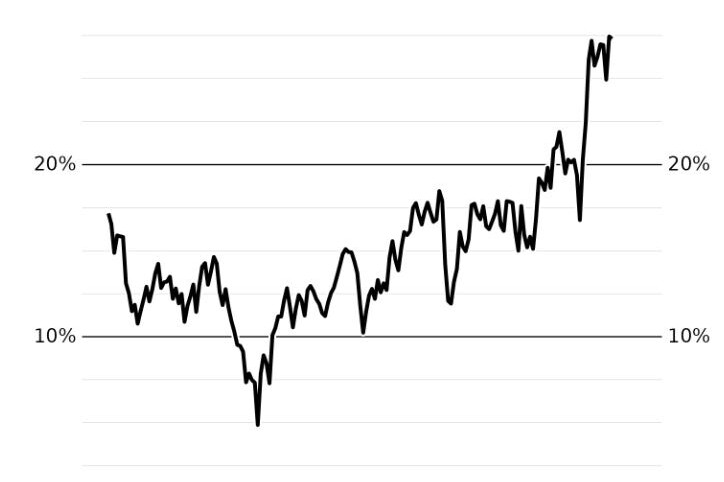

Billionaire Blindspot: How official data understates the severity of Canadian wealth inequality

Statistics Canada's official wealth survey significantly underestimates wealth inequality. Canada’s wealth concentration is not as extreme as in the United States, but closer than official data suggest. This misleading portrait undermines Canadians’ ability to have an evidence-informed conversation about how to address growing wealth concentration and the threats it represents for economic resilience and democratic stability.

April 24, 2024

Preparing for SCP’s next strategic phase

Social Capital Partners has a long history of investing in people and projects that create more economic opportunity in Canada. Recently, our focus has been on establishing more avenues for working Canadians to build wealth through ownership. Learn more about what we are moving towards.

April 23, 2024

Canada is bad at studying wealth inequality and we explain why that matters

Social Capital Partner's Director of Policy Dan Skilleter summarizes the key findings of his recent report "Billionaire Blindspot" in a Toronto Star Opinion piece.

April 4, 2024

Social Capital Partners releases new report on wealth inequality in Canada – concludes that official statistics significantly underestimate the problem

This new report critically analyzes Canada’s flagship wealth survey, the Survey of Financial Security (SFS), and outlines how its methodological shortcomings lead to significant underreporting of wealth inequality.

April 4, 2024

Social Capital Partner’s Director of Policy, Dan Skilleter, on The Agenda with Steve Paikin

Social Capital Partner’s Director of Policy, Dan Skilleter, sits down with Steve Paikin on The Agenda to discuss his recent report “Billionaire Blindspot”. This segment digs into how Canada’s official statistics severely underestimate how rich the richest Canadians are and includes steps that can be taken to correct this misrepresentation.

April 2, 2024

Bank of Canada’s unproductive productivity speech

Social Capital Partners' CEO, Matthew Mendelsohn, reflects on the Bank of Canada's productivity speech and calls for need of fresh ideas, voices and questions.

March 28, 2024

Building an employee ownership economy

New research continues to demonstrate that employee ownership fosters economic resilience. As in previous economic crises, employee-owned companies were better at retaining employees and at maintaining hours and salaries throughout the pandemic. In a post-pandemic economic environment, the demonstrated benefits of increased employee retention and alignment by employee-owned companies will be even more important to support economic growth.

March 22, 2022