Browse our ideas, opinions and initiatives designed to unlock pathways to wealth and economic security for working people. Or, filter your search by Topic or Type by clicking the menu options on the left.

Mark Carney’s economic agenda misses something vital | Toronto Star

Prime Minister Mark Carney's campaign focused on economic growth and sovereignty. He talked a lot about how Trump wants to "break us so he can own us," and yet, so far, details of an ownership agenda are pretty thin. The reality is that Canadians cannot be "masters in our own home" if the home is owned by a U.S. hedge fund. Broadly distributed, local Canadian ownership of our economy and our assets must be a central part of our economic growth strategy. In the Toronto Star, SCP CEO Matthew Mendelsohn writes that he sees some early, positive signs of such a plan coming from the federal government and spells out what a real ownership agenda that serves "the owners of Canada" would look like.

July 7, 2025

HBS Case | Taylor Guitars: Making Employee Ownership Work the Taylor Way

After a successful transition to 100% employee ownership, Taylor Guitars' experience is now the subject of a Harvard Business School case. Read more about how their experience brings the evidence to life: "Employee-owned firms grow faster, default less often, are far more resilient in economic downturns and pay their people more, even before you factor in the wealth-generating effects of ownership. It’s also a great business succession option as it lets owners exit for fair prices while protecting the people and communities they care deeply about.”

July 3, 2025

The tariff war means a new normal for Hamilton businesses | Hamilton City Magazine

The wrecking ball that Donald Trump has taken to international trade has wounded relations between Hamilton businesses and their American suppliers and customers, reports Eugene Ellman in Hamilton City Magazine. Now, they’re looking east and west to replace traditional links to the south and pushing back. When Trump started pontificating about how Canada should become the 51st state and claiming the United States was subsidizing its northern neighbour, SCP Founder Bill Young and the team responded with Always Canada. Never 51 - part economic populism mixed with methodical policy-making, the series is devoted to the issues of wealth inequality and Canadian sovereignty.

May 20, 2025

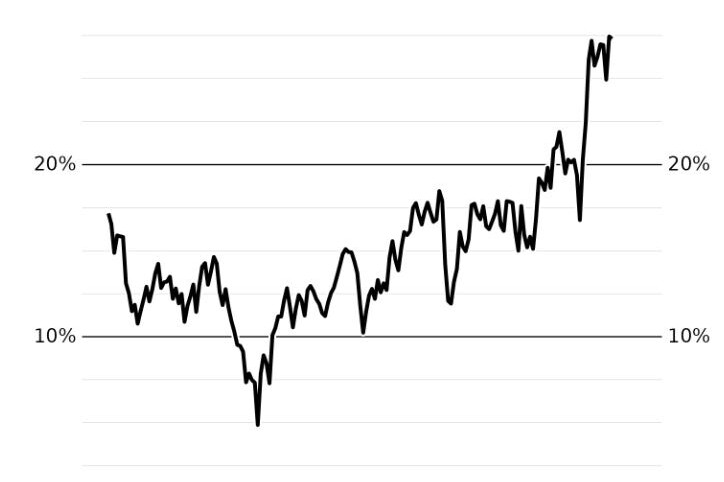

Innovate? In this economy? With these profit margins?

Canadian businesses are immensely profitable, but businesses simply haven't been reinvesting in them. As Tom Goldsmith writes in Orbit Policy's Deep Dives, the financialization of Canada’s economy and the high levels of rent extraction that accompany it are barriers to innovation. We are impoverishing ourselves over the long term to support short-term financial gains. If we care about innovation and productivity, then we need to focus far more critical attention on corporate Canada.

May 14, 2025

Canada’s Liberal party will face down Trump. But will it address inequality? | Truthout

Prime Minister Mark Carney has a monumental task to lead Canadians through the turmoil of a second Donald Trump term, while also addressing various crises: affordability, housing, toxic drugs and health care, to name a few. For Truthout, Nora Loreto interviewed SCP Fellow Silas Xuereb about the crises that loomed over Canada's recent federal election and one fundamental cause that was never clearly identified: concentrated corporate power.

May 8, 2025

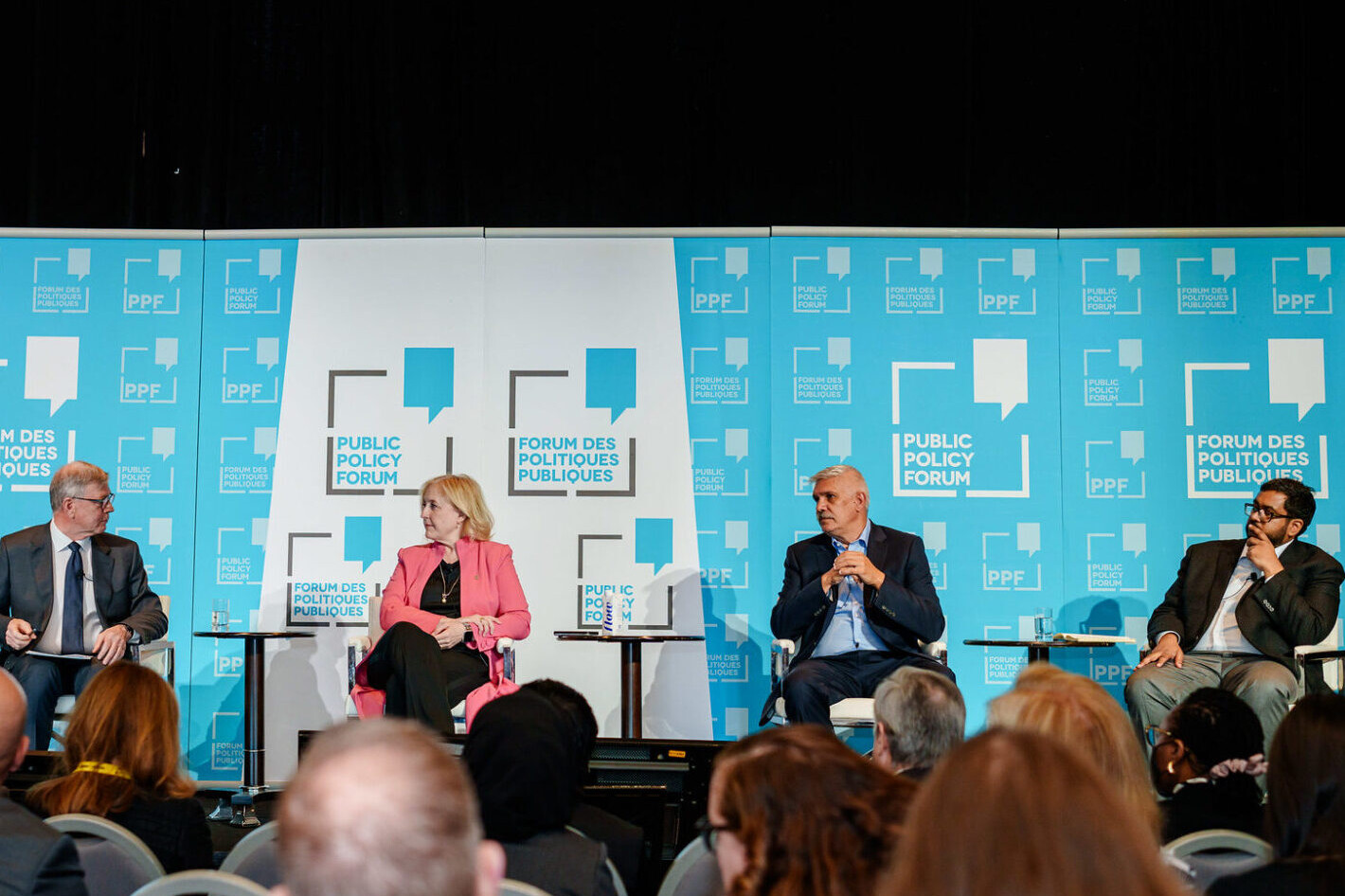

Ten ways to unleash Canada’s potential | Public Policy Forum

As Trump’s mercurial tariff mandate unleashes market mayhem and geopolitical unease, Canadians have galvanized—buying local, putting the maple leaf on everything, ratcheting our elbows way up. Over the course of a dozen sessions at Public Policy Forum’s 2025 Canada Growth Summit, more than 40 speakers, including SCP's CEO Matthew Mendelsohn, put forward a series of smart, actionable ideas for how governments, businesses, policymakers and communities can work together to advance our collective fortunes.

April 25, 2025

How employee ownership can help secure Canadian sovereignty | ImpactAlpha

While Canada’s policymakers try to figure out how to make the Canadian economy less vulnerable to Trump’s whims, many Canadian businesses are going to look like a good deal for American investors. A weak Canadian dollar, low interest rates and expected liquidity challenges create the conditions for an acceleration of private equity-led buyouts of Canadian firms. In ImpactAlpha, SCP's CEO Matthew Mendelsohn explains how, as Canada faces Trump’s mercurial and predatory approach to trade and economic policy, employee ownership can offer much-needed stability and resilience.

April 16, 2025

Are young people giving up on Canada? | Missing Middle Podcast

Sabrina Maddeaux and Michael Moffatt explore how the inability to afford housing not only affects individuals but also poses systemic risks to the Canadian economy and society. They delve into the implications of economic vulnerability, the talent exodus to the U.S. and the growing disconnection among younger generations, emphasizing the urgent need for a cohesive housing policy that addresses these interconnected issues to ensure a stable and resilient future for Canada.

April 2, 2025

As Canada prepares for disruption and sacrifice, whose side are our leaders on?

In this election, Canadians are looking for a leader who will stand up to economic threats from our mercurial and adversarial neighbour. But how, Matthew Mendelsohn asks, will the ideas on offer help workers, regular people, not-for-profits and smaller and medium-sized businesses transition to the emerging new world order? Yes, Canada needs economic growth, but it needs to be the kind that enriches working Canadians, not just not just large financial and corporate interests.

March 29, 2025

How employee ownership can help secure Canadian sovereignty | The Calgary Herald

With Canada’s sovereignty at stake, we must invest in every approach to keeping Canadian businesses in Canadian hands. If we match the U.K.'s success in incentivizing employee-ownership conversion, we would see 300 Canadian companies sold to their workers each year. SCP Chair Jon Shell and Employee Ownership Canada CEO Michael Ras explain how very few policies promise as powerful an outcome.

March 23, 2025

The Alternative Exit podcast: Championing Employee Ownership Trusts to revolutionize wealth distribution

SCP Chair Jon Shell sits down with Andy Farquharson on The Alternative Exit Podcast to explore the transformative potential of employee ownership. Jon recounts how he advocated for Employee Ownership Trusts (EOTs) in Canada to address wealth inequality and business succession. He talks advantages of EOTs, from preserving a company’s legacy to fostering economic resilience in the workforce and reshaping both business culture and wealth distribution.

January 23, 2025

Social Capital Partners appoints slate of new advisors

Advisory Board members will advise on SCP’s strategy and agenda, drawing on decades of experience across finance, business, government, public policy, communications, civil society and community economic development.

January 21, 2025

A message from Social Capital Partners: We’re going to tell you the truth

There are lots of real, tangible public-policy solutions to the problems we face, says Matthew Mendelsohn. It begins with talking about the economy in a different way, grounded firmly in the public interest and data that reflect the reality of how people experience their economic lives.

January 16, 2025

Overheard at Crowe Soberman: The EOT advantage

Crowe Soberman Audit and Advisory Partner Chandor Gauthier sits down with Jon Shell, Chair of Social Capital Partners and Board Member at Employee Ownership Canada. They dive into the benefits of Employee Ownership Trusts and get into the nitty gritty of how EOTs can support smooth business succession, boost equity and retention and safeguard business legacies.

November 12, 2024

At the corner of Main Street and Purpose: Rethinking small businesses by rethinking who owns them

Is alternative ownership the future of business in Canada? Shane Gibson from Future of Good reports on how converting to a non-profit, establishing an Employee Ownership Trust, or becoming a co-operative can help a small business become more sustainable, ensure job security and retain wealth within the community.

October 18, 2024

Employee ownership trusts explainer | Toronto Sun

SCP Chair Jon Shell in the Toronto Sun on what Employee Ownership Trusts mean for business owners, the community and the broader economy

October 9, 2024

Uncommons Podcast: Wealth inequality and inclusive growth with Matthew Mendelsohn

Social Capital Partners’ CEO, Matthew Mendelsohn, joins Member of Parliament for Beaches-East York, Nate Erksin-Smith, on his podcase “Uncommons”. Matthew and Nate talk about wealth concentration and its threat to democratic stability. They also discuss practical solutions to address wealth inequality, lack of trust in democratic institutions, the role of the federal public service and the need for a competent and responsive government.

July 26, 2024

Employee Ownership Trusts make it easier for Canadian businesses to share wealth with employees

When outside interests take over a small or medium business, it's often purchased then closed, leaving holes in the community. Future of Good reports on how new laws could encourage more retiring business owners to sell to their employees through Employee Ownership Trusts. EOTs help businesses stay local and contribute to employee retention and financial wealth.

June 21, 2024

Mark Carney and the Canadian business elite need to think more about growing wealth inequality that is destabilizing democracies around the world

Mark Carney made a speech last week and many people had plenty to say about it. But one of his replies during the Q & A deserves more attention than it received. MP Nate Erskine-Smith asked Carney what he would do about Canada’s growing wealth inequality. Carney’s answer was a bit unfocused, but he made two points clearly: 1) Let’s hope wealthy people give more to charity, and 2) We shouldn’t only focus on redistribution.

May 14, 2024

Employee ownership trusts: What they mean for Canadian business owners

A helpful summary of Employee Ownership Trusts that gives Canadian business owners and their advisors a simple (albeit not short) explanation about what they are, and why they should care.

May 9, 2024

Employee ownership trusts FAQs

Bringing EOTs to Canada has been a labour of love for a lot of people over the last few years. We’re deeply grateful to the government for establishing the policies we need for employee ownership to flourish here. Now that it’s real we can’t wait to see the community pick the idea up and run with it.

May 9, 2024

Budget 2024 unleashes unprecedented opportunities for employee ownership in Canada

After four years of research, engagement and advocacy, the federal government has finalized the legislative and tax structure for Employee Ownership Trusts (EOTs). Social Capital Partners and the Canadian Employee Ownership Coalition are grateful for the government's careful work to make EOTs an attractive option for business owners.

May 8, 2024

Billionaire Blindspot: How official data understates the severity of Canadian wealth inequality

Statistics Canada's official wealth survey significantly underestimates wealth inequality. Canada’s wealth concentration is not as extreme as in the United States, but closer than official data suggest. This misleading portrait undermines Canadians’ ability to have an evidence-informed conversation about how to address growing wealth concentration and the threats it represents for economic resilience and democratic stability.

April 24, 2024

Preparing for SCP’s next strategic phase

Social Capital Partners has a long history of investing in people and projects that create more economic opportunity in Canada. Recently, our focus has been on establishing more avenues for working Canadians to build wealth through ownership. Learn more about what we are moving towards.

April 23, 2024

Unlocking the potential of employee ownership in Canada

In the US and the UK, employee-owned companies grow faster, pay better, are less prone to lay-offs or bankruptcies in economic downturns, and are more likely to keep jobs in local economies. Due to supportive public policy, EOTs are a popular structure for business succession in those countries and have generated significant wealth for front-line employees. Canada does not have a business structure comparable to the employee ownership trust (EOT).

April 19, 2024

Canada is bad at studying wealth inequality and we explain why that matters

Social Capital Partner's Director of Policy Dan Skilleter summarizes the key findings of his recent report "Billionaire Blindspot" in a Toronto Star Opinion piece.

April 4, 2024

Social Capital Partners releases new report on wealth inequality in Canada – concludes that official statistics significantly underestimate the problem

This new report critically analyzes Canada’s flagship wealth survey, the Survey of Financial Security (SFS), and outlines how its methodological shortcomings lead to significant underreporting of wealth inequality.

April 4, 2024

Social Capital Partner’s Director of Policy, Dan Skilleter, on The Agenda with Steve Paikin

Social Capital Partner’s Director of Policy, Dan Skilleter, sits down with Steve Paikin on The Agenda to discuss his recent report “Billionaire Blindspot”. This segment digs into how Canada’s official statistics severely underestimate how rich the richest Canadians are and includes steps that can be taken to correct this misrepresentation.

April 2, 2024

Bank of Canada’s unproductive productivity speech

Social Capital Partners' CEO, Matthew Mendelsohn, reflects on the Bank of Canada's productivity speech and calls for need of fresh ideas, voices and questions.

March 28, 2024

Building an employee ownership economy

New research continues to demonstrate that employee ownership fosters economic resilience. As in previous economic crises, employee-owned companies were better at retaining employees and at maintaining hours and salaries throughout the pandemic. In a post-pandemic economic environment, the demonstrated benefits of increased employee retention and alignment by employee-owned companies will be even more important to support economic growth.

March 22, 2022

Taylor Guitars’ transitions to 100% employee ownership with support from the Healthcare of Ontario Pension Plan (HOOPP) and Social Capital Partners (SCP)

In a transaction that would be impossible for a Canadian company, the owners of North America's largest builder of acoustic guitars secure a sustainable future for their company and its employees.

February 16, 2021