Browse our ideas, opinions and initiatives designed to unlock pathways to wealth and economic security for working people. Or, filter your search by Topic or Type by clicking the menu options on the left.

Could increased employee ownership restore confidence in Canada’s economy? | The Hub

As companies consolidate under ever larger pools of private capital, there’s growing unease around who’s actually benefiting from corporate growth. Falice Chin writes in The Hub that it’s no coincidence, then, that voices across the political spectrum are now revisiting models of employee ownership as a potential antidote to widening wealth inequality, fading community ties and a growing distrust in capitalism itself. This deep-dive looks at how employee ownership trusts, or EOTs, could be an elegant policy remedy to a crisis of confidence in the modern economy.

November 4, 2025

Elbows up: A practical program for Canadian sovereignty | Report

Canada can’t become a sovereign country by doing the same old things, explains a new compendium of essays co-sponsored by the CCPA, the Centre for Future Work and several national civil society organizations. Elbows Up: A Practical Program for Canadian Sovereignty is a response to corporate rallying cries responding to Donald Trump with a familiar playbook: deregulation, austerity, tax cuts and fossil fuel expansion. The collection includes contributions from 20 progressive economists and policy experts, including SCP CEO Matthew Mendelsohn and others who participated in the Elbows Up Economic Summit held in September 2025 in Ottawa.

October 31, 2025

Pipelines and algorithms aren’t going to save us | The Hill Times

Smart investments in natural resources and AI alone will not get us through this moment of geopolitical rupture. As Matthew Mendelsohn writes in an op-ed for The Hill Times, SMEs contribute just over half of Canada’s GDP and employ 64 per cent of our people. We have to make more low-cost capital available to the smaller businesses, locally owned enterprises, not-for-profits and social enterprises who crucially employ and reinvest locally, act as important local economic infrastructure and provide services that are crucial for well-being. They are automatic stabilizers in the face of tariff threats outside our control.

October 28, 2025

What’s wrong with mainstream economics?

Mainstream, or “neoclassical,” economics still dominates how we teach, study and understand our economy, even though much of it doesn’t match reality. In this piece, economists Louis-Philippe Rochon and Guillaume Vallet explain why outdated economic ideas persist and how they can lead to harmful policies. They challenge five common myths about inflation, growth and inequality, showing that today’s economy is driven more by power and institutions than by perfect markets. As "heterodox" economists, they argue it's time for a new kind of economics that reflects how the real world actually works.

October 27, 2025

Building a thriving economy: CSA Policy Pathways Conference

The CSA Policy Pathways Conference convenes leaders, thinkers and changemakers across government, business, community and academia to confront the pressing questions shaping our economic future. How can we build resilience in the face of global uncertainty? What will it take to unlock innovation and ensure its benefits are broadly shared? How do we design policies that promote competition, inclusion, and financial security? Join us on November 5, 2025, in Toronto, as we explore how we can take bolder steps toward a more resilient, innovative and equitable economic future.

October 26, 2025

Creativity could be collateral damage of U.S. film tariff

When U.S. tariffs threaten to strike creativity and culture, we can't afford to stay quiet. SCP Fellow and POV executive director Biju Pappachan explores the implications of the U.S. imposing a tariff on foreign-made films and explains why this is the moment for Canada to stand up for its filmmakers, crews and cultural sovereignty. Film and television are not luxuries; cultural production is a strategic sector that delivers exports, jobs and soft power. Just as we negotiate for agricultural or industrial tariff exemptions, cultural production deserves equal protection.

October 21, 2025

Hype or help? Can crypto and stablecoins solve economic inequality?

Some cryptocurrency advocates are promoting the use of stablecoins as a common currency, arguing that this new currency could help the cost-of-living crisis and promote economic equality – particularly for young people. Law professor, money expert and SCP Fellow Dan Rohde is not convinced that crypto can help address economic inequality. In this explainer, he breaks down what stablecoins are and aren’t, and how to think critically about their promises.

October 21, 2025

Budget 2025 should bolster employee ownership to strengthen Canada’s economy | Canadian Dimension

Budget 2025 offers Canada a chance to make employee ownership permanent by extending tax incentives for employee ownership trusts (EOTs) and worker co-ops. In Canadian Dimension, Simon Pek, Lorin Busaan and Alex Hemingway write that doing so would boost productivity, reduce inequality and secure business succession, while keeping jobs and decision-making local. A modest investment promises significant economic and social dividends.

October 8, 2025

What being an employee-owned company means to me

For what it’s like to be on the inside of an employee-owned company, we spoke to a few of the 750 employees who recently became 100-per cent owners of Taproot Community Support Services, a social services provider across B.C., Alberta and Ontario. Rewards the employees highlighted include company morale and spirit, for sure. They also include financial rewards paid out annually to each employee as dividends. Last year, each employee would have received about $1000 to $1500 on top of their salaries—and as the company succeeds over time, the employees will share financially in Taproot’s success.

October 2, 2025

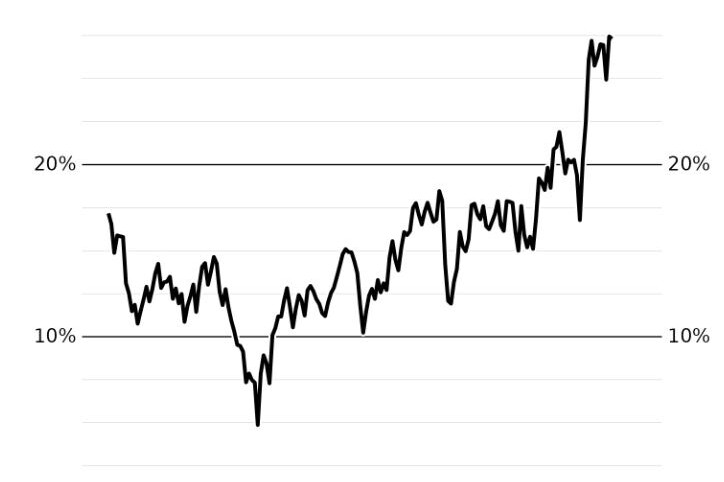

Wealth inequality in Canada is far worse than StatsCan reports

Our government’s best available data on Canada’s wealth gap excludes, by design, the wealthiest families in the country. As SCP Director of Policy Dan Skilleter writes, if we didn’t have the Parliamentary Budget Officer fact-checking Statistics Canada’s work, their numbers would tell us the top one per cent own only 2.5 per cent of all wealth – not nearly 25 per cent of all wealth in Canada, as the PBO reports. We like to think of Canada as a beacon of egalitarianism compared to our southern neighbours, but when you add in data from "rich lists" published by Forbes and Maclean's, our wealth concentration looks quite similar to the U.S.

October 2, 2025

Watch the video: Is Canada’s wealth gap really as bad as the U.S?

As Canadians, we like to think we’re strong and free. But as SCP's Director of Policy Dan Skilleter explains, when it comes to the wealth gap, we're looking more like America Lite—better manners, but almost all the inequality. The way our economy is set up means that most of the benefits from economic growth go to financial interests and speculators, rather than to workers or other businesses. We can shift economic power to more people and aspiring entrepreneurs by making them owners. When more people have a stake, Canada’s economy works better for everyone—not just investors.

October 1, 2025

Build, baby, build. Or sell, baby, sell? Canada should reject Sunoco’s takeover of Parkland | Policy Options

Approving a sale of Parkland to Sunoco may be attractive to the government because it would add US$9 billion to Canada’s total foreign direct investment (FDI), which politicians often tout as an indicator of national economic health. But, as SCP Fellow Sarah Doyle and SCP Chair Jon Shell write, total foreign direct investment is not a good reflection of the underlying strength of the economy. Plus, this deal would bring none of the benefits typically associated with FDI. It is unlikely to lead to increased capital investment, more or better jobs, or technology transfer into Canada. In fact, its impact may be just the opposite. If there ever was a deal with almost no Canadian winners, this is it. Ottawa should say no to Sunoco.

September 26, 2025

The federal government is leaving investment dollars on the table—but it can fix that in the budget

At the recent Victoria Forum, community and philanthropic leaders outlined creative community finance and impact investment ideas that could mobilize big pools of private capital to invest in local businesses, social purpose organizations and community infrastructure. However, as SCP CEO Matthew Mendelsohn writes, despite the growing maturity of the social finance community, Canada still lacks the social and community financing infrastructure and policies to make this happen. With some important fixes to fragmented financing and outdated regulatory frameworks, the coming Budget could make it easier for social finance investments to properly scale and deliver the kind of outsized impact Canada needs at this time.

September 23, 2025

Acquisitions can’t build Canada: Understanding Foreign Direct Investment in an age of geopolitical fracturing

Levels of our country's Foreign Direct Investment, or FDI, do not actually tell us much about the state of the economy. One large deal can significantly affect total FDI inflows, which can vary dramatically from year to year. Plus, as SCP Fellow Sarah Doyle and SCP Chair Jon Shell write, not all FDI is created equal. Distinguishing between beneficial and harmful FDI is even more important now, in the context of a global trade war and threats to Canada’s economic sovereignty. In this explainer, they unpack FDI: what it is, when it is and isn’t beneficial and why understanding these nuances matters.

September 19, 2025

The Canadian Tax Observatory announces Heather Scoffield as founding CEO

Heather Scoffield is founding CEO of a new independent nonprofit Canadian institution created to lead an informed national conversation on the links between taxation, economic fairness and a thriving democracy. Under her leadership, the Canadian Tax Observatory will drive in-depth research that pulls apart the strands of our current system so that we can thoroughly evaluate where we are and engage Canadians in a broad discussion about how to support economic growth while improving the fairness of Canada’s tax system. Over the next six months, the Observatory will connect with researchers in Canada, build alliances globally and develop its research agenda.

September 11, 2025

Maple Ridge-based company now owned by its 750 employees | Maple Ridge-Pitt Meadows News

Neil Corbett of the Maple Ridge-Pitt Meadows News reports on locally based Taproot Community Support Services making some business history in Canada. Taproot's 750 employees in B.C., Alberta Ontario will now own 100 per cent of the business, becoming the largest Employee Ownership Trust (EOT) in Canada and the first in the social services sector. Finance minister Francois-Philippe Champagne explains why this is a perfect example of what EOTs can do, calling the trusts "a powerful, timely tool that helps Canadian employees become owners of the businesses they work for, while helping entrepreneurs find the right people to carry their legacy forward."

September 4, 2025

Taproot becomes Canada’s largest employee-owned trust with 750 workers | The Globe and Mail

On Sept. 2, 2025, B.C.-based Taproot community support services surprised its 750 employees with the news they will become equal owners of the company they helped build. Minister of Finance & National Revenue Francois-Philippe Champagne joined CEO Mike Fotheringham and Social Capital Partners Chair Jon Shell to celebrate the new worker-owners and Canada’s largest Employee Ownership Trust (EOT) to date. In the Globe and Mail, Meera Raman reports on Taproot's milestone and how this succession model keeps companies Canadian, keeps jobs in local communities and builds wealth for workers.

September 2, 2025

Social Capital Partners’ 2025 Federal Pre-Budget Submission

There has never been a federal budget quite like this one. Canada faces a moment of extreme peril, threatened by an American administration that has abandoned our mutually beneficial trading and security regime. In our pre-budget submission, Social Capital Partners recommends that Budget 2025 focus on broadening ownership to ensure the benefits of economic growth are more widely shared. Policy choices should move us away from an economy fueled by wealth extraction that enriches billionaires and inflates the bottom lines of foreign funds, and instead, move us towards more local reinvestment that builds an inclusive, sustainable and resilient democratic future where all Canadians have realistic chances to build economic security.

August 28, 2025

How Canada’s tax system puts the wealthy above workers

Rather than using the tax system to prevent wealth concentration, our current tax system promotes it. Those who earn income from their investments have more income left over after taxes, allowing them to accumulate wealth more quickly than others. SCP Fellow Silas Xuereb explains how, south of the border, we are witnessing the consequences of runaway wealth inequality – billionaires use their media conglomerates to get political favours, exploit the instruments of the state to enrich themselves and, increasingly, secure political office. All of these trends are leading to the erosion of democracy and public policy that advances the interests of the wealthy at the expense of everyone else. If Canada does not rebalance our tax system to prioritize work over wealth, we may soon find ourselves on the same path.

August 27, 2025

Trump pumps private equity with 401k changes | Breaking Points podcast

Breaking Points podcast correspondent James Li sits down with corporate lawyer, economic analyst and SCP Fellow Rachel Wasserman to discuss Trump's executive order opening up 401k plans to private equity. Trends show that with rising interest rates and frozen exit markets, the private equity investment model could be under serious stress. So, what are the implications of making this type of investment available to retail investors and their retirement plans? Rachel walks James through how private equity works, what's so dangerous about the buyout-PE model and who might get left holding the bag.

August 12, 2025

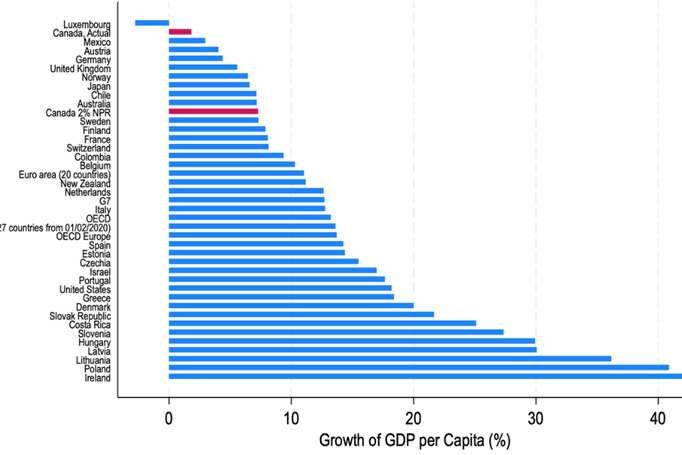

The problem with GDP per capita | West of Centre on CBC

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. On CBC political podcast West of Centre, host Rob Brown asks Petit to dissect the metric politicians love to wield. GDP measures total output, while GDP per capita divides that sum by the population. She explains that the simple math offers an easy snapshot, but can mislead when used alone. For a true read on prosperity, Petit argues Canada needs a broader economic dashboard that weighs productivity, fairness and long term well being.

July 31, 2025

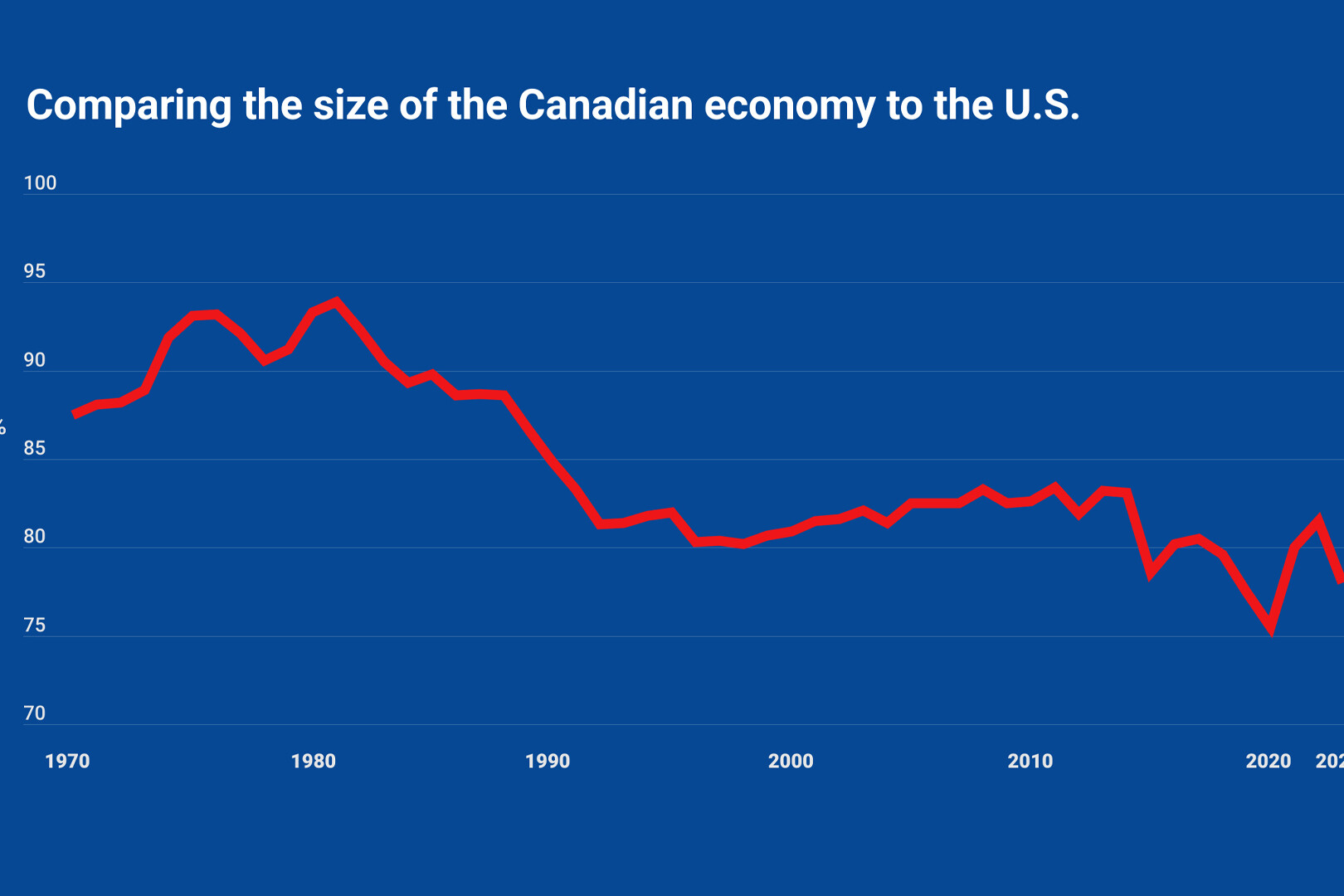

Blame the denominator, not the economy

Over the last couple of years, there have been countless articles warning of Canada’s poor economic performance. The mic drop has increasingly been Canada’s poor performance relative to peer countries on “GDP per capita,” with growth rankings used to draw a variety of sweeping, negative conclusions about Canada’s economy. SCP CEO Matthew Mendelsohn and Policy Director Dan Skilleter draw on economist and SCP Fellow Dr. Gillian Petit's new research to explain why GDP per capita is a deeply flawed measurement for evaluating rich countries - and is easily influenced by a variety of factors having little to do with economic performance or economic well-being.

July 11, 2025

Non-Permanent Residents and their impact on GDP per capita | Summary

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.

July 11, 2025

Non-Permanent Residents and their impact on GDP per capita | Report

New research by economist and SCP Fellow Gillian Petit estimates what Canada’s GDP per capita would have been over the past decade if Canada had kept our temporary resident numbers stable. She also estimates the expected impact on GDP per capita in the coming years due strictly to planned reductions in Canada's intake of non-permanent residents. Among key findings: Canada’s GDP per capita is misleading and should not be used as if it were the sole indicator of economic well-being. Plus, if we had maintained our temporary resident numbers at two percent of the population in recent years, Canada’s GDP per capita would look much more like our peer countries: a little bit ahead of countries like Germany, the United Kingdom and Australia and a little bit lower than countries like Belgium, Sweden and France.

July 11, 2025

How do we not go broke? | Gloves Off Podcast

What happens when a Canadian toy company, a global trade war and the unraveling of American stability collide? Charting in the top 10 on Apple Podcasts, the new Gloves Off podcast talks to Zita Cobb of Fogo Island Inn and Jon Shell of Social Capital Partners about what comes after the collapse of business as usual. Listen for bold ideas on how Canada can prevent getting stuck playing America’s game—and losing.

July 8, 2025

Mark Carney’s economic agenda misses something vital | Toronto Star

Prime Minister Mark Carney's campaign focused on economic growth and sovereignty. He talked a lot about how Trump wants to "break us so he can own us," and yet, so far, details of an ownership agenda are pretty thin. The reality is that Canadians cannot be "masters in our own home" if the home is owned by a U.S. hedge fund. Broadly distributed, local Canadian ownership of our economy and our assets must be a central part of our economic growth strategy. In the Toronto Star, SCP CEO Matthew Mendelsohn writes that he sees some early, positive signs of such a plan coming from the federal government and spells out what a real ownership agenda that serves "the owners of Canada" would look like.

July 7, 2025

HBS Case | Taylor Guitars: Making Employee Ownership Work the Taylor Way

After a successful transition to 100% employee ownership, Taylor Guitars' experience is now the subject of a Harvard Business School case. Read more about how their experience brings the evidence to life: "Employee-owned firms grow faster, default less often, are far more resilient in economic downturns and pay their people more, even before you factor in the wealth-generating effects of ownership. It’s also a great business succession option as it lets owners exit for fair prices while protecting the people and communities they care deeply about.”

July 3, 2025

Now #hiring: Executive Assistant to the CEO

Social Capital Partners is seeking a highly organized and proactive Executive Assistant (EA) to the CEO who thrives in a fast-paced, mission-oriented environment. While this is a true EA position focused on keeping the CEO and team operating at a high level, it is also a unique opportunity to engage in a wide range of stimulating policy and strategy conversations, including the chance to conduct research, contribute to policy initiatives and engage with influential leaders in the field.

July 2, 2025

Sellers’ inflation is back on the horizon. We can stop it before working people pay the price.

Trade-war chaos and confusion are creating a perfect storm for sellers' inflation—when companies with market control choose to hike prices to gouge consumers and grow their profits when they have the chance. As SCP Fellow Kaylie Tiessen writes, this profit-led inflation often hides behind other drivers and can blindside us if we’re not watching closely. There are good reasons to accept some tariff-related price increases—elbows up, right? But she outlines three ways we can stop opportunistic sellers from using this trade chaos to mask their profiteering. We can stop powerful companies from exploiting confusion and weak oversight so working people don't pay the price while profits soar.

June 13, 2025

New Canadian Tax Observatory seeks visionary founding CEO

Social Capital Partners and other funders announce a new, non-partisan, nonprofit Canadian organization to lead an informed national conversation on the links between taxation, economic fairness and a thriving democracy. The Canadian Tax Observatory is seeking a visionary leader who can shape and grow a permanent, influential Canadian institution connected to global networks identifying better, more effective ways to achieve tax fairness.

May 21, 2025

A new middle-power alliance would give Canada leverage and Canadians hope

Canada should lead the world’s middle powers in a collective and overdue weaning from American primacy by establishing a grand new security and economic alliance. As SCP Chair Jon Shell argues in The Hill Times, ten countries including Canada, Australia, France, Germany, Italy, the U.K., Spain, Japan, South Korea and the Netherlands, or the “Core 10," would amount to about the same GDP as the U.S., with significant natural resources, massive buying power - and significant leverage against American economic aggression.

May 21, 2025

The tariff war means a new normal for Hamilton businesses | Hamilton City Magazine

The wrecking ball that Donald Trump has taken to international trade has wounded relations between Hamilton businesses and their American suppliers and customers, reports Eugene Ellman in Hamilton City Magazine. Now, they’re looking east and west to replace traditional links to the south and pushing back. When Trump started pontificating about how Canada should become the 51st state and claiming the United States was subsidizing its northern neighbour, SCP Founder Bill Young and the team responded with Always Canada. Never 51 - part economic populism mixed with methodical policy-making, the series is devoted to the issues of wealth inequality and Canadian sovereignty.

May 20, 2025

As the federal government sets out to “build, baby, build,” do we want to own or be owned?

As our new government pursues growth and a nation-building agenda, we should remember this lesson from history: too often, we build and invest, only to sell off our assets and resources to the highest foreign bidder, leaving us economically vulnerable. In this moment of extreme peril, SCP CEO Matthew Mendelsohn asks how we should “build, baby, build” in a way that doesn’t merely accelerate the trends towards consolidation of wealth and deeper economic dependence. Canada has everything we need to emerge stronger from this period of geopolitical disruption if we put economic sovereignty and broad access to wealth-building at the heart of our agenda.

May 15, 2025

Innovate? In this economy? With these profit margins?

Canadian businesses are immensely profitable, but businesses simply haven't been reinvesting in them. As Tom Goldsmith writes in Orbit Policy's Deep Dives, the financialization of Canada’s economy and the high levels of rent extraction that accompany it are barriers to innovation. We are impoverishing ourselves over the long term to support short-term financial gains. If we care about innovation and productivity, then we need to focus far more critical attention on corporate Canada.

May 14, 2025

Letting private equity buy law firms may stifle service, mobility | Bloomberg Law

If we allow for private equity ownership of law firms, it isn’t unreasonable to expect a similar result as we are seeing in other professions—lower quality of service and work for clients and lower job satisfaction for lawyers. In an op-ed for Bloomberg Law, SCP Fellow Rachel Wasserman of Wasserman Business Law outlines why law firms should decentralize, not consolidate, to provide good service and keep lower overhead.

May 14, 2025

Mark Carney passed a tough test in Washington. He now faces an even tougher one at home | Toronto Star

We predicted that American investors would be looking to buy up Canadian businesses and assets, and that this would threaten our national security and economic sovereignty. Now Canada has to make a call on whether to kill Texas-based energy giant Sunoco's takeover of Parkland Corporation. In the Toronto Star, SCP CEO Matthew Mendelsohn and Chair Jon Shell ask: do we want to be owned by American billionaires, to work for them and have our wealth stripped away to pad bank accounts in New York and Dallas? If we really want Canada to remain ours, they argue, then we need to think and act like it.

May 12, 2025

These Canadian millionaires are asking for tax increases—but just for themselves | CBC News

CBC News profiles new advocacy group Patriotic Millionaires Canada who say their organization is looking for broad changes to wealth taxes and capital gains in this country. The group says it believes lower-income citizens often pay tax on much of their income, while wealthier investors can leverage dividends, investments and capital gains to change what they pay and how. Chair Claire Trottier asks: when are we going to recognize that massive growing runaway wealth inequality is a danger to democracy?"

May 11, 2025

Canada’s Liberal party will face down Trump. But will it address inequality? | Truthout

Prime Minister Mark Carney has a monumental task to lead Canadians through the turmoil of a second Donald Trump term, while also addressing various crises: affordability, housing, toxic drugs and health care, to name a few. For Truthout, Nora Loreto interviewed SCP Fellow Silas Xuereb about the crises that loomed over Canada's recent federal election and one fundamental cause that was never clearly identified: concentrated corporate power.

May 8, 2025

School meals aren’t just good for kids: they can also be good for industry

Scaling up access to school meals through Canada's National School Food Policy is a big win for children and families. As SCP Fellow Sarah Doyle and SCP Advisor Alex Himelfarb outline, the program could also be a win for agrifood businesses, the climate and workers, contributing to a more resilient, just, sustainable and less dependent Canadian economy. The key is an ambitious and strategic approach to food procurement—one that shifts the focus from minimizing price to maximizing public value.

May 2, 2025

Watch the video: Unleashing Canada’s potential in turbulent times | Canada Growth Summit 2025

The United States’ unprecedented economic assault has brought Canada’s many pressing challenges, both internal and geopolitical, into sharp relief. On April 24, SCP CEO Matthew Mendelsohn joined a panel of experts for a discussion on accelerating investment at Growth Summit 2025. This year's PPF event focused on how to urgently unlock Canada’s economic growth potential to safeguard our country’s global competitiveness—and our own standard of living.

May 1, 2025

#HIRING Visionary Founding CEO to lead the Canadian Tax Observatory

Social Capital Partners is seeking a visionary Founding CEO to lead the Canadian Tax Observatory - a new, non-partisan, nonprofit Canadian institution that will drive an informed national conversation on the links between taxation, economic fairness and a thriving democracy. Submit your Statement of Ambition by June 4, 2025.

April 29, 2025

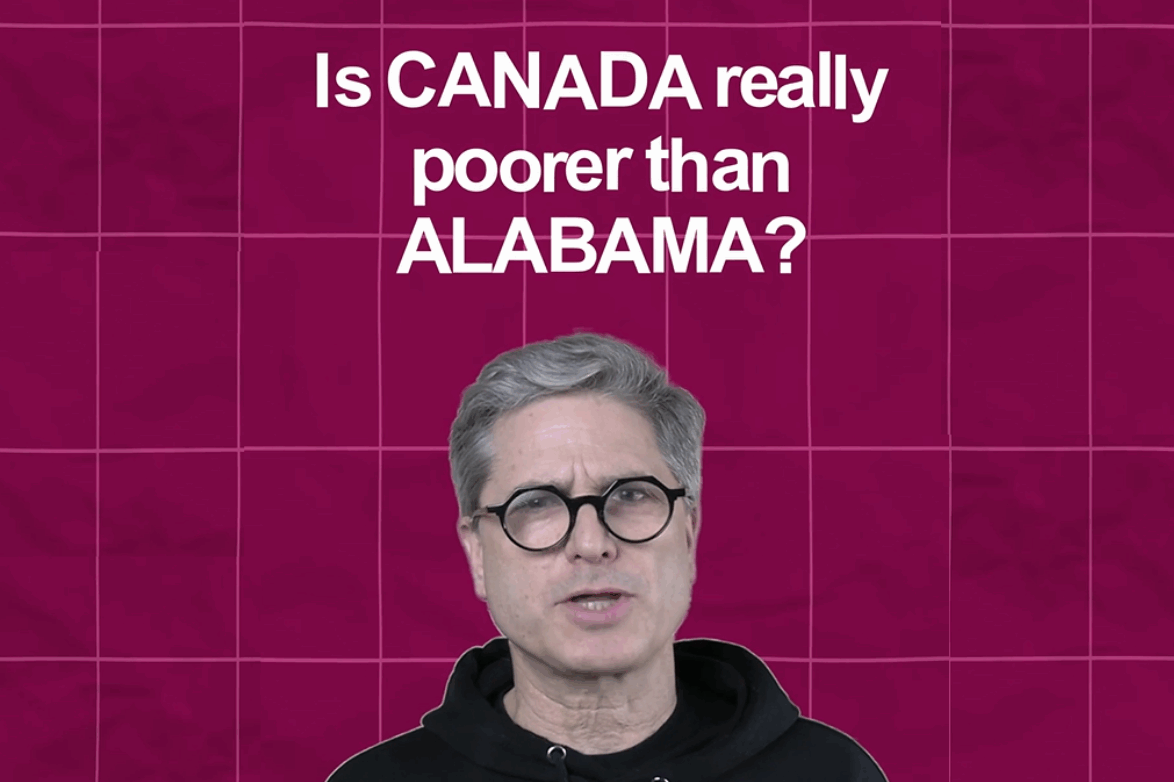

Watch the video: Is Canada really poorer than Alabama?

Corporate leaders are obsessing over GDP per capita. But, as SCP CEO Matthew Mendelsohn explains, if you look at just about any number that would meaningfully tell you how well our economy is doing, Canada does better than the U.S. So, when people speak glowingly of the American economic model, and how great it would be if Canada could be more like the U.S., it is worth asking: which aspect of that mess do they really want to replicate here? And how would that be good for Canadians?

April 28, 2025

Ten ways to unleash Canada’s potential | Public Policy Forum

As Trump’s mercurial tariff mandate unleashes market mayhem and geopolitical unease, Canadians have galvanized—buying local, putting the maple leaf on everything, ratcheting our elbows way up. Over the course of a dozen sessions at Public Policy Forum’s 2025 Canada Growth Summit, more than 40 speakers, including SCP's CEO Matthew Mendelsohn, put forward a series of smart, actionable ideas for how governments, businesses, policymakers and communities can work together to advance our collective fortunes.

April 25, 2025

The misleading use of per capita GDP: Numerators, denominators and living standards | Policy Options

Certain partisans have been citing Canada's performance on per capita GDP as evidence of a supposed 'lost decade' and economic mismanagement. In Policy Options, economist and director of the Centre for Future Work Jim Stanford deconstructs this arbitrary and misleading statistic. In the first of a two-part analysis, he explains multiple factors affecting both the numerator and denominator in this headline-grabbing number and how recent trends in GDP per capita say more about rapid immigration than about Canada’s overall economic health.

April 23, 2025

The perils of per capita GDP: No, Canada is not poorer than Alabama | Policy Options

Some business and political commentators cite a growing gap between the per capita GDP of Canada and the U.S. as evidence of Canada’s purported economic dysfunction. In Policy Options, economist and director of the Centre for Future Work Jim Stanford deconstructs this arbitrary and misleading statistic. In the second of a two-part analysis, he explains how Canada is not poorer than Alabama and how, despite lower economic growth per person, most Canadians earn more, live longer and fare better than Americans.

April 23, 2025

Workforce shocks are coming. Are we going to retreat—or reinvent?

Many Canadian businesses and workers are facing looming furloughs and layoffs. As CEO of Challenge Factory Lisa Taylor argues, these workforce disruptions should be seen as an opportunity to invest in our workers, in our businesses and industries and in the future we want for our families and communities. We must evolve government programs to incentivize businesses to train and upskill workers to meet new market demands and execute on new strategies, rather than lay those employees off. Recovery from workforce shocks is possible with creative ways to reinvent and transform.

April 17, 2025

Hands Off: Investing in employee ownership can ensure Canadian businesses stay Canadian | ImpactAlpha

While Canada’s policymakers try to figure out how to make the Canadian economy less vulnerable to Trump’s whims, many Canadian businesses are going to look like a good deal for American investors. A weak Canadian dollar, low interest rates and expected liquidity challenges create the conditions for an acceleration of private equity-led buyouts of Canadian firms. In ImpactAlpha, SCP's CEO Matthew Mendelsohn explains how, as Canada faces Trump’s mercurial and predatory approach to trade and economic policy, employee ownership can offer much-needed stability and resilience.

April 16, 2025

Canada Growth Summit 2025: Unleashing Canada’s potential in turbulent times

The United States’ unprecedented economic assault has brought Canada’s many pressing challenges, both internal and geopolitical, into sharp relief. On April 24, SCP CEO Matthew Mendelsohn joins a panel of experts for a discussion on accelerating investment at Growth Summit 2025. This year's PPF event will focus on how to urgently unlock Canada’s economic growth potential to safeguard our country’s global competitiveness—and our own standard of living.

April 14, 2025

New Canadian Tax Observatory seeks visionary founding CEO

Social Capital Partners and other funders announce a new, non-partisan, nonprofit Canadian organization to lead an informed national conversation on the links between taxation, economic fairness and a thriving democracy. The Canadian Tax Observatory is seeking a visionary leader who can shape and grow a permanent, influential Canadian institution connected to global networks identifying better, more effective ways to achieve tax fairness.

April 10, 2025

Canada’s pension funds need to get their elbows up

Canada’s pension funds need to step up and help the Canadian economy pivot. They can do so in keeping with their fiduciary duty to their contributors, but in a way that builds long-term economic resilience. SCP's Matthew Mendelsohn and Michelle Arnold argue that defenders of the status quo are mistaken in their analysis, and that the federal government can use its fiscal power in targeted ways to get more capital into the hands of Canadian businesses and communities.

April 9, 2025

Watch the video: New ideas for a democratic economy | DemocracyXChange 2025

What kind of economy do we want for Canada—one that prioritizes growth and productivity, at any cost? Or one that focuses on greater shared prosperity? Watch the April 5th recording of SCP CEO Matthew Mendelsohn and an expert panel discussing "New Ideas for a Democratic Economy" at DemocracyXchange 2025.

April 7, 2025

Why commercial rent control is key to Canada’s economic sovereignty

For small businesses across Canada, a lack of commercial tenancy protections means unexpected rent increases, undue financial distress and even threat of closure. As SCP Fellow Liliana Locke argues, there are jurisdictions that have solved for commercial rent hikes that we can learn from in this moment. Smart policy in the commercial rent market would provide Canada’s small businesses the vital stability they need to sustain and grow their businesses through these turbulent economic times.

April 3, 2025

Are young people giving up on Canada? | Missing Middle Podcast

Sabrina Maddeaux and Michael Moffatt explore how the inability to afford housing not only affects individuals but also poses systemic risks to the Canadian economy and society. They delve into the implications of economic vulnerability, the talent exodus to the U.S. and the growing disconnection among younger generations, emphasizing the urgent need for a cohesive housing policy that addresses these interconnected issues to ensure a stable and resilient future for Canada.

April 2, 2025

As Canada prepares for disruption and sacrifice, whose side are our leaders on?

In this election, Canadians are looking for a leader who will stand up to economic threats from our mercurial and adversarial neighbour. But how, Matthew Mendelsohn asks, will the ideas on offer help workers, regular people, not-for-profits and smaller and medium-sized businesses transition to the emerging new world order? Yes, Canada needs economic growth, but it needs to be the kind that enriches working Canadians, not just not just large financial and corporate interests.

March 29, 2025

A ‘silver tsunami’ of business exits is coming—here’s how to keep them Canadian

A combination of rising U.S. tariffs, a weakening Canadian dollar and a generation of business owners nearing retirement has created the perfect storm for a wave of foreign takeovers. SCP's Michelle Arnold, Futurpreneur's Karen Greve Young and Venture for Canada's Scott Stirrett on how a few targeted policy changes could enable aspiring entrepreneurs to buy existing businesses, keeping jobs and ownership local while injecting fresh energy into our Canadian economy.

March 26, 2025

Policy ideas that meet this moment can come from anywhere—even LinkedIn

From fighter jets to TikTok, nothing is off the table when Canadians talk about how best to counter Trump's economic assault on Canada. SCP brings you some creative, crowdsourced policy ideas gathered by our Chair Jon Shell on a recent LinkedIn post. More evidence that new voices entering the policy discussion will help us get through the current crisis and emerge in a more hopeful place.

March 24, 2025

How employee ownership can help secure Canadian sovereignty | The Calgary Herald

With Canada’s sovereignty at stake, we must invest in every approach to keeping Canadian businesses in Canadian hands. If we match the U.K.'s success in incentivizing employee-ownership conversion, we would see 300 Canadian companies sold to their workers each year. SCP Chair Jon Shell and Employee Ownership Canada CEO Michael Ras explain how very few policies promise as powerful an outcome.

March 23, 2025

Canada’s economic vulnerabilities show why it must invest in the wealth of local communities | The Conversation

For Canada to build a more resilient economy, we must secure local assets, democratize the economy and ensure wealth circulates within communities rather than being extracted by distant, corporate interests. In The Conversation, SCP Fellow Audrey Jamal and Heather M. Hachigian write that a promising solution lies in community wealth building.

March 21, 2025

The hidden takeover of our economy—and 5 things we can do about it

Today, Canada’s main streets are more likely to feature American chains and less likely to be locally owned. We already face economic assault from the south—SCP's CEO Matthew Mendelsohn and Fellow Rachel Wasserman on why we cannot accept unchecked serial acquisitions as a tactic in this economic war against us and what we can do about it.

March 11, 2025

Canada needs a new civil defence corps | The Tyee

If Canada were to build a civil defence program on the scale of those in Sweden or Finland, the numbers would be game-changing. As MASS LBP principal Peter MacLeod lays out in The Tyee, Canadians must be prepared to defend our sovereignty and citizens have roles to play.

March 5, 2025

Four ways to keep Canadian businesses in Canadian hands

Despite the fact that governments, business leaders, workers and Canadians all say they want to be less economically vulnerable, there is a real risk that, two years from now, even more of our businesses and assets will be owned by U.S. investors. SCP's CEO Matthew Mendelsohn and Chair Jon Shell propose four ideas to prevent American finance from gobbling up the Canadian economy.

March 5, 2025

Trump’s tariff threats expose Canada’s internal monopoly problem | Policy Options

Trump’s tariff threats have opened the door for economic thinking that pushes Canada way past business as usual. In Policy Options, Executive Director of the Canadian Anti-Monopoly Project Keldon Bester argues that, from airlines to banks, fixing Canada’s competition problem starts with smarter domestic reforms.

March 3, 2025

Canada is a way better bet than the United States right now

Canada’s value proposition aligns with the values most Canadians hold, even if we execute on them imperfectly: diversity, inclusion, freedom, equality, democracy, respect and reconciliation. SCP's CEO, Matthew Mendelsohn, on why he would rather invest in a country that strives to uphold those values and build an inclusive, democratic capitalist system than invest in the uncertain, volatile mess that is the United States right now.

March 2, 2025

Canadian foundations must invest more in Canada and invest for local impact

Foundations in Canada, both private and community, hold upwards of $140 billion dollars in their endowments. Our CEO, Matthew Mendelsohn, lays out how endowments held by our universities, colleges, hospitals and other public-purpose institutions, including our philanthropic foundations and those who manage our donor advised funds, need to reorient their investment practices to meet this moment.

February 25, 2025

The answer to economic threats: Always Canada. Never 51.

Under economic threat from the Trump administration, Social Capital Partners launches a Special Series of policy ideas that support Canadian economic sovereignty, advance ownership for Canadians and reduce dependence on the U.S. Our CEO, Matthew Mendelsohn, explains how we need to seize this opportunity to advance the interests of workers, small businesses, the economically vulnerable and young Canadians who have known for a long time that our economy is not working well for them.

February 25, 2025

Feb. 25 Webinar | What about cities? Building economic resilience amidst a new Canada-U.S. order

Join moderator Shauna Sylvester for an Urban Climate Leadership online webinar featuring Mary Rowe, CEO of Canadian Urban Institute, Mairin Loewen, Assoc. Program Director at UCL and Matthew Mendelsohn, CEO at Social Capital Partners, in discussion on the impact of U.S. tariffs on Canadian cities. February 25, 2025 from 1:00 - 2:00 p.m. ET.

February 19, 2025

Feb. 14 Webinar | When Global Hits Local

In the face of Trump's economic assault, Canada's local businesses and leaders must manage uncertainty and maintain and strengthen community resilience. How will tariffs impact small businesses, supply chains and local economies? Tune in from 12:00 - 1:00 p.m. on February 14 to hear our CEO Matthew Mendelsohn and an expert panel discuss practical, community-driven solutions to bolster local economies in the face of global shifts.

February 13, 2025

The strength within: Some economists say we can’t count on fair and open trade with the U.S. anymore. Is it time for Canada to look inward instead? | Toronto Star

When U.S. President Donald Trump threatened to launch a full-blown trade war with its closest ally, many Canadians felt as if their best friend had suddenly turned around and stabbed them in the back. The Star spoke with economists, academics and other experts, including SCP CEO Matthew Mendelsohn, about how the country should best navigate this new era of Trump's isolationism, and found there are realistic steps we can take to reduce our dependence on the States.

February 8, 2025

Joint submission to the Ontario Securities Commission regarding a proposal to expand retail investor access to private equity

CAMP and SCP made a joint submission to the Ontario Securities Commission detailing deep concerns about proposals related to expanding retail investor access to private equity funds. The submission details the risks associated with buyout private-equity funds and the harms they can cause to communities and our broader economy.

February 7, 2025

Three ideas to make home ownership more affordable that aren’t getting the attention they need

Canadians are more vulnerable to Trump’s economic warfare today because our housing system is in crisis and has left many Canadians without affordable places to live. Some of our own bad policy choices have put us in this position of vulnerability. We've got three housing policy ideas we want the team at Missing Middle to look into.

February 3, 2025

Inside the corporate battle over your pet’s health | The Fifth Estate

SCP Fellow Rachel Wasserman speaks with CBC's Steven D'Souza as part of an investigation into the skyrocketing cost of owning a pet. The documentary reveals how independent vet clinics are being gobbled up by multinational corporations and private equity for profit.

January 24, 2025

Concepts of a plan to confront the new United States

Living next to a superpower run by oligarchs is not where we expected to be 20 years ago, says Matthew Mendelsohn. But it’s where we are. Pretending otherwise doesn’t serve our interests. Canada is big enough, powerful enough, smart enough and rich enough to build a stronger, more independent economy if we start now.

January 24, 2025

The Alternative Exit podcast: Championing Employee Ownership Trusts to revolutionize wealth distribution

SCP Chair Jon Shell sits down with Andy Farquharson on The Alternative Exit Podcast to explore the transformative potential of employee ownership. Jon recounts how he advocated for Employee Ownership Trusts (EOTs) in Canada to address wealth inequality and business succession. He talks advantages of EOTs, from preserving a company’s legacy to fostering economic resilience in the workforce and reshaping both business culture and wealth distribution.

January 23, 2025

Social Capital Partners appoints slate of new advisors

Advisory Board members will advise on SCP’s strategy and agenda, drawing on decades of experience across finance, business, government, public policy, communications, civil society and community economic development.

January 21, 2025

Why small businesses need rent control

Rising rents are pushing mom-and-pop shops off Canada's streets. In Canadian Business, Aaron Binder and SCP Fellow Liliana Locke (née Camacho) from the Better Way Alliance argue new commercial tenant protections are the answer.

January 16, 2025

A message from Social Capital Partners: We’re going to tell you the truth

There are lots of real, tangible public-policy solutions to the problems we face, says Matthew Mendelsohn. It begins with talking about the economy in a different way, grounded firmly in the public interest and data that reflect the reality of how people experience their economic lives.

January 16, 2025

Feedback on the Competition Bureau’s Review of the Merger Enforcement Guidelines

There is a growing recognition, both globally and within Canada, that competition is essential to fostering a strong, resilient and productive economy. Yet, despite this consensus, the Canadian economy is becoming increasingly consolidated, and entrepreneurship is in steep decline. SCP's feedback on the Competition Bureau's Review of the Merger Enforcement Guidelines outlines our concern with serial-acquisition strategies wherein large firms acquire smaller companies in ways that evade regulatory scrutiny, and shares our recommendations to address this issue.

January 8, 2025

CAMP x SCP virtual talk – understanding private equity

In industries from dentistry to aircraft manufacturing, private equity (PE) is everywhere—some of it intent on rejuvenating flailing businesses, and some of it poised to extract maximum profit at any cost. To demystify this financial tool, CAMP and SCP hosted an expert panel of informed insiders and prominent American critics who have been on the frontlines of fighting PE’s worst excesses.

November 18, 2024

Overheard at Crowe Soberman: The EOT advantage

Crowe Soberman Audit and Advisory Partner Chandor Gauthier sits down with Jon Shell, Chair of Social Capital Partners and Board Member at Employee Ownership Canada. They dive into the benefits of Employee Ownership Trusts and get into the nitty gritty of how EOTs can support smooth business succession, boost equity and retention and safeguard business legacies.

November 12, 2024

Optimizing the impact of Canada’s Small Business Financing Program

Social Capital Partners and Venture for Canada made a joint submission to Innovation, Science, and Economic Development Canada (ISED) to amend the Canadian Small Business Financing Program (CSBFP) to make it easier for would-be entrepreneurs to purchase existing businesses. Our recommendations to encourage more Entrepreneurship through Acquisition, or ETA, could help stop the decline in entrepreneurship, protect small businesses, keep wealth in Canadian communities and unleash more local, private-sector innovation.

October 30, 2024

At the corner of Main Street and Purpose: Rethinking small businesses by rethinking who owns them

Is alternative ownership the future of business in Canada? Shane Gibson from Future of Good reports on how converting to a non-profit, establishing an Employee Ownership Trust, or becoming a co-operative can help a small business become more sustainable, ensure job security and retain wealth within the community.

October 18, 2024

Employee ownership trusts explainer | Toronto Sun

SCP Chair Jon Shell in the Toronto Sun on what Employee Ownership Trusts mean for business owners, the community and the broader economy

October 9, 2024

Uncommons Podcast: Wealth inequality and inclusive growth with Matthew Mendelsohn

Social Capital Partners’ CEO, Matthew Mendelsohn, joins Member of Parliament for Beaches-East York, Nate Erksin-Smith, on his podcase “Uncommons”. Matthew and Nate talk about wealth concentration and its threat to democratic stability. They also discuss practical solutions to address wealth inequality, lack of trust in democratic institutions, the role of the federal public service and the need for a competent and responsive government.

July 26, 2024

Employee Ownership Trusts make it easier for Canadian businesses to share wealth with employees

When outside interests take over a small or medium business, it's often purchased then closed, leaving holes in the community. Future of Good reports on how new laws could encourage more retiring business owners to sell to their employees through Employee Ownership Trusts. EOTs help businesses stay local and contribute to employee retention and financial wealth.

June 21, 2024

Mark Carney and the Canadian business elite need to think more about growing wealth inequality that is destabilizing democracies around the world

Mark Carney made a speech last week and many people had plenty to say about it. But one of his replies during the Q & A deserves more attention than it received. MP Nate Erskine-Smith asked Carney what he would do about Canada’s growing wealth inequality. Carney’s answer was a bit unfocused, but he made two points clearly: 1) Let’s hope wealthy people give more to charity, and 2) We shouldn’t only focus on redistribution.

May 14, 2024

Employee ownership trusts: What they mean for Canadian business owners

A helpful summary of Employee Ownership Trusts that gives Canadian business owners and their advisors a simple (albeit not short) explanation about what they are, and why they should care.

May 9, 2024

Employee ownership trusts FAQs

Bringing EOTs to Canada has been a labour of love for a lot of people over the last few years. We’re deeply grateful to the government for establishing the policies we need for employee ownership to flourish here. Now that it’s real we can’t wait to see the community pick the idea up and run with it.

May 9, 2024

Budget 2024 unleashes unprecedented opportunities for employee ownership in Canada

After four years of research, engagement and advocacy, the federal government has finalized the legislative and tax structure for Employee Ownership Trusts (EOTs). Social Capital Partners and the Canadian Employee Ownership Coalition are grateful for the government's careful work to make EOTs an attractive option for business owners.

May 8, 2024

Billionaire Blindspot: How official data understates the severity of Canadian wealth inequality

Statistics Canada's official wealth survey significantly underestimates wealth inequality. Canada’s wealth concentration is not as extreme as in the United States, but closer than official data suggest. This misleading portrait undermines Canadians’ ability to have an evidence-informed conversation about how to address growing wealth concentration and the threats it represents for economic resilience and democratic stability.

April 24, 2024

Preparing for SCP’s next strategic phase

Social Capital Partners has a long history of investing in people and projects that create more economic opportunity in Canada. Recently, our focus has been on establishing more avenues for working Canadians to build wealth through ownership. Learn more about what we are moving towards.

April 23, 2024

Getting the facts straight on the changes to capital gains tax in budget 2024

Social Capital Partners' Chair, Jon Shell, sets the record straight on the capital gains changes in the 2024 Federal Budget.

April 22, 2024

Unlocking the potential of employee ownership in Canada

In the US and the UK, employee-owned companies grow faster, pay better, are less prone to lay-offs or bankruptcies in economic downturns, and are more likely to keep jobs in local economies. Due to supportive public policy, EOTs are a popular structure for business succession in those countries and have generated significant wealth for front-line employees. Canada does not have a business structure comparable to the employee ownership trust (EOT).

April 19, 2024

Canada is bad at studying wealth inequality and we explain why that matters

Social Capital Partner's Director of Policy Dan Skilleter summarizes the key findings of his recent report "Billionaire Blindspot" in a Toronto Star Opinion piece.

April 4, 2024

Social Capital Partners releases new report on wealth inequality in Canada – concludes that official statistics significantly underestimate the problem

This new report critically analyzes Canada’s flagship wealth survey, the Survey of Financial Security (SFS), and outlines how its methodological shortcomings lead to significant underreporting of wealth inequality.

April 4, 2024

Social Capital Partner’s Director of Policy, Dan Skilleter, on The Agenda with Steve Paikin

Social Capital Partner’s Director of Policy, Dan Skilleter, sits down with Steve Paikin on The Agenda to discuss his recent report “Billionaire Blindspot”. This segment digs into how Canada’s official statistics severely underestimate how rich the richest Canadians are and includes steps that can be taken to correct this misrepresentation.

April 2, 2024

Bank of Canada’s unproductive productivity speech

Social Capital Partners' CEO, Matthew Mendelsohn, reflects on the Bank of Canada's productivity speech and calls for need of fresh ideas, voices and questions.

March 28, 2024

Consultation on the future of competition policy in Canada

Canada’s existing competition regime is unfair for small business. We surveyed over 1,000 small business owners to understand how competition policy has affected them.

March 23, 2024

Social Capital Partners appoints Matthew Mendelsohn as new CEO

Social Capital Partners announces the appointment of Matthew Mendelsohn as its new CEO, effective January 2, 2024. Jon Shell, SCP’s current Managing Director will become SCP’s Chair.

November 29, 2023

A positive vision for the future of Canadian competition policy

The concentration of corporate power in Canada can be traced back to the antiquated objectives of our nation’s competition policy. Our submission to the government’s review of the Competition Act provides sharp critiques and recommendations on a path forward.

March 1, 2023

Inclusive search fund concept paper

Search funds allow entrepreneurs without capital to buy small businesses. However, only an exclusive club can access the financing to do so and are often forced to re-sell their businesses. We’ve put a twist on the search-fund model to make it more inclusive and long-term.

July 20, 2022

Building an employee ownership economy

New research continues to demonstrate that employee ownership fosters economic resilience. As in previous economic crises, employee-owned companies were better at retaining employees and at maintaining hours and salaries throughout the pandemic. In a post-pandemic economic environment, the demonstrated benefits of increased employee retention and alignment by employee-owned companies will be even more important to support economic growth.

March 22, 2022

Taylor Guitars’ transitions to 100% employee ownership with support from the Healthcare of Ontario Pension Plan (HOOPP) and Social Capital Partners (SCP)

In a transaction that would be impossible for a Canadian company, the owners of North America's largest builder of acoustic guitars secure a sustainable future for their company and its employees.

February 16, 2021

Business-in-a-box concept paper

Small, independent businesses are the backbone of our economy. Unfortunately, they’ve become harder to start and struggle to compete with large chains. We’ve been inspired by owner-owned cooperatives that help small businesses thrive.

July 1, 2020

Rate drop rebate: final evaluation report

The story of the Rate Drop Rebate pilot, including key milestones, successes, dilemmas, insights and lessons learned. The Rate Drop Rebate was a unique partnership that brought SCP together with financial institutions, publicly funded employment service providers and the Government to reduce unfair barriers to employment and help grow the province’s small and mid-sized businesses.

October 24, 2017

Ontario launches rate drop rebate in London

Ontario is launching an innovative partnership with financial institutions to help businesses in London grow and increase employment opportunities for people with disabilities and facing other barriers. Through the new Rate Drop Rebate program, small- and medium-sized businesses that hire eligible people can receive discounted rates on financial products, such as loans. The rebate is made possible through funding from Ontario's two-year, $4-million Community Loans Fund.

April 11, 2016

Ontario financial institutions and government join forces to boost local businesses and do good in communities

Rate Drop Rebate™ pilot is expected to significantly impact those facing barriers to employment include students with limited work experience, long-term unemployed, older unemployed, people with disabilities, newcomers to Canada and unemployed Indigenous persons. The program aims to generate up to 1,100 new employment opportunities.

April 11, 2016

Ontario improving employment opportunities for people facing barriers

Ontario is partnering with leading financial institutions to build on Social Capital Partners existing loan program and create a fund aimed at increasing employment opportunities for people facing employment barriers.

December 3, 2015

Partnership council on employment oportunities for people with disabilities

The Partnership Council champions the hiring of people with disabilities and provides strategic advice to the Ontario Minister of Economic Development, Employment and Infrastructure to enhance employment opportunities for Ontarians with disabilities.

May 11, 2015

Social Capital Partners and Ontario Government to begin consultations with Canadian financial institutions for a Community Loan Pilot Project

Social Capital Partners announces innovative collaboration with the Government of Ontario designed to explore a novel social finance approach that provides employment opportunities for people with disabilities and other vulnerable populations.

November 7, 2014

Social Capital Partners’ collaboration with the Ontario Ministry of Economic Development, Trade and Employment

Social Capital Partners collaborates with Ontario government’s Office of Social Enterprise to explore a pay-for-performance model that will increase access to employment opportunities for persons with disabilities, new Canadians and other traditionally disadvantaged groups.

March 18, 2014

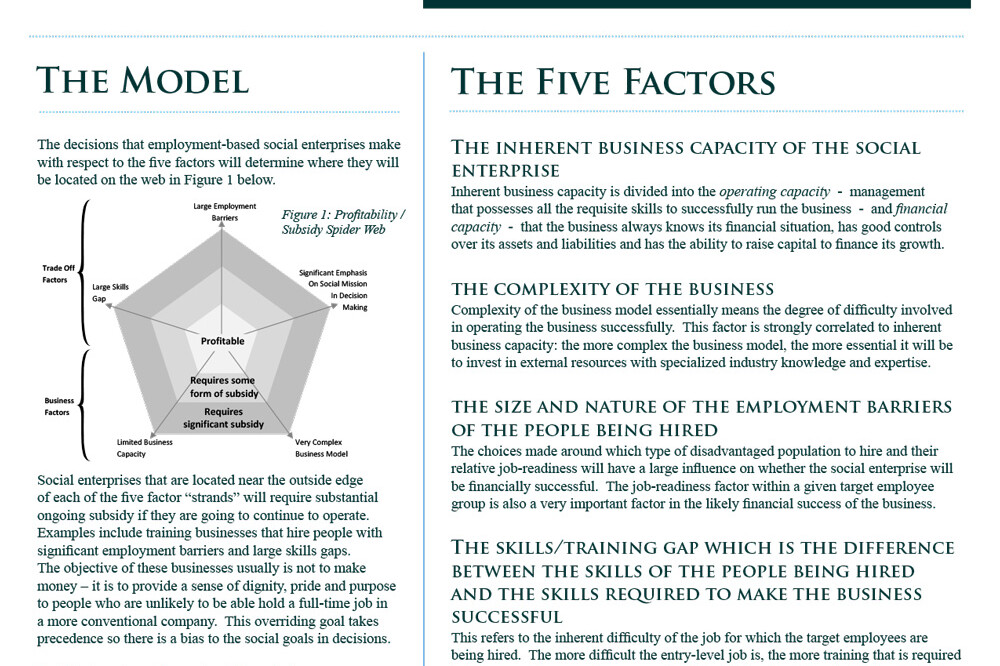

The five critical factors of social enterprise profitability

What are boards, investors and management teams to do when there is tension between the financial and social bottom lines of social enterprises? Social Capital Partners shares learnings gleaned from seven years of investing in employment-based social enterprises. We identify the five most important factors that determine whether a social enterprise will be profitable or require some form of subsidy.

August 8, 2009

Working together: Implementing a demand-led employment and training system

Canada’s approach to training and development needs reform. Billions of dollars are spent annually on job training and skills development, with limited evidence of lasting benefits. Most problematic, employers’ talent needs (i.e., actual skills demand) are not formally embedded in the process of determining how or where money is spent, leaving a fundamental disconnect between demand for skills and the investments being made by governments.

April 14, 2009

A Fine Balance: What Inner City Renovations taught us about managing social and economic objectives inside business models

What are reasonable profitability targets for a social enterprise start-up with a mission to create employment for disadvantaged populations? How does external financing play a role in the execution of the social mission and how does a social mission as a key part of the business model impact the ability to reach profitability targets? SCP showcases one of our early investments and highlights key learnings about the inherent mission tensions in these business models.

May 8, 2008

Social return on investment report: TurnAround Couriers

SCP reports on six years of TurnAround Couriers, a social-purpose business dedicated to helping at-risk youth in the Greater Toronto Area overcome social and economic obstacles by providing them with a chance to get ahead.

January 8, 2007